Make the market your own with Select Sector SPDR® ETFs

Target sectors trends with the lowest cost US sector ETF suite

Precision, power, and performance. Investors rely on the largest, lowest cost1 US sector ETF suite—at just 8 basis points with higher trading volume and tighter bid/ask spreads—to adapt to market shifts and diversify core exposures.2

Explore Select Sector SPDR ETFs The only US-listed suite covering all 11 S&P 500® sectors³

Track sector performance across the S&P 500

Use our sector tracker tool to identify sector leaders and laggards, momentum shifts, underlying drivers.

Overview

Holdings and performance

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. Current performance may be higher or lower than that quoted. All results are historical and assume the reinvestment of dividends and capital gains.

In general, ETFs can be expect to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Investors may acquire ETFs and tender them for redemption through the Fund in Creation Unit Aggregations only. Please see the prospectus for more details.

Sector insights

Monthly Sector Chart Pack

A deep dive into sector performance including macro, fundamental, and technical trends driving current opportunities.

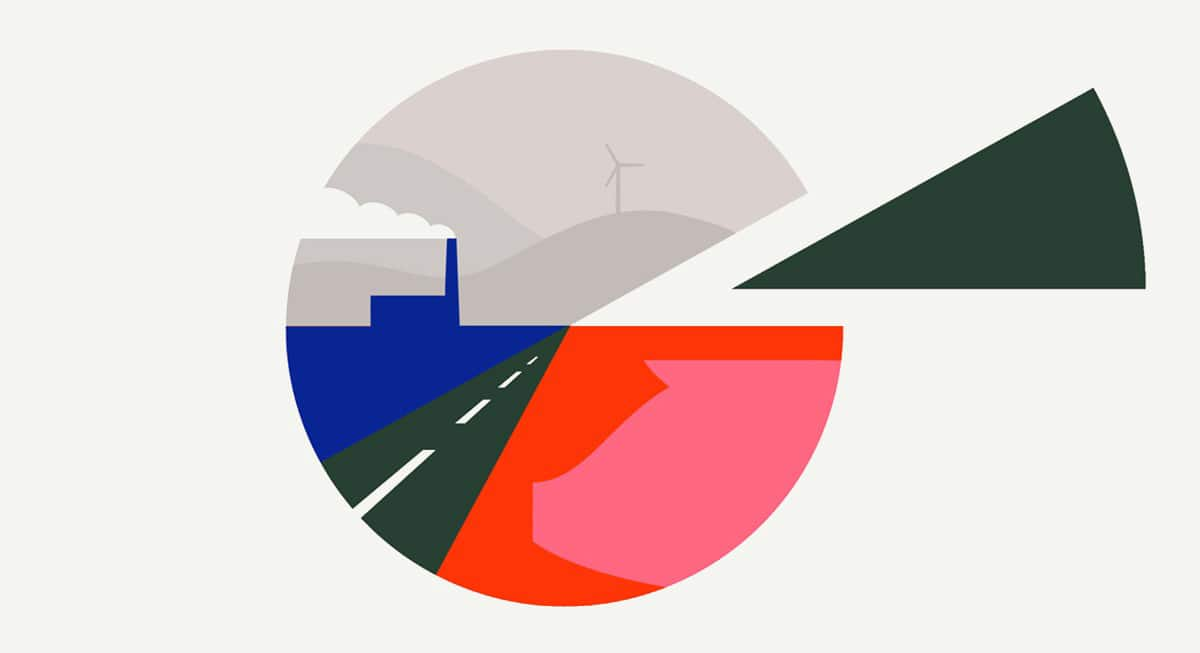

3 reasons to implement a sector strategy

Sector based investment strategies can help investors align and adjust portfolios to their objectives to accomplish three important goals.

Use business cycles to guide your allocations

See which sectors are favored in each economic phase.

.png)

How macroeconomic variables impact sector performance

Inflation, GDP, monetary and fiscal policy all affect asset prices.

Tap into the income opportunities across 11 S&P 500 sectors

Check out the actively managed Select Sector SPDR® Premium Income ETFs.

STATE STREET INVESTMENT MANAGEMENT Invest with the leader in sector ETFs

We pioneered the world’s first S&P 500 ETF in 1993 and the first suite of sector ETFs in 1998. We continue to build on our legacy of innovation and scale—empowering investors to target investment exposures with precision and confidence.

State Street Investment Management AUM 4

Select Sector ETF AUM 5

Greater average trading volume than the next-largest competitor 6

Managing sector ETFs