Rethink the plus in core-plus with investment-grade private credit

Today, persistent inflation, uncertain macroeconomic policies, and unbalanced risk/return profiles have bond investors rethinking their core-plus allocations—searching for new ways to generate excess returns without taking on more risk.

Add a new plus to core-plus fixed income

Sometimes getting there requires rethinking your approach.

Core-plus fixed income managers have traditionally relied on risky public market segments to extract higher returns, either by increasing exposure to below investment-grade investments, such as high yield bonds and senior loans, or choosing emerging market debt segments that contain currency and geopolitical risks.

The added risk increases their odds of beating the benchmark but also creates more potential for downside. For example, 76% of active core-plus managers, on average, outperformed the Bloomberg US Aggregate Bond Index (Agg) in the 14 years that high yield bonds also outperformed the Agg. That compares to just 28% of managers beating the Agg in the six years when the Agg bested high yield bonds.1

But today, the risk/reward relationship for these higher-risk credit segments is unbalanced. In high yield’s case, credit spreads are near all-time tights, trading around the 90th percentile since 1994.2 That means further spread tightening to generate upside/returns is unlikely. Meanwhile, the uncertain macro outlook raises the potential for spreads to widen if growth dynamics weaken and risk premia are repriced.

If only you could pursue the plus in core-plus without taking on below investment-grade credit risk.

You can, with private credit.

Consider investment-grade private credit for better risk-adjusted returns

Most of private credit’s addressable market is investment-grade3—offering investors a unique source of alpha and yield premium, without taking on below investment-grade credit risk.

Long relied on by institutional investors for higher yields and a lower correlation to stocks and bonds,4 private credit offers investors a powerful combination of income and resilience.

And now, through vehicles like the actively managed SPDR® SSGA IG Public & Private Credit ETF (PRIV) and the State Street® Short Duration IG Public & Private Credit ETF (PRSD), all investors can access a blend of public and private investment-grade credit in a liquid, transparent ETF format. The ETF structure allows for daily pricing and holdings disclosure, addressing historical concerns about opacity and illiquidity.

PRIV and PRSD may invest in private credit instruments sourced by Apollo Global Securities LLC, which will generally range between 10%-35% of the fund’s portfolio. The allocation also may comprise less than 10% or more than 35% of the fund’s investment portfolio at any given time.

The goal: Through active management and the ability to invest across the investment-grade private and public credit markets, PRIV and PRSD seek to help investors pursue:

- Enhanced yield potential without sacrificing credit quality

- Broader diversification with exposure to private credit markets, including asset-based investments across sectors not well represented in the public market, as well as private financing solutions provided to large corporations /institutions

- Greater excess return-per-unit-of-risk relative to traditional core and core-plus fixed income strategies

Notably, to help manage interest rate risk, PRSD, with a duration target between 1 and 3 years, provides the potential for greater high-quality income than ultra-short exposures while limiting the volatility associated with intermediate- and longer-term bond strategies. Relative to core bonds, short-term exposures have historically provided 70% less volatility but only 24% less return.5

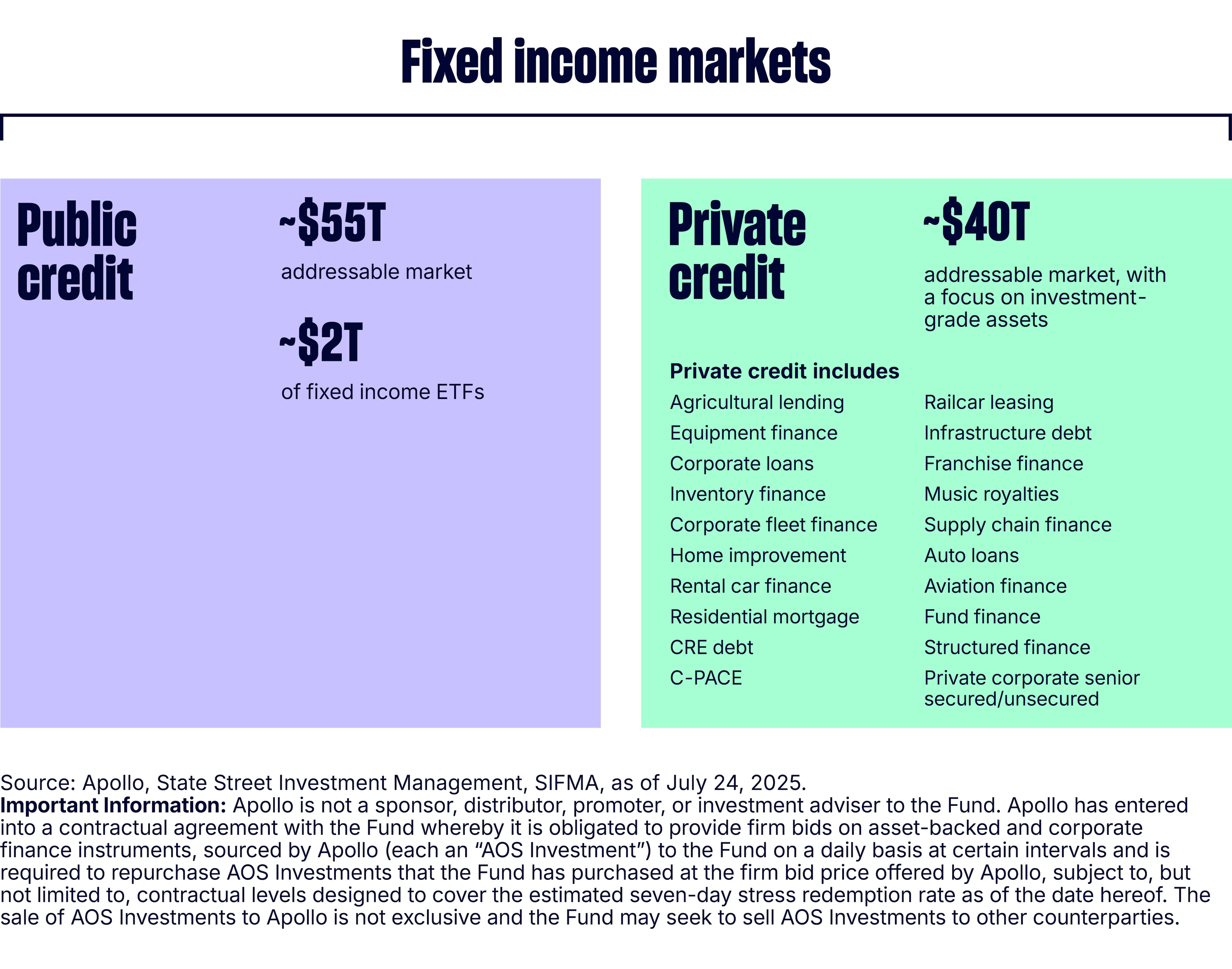

$40T addressable private credit market: From corporate financing to asset-based finance

Private credit has grown substantially for more than a decade and a half, as banks have retreated from certain forms of credit origination. Increasingly, private capital and the broader investor marketplace have been stepping in to fill the void and finance global economies.

Today, in addition to direct financing of investment-grade-rated companies, private credit also comes in the form of Asset-Based Finance (ABF), credit assets secured by contractual cash flows and real-world collateral—everything from real estate, to aviation equipment and machinery, to music royalties, consumer receivables, and more.

Figure 1: Private credit’s $40T potential opportunity

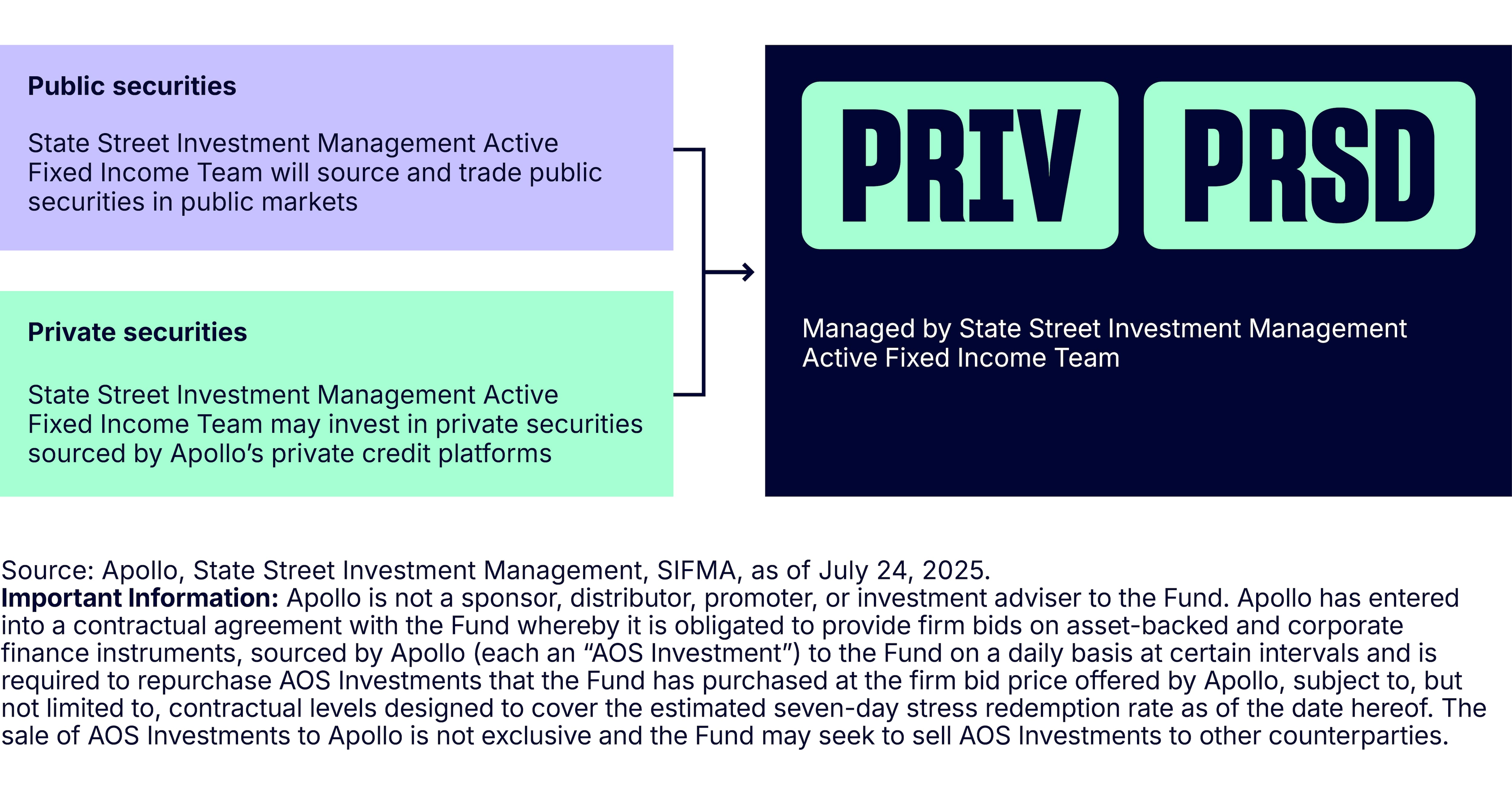

How PRIV and PRSD access private credit

Through a contractual agreement with Apollo, a leading global alternative asset manager, PRIV and PRSD may invest in private credit instruments sourced by Apollo as well as its unique origination platforms.

Apollo’s credit platform originated more than $220 billion of transactions in 2024,6 supported by its credit business and broader origination ecosystem currently spanning 16 standalone businesses that provide novel access to directly sourced private credit originations, including both corporate lending and asset-based finance.

The partnership is designed to offer investors the potential benefits of private credit, with an innovative liquidity agreement and transparency into the private credit instruments sourced by Apollo.

Active management matters

Active management of fixed income is anchored around the belief that while market efficiency continues to improve, persistent inefficiencies arise from investor sentiment, varied institutional objectives and timeframes, and market complexity. These inefficiencies create opportunities to source alpha from structural and cyclical risk premia.

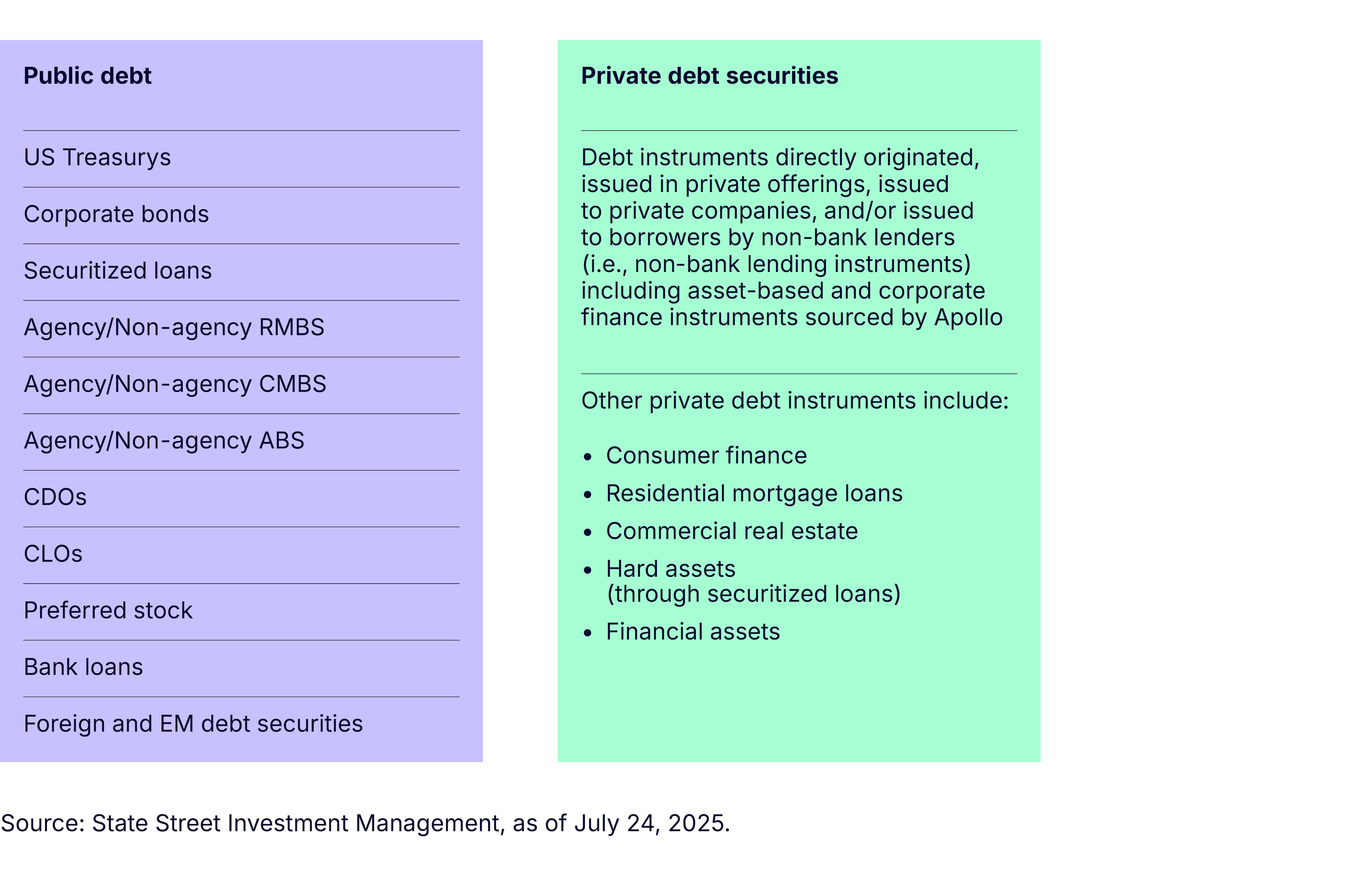

Built on a platform designed for efficient portfolio construction, PRIV and PRSD are managed by State Street Investment Management’s Active Fixed Income Team. Using a risk-aware, macroeconomic top-down approach, combined with bottom-up security selection, the team constructs a portfolio that seeks to overweight the most attractive sectors and issuers across a wide opportunity set within both public and private credit markets (Figure 2).

Figure 2: PRIV’s flexible and diverse opportunity set

PRIV and PRSD’s sector allocation, credit rating allocation, and sensitivity to interest rates will vary over time. Allocation decisions, where the fund can also own up to 20% in high yield securities, will be informed by the team’s proprietary long-term structural and intermediate-term cyclical views based on its analysis of macroeconomic factors, financial conditions, industry and sector trends, as well as rigorous fundamental and issuer-specific relative value research.

Our active fixed income team’s investment process

Anchored around their estimate of long-term fair value for a range of fixed income exposures, our Active Fixed Income Team combines their macroeconomic top-down views with bottom-up security selection to adjust positions across sectors and credit curves in a consistent manner.

This flexible process is particularly valuable in today’s environment, where macro risks and market dislocations can quickly shift the opportunity set. It is also highly adaptive to incorporating market evolutions like the recent developments of private credit and the blurring of the line between what is public credit and private credit:

- Define objectives and constraints: Through sample portfolios and risk modeling, we can gauge risk tolerance and, as a result, form a clear picture of what success looks like over a full market cycle within the context of investment guidelines.

- Structure portfolio: Reviewing long-term economic, policy, and market trends provides a framework for assessing long-term fair value for a range of fixed income exposures. It also allows us, within the above objectives and constraints, to establish strategic asset allocation risk targets for market environments where pricing is fair. We like to describe it as the fund’s average expected asset allocation strategy over a full market cycle, assuming fair value pricing.

- Cyclically adjust exposures: As market pricing deviates from long-term fair value, the team adjusts positions across sectors and credit curves to reflect where the team believes we are in both the economic and market cycle. Given the team’s anchoring to long-term fair value, our adjustments and resulting risk positions can be seen as counter-cyclical.

- Build a portfolio and manage risk: This is where each fixed income team builds a portfolio on a rigorous, bottoms-up basis in a manner consistent with the overall portfolio’s return objectives and risk tolerance. Security-level assessments of fair value anchor the relative value portfolio construction process. Daily reviews of risk exposures versus risk targets and performance attribution drive our risk management process.

“We are trying to outperform investment-grade rated public markets, achieve top quartile results, and provide a differentiated excess return stream relative to the typical core plus fund, all by widening the aperture on the investable universe in fixed income to incorporate both public and private debt. We have a broad mandate but intend to invest in investment-grade instruments and are subject to liquidity constraints in managing an ETF.

The primary source of excess returns over time are expected to stem from the private debt securities we participate in, but a holistic approach to the portfolio focused on broad diversification across sectors and issuers, sound credit research, and a strong relative value anchor seeks to ensure risk and return are appropriately aligned.”

—State Street Investment Management’s Active Fixed Income Team

Figure 3: PRIV and PRSD and private credit access

Investment-grade credit: A new core-plus and a new path

Allocating to both public and private investment-grade credit markets to generate alpha can serve as a timely replacement to a core-plus bond allocation that relies mainly on high yield exposures that increase credit risks.

With PRIV and PRSD, investors can easily access both investment-grade public and private credit securities together in an active, transparent, tradable ETF.

When added to a traditional balanced portfolio of stocks and bonds, PRIV and PRSD may offer investors the potential for meaningful diversification beyond public markets, enhanced yield generation from investment-grade exposures, and improved risk-adjusted-returns.

Bigger picture, the move toward private credit is part of a larger trend in portfolio construction: the convergence of public and private credit. Investors are increasingly blending public and private exposures to capture the best of both worlds—yield, diversification, and liquidity.

And this convergence of the public and private credit markets will continue to reshape how fixed income is defined and deployed across portfolios.