Seek New Opportunities Supported by Macro Momentum

While macro trends from rates and inflation to geopolitical tension will likely create disruptive episodic volatility, this macro-led volatility also can create new opportunities in impacted markets.

Volatility is back. The CBOE VIX Index (VIX) recently traded in the 20s after spending 80% of 2023 below its historical average of 19.1 Between high rates, above-average inflation, and increasing geopolitical stress, investors are likely to see episodic volatility throughout 2024. But while it can sow uncertainty and cause upheaval, macro volatility also creates opportunities.

For example, despite rate volatility and above-average inflation in 2023, strong labor and wage foundations that underpin consumer strength kept unemployment low while fueling consumption. In fact, the consumer was the main driver of growth, expanding by 4% and driving 82% of the 4.9% headline real GDP figure in Q3.2 And inflation-adjusted final sales to private domestic purchasers, a key gauge of underlying demand, rose 6.1% on the quarter.3

With forward-looking GDP estimates positive4 and the probability of recession moving lower,5 industries connected to the consumer engine could remain a source of macro-driven momentum in 2024.

Macro trends could even turn into tailwinds, creating momentum in the following markets:

- Housing and home retail, driven by a resilient consumer that may benefit if the Federal Reserve (Fed) cuts rates and mortgage rates fall.

- Defense industry, likely fueled by strong bipartisan support in Washington, DC.

- Real assets, where natural resource markets have reacted differently to geopolitical stress.

- Gold, which has historically outperformed in volatile markets and has potential upside from a stretched US dollar and persistent inflation.6

What supports macro-led volatility turning into macro-led opportunity in 2024?

Consumer Strength: A Sturdy Foundation for Homebuilders

Nowhere has the consumer been more resilient than in the Homebuilders industry — home construction, home retail, and home furnishings. Even as elevated mortgage rates and tight supply curtailed existing home sales, and expected sales and prospective buyer traffic expectations dropped to their lowest level in a year,7 new home sales have risen.8 And the National Association of Home Builders’ (NAHB) sentiment reading indicates greater demand for new construction,9 supported by builders offering financing incentives to reduce the pain of high rates.10

A 3.4-month inventory to end 2023 favors sellers and builders who will continue to benefit from higher prices. The tight housing market also has resulted in an increase in home improvement projects. The remodeling market condition indicator is 23% above its 15-year average, benefiting housing retail.11

Between increased new home sales and above-average remodeling plans, it’s no surprise that Homebuilders stocks gained 30% in 2023,12 12 percentage points better than the market13 — talk about flying in the face of the “high rates hurt housing” mantra.

More than 83% of firms, including the big box firms, surprised to the upside for Q3 2023 earnings season — outpacing expectations by 8.4%.14 Both figures are better than the market (81%, 7.5%, respectively).15 And while the broader market has had its 2024 earnings forecast lowered over the past few months (-0.6%), Homebuilders has witnessed a near 4% increase.16

Importantly, the recent price and fundamental momentum hasn’t extended valuations. Across price-to-next-twelve-month-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B), Homebuilders is trading at a larger-than-normal discount to the S&P 500® Index today than over the past ten years (Figure 1).17

Looking ahead, Fed rate cuts in 2024 could help ease the housing affordability burden by lowering mortgage costs. But given the tight supply, it’s unlikely we’ll see a buyers’ market overnight. In fact, the National Association of Realtors expects home prices to rise by 2.6% in 2024.18

Alongside resilient earnings trends and constructive valuations, this may lead to a continued optimistic outlook for this consumer-oriented industry.

Bipartisan Support for Defense Defies US Political Trend

Headlines in a divided Washington focus on contentious budget debates and theatrics on the campaign trail. Meanwhile, defense spending has quietly garnered bipartisan support. The Biden administration proposed a $106 billion supplemental-aid request to support Ukraine, Israel, and other critical national security priorities. Such a request could drive an incremental 7-8% increase to the 2024 Pentagon budget.19

At the same time, Republican Senate Leader Mitch McConnell, along with other defense hawks, urged the Senate to support more aid as part of broad national security package.20 Proposals by the GOP-led House of Representatives carved out measures for aid to both Israel and Ukraine, while cutting other discretionary spending measures.21 And on the campaign trail, GOP candidates are touting their support for Ukraine and Israel along with being tough on China and US border enforcement.22

The defense budget has expanded from $687 billion in 2019 to $817 billion in 2023 as violence around the world increased. The Biden administration suggested a 2024 budget of $886 billion under the National Defense Authorization Act (Figure 2).23

Add in the emerging threat of artificial intelligence (AI) on top of increased cyber warfare, and defense spending will extend from traditional expenditures to advanced technologies. In addition to President Biden’s executive order on “Safe, Secure, and Trustworthy Artificial Intelligence,”24 there have been hearings on Capitol Hill on the growing influence of AI and bipartisan bills proposed to regulate the industry.25

With more spending on defense, contractors in the space are likely to witness upticks in bottom-line and top-line growth. Aerospace & defense firms have had their 12-month earnings forecast revised upwards by 3% since the start of Q3 earnings season, right as those firms registered 57% earnings-per-share growth while 75% firms beat estimates — outpacing forecasts by 6.6%.26

More importantly, and reflecting the strong demand, their sales growth was 10%, with 85% of firms either beating or matching estimates.27 This growth profile coincides with valuations that remain attractive. Aerospace & defense firms trade at a 1% discount to the market based on P/B versus a historical 8% premium, and they trade at a 25% discount based on P/S versus a historical 23% discount to the market.28

Looking ahead, with continued demand for services from their largest customer, alongside constructive fundamentals, the outlook for the defense industry is supported by both strong macro and fundamental trends.

Commodity Volatility Creates Dispersion and Opportunity in Real Assets

Increased geopolitical risks have turned commodity prices volatile. After falling through the first nine months of the year, implied oil volatility spiked 30% following the attack by Hamas on Israel.29 Realized 30-day volatility on the broader commodity markets recently doubled from its nadir in September.30

Volatility has also resulted in widening dispersion, as commodity markets reacted differently. One-month dispersion across the major commodity markets rose to the 50th percentile and has been volatile itself — ranging from the first percentile all the way to the 70th percentile in the past three months.31

This return dispersion can create tactical opportunities.

In the US, global growth plays a role because it anchors demand for commodities and other inflation-related real assets like real estate. And growth is under slight pressure. Global real GDP is forecast to be 2.6% in 2024 and 3.0% in 2025, below the 3.3% pre-pandemic five-year average.32 The fact that those figures are still positive, indicating no recession over the next two years, should reassure broad-based demand concerns.

In fact, Morgan Stanley’s outlook for aluminum and copper is positive, given stronger-than-expected demand in China, driven by property completions and “green” applications.33 They also expect bulk commodity prices to stay resilient, with increasingly unlikely steel production cuts in China set to keep demand for iron ore and metallurgical coal strong.34

Barclays views US oil demand for 2024 to be higher than it was for 2023, as the economy remains resilient and growth positive.35 This is all set against weaker supply. Planned OPEC+ output cuts,36 alongside a tepid outlook for US inventories, indicate a tighter market that should support oil's prospects. Lower inventories are likely to boost oil prices, with the US Department of Energy Information Administration estimating the spot price of Brent crude around $94.91 a barrel in 2024, up from a previous forecast of $88.22.37

Inflation — expected to linger around 3% in 2024 with upside risks from commodity prices38 — also supports the case for real assets. While cooling, inflation will still be somewhat sticky over the next year and is not expected register pre-pandemic levels for some time.

Sticky inflation is corroborated by the recent University of Michigan US Consumer Confidence Report revealing that consumers’ long-term inflation expectations increased to the highest rate since 2011 (Figure 3).39 The rationale for higher prices over the years ahead: increasing gas prices.

There are also strategic reasons to add to real assets. Namely, most portfolios are likely overweight equities and nominal assets like bonds that can be challenged on a real return basis, given the current growth and inflation backdrop.

Overlaying a less correlated tactical real asset natural resource sector rotation strategy may offer potential diversification as investors position for a macro environment where commodity prices may have a volatile, but potentially upward bias if aggregate demand continues to improve.

As Volatility Builds, Think Gold

With higher-for-longer rates raising funding concerns for firms and leading to weaker guidance, violence in the Middle East disrupting commodity markets, and political posturing around record deficits, no wonder cross-asset volatility has risen.40

Rates implied volatility (IV), a main driver of cross-asset volatility, now sits above that of S&P 500 Index IV by almost four percentage points.41 On average, rates volatility is usually below equity volatility by 3%. And volatile volatility (vol-of-vol) has spiked by 50% from summer lows.42

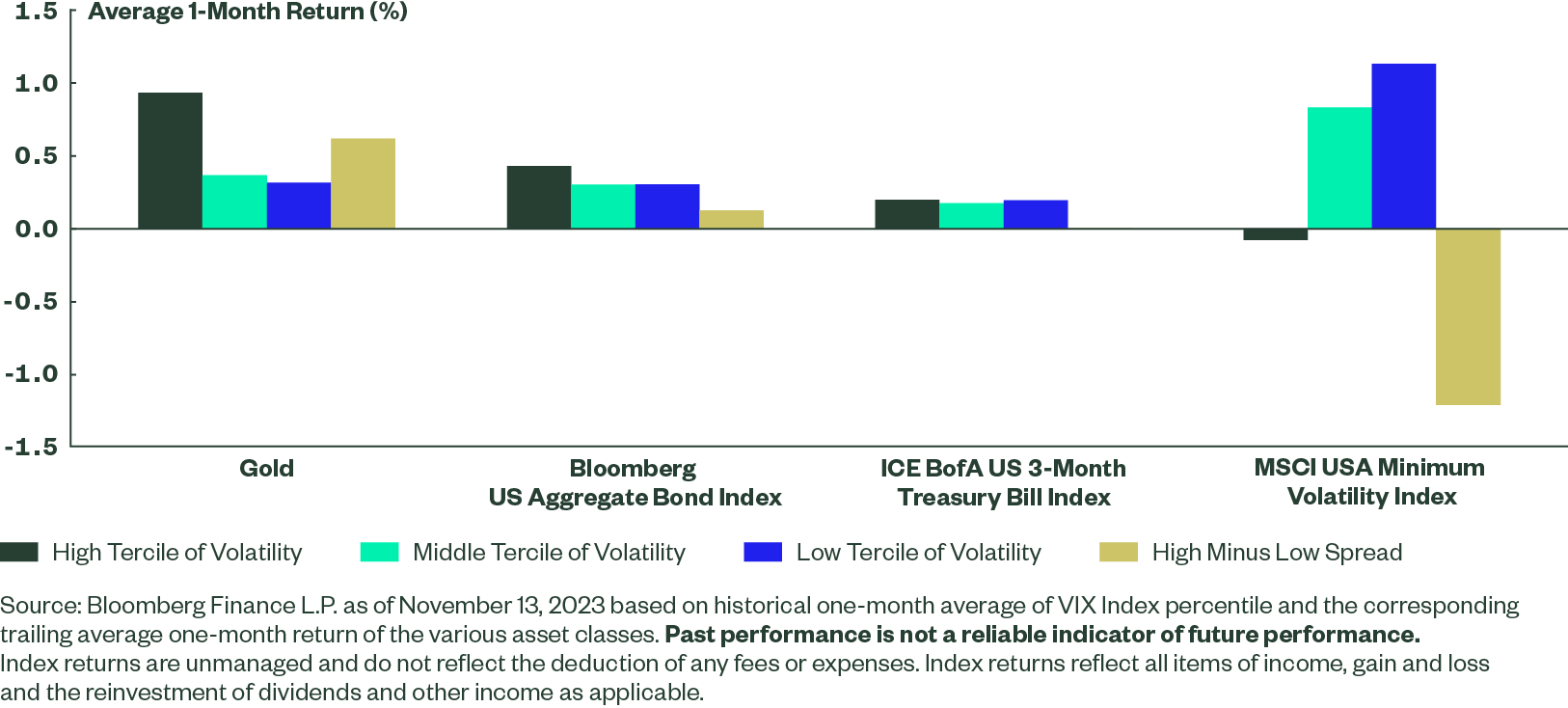

Historically, on average, in high volatility periods when the VIX Index rises, gold prices have outperformed other traditional risk mitigators like bonds, Treasury bills, and defensive equities. And gold has the largest spread of returns between high and low terciles (Figure 4).43

Figure 4: Gold Has Shined During Periods of High Volatility

Gold is not only for risk mitigation. There could be additional tailwinds to the spot price of gold from a macro perspective. The dollar, given the restrictive policy from the Fed, remains toward the higher end of its historical value, trading well above its historical real effective rate and just 4% away from its all-time high.44 If the Fed does decide to cut rates, that could lead to relative depreciation versus other currencies and some mean reversion. Gold has had a -45% correlation to the dollar over the past 20 years.45

Meanwhile, if inflation remains stubborn, that could embolden the Fed to keep rates higher for longer than expected. In that case, gold’s store of value properties maybe be supported by strong global demand led by central banks.

That’s something strategic investors realized in 2022 when CPI hit multi-year highs and gold was up 44 basis points on the back of the highest level of central bank demand for gold on record, while stocks and bonds were both negative.46

Either increasing a strategic allocation to gold, or introducing an initial portfolio position now, could potentially benefit investors amid rising geopolitical risks, a mean-reverting weaker dollar, and stubborn inflation.

Implementation Ideas

To turn macro-led volatility into a macro-led opportunity, consider: