Invest with sector and industry ETFs

Express your market views, position for macroeconomic trends, and manage portfolio risks.

Sector trends to watch now

Get insights from our strategy team on sector opportunities in Q4 2025.

Explore our sector and industry ETFs

Select Sector SPDR® ETFs

Sector ETFs enable you to invest in an entire sector in a single trade. Learn how to diversify risk and implement sector investing strategies with ease.

State Street Industry ETFs

Our industry funds offer broader industry coverage with a mid- and small-cap tilt and less concentration risk than market cap weighted exposures.

State Street Thematic ETFs

Use thematic ETFs to pursue the innovative firms and emerging technologies that are rapidly reshaping society.

State Street Sector Rotation ETF

The SPDR® SSGA US Sector Rotation ETF (XLSR) combines tactical sector over- and underweights based on our Investment Solutions Group’s quantitative signals.

Looking for more income?

Check out the actively managed Select Sector SPDR® Premium Income ETFs.

Tools to track sector performance in real time

GICS sector and industry map

Explore the interactive map to see which industries fall under the 11 GICS sectors and get year-to-date performance.

Track sector performance

Use the sector tracker tool to identify sector leaders and laggers, momentum shifts, and rotation trends.

Get the latest industry and sector insights

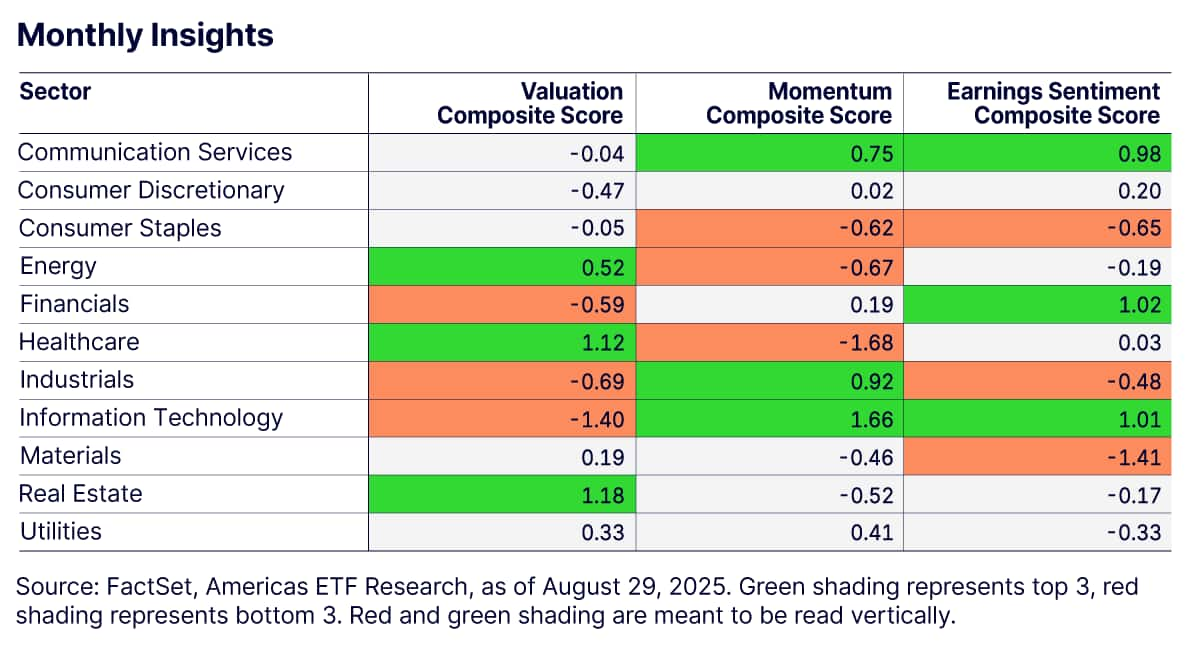

Compare sectors based on valuation, sentiment, volatility, and more.

STATE STREET INVESTMENT MANAGEMENT Invest with the leader in sector ETFs

We pioneered the world’s first S&P 500 ETF in 1993 and the first suite of sector ETFs in 1998. We continue to build on our legacy of innovation and scale—empowering investors to target investment exposures with precision and confidence.

State Street Investment Management AUM 1

Sector ETF AUM 2

Managing sector ETFs

ETFs with exposure to sectors, industries, thematics, and rotation strategies