5 Questions Every Scheme Should Ask in 2025

Last year marked the dawn of a fresh era in geopolitics, setting the stage for continued volatility in financial markets as we move into 2025. In the UK, the general election and the policies of the newly elected Labour government dominated the gilt market, shaping investor sentiment and driving key market movements.

Rate cuts arrived later and in fewer numbers than anticipated, while fiscal easing measures introduced by the new government fuelled growing concerns over fiscal sustainability, reflecting broader global trends. Meanwhile, inflation has proven stubborn in its descent, and while economic growth has softened, fears of a deeper recession have yet to materialize.

Against this backdrop, below are the 5 Questions every scheme should ask itself to remain resilient as we go through 2025.

- How will the economy and markets affect UK DB schemes in 2025?

- What tail risks should we be worried about?

- What noteworthy innovations are in the market?

- How are endgame options changing?

- Does it make sense to review our LDI arrangements?

1.How will the economy and markets impact UK DB schemes in 2025?

Government bond markets is expected to remain highly volatile, as the economy experiences weak growth and sticky levels of inflation, making the future path for monetary and fiscal policy highly uncertain. DB schemes that are nimble can be rewarded with the opportunity to further increase hedge ratios at historically attractive levels. The heightened levels of volatility however will mean schemes may need to ensure they remain resilient to different market conditions.

The BoE is expected to continue cutting interest rates, will inflation come in softer?

Whilst interest rates are expected to be cut further in 2025, inflation stickiness will mean the Bank of England may have to be cautious over the pace of further easing, despite the weak growth backdrop. Correspondingly, whilst yields are at historically high levels, they may be slow to fall.

What is the likely impact from any further tax rises made to help meet the fiscal targets?

Fiscal risks are rising globally and whilst the Autumn budget is expected to boost growth in the near term, we remain concerned about the government’s ability to meet its fiscal rules without further tax rises or spending cuts. Any further tightening in fiscal policy may weaken growth and place more onus to the Bank of England to respond with easing monetary policy.

Debt issuance is likely to still be high and increasingly shift towards shorts and mediums.

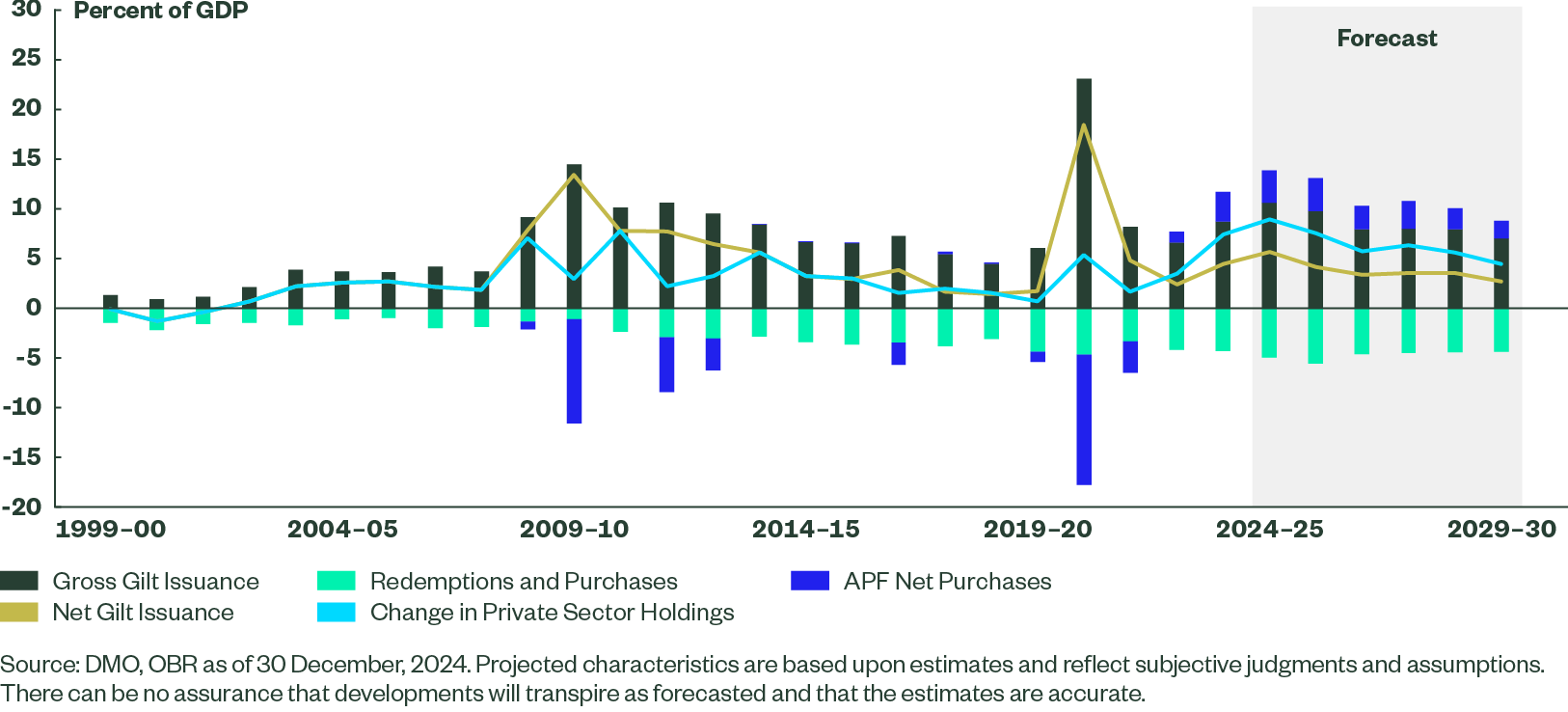

As shown in the below chart, the Office for Budget Responsibility’s most recent forecasts show that the amount of government bonds that the private sector will need to absorb will remain at elevated levels over the 5-year forecast horizon. Whist ordinarily this would be associated with higher yields and steeper yield curves, the Debt Management Office will likely to continue to skew issuance to shorter-dated gilts, to limit the total amount of duration supplied to the market.

Figure 1: Gilt issuance forecasts

Expect more volatility and term structure to repo markets.

Changes in the size and composition of the BoE’s balance sheet may see higher levels of volatility in repo markets, particularly around quarter ends. We may also see longer-dated repo rates rise relative to shorter-dated repo rates. DB schemes should ensure they have a wide range of repo counterparties to allow greater diversification, to minimise repo costs and reduce repo roll risk.

2.What tail risks should we be worried about?

- Fiscal accident Governments globally look set to continue running large deficits, with little sign of measures being implemented that will keep debt at sustainable levels. We’ve seen an orderly cheapening of government bond markets under various metrics. The risk is that we see a more disruptive sell off in bond markets that may drown under the weight of ongoing bond supply, leading to declines in risky asset markets too. This may necessitate central bank intervention in bond markets, or require regulating institutions to hold more government bonds, which may increase inflationary risks. Without these measures, governments may be forced into delivering a painful fiscal tightening, with a negative impact on both growth and inflation.

- Rising geopolitical risks Trade war escalations may become increasingly disruptive, with the potential to disrupt supply chains, particularly in energy markets. This would mean lower growth and higher inflation over time, which would create greater uncertainty over the path for monetary policy and correspondingly greater volatility in government bond markets.

- Deflation The high levels of inflation we’ve seen since the pandemic has meant an increased focus on the risk that inflation stays above target for a prolonged period of time. However deflation remains a big risk for pension schemes — the assets they hold to hedge against inflation will remain linked to the price level, whilst LPI-linked liabilities will see a zero- floor applied to their annual increase. If the UK chose not to retaliate in trade wars, we could see cheap imports from affected countries like China, which could lead to negative goods price inflation, potentially bringing inflation to below zero.

- Ozempic and AI The significant rally in equity markets over the past 2 years reflects in part optimism over new innovations such as Ozempic and AI. In our view we’re not at the point where we need to see a more widespread adoption of these to justify valuations. However, they have the potential to materially change productivity, growth and future life expectancy. These in turn will affect the future path of monetary and fiscal policy and valuations in government bond markets. Could the revolution in healthcare and potential impact on longevity have a more meaningful effect on DB pension schemes and their funding level?

3.What noteworthy innovations are in the market?

With pension schemes well funded, we expect to see clients to focus more on ways to further make their portfolios more robust and resilient to market conditions.

Credit index futures are one tool to do so. They allow investors the ability to access the total return of the underlying index via exchange traded futures contracts. The past few years have seen several futures contracts launched across different exchanges, but 2024 saw a significant increase in liquidity and they are now an instrument that pension funds should consider.

The key benefits of using credit index futures are:

- They are a cleared derivatives position, with potential netting benefits with other futures contracts held at the same exchange. They will also have less counterparty risk than bilateral Total Return Swaps.

- These instruments more closely align with the total return of the chosen index than index CDS contracts will, and they also include the duration risk of the index.

- They are unfunded positions and therefore are an attractive way to obtain a leveraged exposure to credit.

- The high levels of liquidity in ETFs and Total Return Swaps that follow the same indices lead to higher levels of liquidity in the futures contract.

Some potential drawbacks however do exist:

- Liquidity in period of stress could become a challenge and result in an increased cost of trading. This is also true for physical corporate bonds.

- Volumes have been building up steadily in the futures contracts however the cost of trading could fluctuate depending on size and volumes transacted.

As a result of the development of this new instrument, we believe pension schemes should consider adding these instruments to their toolkit, as they give market participants standardized, liquid access to global credit derivatives markets with considerable advantages and low tracking error compared to traditional credit products.

4.How are the endgame options changing?

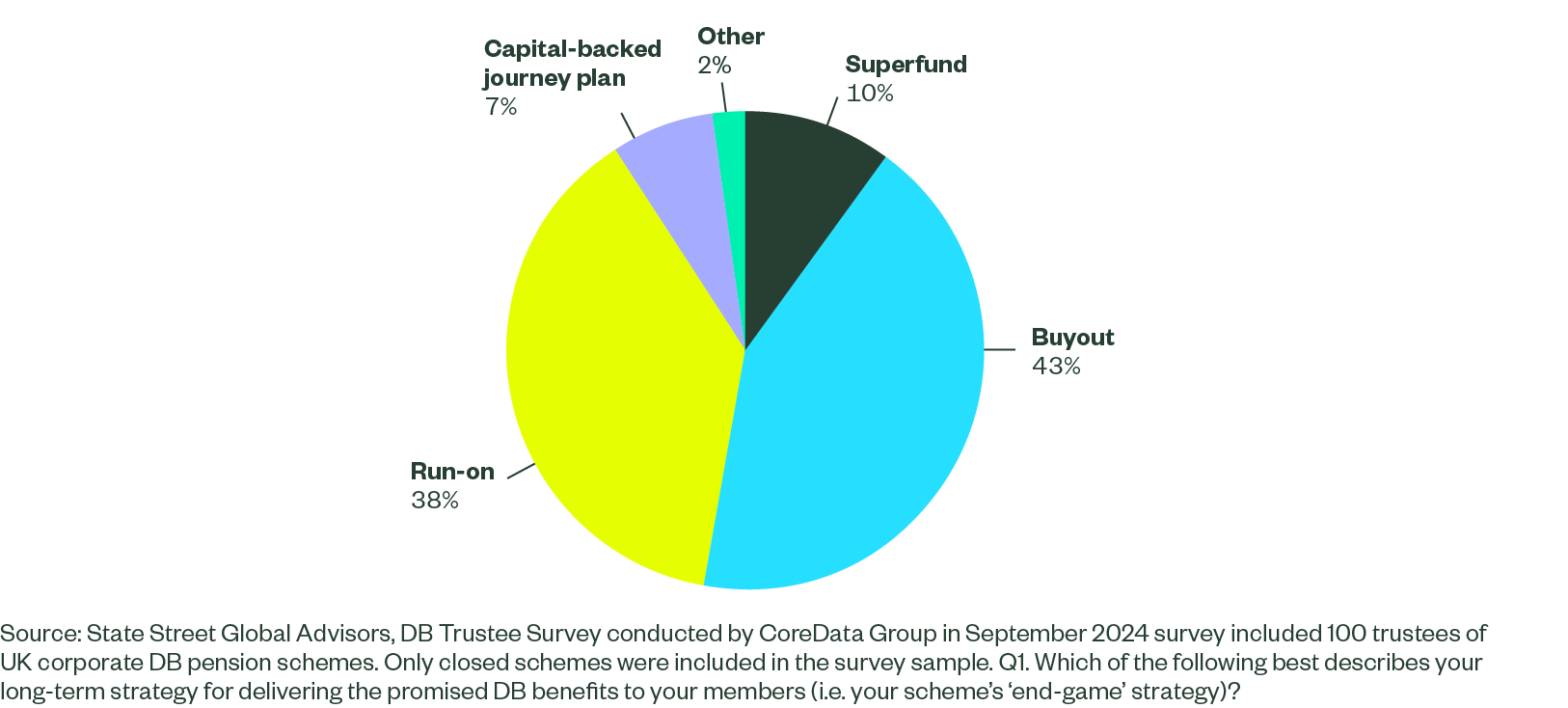

Schemes, in aggregate, remain extremely well-funded. Whilst buyout is often deemed to be the gold standard, alternatives have gained more interest over the year. We recently surveyed 100 DB scheme trustees on their preferred endgame choice, and the results showed a broad split of favourites:

Figure 2: What best describes scheme’s endgame strategy?

Even for schemes favouring buyout, there are considerations for trustees and schemes:

- Buyout pricing remains relatively expensive compared to running on. Running on for a further 5–10 years can cheapen the cost of buyout substantially.

- Aiming to invest in line with an insurer is likely to be increasingly difficult, as insurers are increasingly using leveraged gilt exposures to hedge new buyout transactions.

There has also been an increase in interest in consolidators and superfunds like Clara-Pensions (Clara), with two schemes having already joined Clara, and a third scheme joining soon. Clara offers a bridge-to- buyout solution that may be appealing to schemes that cannot currently afford a buyout and where the sponsor is unwilling, or unable, to inject the capital to make it a realistic prospect.

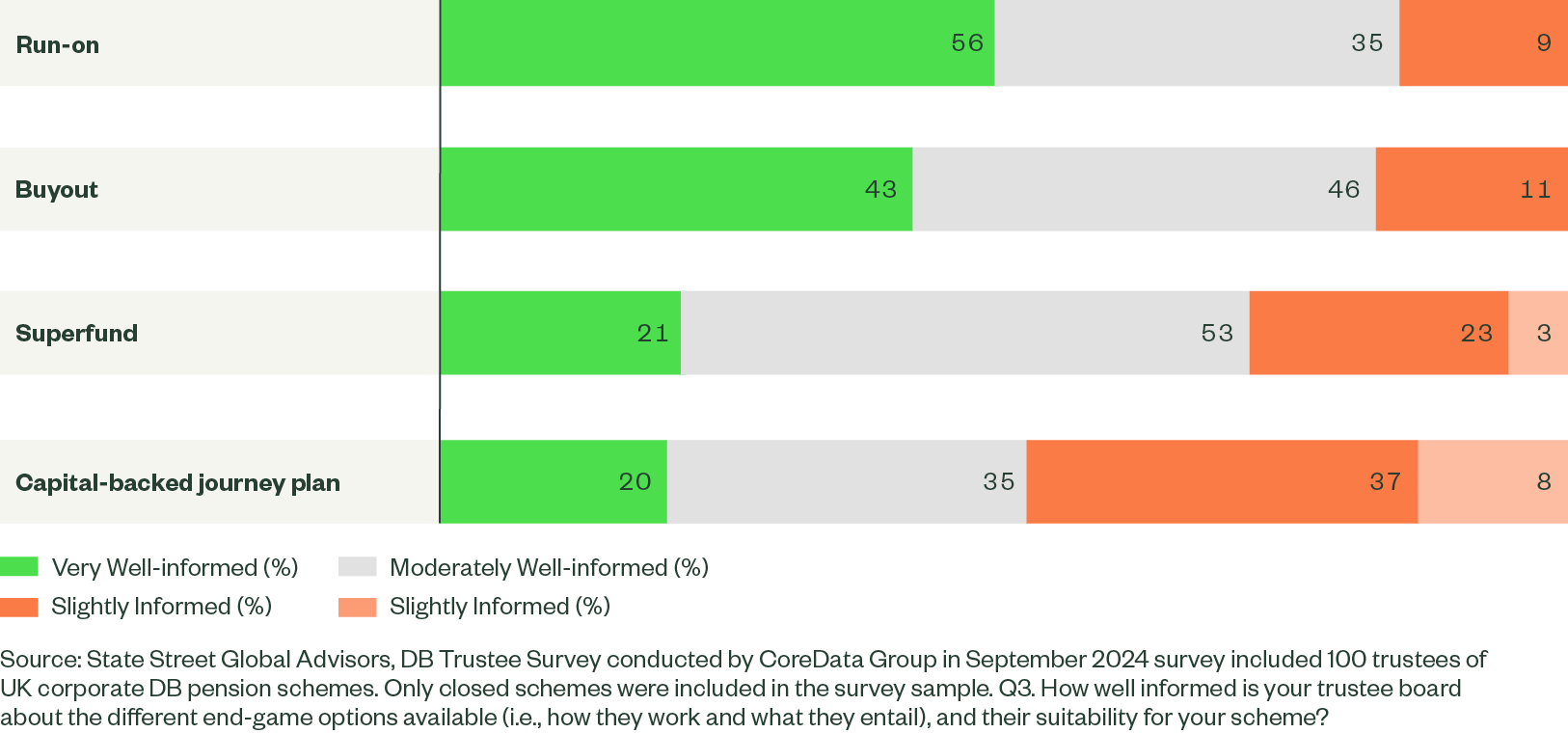

When we spoke with our panel of 100 DB trustees, a relatively large number admitted being less well informed on options such as superfunds (compared to run-on or buyout). As the number of headlines continue to grow with respect to these other options for schemes, we expect trustees to continue to become better informed and to grow comfortable with what is on offer.

Figure 3: Trustees’ understanding of different endgame options

5.Should we review our LDI arrangements?

With the backdrop we outline earlier, we believe schemes — particularly those expecting to run on for a significant period of time — should consider whether their LDI manager still suits their needs. We believe that schemes have traditionally been underserved with their LDI solutions and that they should expect more from their LDI providers.

Technology is one key pathway to improving LDI solutions and we have invested heavily in state- of-the-art technology and our teams to help enable better services and outcomes. Our model is a tight, core team that enables strong communications and intimate knowledge of all components of the LDI solution, supported by our global trading and operations teams. This design facilitates nimble decision-making and direct contact with portfolio managers, underpinned by global trading expertise and highly experienced operational management.

We have extensive recent experience transitioning a wide variety of LDI portfolios and instrument types to SSGA, often without any transaction costs, from a variety of different incumbent asset managers, including periods in which multiple clients were onboarded per week.

While there may be one-off costs related to transitioning to a new manager, these could quickly be outweighed by the significant benefits that become available to the scheme. Your scheme may benefit from paying lower management fees with a new LDI provider. The savings here could very quickly dwarf any transition costs, not to mention other considerable benefits such as improved portfolio efficiency, better service and improved reporting.

We have the required depth of experience to deliver efficient portfolio transitions, without any out-of-market exposure, with well-coordinated collaboration across our dedicated Client Implementation Team, Relationship Management, Legal, Operations, Portfolio Management and Trading teams.