Why ETF Growth Is Booming

- The SPDR® S&P 500® ETF (SPY), a basket of securities tracking the S&P 500® Index, made its debut in 1993 as the original US-listed ETF.

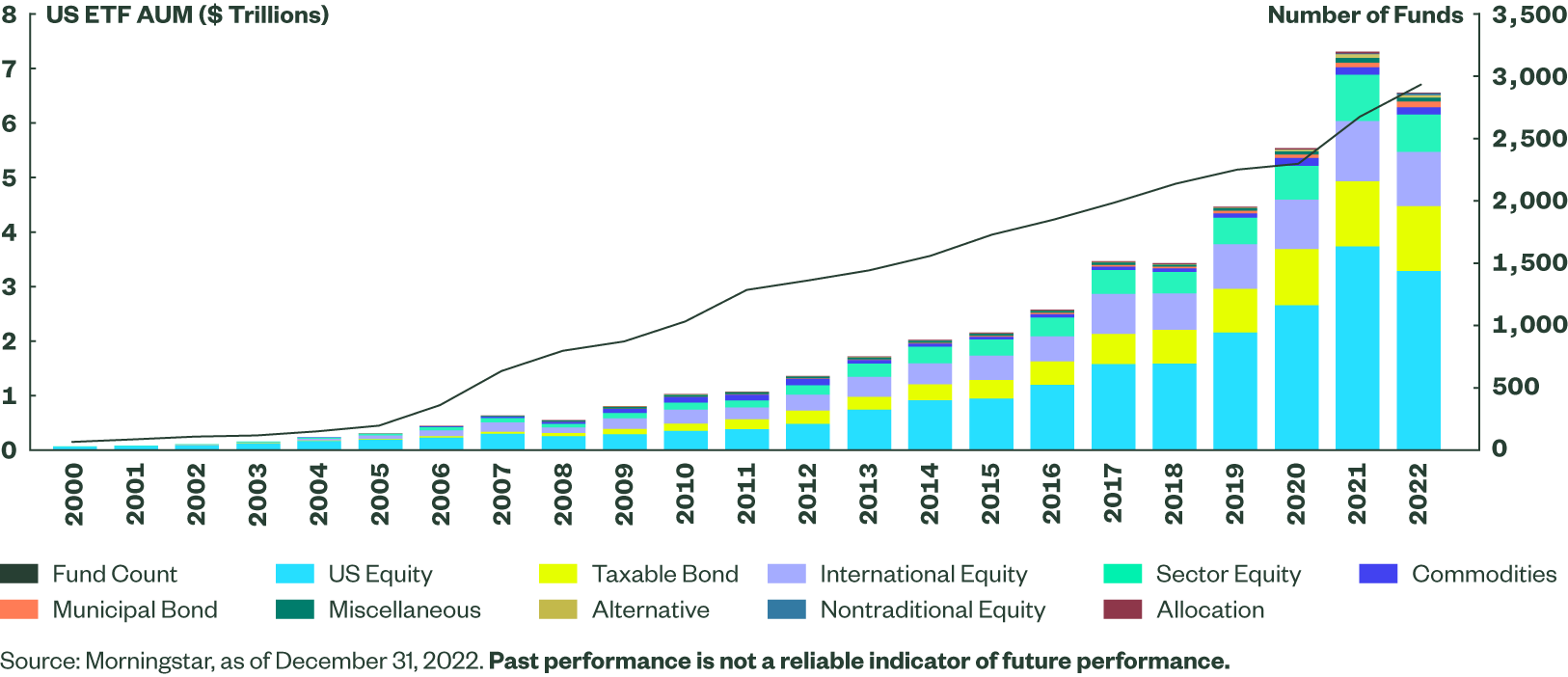

- Since then, the US ETF industry has grown to top $6.5 trillion in AUM, with just under 3,000 ETFs in market.1

- Nearly 75% of investors said in a recent survey that ETFs have improved the overall performance of their portfolio2 — proving that ETFs have become key portfolio building blocks.

SPY Sparked ETF Industry Growth

State Street Global Advisors is proud to have launched the first US-listed ETF in 1993 in response to the 1987 market crash — infamously known as “Black Monday.” On that day, stock markets plummeted so abruptly that the damage is believed to have been more significant than the Great Depression.

As regulators worked to determine what went wrong, the SPDR® S&P 500® ETF Trust (SPY) — a basket of securities that trades like a single stock — emerged from the rubble as a new type of investment structure that could help avert future disaster.

In the decades since SPY’s launch, ETFs have endured periods of market strength and stress. And, as volatility returned to global markets in 2022 and continues in 2023, ETFs are again demonstrating their value and resilience.

ETFs Never Went Out of Style

Just like a 90s fashion trend, the present-day popularity of ETFs is hard to miss. But, unlike plaid flannel shirts and combat boots, ETFs didn’t go out of vogue only to make a comeback 30 years later. Instead, their popularity has consistently grown over the years.

Since SPY’s launch, ETF assets have soared in the US market, reaching $6.5 trillion in assets under management (AUM)3 and growing at an annualized rate of 23.8% since 2000.4 And the total number of ETFs available to investors has risen to 2,988.5

ETFs Offer Several Key Advantages

There are a multitude of benefits that have led to the rapid growth of the ETF industry.

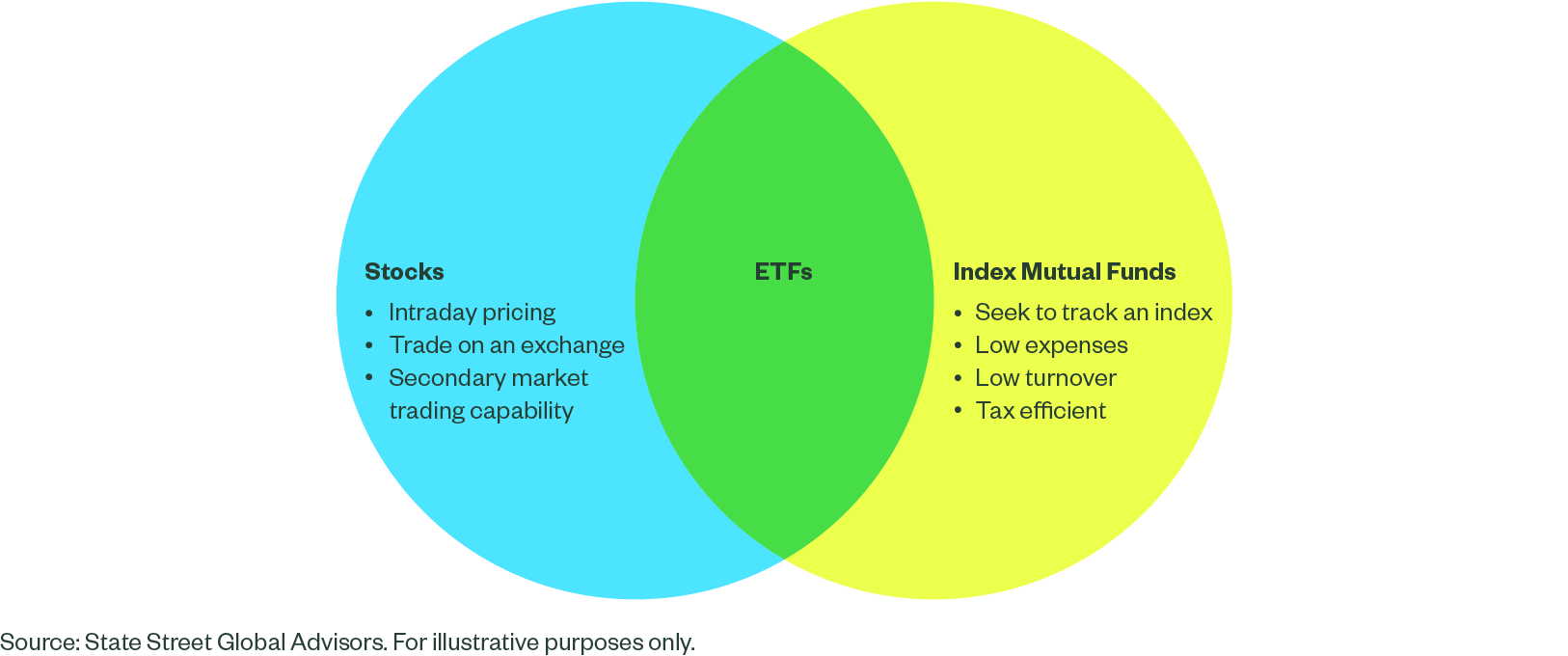

A Best-of-Both-Worlds Structure

ETFs are a mashup invention: they’re funds that trade like stocks while offering the diversification benefits of mutual funds. An ETF is a basket of securities that seeks to provide exposure to a broad or specific market segment. But unlike mutual funds, ETFs can be bought and sold in a single trade on an exchange throughout the day — just like stocks.

ETFs generally track the performance of an index and typically charge lower fees than mutual funds. In one trade, they offer diversified, low-cost, transparent, and tax-efficient exposure to a basket of securities.

How ETFs Compare to Mutual Funds and Individual Stocks

| ETFs | Index Mutual Funds | Individual Stocks | |

|---|---|---|---|

| Track an Index | Yes | Yes | No |

| Provide Diversification | Yes | Yes | No |

| Average Net Expense Ratio | 0.57% | 0.84% | N/A |

| Pricing | Market Price | Closing Net Asset Value (NAV) | Market Price |

| Intraday Trading | Yes | No | Yes |

| Minimum Investment | No minumum required | Some require minimums | No minimum required* |

| Tax Treatment | Low impact on shareholder’s level | High impact on shareholder’s level | Impact on individual level only |

Source: Morningstar Direct. Data as of March 7, 2023. Oldest share class of mutual fund used.

*The brokerage through which you purchase individual stocks may have a minimum account requirement.

The ETF Advantages Fueling Growth

For any invention to be defined as revolutionary, it needs to offer a unique combination of features that differentiate it from products that existed before. ETFs offer several such attributes, like the ability to easily access precise and diversified exposure in a single trade. They’re also cost effective, transparent, and tax efficient due to their unique creation and redemption mechanism.

The Key Advantages of ETFs

| Diversification | Exposure to broad or specific market segments |

|---|---|

| Transparency | Daily disclosure of underlying portfolio holdings and intraday pricing |

| Cost and Tax Efficiency | Structure leads to low management fees/operating expenses — and the creation and redemption process helps with tax efficiency |

| Flexibility | Trading techniques can include limit orders, stop-loss orders, and buying on margin |

| Precision | Allows investors to target exposures to match changing portfolio goals and economic environments |

| Liquidity | Easy to buy and sell in market stress, and can also support large institutional trades |

Certain securities may trade in limited volume or may not have an active trading market. Therefore, there is the risk that it may not be possible to sell the investment at a particular time for an acceptable price. Diversification does not ensure a profit or guarantee against loss. There can be no assurance that a liquid market will be maintained for ETF shares.

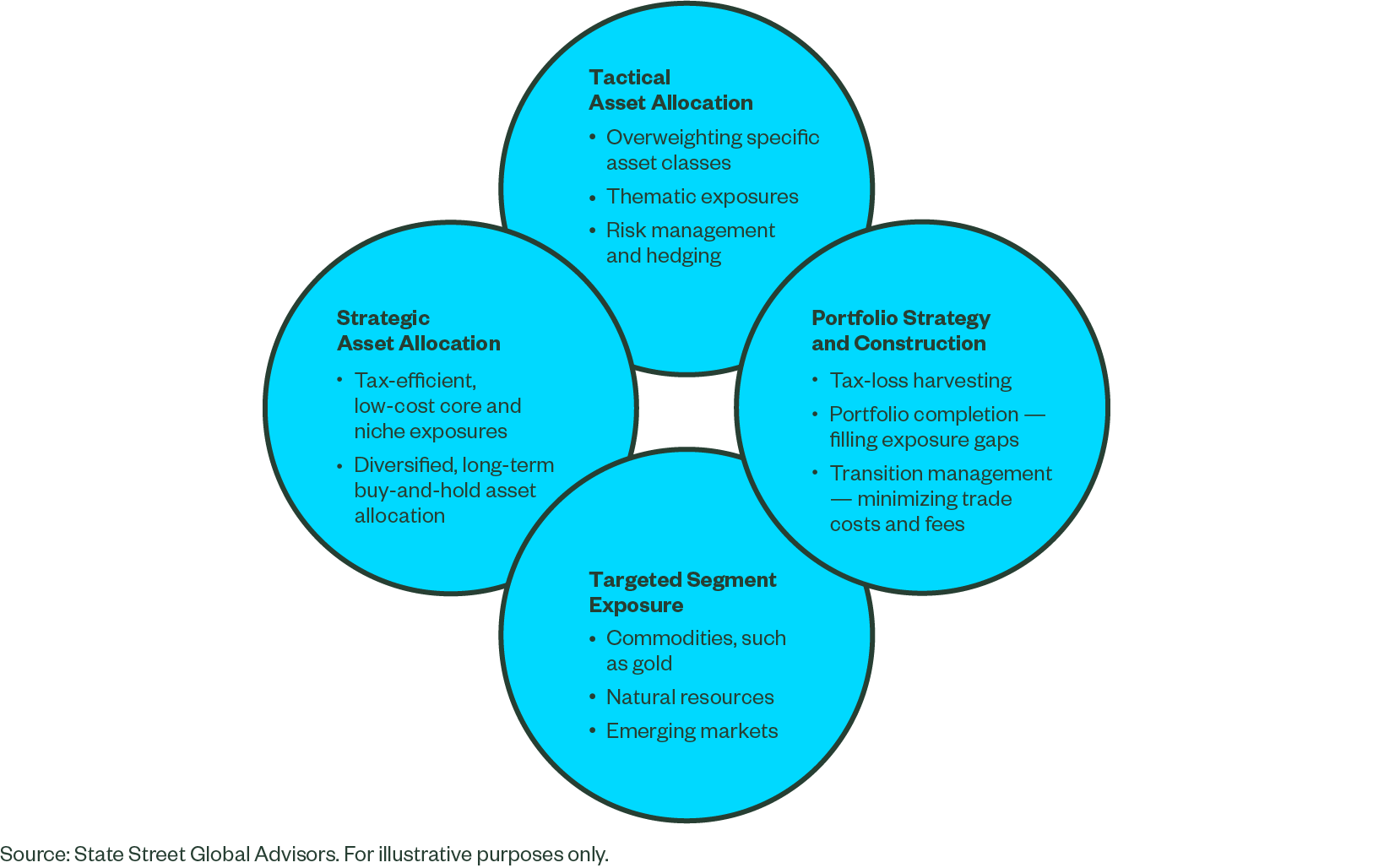

ETFs Meet a Wide Range of Investors Needs

As the ETF market has grown and evolved, so too have the various ways investors use ETFs. Today, ETFs have become key building blocks when making asset allocation decisions. They allow investors to focus on a wide range of portfolio outcomes with greater efficiency. And the surging popularity of ETFs has given rise to remarkable liquidity — making them powerful trading tools, especially amid periods of market volatility.

From strategic asset allocation to risk management, ETFs offer a myriad of use cases that can help investors achieve their investment objectives — showcasing the versatility and effectiveness of these investment vehicles.

ETFs Improved Overall Portolio Performance, Investors Said

ETFs wouldn’t be trending for three decades if investors didn’t find great value in them. Our 2023 ETF Impact Survey, gauging individual investor sentiment in volatile markets found that the growing number of investors that have embraced ETFs have not been disappointed.

Nearly three-quarters of the ETF investors we surveyed said that ETFs have improved the overall performance of their portfolio. And more than two-thirds said ETFs have made them a better investor.

Room for ETF Growth and Adoption Ahead

Despite the explosive growth of the ETF industry over the past three decades, the global ETF industry still has a long runway for adoption, as just 40% of investors around the world say they own an ETF.6 This is considerably lower than investors’ ownership of stocks (77%), mutual funds (56%), and bonds (49%).7

Now with $8.8 trillion in AUM globally,8 ETFs provide a highly liquid, cost-effective, and transparent way to invest in all corners of the market. And with more than 9,500 ETFs available globally,9 more investors can gain exposure to an increasingly wide variety of market segments to achieve their financial goals.