Brace for a volatile summer

Brace for a data-driven, low-liquidity summer with potential for a US dollar rebound following strong July jobs data. Uncertainty looms from tariff policy, Middle East tensions, and an earnings season closely watched for tariff impacts.

The big themes that drove currencies and rates in the first half of the year are fading, namely, the unwinding of overly optimistic US growth expectations from the fourth quarter of 2024 and the pricing in of both US tariff and fiscal risks.

Now that expectations and risk premia have adjusted, markets will need another surprise to extend the dramatic first-half US dollar selloff. That surprise could come in the form of a sharper downturn in US labor markets or inflation, which might force a reset in Federal Reserve rate expectations and push the dollar lower. However, the strong July labor market report suggests such a shift would likely occur later in the third quarter.

Alternatively, President Trump could announce more severe tariffs than expected as the 9 July deadline for trade negotiations approaches, which could drive the dollar down again.

For those with a shorter-term horizon, we recommend approaching the summer with agility, ready to react, but not overreact. Look for market overreactions as contrarian opportunities. At the moment, the Swiss franc appears to have overreacted to the upside. It looks expensive for a currency backed by zero interest rates in a country that may soon be battling outright deflation and is partially exposed to weaker growth due to US tariffs.

The British pound, meanwhile, has kept pace with euro strength and offers attractive nominal yields. However, the UK remains in a precarious position, constrained by severe fiscal challenges, persistent inflation limiting monetary policy flexibility, and a rising unemployment rate.

For those with longer-term horizons, use the summer news cycle to assess signs of structural change. Otherwise, stay anchored to durable long-term themes. Chief among them is our bearish view on the US dollar. Over the next five to 10 years, US exceptionalism is likely to weaken due to unsustainably high debt levels, gradually rising interest expenses, and the fading tailwind of globalization and offshoring. We see the broad dollar falling at least 15% over the next several years.

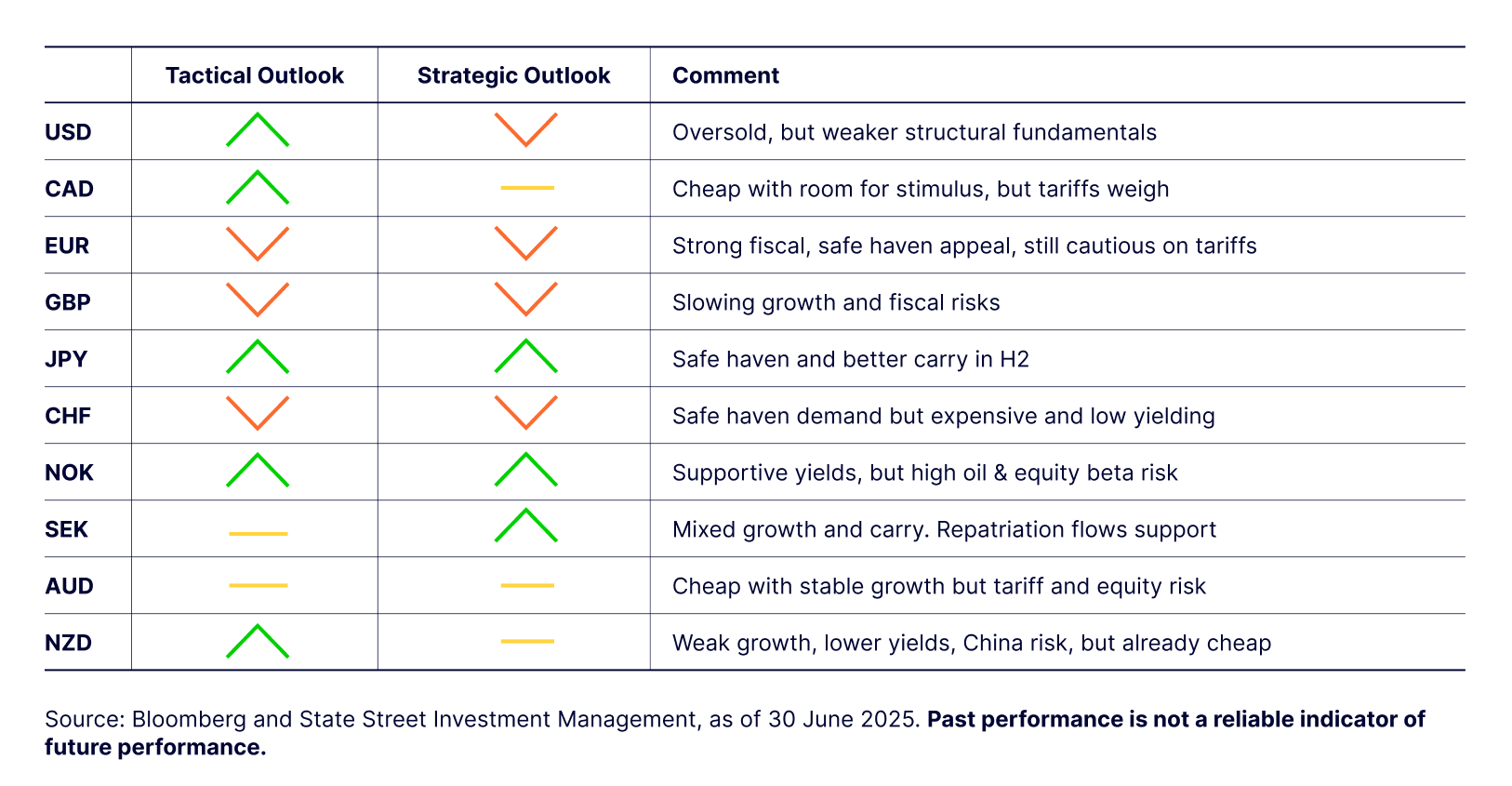

Figure 2: June 2025 Directional Outlook

Against the US dollar, favor currencies with positive net international investment positions, strong fiscal and monetary flexibility, and those that are historically undervalued. Based on these criteria, the Japanese yen, Swedish krona and Norwegian krone stand out as likely top performers. The Australian dollar, euro, Canadian dollar and British pound should also post gains against the US dollar, in that order. The Swiss franc is most at risk of underperforming the dollar, especially on a total return basis, given its negative interest rate carry.

US Dollar (USD)

We continue to view the US dollar as short-term oversold following its sharp decline this year. A temporary bounce appears likely at the start of summer, driven by the resurgence in US equities in June, the upside surprise in July employment data, and upcoming tariff developments that may squeeze short-dollar positions.

While tariff news has generally been negative for the dollar, the short-term growth impact of tariffs may be more severe outside the US than within it. From a cyclical perspective, non-US growth downgrades following the July tariff announcements could temporarily improve the relative US outlook and support the dollar. At the very least, we expect the US dollar to remain more rangebound over the coming weeks as markets digest its year-to-date losses.

This more optimistic short-term outlook does not signal a change in our medium- to long-term views. We continue to forecast a multi-year US dollar bear market, with the currency expected to decline at least 15 percent over the next two to four years. While innovative companies and the dynamic, flexible US labor and capital markets continue to make the US an attractive destination for capital investment, we believe the degree of US economic outperformance will be meaningfully smaller, and the reliability of the dollar as a safe haven materially weaker, over the next 10 to 15 years compared with the previous decade.

According to the Bureau of Economic Analysis’s net international investment position report, non-US investors hold more than USD 33 trillion in US portfolio investments and over USD 62 trillion in total US investments, excluding financial derivatives. Even a modest 10 to 15 percent reallocation from US assets, or a 10 percent increase in the average US dollar hedge ratio, would imply USD 3 to 5 trillion in US dollar sales. That’s more than enough to fuel a prolonged US dollar bear market, even if the US remains among the top-performing economies.

Canadian Dollar (CAD)

Canada appears vulnerable relative to the broader G10 due to rising recession concerns, spillover from a weaker US dollar, subdued consumption and investment amid tariff uncertainty. That said, our signals have turned more positive on the Canadian dollar. Despite the headwinds, there are several reasons to expect a recovery, particularly against the US dollar and Swiss franc. The Canadian dollar remains undervalued based on our long-run fair value models. While the tariff outlook is volatile, we are cautiously optimistic. We expect North American tariff tensions to ultimately lead to a renegotiated the United States-Mexico-Canada Agreement that largely preserves regional free trade.

Canada also has more room than the US to deploy near-term monetary and fiscal stimulus, as well as significant potential for deregulation and expanded trade with countries outside North America. In the second half of the year, we expect USD/CAD to continue falling, reaching the low 1.30s versus the US dollar ultimately trading back below 1.20 in coming years. However, the Canadian dollar is likely to remain sluggish versus the G10 ex-US currencies, as broad US dollar weakness acts as a headwind.

Euro (EUR)

After a stellar first half of the year, we see temporary downside euro risks heading into the summer. The underperformance of European equities and the risks to second-half growth from US tariffs suggest the euro is currently overbought. there is a high likelihood that President Trump will take a tougher stance on European Union tariffs, which would pose a significant headwind to growth in the second half of the year. In contrast, if history is any guide, the proposed fiscal stimulus may take longer to implement than hoped. That said, short-term economic risks remain skewed to the downside, which may limit the euro’s capacity to rally, particularly against traditional safe-haven currencies like the Japanese yen and Swiss franc.

Over the medium term, we remain constructive on the euro. Household balance sheets are strong, unemployment is low, and real wage growth is positive. The planned increase in defense spending and the proposed €500 billion German infrastructure fund are also supportive for the currency. There is a strong case for EU investors to reduce their concentrated exposure to US assets, or at least increase average currency hedge ratios, as the US becomes a less reliable trade and security partner. These factors are likely to support the euro against the US dollar over the longer term. We see scope for EUR/USD to move toward 1.35 over the next three to five years.

However, the outlook for the euro against other G10 currencies is less optimistic. It appears expensive relative to the Japanese yen, Norwegian krone, Swedish krona, and Australian dollar, and is likely to underperform these currencies in the coming years — particularly once tariff-related growth risks subside and equity market volatility normalizes.

British Pound (GBP)

We are tactically bearish on the British pound relative to the G10 average, while we see upside versus US dollar and Swiss franc. While the UK economy held up better than expected in the first quarter, signs of weakness are emerging. April GDP was negative, the manufacturing sector remains soft, retail sales have disappointed, and unemployment continues to rise. The Bank of England is easing policy, but with inflation still well above target, rate cuts are likely to be gradual. Meanwhile, the pound’s strong appreciation this year has outpaced the UK’s relative interest rate and growth outlook.

In addition, the UK’s limited capacity to deliver near-term monetary and fiscal stimulus adds further risk, especially if a global slowdown, driven by US tariffs, materializes. This raises the likelihood of slower UK growth and faster Bank of England rate cuts in late 2025 and into 2026, which does not bode well for the pound’s medium-term performance against G10 ex-US currencies.

Japanese Yen (JPY)

Better-than-expected economic data and consecutive months of yen underperformance have improved the outlook for the currency over the next few months. However, US tariffs remain a key risk. President Trump has singled out Japan as a tough negotiator and floated the possibility of a 30–35 percent across-the-board levy. Tariffs at that level would likely delay hopes for a Bank of Japan rate hike and weigh on the yen.

That said, we remain constructive on the yen over the medium to long term. The currency remains extremely undervalued relative to fair value, and the negative global demand shock from tariffs is likely to push global yields lower, improving Japan’s interest rate differentials.

Despite its poor performance during the Israel-Iran conflict, the yen retains strong safe-haven characteristics. As the US economy absorbs the impact of a substantial effective tariff tax hike and faces the potential for sustained portfolio outflows, either through direct asset sales or increased dollar hedging, the yen should become a more attractive safe haven, particularly in crisis periods that do not trigger a major spike in oil prices.

Should global growth slow more than expected or risk aversion rise sharply, we believe the yen will offer superior protection.

Swiss Franc (CHF)

If our broad US dollar bear market thesis proves correct, the Swiss franc may still post modest gains against the dollar. However, once the current period of heightened uncertainty passes, we expect the franc to materially underperform all other G10 currencies.

The franc is the most expensive G10 currency based on our long-run fair value estimates and offers the lowest yields and inflation in the group. The risk of higher US tariffs, particularly those targeting the pharmaceutical sector, poses an additional drag on Swiss growth and inflation.

In response, we expect the Swiss National Bank to become more open to direct currency market intervention in the second half of the year and potentially return to negative policy rates. On a total return basis, accounting for the increasingly negative interest rate carry on long the franc positions, it is difficult to see the franc outperforming its G10 peers.

In addition, we do not expect portfolio rebalancing away from the US dollar over the next one to three years to benefit the Swiss franc as much as it might other currencies. Swiss investors already hedge a large share of their foreign exchange exposure, which limits the scope for further increases in US dollar hedge ratios. In simpler terms, there is less room for additional USD selling and franc buying.

Norwegian Krone (NOK)

We expect substantial volatility in the Norwegian krone during this tariff shock, given its high beta to both equity and oil markets. That said, we remain broadly constructive on the currency, supported by high relative interest rates and resilient underlying growth. The sharp selloff on 4 April, when Norwegian krone dropped 4.05% against the US dollar and 3.2% against the euro, illustrates the downside risks during periods of heightened market uncertainty.

Oil prices may remain under pressure due to rising OPEC+ production and weaker global demand tied to the tariff-driven slowdown, posing a key headwind for Norwegian krone in 2025. Still, the krone remains historically undervalued relative to our fair value estimates and is backed by Norway’s solid long-term growth prospects and robust sovereign balance sheet.

Importantly, Norway has considerable fiscal and monetary flexibility to cushion the economy and prevent long-term damage from the current shock. We believe the krone is setting up for strong gains once markets reach peak tariff tension, reprice risky assets and oil, and begin shifting focus toward tariff reductions and coordinated stimulus measures.

Swedish Krona (SEK)

We are largely neutral on the Swedish krona in the short term. While the currency remains extremely undervalued relative to our long-run fair value estimates, and we maintain decent medium-term growth expectations for Sweden, recent data has been soft.

The Riksbank struck a dovish tone, but it is unlikely to cut rates as aggressively as most other major G10 central banks this year. As a result, we expect improved carry through year-end to be supportive of the krona. Sweden also benefits from fiscal and monetary flexibility, as well as the potential for gradual portfolio rebalancing.

Importantly, the large foreign asset holdings in both Sweden and the EU present scope for a shift away from US exposure, even if only through higher US dollar hedge ratios. This dynamic should provide a meaningful tailwind for krona appreciation over the medium term.

That said, as a small, open economy with a relatively illiquid currency, Sweden is vulnerable to downside volatility in the near term, particularly if the tariff shock re-intensifies this summer.

Australian Dollar (AUD)

Our tactical models remain neutral on the Australian dollar. Despite the Reserve Bank of Australia’s recent growth downgrade and the high likelihood of further rate cuts this summer, the growth outlook appears stable, albeit below trend, and direct US tariff risks remain low.

Australia, like many Asian economies, has ample room for both fiscal and monetary stimulus to cushion the impact of elevated tariffs. Additionally, Australian investors, similar to their global peers, hold a significant share of unhedged US dollar-denominated assets. We believe this exposure is likely to be rebalanced through higher hedge ratios or a broader shift toward more diversified global portfolios.

As markets gain clarity on peak tariffs and begin to look ahead to potential reciprocal tariff reductions, the Australian dollar has room for a longer-term rally.

However, we see an elevated risk of further drawdowns in the Australian dollar during this period of high uncertainty. A lasting US-China trade deal remains far from certain. The Reserve Bank of Australia is expected to ease policy more aggressively than most G10 central banks over the next year, and export prices have been sluggish.

Australia also faces challenges such as weak business investment, high household debt service burdens, and what appears to be a long-term decline in productivity growth.

New Zealand Dollar (NZD)

Our tactical model has turned slightly positive on the New Zealand dollar versus the G10 average. Growth indicators point to a continued recovery, and we expect the Reserve Bank of New Zealand to remain patient, keeping interest rates steady following last year’s significant easing cycle.

New Zealand is largely insulated from direct US tariffs, though it may still experience some drag if US tariffs on China and broader Asia come in higher than expected.

While we are modestly positive, we caution that the New Zealand dollar may remain relatively volatile due to its historically high sensitivity to global risk sentiment, especially during this period of heightened economic and policy uncertainty.

Over the longer term, our outlook is mixed. Our estimates of long-run fair value suggest the currency is undervalued against the US dollar and Swiss franc, with ample room to appreciate. However, it appears overvalued relative to the yen and Scandinavian currencies.