What’s On the Horizon for ETF Investors? 3 ETF Trends Taking the Industry by Storm

Despite their remarkable growth to date, ETFs still only represent about 9% of investable assets — which means there’s plenty of room for growth and adoption as we enter the next era of investing.

But which asset classes present the greatest opportunity for investors — in 2023 and beyond? Below are three of our top predictions.

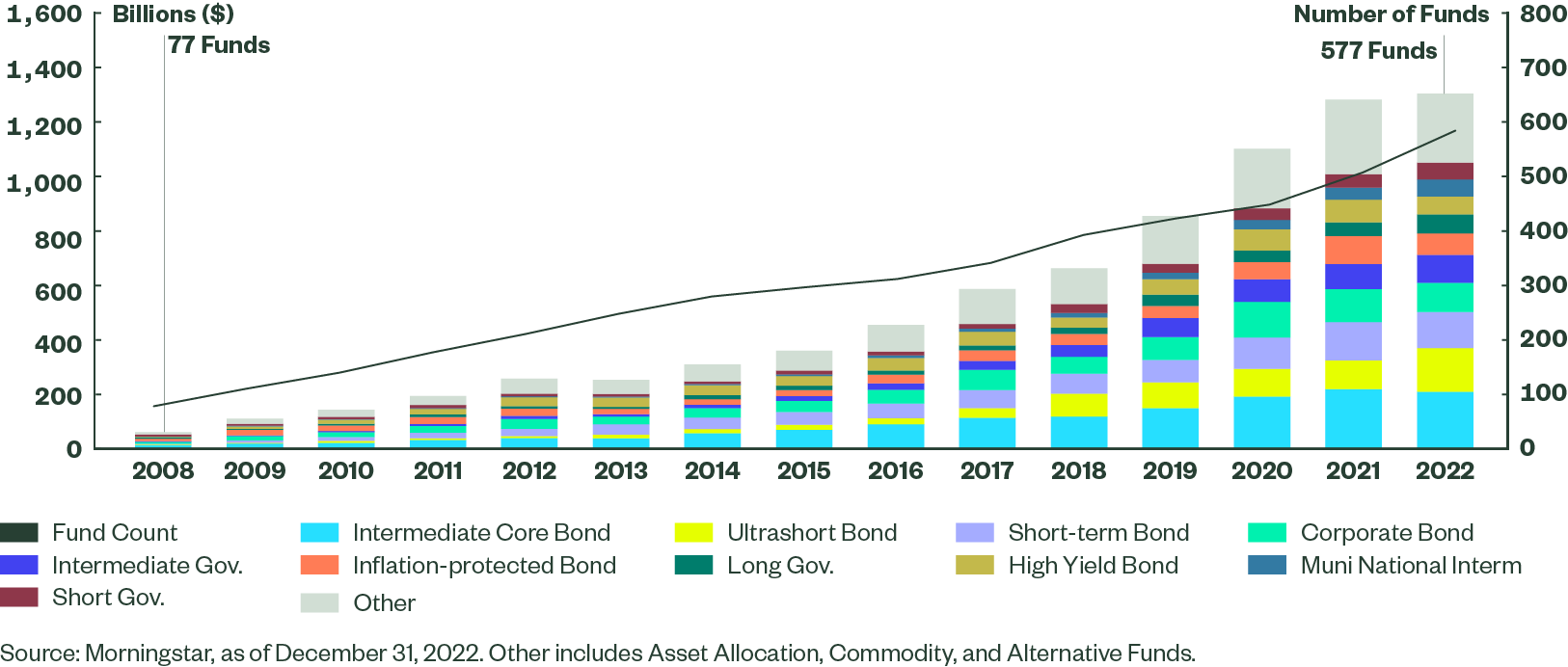

1. The Choice of Fixed Income ETFs Will Continue to Expand

Bond ETFs took in nearly $200 billion in 2022, led by a record $125 billion of inflows into government funds. As investors sought higher yielding short duration sectors amid rising rates, ultra-short government bond ETFs comprised more than a third of bond ETF inflows.

Looking ahead, we expect fixed income ETF flows will continue to gather steam. And as the fixed income ETF universe has expanded and evolved, investors have the choice to look at shorter-duration segments beyond government bonds.

Today’s extensive breadth of choice in the fixed income ETF market gives investors the ability to strategically design bond exposures for what lies ahead — and slice and dice the bond market to target outcomes with precision.

Figure 1: Fixed Income ETFs Offer More Choice for Investors

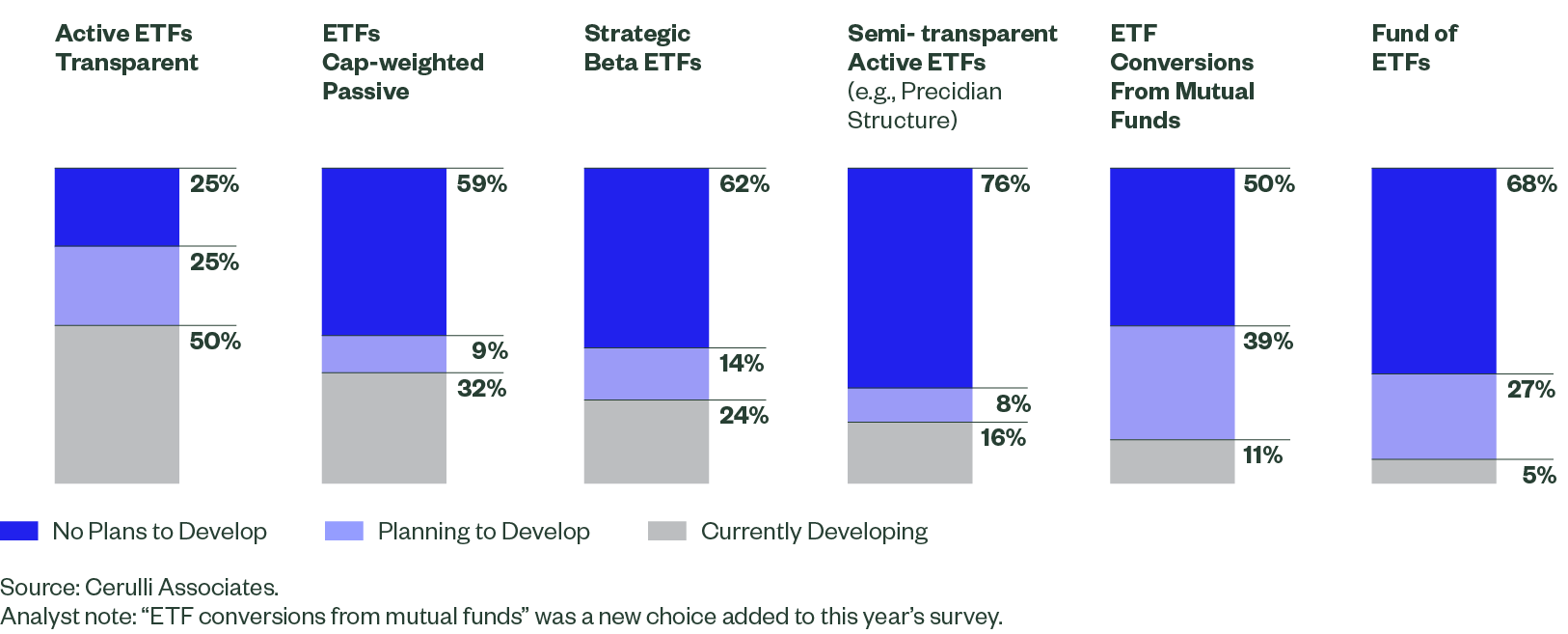

2. Active ETFs Will Lead the Way in Product Development

We’re also seeing room for growth in active ETFs — a trend that’s evident in ETF issuer product development plans for the year ahead. When surveyed by Cerulli Associates in 2022, 75% of ETF issuers reported either currently developing or planning to develop transparent active ETFs.

Figure 2: ETF Issuers’ Plans to Develop Exchange Traded Vehicles by Type, 2022

With active ETFs at the forefront of product development, it will perhaps come as no surprise that the majority of ETF issuers also said they expect “significant flows” into transparent active ETFs in 2023 — and it appears this is already materializing.

In 2022, active strategies took in a record amount of assets, registering $106 billion of total inflows on the year. This was 22% more than the 2021 record of $87 billion — and was fueled by active equity ETFs. Those funds amassed $86 billion in 2022, a 100% increase from their prior record total in 2021 of $43 billion.1

Strong flows into active ETFs overall have continued into 2023, taking in $33 billion through just the first four months of the year, pushing total active ETF assets to $394 billion. And if asset gathering continues at 2022’s pace, assets could surpass $450 billion by the end of this year — presenting additional opportunities for investors.

3. Investors Will Want to Pay Less for Core Exposure

With recession fears and lower return expectations extending into 2023, we expect investors will continue to look closely at the total cost of ownership of their investments, further driving flows into low-cost ETFs.

Because costs can accumulate over time and erode portfolio returns, building a low-cost, diversified core is even more important today given the murky outlook for markets and the economy.