CAD, NOK poised to outperform

We turned positive on both the Canadian dollar and Norwegian krone, on improved growth prospects and resilient yields. Across G10 currencies, local risks and diverging fundamentals continue to drive market performance.

The return of Federal Reserve (Fed) rate cuts and soft US labor markets imply a downside bias for the US dollar. However, as noted last month, we expect any downside to be gradual. The dollar remains supported by strong consumption, resilient AI-related capex, sticky inflation, and impressive equity returns driven by elevated corporate earnings expectations.

The yen looks well positioned to outperform, appearing the most misvalued relative to falling US yields. However, market concerns around looser fiscal and easier monetary policy following Sanae Takaichi’s appointment as the new Liberal Democratic Party (LDP) leader need to be resolved first. In the near term, there’s a risk of additional yen weakness, potentially pushing USD/JPY back toward the 155–157 range where it began the year.

Our other favored currencies carry more risk. The Australian and Norwegian dollars benefit from decent growth, higher relative yields, and support from a firm euro. However, near-term downside risks persist, with oil trading on the soft side and the krone historically sensitive to equity volatility. The Canadian dollar remains under pressure due to weak gross domestic product (GDP) growth, elevated unemployment, and looming tensions surrounding the renegotiation of the United States-Mexico-Canada Agreement (USMCA) trade agreement.

The Swiss franc, British pound, and euro are the lowest ranked in our view. The franc may hold up in the face of French and Japanese political uncertainty but is struggling with low inflation, zero interest rates, and elevated tariff levels. The pound is constrained by low growth, sticky inflation, and weak labor markets, alongside both fiscal and monetary policy limitations that offset any benefit of high interest rates. The euro looks relatively better and may perform well in an equity market correction, but growth remains sluggish and French political gridlock continues to weigh down.

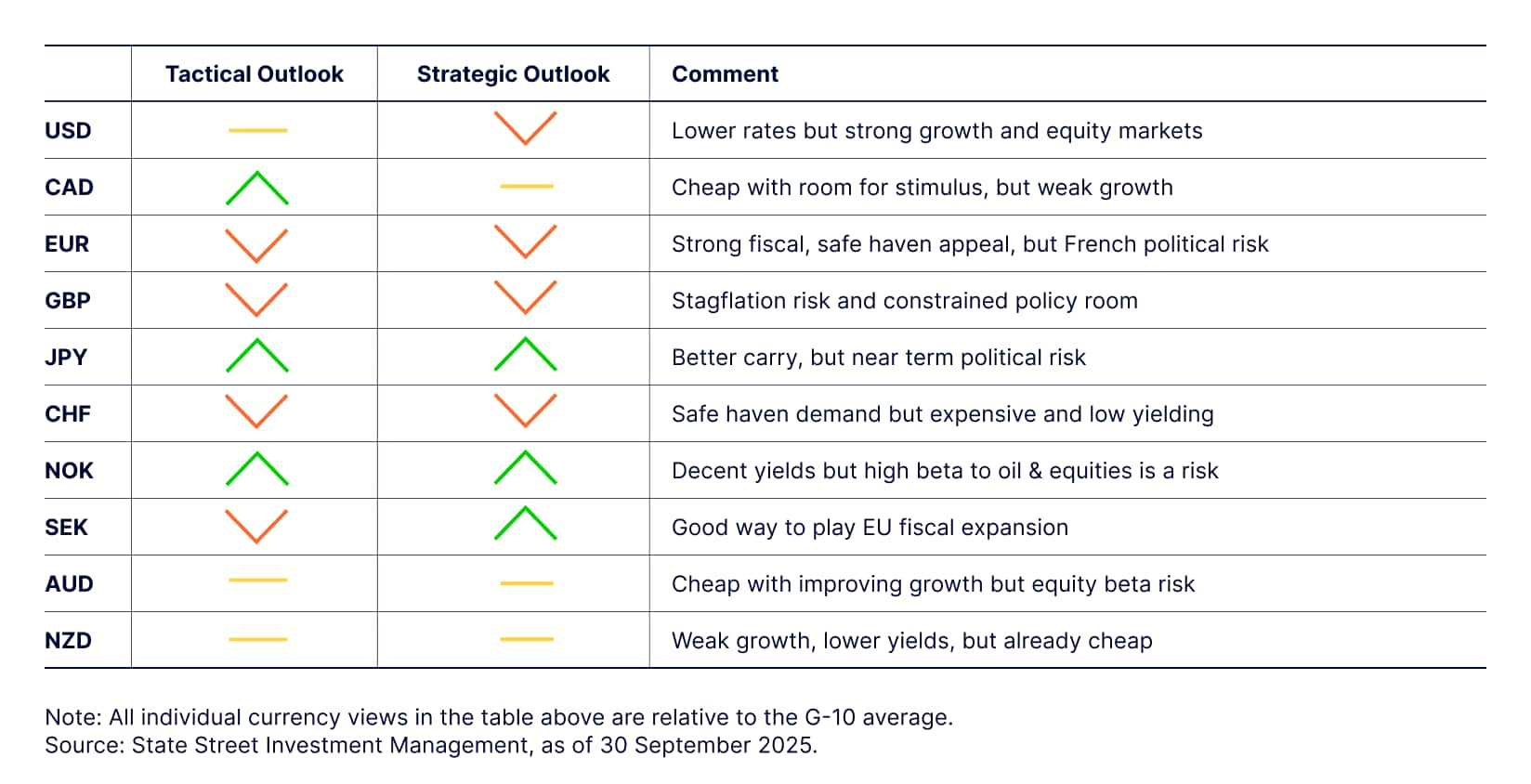

Figure 2: October 2025 directional outlook

Over the long term, we favor short positions in the US dollar against currencies with strong net international investment positions, robust fiscal and monetary flexibility, and historically attractive valuations relative to the US dollar. Based on these criteria, the Japanese yen, Swedish krona, and Norwegian krone stand out as likely top performers. The Australian dollar, euro, Canadian dollar, and British pound are also expected to post solid gains against the US dollar, in that order. The Swiss franc, however, is most at risk of underperforming, particularly on a total return basis, due to its negative interest rate carry.

US dollar (USD)

We remain neutral to slightly negative on the US dollar over the next month or two. The return of Fed rate cuts and soft labor market data imply a downside bias, but as noted last month, we expect any weakness to be gradual. The dollar continues to be supported by strong consumption, healthy AI-related capital expenditure, sticky inflation, and impressive equity returns driven by elevated corporate earnings expectations. Unless economic data turns decisively negative, the US dollar should remain range-bound with only a slight downward tilt. Additionally, policy risks in France and Japan may offer further support for the dollar in October.

We maintain our call for a multi-year US dollar bear market, expecting a decline of at least 15% over the next 2–4 years. While the US remains a strong destination for capital investment, thanks to its innovative companies and flexible labor and capital markets, we anticipate a materially smaller degree of economic outperformance and a weaker safe-haven status for the dollar over the next 10–15 years compared to the previous decade.

According to the BEA’s net international investment position report, non-US investors hold over $33 trillion in US portfolio assets and more than $62 trillion in total US investments, excluding financial derivatives. Even a modest 10% increase in the average US dollar hedge ratio would imply over $3 trillion in US dollar sales—more than enough to fuel a sustained US dollar bear market, even if the US continues to rank among the top-performing economies.

Canadian dollar (CAD)

Our models continue to favor the Canadian dollar based on improved commodity prices and strong local equity returns, partly driven by robust earnings from commodity-related companies. However, we see substantial near-term risks to this model scorecard. While the commodity and equity sub-signals are typically reliable, current weakness in GDP growth, elevated unemployment, and looming tensions around the renegotiation of the USMCA trade agreement (CUSMA in Canada) are likely to keep the Candain dollar under pressure.

Additionally, the recent uptick in broad commodity indices, supporting both our commodity and equity signals, appears vulnerable as oil prices trend lower. It’s also worth noting that much of the recent strength in commodity prices stems from factors that are not supportive to the Canadian dollar, such as negative supply shocks in copper and a surge in precious metals driven by economic and policy uncertainty.

In the medium term, we are more constructive. The Canadian dollar is undervalued by our long-run fair value measures. We expect the North American tariff dispute to ultimately result in a renegotiated USMCA that preserves favorable relative tariffs for the region. Canada also has more room than the US for swift monetary and fiscal stimulus, as well as potential for deregulation and expanded trade with countries outside North America.

We see scope for USD/CAD to fall into the low 1.30s by 2026, as clarity emerges on tariffs and the USMCA, the Fed resumes rate cuts, and Canada begins to benefit from Bank of Canada’s aggressive easing and fiscal stimulus. Over the longer term, consistent with our broader US dollar bear market thesis, we expect USD/CAD to trade below 1.20. However, the Canadian dollar is likely to remain sluggish versus the G10 ex-US, as a weaker US dollar acts as a headwind.

Euro (EUR)

We’ve adopted a slightly negative near-term stance on the euro. While falling US yields and the ECB’s steady rate policy support improved relative interest rate carry in favor of the euro, growth remains fragile. The full impact of US tariffs is likely yet to be felt, and rising political risks in France are weighing on sentiment. Although we do not view this as the onset of an EU debt crisis 2.0, these negatives slightly outweigh the positives. Euro weakness could intensify if conditions deteriorate enough for markets to price in one to two additional European Central Bank rate cuts in 2026. For now, we see the euro as stable to slightly negative.

In the medium term, we remain constructive on the euro, despite its relatively expensive trade-weighted valuation. Strong household balance sheets, low unemployment, positive real wage growth, increased defense spending, and the proposed €500 billion German infrastructure fund all support the currency. Additionally, EU investors may reduce their concentrated exposure to US assets or increase average currency hedge ratios, especially as the US becomes a less reliable trade and security partner. These factors are likely to support the euro against the US dollar over the longer term, and we see scope for EUR/USD to move toward 1.35 over the next 3–5 years.

The outlook against other G10 currencies is less favorable. The US dollar appears expensive relative to the Japanese yen, Norwegian krone, Swedish krona, and Australian dollar, and is likely to underperform these currencies over the coming years, particularly once tariff-related growth risks subside and the elevated potential for equity market volatility is absorbed.

British pound (GBP)

We hold a modestly negative view on the pound in the near term. Sterling rests on a fragile foundation of high debt, persistent current account deficits, and near-stagflation. The delayed autumn budget is expected to introduce further fiscal tightening, which will make it harder to address weak GDP growth (running at a 3M/3M rate slightly below 1% YoY) and rising unemployment (now at 4.7%, a four-year high).

Monetary policy is also constrained, with core CPI at 3.6% YoY limiting the Bank of England’s flexibility to respond to downside economic surprises. While relatively high yields offer some support to the pound, that support is limited by the fact that rates are elevated for unhealthy reasons.

In the long term, the outlook is less shaky, at least against the US dollar and Swiss franc. While the pound faces challenges versus most G10 currencies, we expect it to stabilize in the low to mid 1.30s against the US dollar this year and approach 1.45+ over the next 3–5 years. We also see the British pound outperforming the expensive, low-yielding Swiss franc over the coming years on a total return basis. Beyond US dollar and Swiss franc, however, the pound is likely to struggle over the medium term.

Japanese yen (JPY)

Our models are increasingly constructive on the yen, and we believe that weak US employment data sets the stage for yen outperformance in Q4 as yield differentials compress in Japan’s favor. Before a sustained rally can take hold, however, markets must digest the surprise victory of Takaichi in the LDP leadership race. Her inclination toward fiscal stimulus and loose monetary policy may cause short-term volatility in both the currency and Japanese rates markets—higher yields and a weaker yen.

While the next month may be rocky, we view politically driven yen weakness as a buying opportunity.

Investors may worry about increased fiscal spending and potential pressure on the Bank of Japan (BoJ) to delay rate hikes. We believe it is highly unlikely that the BoJ will raise rates at its October meeting. Beyond that, expected fiscal expansion could help embed above-target inflation, justifying a more substantial BoJ tightening cycle next year. Even so, our medium-term bullish view on the yen hinges more on US rates falling by at least 100–125 basis points, a far more influential factor than another 25–50 basis points of BoJ rate hikes. As for fiscal concerns potentially dragging the yen lower, we believe those worries are overstated at this time. Japan’s debt is domestically financed, and the government retains flexibility to avoid long-end issuance or manage it through the BoJ’s balance sheet.

Swiss franc (CHF)

We expect the franc to materially underperform other G10 currencies. It is the most expensive G10 currency based on our long-run fair value estimates and carries the lowest yields and inflation rates in the group. US tariffs are likely to add further deflationary pressure, even if partially rolled back through negotiation. In response, we expect the Swiss National Bank (SNB) to remain open to direct currency market intervention, as seen in Q2. The SNB may also be forced to consider negative policy rates, though we believe such a move would require a meaningful deterioration in CPI. On a total return basis, the increasingly negative interest rate carry on long franc positions makes it difficult to see the franc outperforming. Even against the US dollar, the franc would need to appreciate by 10–15% over the next 3–5 years just to offset the drag from negative carry.

Additionally, we do not expect portfolio rebalancing away from the US dollar over the next 1–3 years to benefit the franc as much as other currencies. Swiss investors already hedge a large portion of their foreign exchange exposure, leaving limited room for further increases in US dollar hedge ratios. In simpler terms, there is less scope for US dollar selling and franc buying.

Norwegian krone (NOK)

We remain broadly constructive on the Norwegian krone in the near term. With the Fed resuming rate cuts, Norwegian yields are likely to stay among the highest in the G10, even if Norges Bank delivers one or two cuts by year-end. Beyond rates, Norway’s pristine national balance sheet is a key strength in an environment marked by fiscal concerns and elevated term premiums. That said, the krone is not without risks. Two near-term concerns stand out: first, pressure on oil markets from increased OPEC+ production amid potentially sluggish demand growth if tariffs slow the global economy; second, the risk of renewed equity market volatility as policy and economic uncertainty persist. Historically, the krone has been particularly sensitive to equity market swings. As a result, we see potential for substantial volatility in the krone despite our model’s positive outlook.

In the long term, the krone is historically undervalued relative to our fair value estimates and is supported by steady potential growth and a strong balance sheet. Norway also has significant fiscal and monetary flexibility to mitigate long-term damage from the current tariff shock. We believe the krone is well positioned for solid gains once markets move past peak tariffs, reprice risky assets and oil, and begin to focus on tariff reductions and renewed fiscal and monetary stimulus.

Swedish krona (SEK)

Our near-term outlook for the krona is modestly negative. As a small, open economy with a less liquid currency, Sweden is likely to experience greater downside volatility in sympathy with euro fluctuations, particularly as France navigates political uncertainty, regional growth remains under pressure from tariffs, and equity markets face increased risk of a healthy pullback. Historically, the krona has been sensitive to equity market volatility.

Beyond these near-term concerns, we are more constructive. With the Fed easing and the Riksbank likely on hold, interest rate differentials should continue to shift in Sweden’s favor. Growth is improving, and Sweden offers an attractive way to gain exposure to potential European Union (EU) fiscal stimulus, especially given concerns around French debt and politics. The country also benefits from material defense sector exposure and a low debt-to-GDP ratio of 33%.

The krona is historically undervalued on a real effective exchange rate basis. Sweden’s fiscal and monetary flexibility, combined with the potential for gradual portfolio rebalancing, adds to the positive outlook. A shift in foreign asset holdings, particularly from Sweden and the broader EU, away from the US, even if only through higher US dollar hedge ratios, could provide a meaningful tailwind for the krona.

Australian dollar (AUD)

Our tactical models have shifted to neutral on the Australian dollar in the near term. There are several headwinds: uncertainty around a durable US–China trade deal, subdued business investment, high household debt servicing burdens, and a structural downshift in productivity growth. We expect a gradual slowdown in the US economy into 2026, and the global drag from tariffs to become more evident in upcoming data. Combined with a seasonal bias toward higher equity market volatility, these factors are likely to weigh on commodity prices and cyclically sensitive currencies like the Australian dollar.

That said, there are also reasons to remain constructive. Recent data from late August and early September has been encouraging. Strong manufacturing and services PMIs signal solid expansion. Labor markets remain resilient despite the September miss, Q2 GDP surprised to the upside at 0.6% QoQ vs. 0.5% expected, and July household spending was robust at 5.1% YoY. If this momentum continues, the RBA is likely to maintain its hawkish stance, supporting the currency.

In the long term, we are quite positive on the Australian dollar. It is significantly undervalued relative to our fair value estimates. Growth has been more resilient and inflation higher than expected. Australia also has ample room for fiscal and monetary stimulus to mitigate long-term damage from elevated tariffs. Additionally, Australian investors appear to hold substantial unhedged US dollar asset exposure, which we believe will be subject to higher hedge ratios or a rotation into more diversified global portfolios. Once markets adjust to the new tariff regime, the Australian dollar has room for a meaningful long-term rally.

New Zealand dollar (NZD)

Our tactical model has shifted to a neutral stance on the New Zealand dollar in the near term. Weak GDP and elevated unemployment point to lower inflation, softer policy rates, and continued pressure on the currency. While New Zealand is largely insulated from direct US tariffs, it is likely to feel the effects of broader Asian growth headwinds as tariffs take hold. The policy rate is expected to decline toward 2.25%—a low level for a country with a moderate fiscal deficit and a current account deficit near 6%.

The New Zealand dollar also remains vulnerable to global risk sentiment, given its historically high sensitivity to shifts in investor confidence. With economic and policy uncertainty elevated, this could lead to increased volatility. The one factor tempering our negative bias is that the New Zealand dollar has already declined significantly and now reflects much of the pessimistic economic outlook.

In the long term, our view is mixed. The New Zealand dollar appears undervalued relative to the US dollar and Swiss franc, suggesting room for appreciation. However, the currency looks expensive against the yen and Scandinavian currencies.