Hawkish Fed supports USD

The Federal Reserve’s stance and steady US growth support higher short-end yields and dollar strength, yet weak labor markets, tariffs, and prior easing limit prospects for a lasting rally.

The 29 October Federal Reserve (Fed) meeting and the lack of signs that US growth is slowing materially open the door for higher short-end yields and additional near-term US dollar strength. That said, it’s hard to see a dramatic, sustained rally as labor markets remain lackluster, tariffs may yet prove a drag on growth, and the dollar has yet to respond to the recent 50 bps of Fed easing.

The Japanese yen looks well-positioned to outperform as it appears the most misvalued versus falling US yields, though we first need to get past market worries of looser fiscal and easier monetary policy after Sanae Takaichi became the new LDP leader, as well as the recent hawkish Federal Reserve shift. We expect Takaichi to deliver moderate policies that support growth, inflation, and a Bank of Japan rate hike by early 2026.

The Australian dollar outlook is notably improved thanks to the US-China trade truce and higher inflation, which is likely to keep the Reserve Bank of Australia on hold over the next couple of meetings, at least. Sluggish but positive employment growth and the risk of a temporary correction in sky-high equity markets introduce some near-term risk. The Norwegian krone is also sensitive to equity market drawdowns but remains attractive on cheap historical valuation, decent growth, high yields, and a pristine sovereign balance sheet.

The Canadian dollar has been out of favor for some time, but growth data has stabilized, and the BoC appears near the end of its easing cycle—making the Canadian dollar attractive in our scorecards. However, the upcoming renegotiation of the United States-Mexico-Canada Agreement (USMCA) trade agreement (or Canada-United States-Mexico Agreement [CUSMA] in Canada) poses a significant risk. Tough US negotiating tactics and resulting uncertainty could weigh on both the Canadian economy and the currency in the months ahead.

The British pound, Swiss franc, and euro rank lowest in our scorecards. The pound looks vulnerable as fiscal austerity, weak labor markets, and renewed disinflation increase the likelihood of accelerated Bank of England (BoE) easing and further softness through 2026. The franc faces challenges from low inflation, zero interest rates, and high tariffs, while the Swiss National Bank has stepped up interventions to curb the franc strength, primarily against the euro.

The euro appears relatively resilient in an equity market correction but remains constrained by sluggish growth, French political gridlock, and the risk of additional European Central Bank (ECB) rate cuts next year.

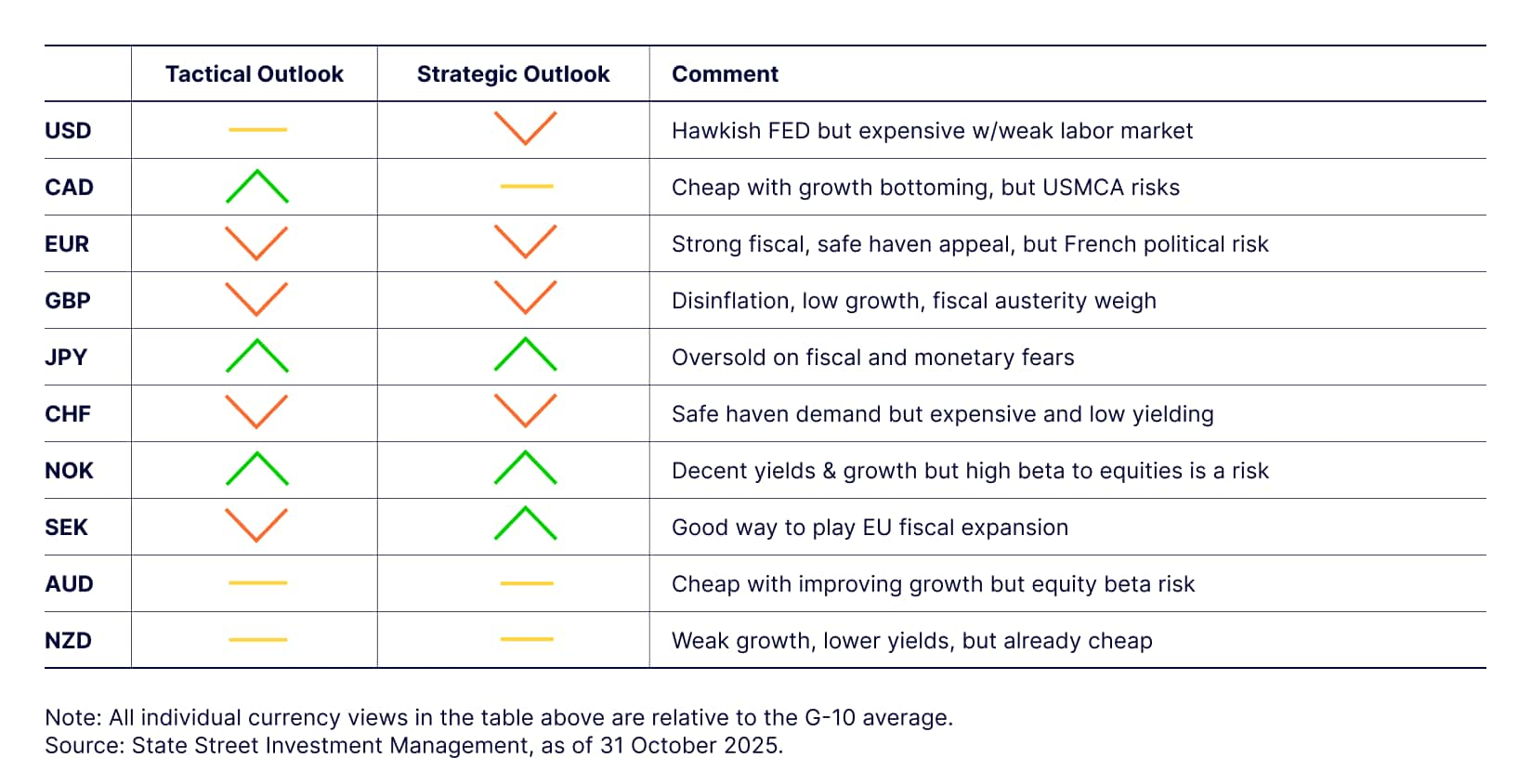

Figure 2: November 2025 directional outlook

Over the long term, we favor short US dollar positions against currencies with positive net international investment positions, good fiscal and monetary flexibility, and historically cheap valuations versus the US dollar. On these criteria, the Japanese yen, Swedish krona, and Norwegian krone stand out as likely top performers. The Australian dollar, euro, Canadian dollar, and British pound should enjoy solid gains versus the US dollar, in that order. The Swiss franc is most at risk of underperforming the US dollar, especially on a total return basis including the franc’s negative interest rate carry.

US dollar (USD)

We see an upside bias to the US dollar going into November but are largely neutral over the next month or two. The dollar remains supported by the positive forces of strong consumption; healthy AI capital expenditure, fiscal expansion, sticky inflation, impressive equity returns on the back of elevated corporate earnings expectations, and the hawkish Federal Reserve shift. However, US labor markets remain soft, we expect growth to slow from its blistering Q2–Q3 pace near 4% back to the low-mid 2% range in 2026, and the Federal Reserve has already cut 50 basis points with a trajectory toward lower rates, though perhaps at a slower pace than markets had hoped. This is likely to limit the scope of the near-term US dollar rally and lead to gradual softness in 2026.

We retain our call for a multi-year US dollar bear market that will see the currency lose at least 15% over the next 2–4 years. Innovative companies and the dynamic, flexible US labor and capital markets underpin the US as a strong home for capital investment. But we expect that the degree of US economic outperformance will be materially smaller and the reliability of the US dollar as a safe haven will be materially weaker over the next 10–15 years than it has been for the last 10–15 years.

The Bureau of Economic Analysis net international investment position report indicates that non-US investors hold over $33 trillion of US portfolio investments and more than $62 trillion in total US investments excluding financial derivatives. Even a modest 10% increase in the average US dollar hedge ratio implies more than $3 trillion of US dollar sales. This is more than enough to power a prolonged US dollar bear market even if the US remains among the top-performing countries.

Canadian dollar (CAD)

Our models favor the Canadian dollar on improved commodity prices and strong local equity returns, partly thanks to robust earnings from commodity-related companies. Our economic indicator is on the weak side but improving slightly. It is encouraging to see signs of growth stabilization, particularly the strong employment report. We further expect that the cumulative impact of easing the monetary policy rate from 5% to 2.25% over the past 18 months and robust fiscal expansion in 2026 should begin to lend support to the economy.

The big risk for the Canadian dollar as we head into 2026 is the upcoming renegotiation of the USMCA trade agreement (also known as CUSMA in Canada). We expect threats and tough negotiating tactics on the part of the US to keep the Canadian dollar on the back foot as it destabilizes consumer and business sentiment, threatening growth and the potential for lower interest rates.

We are more constructive in the medium term. The Canadian dollar is cheap by our long-run fair value measure. We see the North American tariff dispute as ultimately leading to a renegotiated USMCA that largely preserves favorable relative tariffs for North America compared to the rest of the world. Canada also has more room for quick monetary and fiscal stimulus than the US, as well as ample scope for both deregulation and greater trade with countries outside North America.

We see scope for USD/CAD to fall into the low 1.30s versus the US dollar in 2026 as we gain clarity on tariffs and the USMCA, the Federal Reserve resumes rate cuts, and we begin to see greater growth benefit from both the Bank of Canada’s aggressive rate cuts and Canadian fiscal stimulus. Ultimately, given our US dollar bear market thesis, we see USD/CAD trading back below 1.20 in coming years, though the Canadian dollar likely remains sluggish versus the G10 ex-US as the weak US dollar serves as a headwind.

Euro (EUR)

We maintain a negative stance on the euro over the near term. The issue is not specifically with European Union fundamentals but rather that they are lackluster compared to other opportunities in the G10. Our economic score for the EU is second best in the G10, though we expect absolute growth levels to be low. The European Central Bank is likely near or very nearly done with its rate-cutting cycle, but with the policy rate at 2%, there are more interesting opportunities to pick up carry.

Recent equity market underperformance on a relative basis and the uptrend in commodity prices also weigh on the outlook relative to other G10 currencies. We prefer the US dollar, Australian dollar, and Norwegian krone, which are backed by higher yields and a better near-term growth story. We also prefer the Japanese yen on valuation and an expected reduction in Japanese fiscal risk premium despite its ultra-low yield.

In the medium term, we remain constructive on the currency. Strong household balance sheets, low unemployment, positive real wage growth, increased defence spending, and the proposed €500 billion German infrastructure fund are all positive for the euro. The case for EU investors to pull back from their concentrated exposure to US assets—or at least implement higher average currency hedge ratios—is strong as the US becomes a less reliable trade and security partner. We see scope for a move up toward 1.35 in euro/US dollar over the next 3–5 years.

The outlook against other G10 currencies is less optimistic. It is expensive versus the Japanese yen, Norwegian krone, Swedish krona, and Australian dollar, and is likely to underperform those currencies over coming years once we work through tariff-related growth risks and the heightened potential for equity market volatility.

British pound (GBP)

We are modestly negative on the pound over the near term. Sterling rests on a shaky foundation of high debt, persistent current account deficits, and near-stagflation. The now-delayed autumn budget, expected in late November, is likely to bring further fiscal tightening. That fiscal constraint makes it difficult to address GDP growth, which has a three-month run rate slightly below 1% year-over-year, and unemployment at 4.8%, a four-year high. Even worse, monetary policy is constrained by core CPI at 3.5% year-over-year versus the 2% target, limiting flexibility for rate cuts to respond to downside economic surprises. Relatively high yields are marginally supportive of pound, but that support is limited by the fact that rates are high for unhealthy reasons.

In the long term, the story isn’t as shaky—at least not against the US dollar and Swiss franc. While the pound looks challenged versus most of the G10, against the US dollar we see it stabilizing in the low to mid-1.30s this year and approaching 1.45+ over the three- to five-year horizon. We also expect the pound to outpace the expensive, low-yielding Swiss franc over coming years on a total return basis. Beyond the US dollar and Swiss franc, we see the pound struggling over the medium term.

Japanese yen (JPY)

Our tactical models are neutral on the yen. The hawkish divergence of the Federal Reserve relative to the Bank of Japan is likely to cause some additional yen weakness into November. Additionally, Prime Minister Takaichi’s historical bias toward loose fiscal stimulus and monetary policy is likely to continue to cause jitters in the currency and Japanese rates markets, biasing markets toward higher yields and a weaker yen.

While the next month may be rocky, our bias is to view this yen weakness as a buying opportunity over a multi-month horizon. Investors may worry about higher fiscal spending and the potential for a new government to pressure the Bank of Japan to delay rate hikes, but we have a more optimistic outlook.

Growth is likely to remain positive and stable, while we expect only moderate fiscal stimulus that will further support growth and embed above-target inflation. We believe the Bank of Japan will tighten policy toward 1% by the end of 2026, while the Federal Reserve eases policy by 50–75 basis points over that same period for a total carry compression of 1–1.25% in favor of the yen. That should be sufficient to get the yen back toward 135 by the end of 2026. Thus, we have a medium-term bullish yen view despite acknowledging some very near-term downside risk.

In the long term, we see even more upside, with the yen likely to fall back into the 120–130 range versus the US dollar over the next three to five years, consistent with our long-term US dollar bear market thesis.

Swiss franc (CHF)

We expect the Swiss franc to materially underperform G10 currencies going forward. It is the most expensive G10 currency per our estimates of long-run fair value and has the lowest yields and inflation in the G10. US tariffs are likely to be an additional deflationary shock, even if they are reduced via negotiation. In response, we expect the Swiss National Bank to prove more amenable to direct currency market intervention to weaken the franc, as it did with more than 5 billion in franc selling during Q2.

The SNB may also be forced to move to negative policy rates, though we believe such a move would require a meaningful deterioration in CPI. On a total return basis, accounting for the increasingly negative interest rate carry in long franc positions, it is difficult to see the franc outperforming the G10. Even versus the US dollar, the franc would have to gain at least another 10–15% over the next three to five years just to overcome the negative interest rate carry.

In addition, we do not expect portfolio rebalancing away from the US dollar over the next one to three years to be as beneficial for the franc as it is for other currencies. Swiss investors already tend to hedge a large percentage of their foreign exchange risk. That means there is not as much room for US dollar hedge ratio increases. In simpler terms, we see less scope for US dollar selling and franc buying.

Norwegian krone (NOK)

We retain a positive tactical bias on the Norwegian krone despite potential risks from additional oil weakness and/or an equity market correction. Norwegian growth is holding up well, and following the Federal Reserve rate cut, Norway is now the highest-yielding G10 currency. The Norwegian krone is historically quite vulnerable to equity market volatility.

Oil is also holding up well in the mid-60s for the moment, and the equity market trend is still upward. But this is where we see short-term risk in long Norwegian krone positions: first, from potential pressure on oil markets due to fears of increased OPEC+ production, combined with the risk of sluggish demand growth, should tariffs slow the global economy; second, the risk of further flare-ups in equity volatility as we navigate through this period of high policy and economic uncertainty. For these reasons, we see the potential for periods of substantial volatility in the Norwegian krone despite our positive outlook.

In the long term, the krone is historically cheap relative to our estimates of fair value and is supported by steady long-run potential growth and a strong balance sheet. Norway also has significant fiscal and monetary flexibility to prevent long-term damage from the current tariff shock. We believe the krone is setting up for solid gains once we reach peak tariffs, reprice risky assets, reprice oil, and begin to focus on tariff reductions and fiscal/monetary stimulus.

Swedish krona (SEK)

Our krona outlook is modestly negative over the near term. After leading the G10 in 2025, with a gain of +9% versus the G10 average, we see the krona running out of steam for a time. As a small open economy with a less liquid currency, we expect the krona to experience greater downside volatility in sympathy with higher euro volatility as France sorts out its government, regional growth continues to face tariff drag, and risks of a healthy pullback in equity markets appear elevated. The recent hawkish shift from the Federal Reserve is also likely to weigh on the krona given its low yield.

However, beyond our near-term concerns, we are more constructive. The medium-term trend in Federal Reserve policy still favors easing, implying that interest rate differentials are likely to continue shifting in Sweden’s favor. In addition, growth is improving, and Sweden is an attractive way to play potential EU fiscal stimulus considering French debt and political worries. Sweden has a very comfortable 33% debt-to-GDP ratio, partly immunizing the krona from global fiscal risk premium, and it has material exposure to the defense sector—a primary recipient of EU fiscal expansion.

Sweden should also benefit from gradual portfolio rebalancing under our long-term US dollar bear market thesis. The scope for a shift in the large foreign asset holdings in both Sweden and the EU away from the US, even if just in the form of higher US dollar currency hedges, should provide a material tailwind for the krona.

Australian dollar (AUD)

We have a positive bias on the Australian dollar over the near term but see risk from the potential for higher equity market volatility after the stellar six-month rally in share prices. The US-China trade deal suggests a prolonged period of relative stability, opening the door for a further reduction in tariff risk premium.

The much higher-than-expected Q3 CPI print, alongside improving consumer spending and strong home price gains, should keep the Reserve Bank of Australia (RBA) on the sideline for as long as three to six months barring a negative surprise. This solidifies Australian dollar as one of the higher-yielding G10 currencies heading into 2026.

On top of that, there is ample room for fiscal support and the ability for more pronounced fiscal spending should we experience a negative global growth shock. This is an enviable position in a world of excessively high government debt. The recent slowdown in job creation and rise in the unemployment rate is a minor concern as job and real wage growth remain positive and the household and government spending outlook is solid.

In the long term, we are quite positive on the currency. The Australian dollar is significantly cheap relative to our estimates of fair value. Growth has been lackluster but resilient, as seen in better household consumption numbers and solid services PMIs. Australia also has ample room for fiscal and monetary stimulus to limit long-run damage from high tariffs.

Australian investors appear to have high levels of currency-unhedged US dollar asset exposure that we believe will be subject to higher currency hedge ratios or an outright rotation into a more diversified global portfolio. Once the world adjusts to the new tariff regime, the Australian dollar has room for a material long-term rally.

New Zealand dollar (NZD)

We are neutral on the New Zealand dollar over the near term. Poor GDP and high unemployment suggest lower inflation, low policy rates, and a weak New Zealand dollar. The US-China trade deal and slightly improved Chinese growth outlook are positive but offset over the near term by the more hawkish tone from the Federal Reserve. The Reserve Bank of New Zealand’s monetary policy rate is expected to fall toward 2.0%, a very low rate for a country with a moderate fiscal deficit and a near 6% current account deficit.

In addition, the New Zealand dollar may be volatile due to its historically high sensitivity to global risk sentiment, which is likely to be unstable in this period of heightened economic and policy uncertainty. The one saving grace that limits our negative bias on the New Zealand dollar is that it has already fallen significantly and prices in much of the pessimistic economic story described above.

In the long term, our outlook is mixed. Our estimates of long-run fair value suggest that it is cheap versus the US dollar and Swiss franc and has ample room to appreciate, but it is expensive against the yen and the Scandinavian currencies.