Favor USD, JPY as Stagnation Ahead

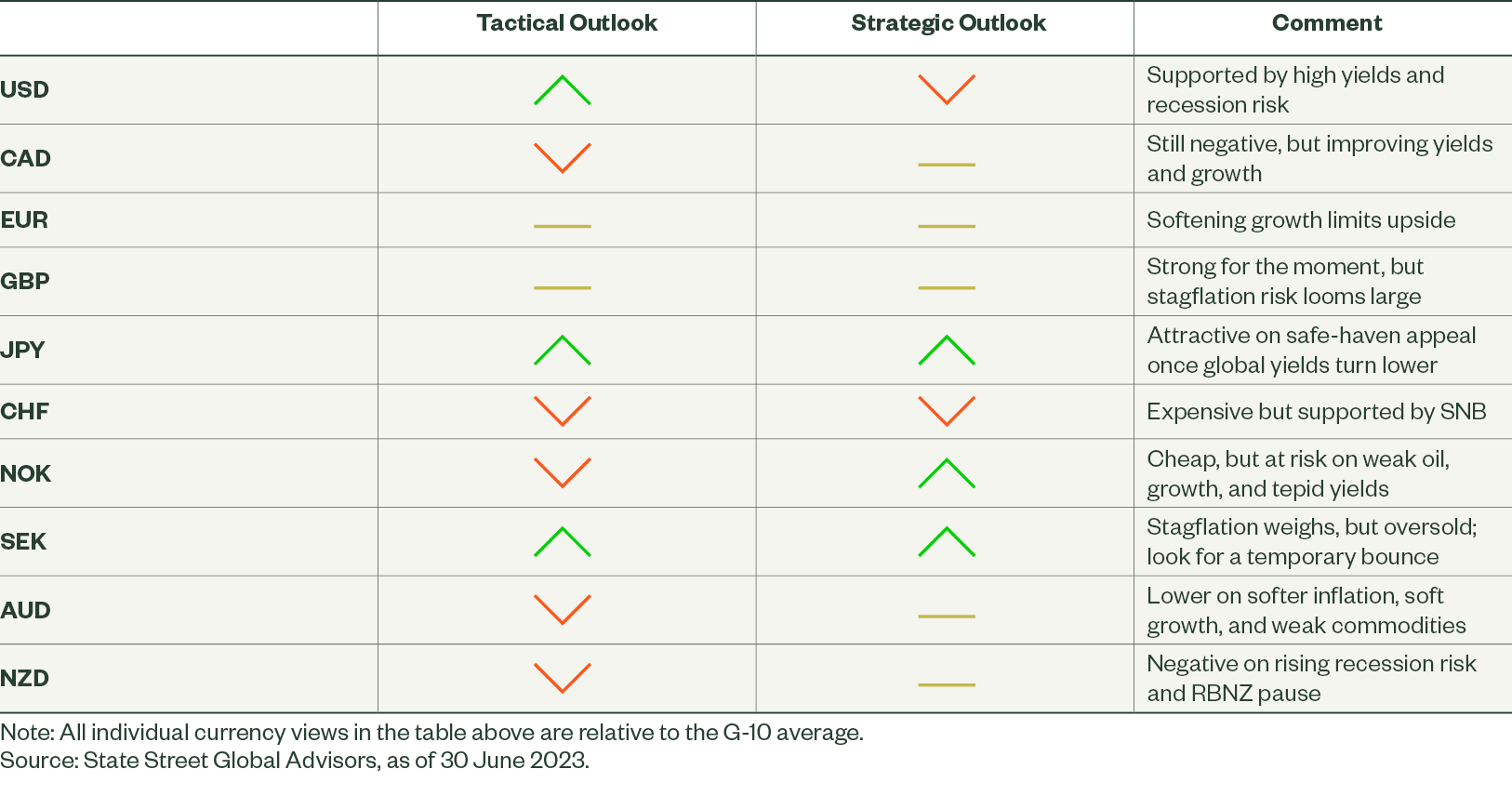

Equities, credit, and commodities gained in June, while global yields rose, and the defensive USD and JPY suffered. Our base case is that eventually we may see a more pronounced stagnation across the world through 2024. Overall, we still remain defensive in G10 currency markets. Tactically, we have turned neutral on the EUR, negative on the CHF, and positive on the SEK.

Investors appear to have reinterpreted the current environment as one of a healthy mid- to late-cycle expansion marked by solid growth alongside rising interest rates, which are well justified by that growth. Accordingly, the MSCI World ex-USA gained 3.46% in local terms, and US equities did even better, with the S&P 500 up an impressive 6.47%. Credit spreads tightened and the Bloomberg Commodity Index was up 3.59%, all while the average G10 two-year yield rose 48 basis points (bp) on expectations of higher monetary policy rates for longer.

The more cyclically- and equity-sensitive currencies of Norway, Australia, Canada, New Zealand, and the UK all outperformed, while the defensive Japanese yen and US dollar underperformed, even as risks mounted due to the unhealthy levels of inflation, high post-pandemic government debt ratios, and the most dramatic monetary tightening cycle in 40+ years.

The pro-risk trade certainly has momentum. That optimism may well continue through July and beyond until one of the risks bites. Our base case is that eventually we may see a more pronounced stagnation across the world through 2024, with increased recession risk as central banks continue to tighten more than expected.

Given the risks outlined above, we favor higher-yielding defensive currencies over a six-month horizon. The US dollar stands tallest in this regard. The Japanese yen does not meet the high yield criteria and could continue to weaken in the near term, but, over H2 and into next year, we see substantial room for appreciation once growth rolls over and global interest rate expectations begin to fall.

Figure 2: June 2023 Directional Outlook

US Dollar (USD)

The US dollar is expensive and likely to fall at least 10%–15% over the coming years, but it is too soon for a downtrend now. In the near term, the resilience of the US economy and stickiness of inflation should support short-end US yields and the US dollar.

In the medium term, safe-haven demand may further support the US dollar as the cumulative impact of monetary tightening threatens growth and adds volatility to risky assets. If we are right that late 2023 and 2024 may bring economic stagnation, investors may have to wait before they can see through the fog of tight monetary policy and recession risk – not just hope a recession will not happen – before they see a sustainable dollar weakness.

Canadian Dollar (CAD)

Weak/range-bound commodities and poor Canadian relative equity market performance were important headwinds for the Canadian dollar in June, though things are improving on the back of better economic data and further monetary tightening. Its high correlation to the US dollar also makes it more attractive than other more cyclical currencies such as the krone and the Australian dollar in a global hard landing scenario.

In the longer term, the Canadian dollar looks cheap in our estimates of fair value and Canada’s long-term potential growth is poised to improve on an aggressive increase in immigration and substantial plans to invest in sectors such as green energy technology.

Euro (EUR)

We are now neutral on the euro following weaker economic data surprises. Further European Central Bank (ECB) tightening should help prevent significant weakness; and any return of pessimism and equity volatility would likely support the euro vs. higher-beta currencies. But the euro upside appears unlikely in the near future. ECB policy rates are middling relative to the rest of the G10, providing only limited yield support for the euro, while the risk of recession is rising as the ECB tightens monetary policy, adding headwinds to a European Union economy that has already posted two quarters of negative growth.

British Pound (GBP)

The British pound is currently holding strong as investors expect another 130 bp of monetary tightening after both May core Consumer Price Index (CPI) and wage growth set a fresh cycle high above 7%. But we see major risks ahead. Rapid wage increases risk imbedding high inflation, requiring the Bank of England to take aggressive action – action that would likely cause a recession. Not doing so risks a loss of monetary policy credibility; both are bad for the pound.

Japanese Yen (JPY)

So long as global yields trend higher, the yen is likely to trend lower. But we see yen risks increasingly skewed to the upside. We expect weaker global growth, and thereby reduced yields, to directly support the yen. The Bank of Japan (BoJ) is patiently studying the Yield Curve Control (YCC) policy, but ongoing inflation and rising wages suggest further relaxation of the policy by end-Q3, another positive for the deeply undervalued yen. And the Japanese government has recently pushed back on recent weakness, opening the door to additional intervention to prop up the currency should the yen downtrend continue.

Swiss Franc (CHF)

It is the most expensive G10 currency in our estimates of long-run fair value. Growth data continues to soften, inflation appears to be rolling over, and, aside from the yen, the franc has the lowest yields in the G10. Despite those negative forces, our pessimistic view of the franc will require patience. Inflation is improving but domestic services inflation remains stubbornly high and labor markets are very tight. Swiss National Bank (SNB) President Thomas Jordan has been clear that inflation above 2% risks becoming imbedded. The SNB is likely to continue to raise interest rates and intervene to prevent any notable franc weakness.

Norwegian Krone (NOK)

We remain negative on the krone due to shaky economic data, middling yields, weak equity markets, range-bound oil prices, and risks due to its high beta to equity market risk during this highly uncertain macro environment. The Norges Bank is trying to help with higher rates, but the levels are not high enough to sustain a material recovery in the krone over the next few months. In the long term, the story is more positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady potential growth.

Swedish Krona (SEK)

The widespread pessimism regarding the krona and recent economic surprises relative to depressed expectations open the door to a temporary relief rally off recently oversold levels. Although a sustained krona rally looks unlikely in the face of negative real yields, high inflation, and negative growth, it could easily set new lows for the year in Q3. Eventually, though maybe not in the next 6–12 months, Swedish and global inflation will be under control and the economy will begin a more durable recovery. Once that happens, the historically cheap krona has substantial room to appreciate back toward its long-run fair value on a sustained basis.

Australian Dollar (AUD)

We continue to see downside risks in the Australian dollar. Weak/choppy commodity prices, flat-to-negative real wage growth, and rising equity market risk, in our view, in H2 more than offset the Reserve Bank of Australia’s (RBA) pivot back to monetary tightening. That said, we do not see significant near-term downside either. The RBA is likely to deliver 1–2 more rate increases by early Q4, and we expect announcements of targeted fiscal stimulus in China later in July and August to help limit the Australian dollar downside.

New Zealand Dollar (NZD)

We are pessimistic about the New Zealand dollar in the near term. Rising recession risk and the weak external balance – the current account is –8.1% of gross domestic product (GDP) – more than offset any benefit of high yields, particularly now that the RBNZ has signaled a pause. We expect the tepid Chinese growth outlook and higher expected yields in other G10 countries, notably the US and UK, to be additional headwinds for the currency.