Gold ETF Impact Study 2023

Looking to understand individual investors’ perceptions of gold as an investment option? In this study, we shed light on the types of investors using gold in their portfolios and the top reasons they’re investing in this perceived safe-haven* asset.

*Assets may be considered "safe havens" based on investor perception that an asset's value will hold steady or climb even as the value of other investments drops during times of economic stress. Perceived safe-haven assets are not guaranteed to maintain value at any time.

Investors Seek Solace in Gold

20% of US investors who participated in our study currently have gold in their portfolios, according to our research. Among these investors, nearly half (47%) hold gold ETFs.

Do gold investors think that a gold allocation has improved the overall performance of their portfolios?

The Gold Standard: Key Investing Trends

Among approximately 1,000 investors surveyed, we found that millennials averaged a 17% allocation to gold, while Baby Boomers and Gen X investors lagged behind with a 10% allocation.

Millennials Have More Positive Views of Gold Than Other Generations

| Millennials | Gen X | Boomers* | |

|---|---|---|---|

| Average percent of my portfolio invested in gold | 17% | 10% | 10% |

| I agree that it’s easy for investors to buy/sell gold | 82% | 56% | 75% |

| I agree that the overall benefits of gold outweigh lack of yield | 84% | 76% | 65% |

| I agree that gold ETFs are the best way to invest in gold | 69% | 35% | 55% |

| I agree that it’s safer to buy gold ETFs than gold bullion | 64% | 35% | 40% |

| I am likely to increase my investment in gold over the next 6-12 months | 67% | 44% | 60% |

Source: State Street Global Advisors, as of April 19, 2023. *Note that the base size is under 30 for Baby Boomers (n=20).

In addition to generational insights, we’ve evaluated the benefits and purchasing considerations that rank highest among gold investors.

Why Education Is Essential for Gold Investors

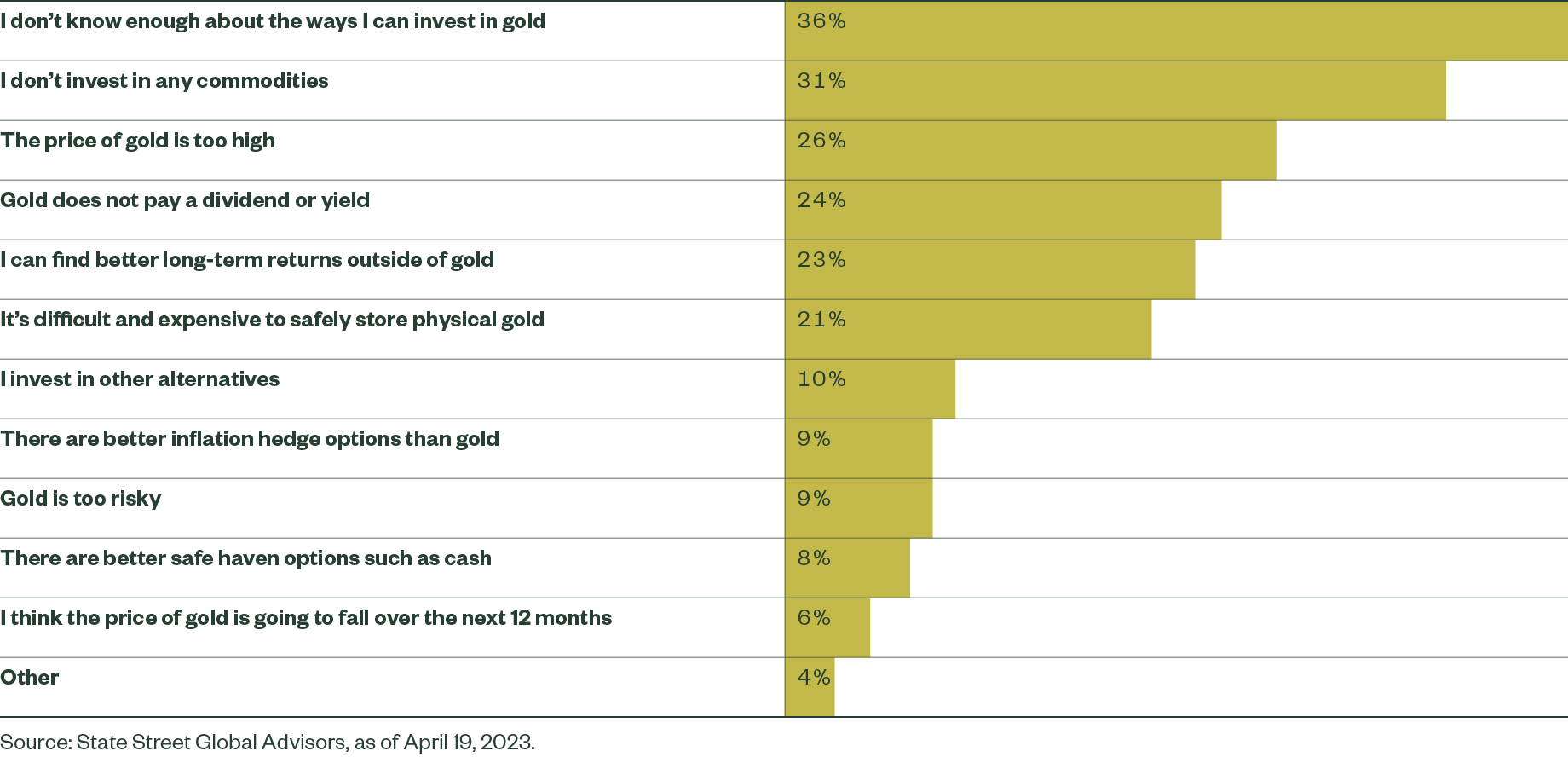

More than one-third of the investors we surveyed say they don’t have gold in their portfolio because they don’t know enough about the ways they can invest in gold.

Lack of Education Ranks as the Top Reason Investors Don’t Invest in Gold

And so we believe that education on how to invest in gold, as well as its potential benefits to a portfolio, can be critically important in the adoption of gold as an investment.

Invest in SPDR Gold ETFs

About the Study

State Street Global Advisors, in partnership with Prodege and A2Bplanning, conducted an online study surveying a random sample of approximately 1,000 individual investors in the US with invested assets of $250,000 or more.

Demographic Breakdown

From the random sample, there were 95 individual investors who held a gold ETF(s). An augment of 10 individual investors who held a gold ETF(s) was performed to achieve a sufficient sample size for analysis.

The survey consisted of 14 close-end questions plus profiling questions and took individual investors 6-7 minutes to complete, on average.

All data was collected between March 24 and April 19, 2023.

Key Findings from This Study

Investors Seek Solace in Gold: A Trusted Commodity and Investment Preference

The Gold Standard: Key Trends in the World of Gold Investing

Why Education Is Essential for Gold Investors