De-Risking Actions to Take Now: Refining Your LDI Portfolio Allocation for Enhanced Precision

Reducing funded status volatility and adjusting contribution requirements are top priorities for well-funded corporate pension plans, and liability-driven investing (LDI) portfolio construction plays a critical role in achieving that goal. Here is how plan sponsors can refine their fixed income holdings to better match their unique liability characteristics.

Thanks to positive trends for corporate pension plans, 2025 is set up to be another good year for companies to advance their de-risking strategies.

Rising interest rates in late 2024 pushed the discount rate to 5.6% at the end of the year — nearly 60 basis points higher than it had been at the end of 2023. This increase, combined with another year of strong equity returns, helped the average funded status of corporate DB plans rise to 105%. Yet increased uncertainty over the direction of interest rates and equity returns in early 2025 is raising the potential for increased funded ratio volatility going forward, creating additional urgency for companies to lock in their strong overall funded positions.

In this environment, plan sponsors may want to take advantage of several de-risking strategies, from refining their LDI portfolios and completing a pension risk transfer to finding additional uses for funding surpluses.

In this article we are focusing on how plan sponsors can minimize funded status volatility by refining their portfolio allocation to closely match the characteristics of their own plan liabilities.

Managing Increased Sensitivity to Fixed Income Volatility

The shift into a more precise fixed income allocation increases along with funded status. Well-funded plans typically shift assets into LDI portfolios as they de-risk, reducing equity exposure to fund their growing fixed income matching allocation. As a result, the contribution to funded status volatility (the tracking risk between plan assets and the liability return) from fixed income grows, while the contribution from equities declines. A more tailored fixed income portfolio therefore becomes an increasingly important component of managing funded ratio volatility.

The first area of focus in building a more customized LDI portfolio is on interest rate, or duration, risk. All else equal, allocating to fixed income will tend to increase overall portfolio duration, reducing the duration mismatch for underhedged plans. Plan sponsors also can seek to more closely match the duration of their liabilities at any point in their glidepath journey through duration extension strategies, such as through the use of US Treasury STRIPS or long duration futures.

The second key risk to focus on when refining an LDI portfolio is credit spreads. The liability discount rate is typically based on a high-quality corporate discount curve. More closely matching the duration times spread (DTS) of this discount curve is key to further reducing funded status volatility.

A third consideration is key rates, more commonly known as yield curve risk — how closely the LDI portfolio matches the liability on key points along the yield curve. After several years of trending lower, volatility across the yield curve, as measured by the spread between 10-year and 30-year bonds, has been on the rise. Generally, higher yield curve volatility increases the importance of matching key rates along the curve, as even modest mismatches can lead to elevated funded status volatility.

Figure 1: Yield Curve Volatility Rising

Better Surplus Risk Management Through Diversified Fixed Income Allocation

Investors now have access to a range of fixed income strategies that target specific interest rate and credit curve exposures. These tools allow plan sponsors to move beyond basic approaches to managing LDI portfolios — such as allocating to a broad-based long government or corporate index — to instead create more precise allocations that better match a plan’s actual liabilities.

Through a custom cash flow analysis, plan sponsors can measure the unique characteristics of their plan’s liabilities. They can then more closely hedge these risks by selecting a mix of fixed income strategies customized to meet their needs.

For example, State Street Global Advisors has created a suite of 17 LDI building block strategies across the maturity spectrum, including 1-3 year, 3-10 year, 7-15 year and 20+ year options in rates and credit. Using these strategies and vehicles, State Street helped one client develop a more precise liability hedging solution than the broad-based index they had been using. To help evaluate alternatives, we designed three potential portfolio solutions that would better match their liability characteristics and improve their hedging ability.

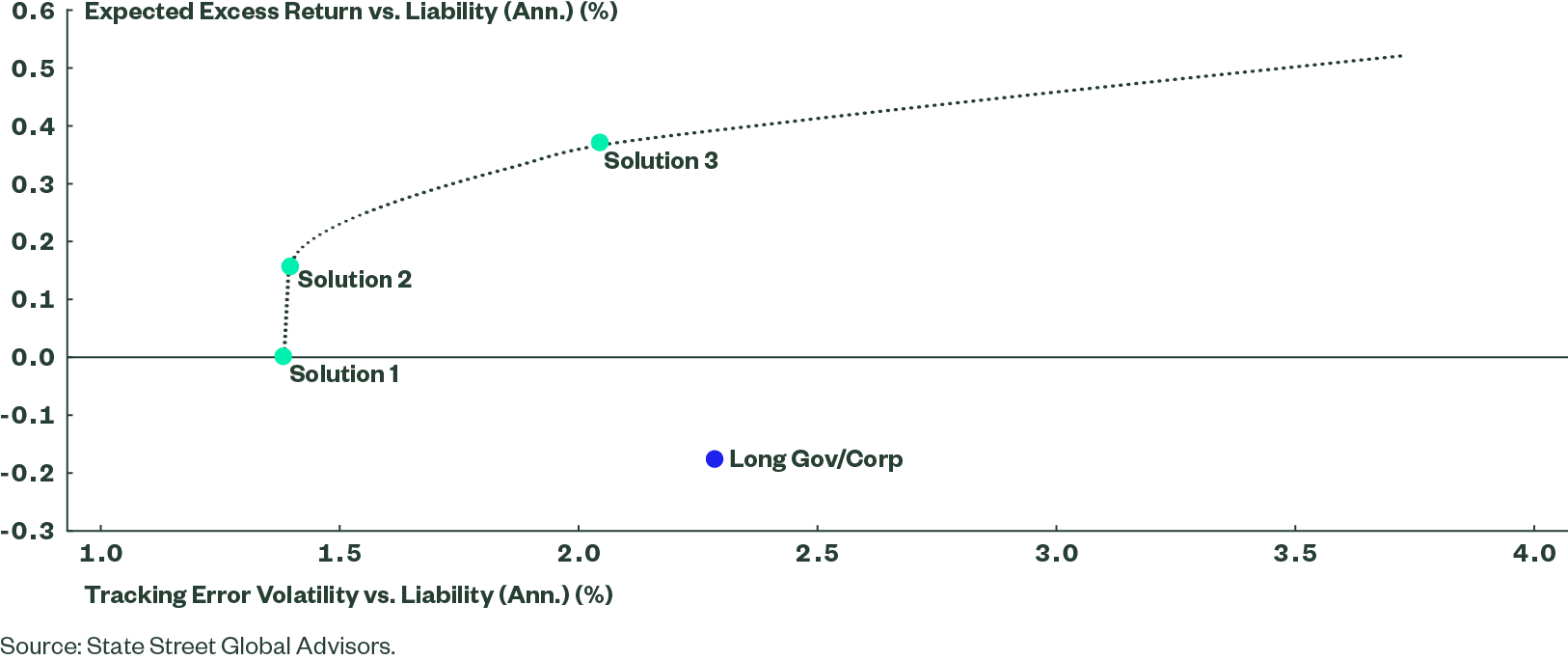

Each solution comprised different allocations to six underlying building block funds. We then illustrated the trade-offs between these mixes and the broader index through an efficient frontier analysis.

Figure 2: Seeking a More Efficient LDI Solution

As shown in Figure 2, the broad benchmark was a sub-optimal solution. It offered relatively high funded ratio volatility with a modestly negative expected funded ratio return. Each of the customized mixes improved on both metrics by more closely matching the duration, credit, and key rate profile of the plan’s liability. The client ultimately chose solution 2, which best met their desire for a more efficient LDI portfolio.

A Foundation for Additional Improvements

For well-funded corporate plans, protecting their improved funded status is a top priority while market conditions remain supportive. Creating an LDI portfolio that more precisely matches liability duration, credit spread, and key rates duration is an important step toward that goal. That mix of funds can then be adjusted to remain aligned with the liability profile as it evolves over time. This building block approach using liquid, low-cost funds can thereby offer a clear and relatively simple solution to what may seem to be a complex problem.

Contact your relationship manager to learn more about State Street Global Advisors' de-risking solutions.

More on Defined Benefit