Four Reasons to Implement a Sector Strategy

Sector strategies may enhance the core of a portfolio by seeking alpha opportunities or diversifying portfolio risks. They can also be used to adjust a portfolio based on changing business cycles or cyclical trends.

Sector investing can be a powerful portfolio construction tool. Since economic variables and business cycles impact segments of the economy differently, sector-based investment strategies can help investors align and adjust portfolios to their objectives to accomplish four important goals:

- Pursue alpha

- Position for business cycles

- Capture secular or cyclical industry trends

- Harness diversification benefits

1. Pursue Alpha

Sectors have historically exhibited wider dispersion than styles. In fact, the return dispersions among sectors have been wider than among styles every year for the past two decades, and more than twice as wide on average—even when we account for style-based strategies in the small-cap universe.1

A wide dispersion and changes atop the leader board provide opportunities to deliver alpha by overweighting winners and underweighting losers.

Figure 1: Sector Exhibit Wider Dispersion than Styles

2. Position for Business Cycles

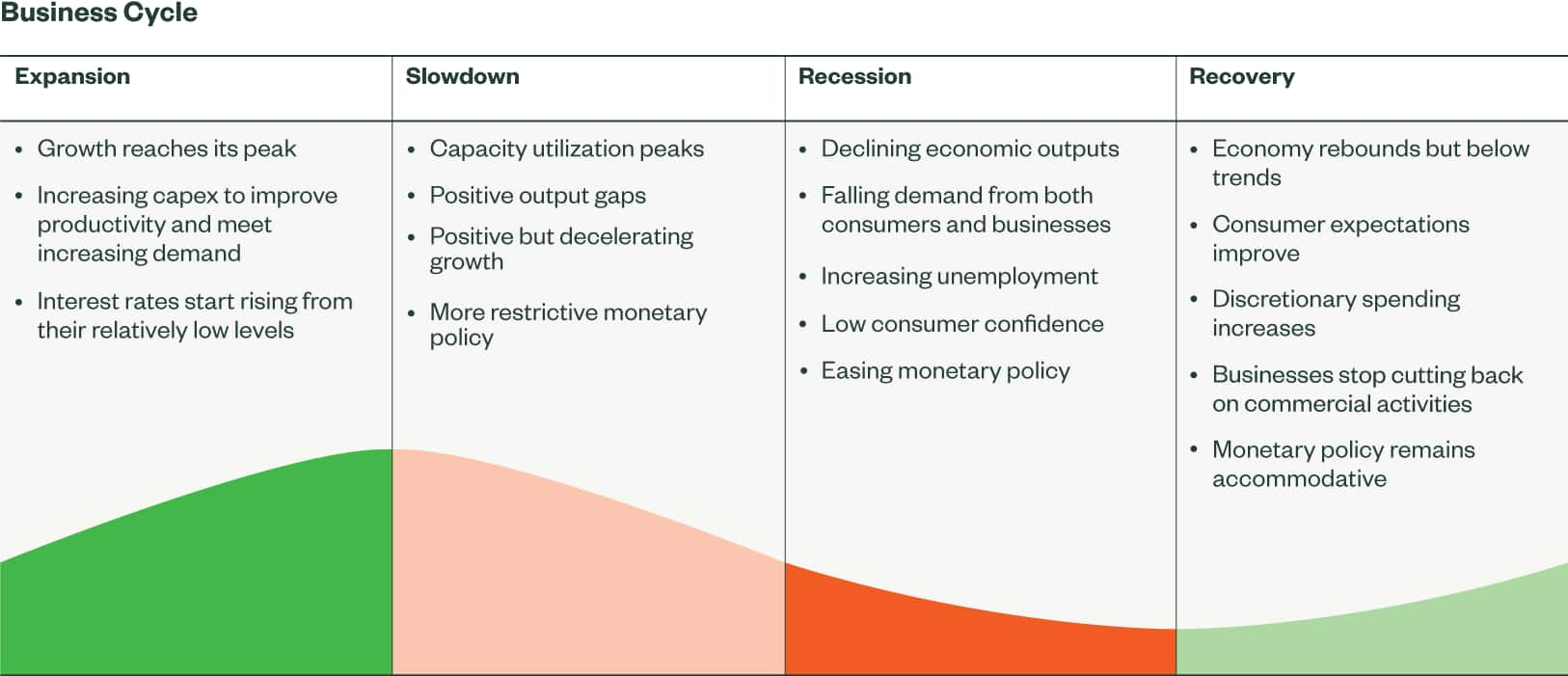

The economy moves in cycles. Each phase typically exhibits characteristics that impact sectors or industries differently, meaning specific sectors may outperform or underperform during different phases. With sector-based strategies, investors can align portfolios with shifts in business cycles by increasing allocations to sectors that are favored by the current economic phase and reducing allocations to sectors facing macro headwinds. Learn more about building a sector roadmap for business cycles here.

3. Capture Secular or Cyclical Industry Trends

Because sectors are closely aligned with specific economic variables, sector-based strategies can help capture secular or cyclical industry trends based on macroeconomic relationships (interest rates, inflation, oil, and the dollar).

Consider, for example, that Oil & Gas industries and Metals & Mining are most sensitive to oil prices and the USD, since the two variables directly impact commodity prices. These sectors are also positively correlated to inflation expectations, as higher commodity prices tend to lift inflation expectations and increase the sectors’ profits.2 Investors with high conviction about the direction of commodity prices or inflation expectations can use sector-based ETFs focused on these industries to adjust beta exposure of their portfolios.

Sector-based strategies can also be used to capture long-term growth opportunities created by secular shifts or technological trends. For example, between 1994 and 2002, the share of US population accessing the Internet increased from less than 5% to nearly 60%.3 The Internet Services & Infrastructure Industry emerged from this exponential increase and expanding use cases of the Internet, and it has outperformed the broad market and the technology sector over the past three decades. (See chart below.)

4. Harness Diversification Benefits

Stock picking is not an easy job. An investor may get the sector call right, but the stock call wrong. Over the past 21 years, more stocks (34%) have underperformed their respective sector averages by more than 10% than have outperformed (29%) by more than 10%, as shown below.

Compared to holding a small group of stocks designed to capture thematic trends, sector investing can help achieve the desired exposure without shouldering too much stock-specific risk. For example, rather than select three or four companies focused on driverless cars to capture the boom in autonomous vehicles, seek a thematic, diversified, but targeted sector exposure focused on many of the firms innovating within that space — the core players and the supply chain providers. This approach seeks to provide targeted exposure to a theme, but mitigate stock-specific risk, in case a stock call was wrong even if the theme was right.

Consider ETFs for Precise Implementation of Sector-based Strategies

From a total portfolio perspective, considering the attributes mentioned above, sector strategies may enhance the core of a portfolio by seeking alpha opportunities or potentially diversifying portfolio risks. And there are many different ways to construct sector rotation strategies (technical, fundamental, and macro-based).

ETFs allow investors to implement either simple or sophisticated strategies with significant precision. We launched the first sector suite in 1998, and today, the SPDR family covers 11 GICS® sectors and 20 industries, an active sector rotation ETF, as well as thematic sectors focused on firms driving technological innovations in areas such as smart transportation, clean power, and intelligent infrastructure.