JPY Deeply Undervalued

Expectations of rates being higher for longer in the US drove the USD higher and equity markets down. Elsewhere, investor focus on the relative outlook for monetary policy, growth and inflation weighed heavily on European currencies, while more hawkish central banks lent support for the Scandinavian currencies.

Tactically, we turn positive on the deeply undervalued JPY, especially relative to the GBP, the EUR and the CHF.

Despite our longer-term US dollar bear market thesis, it is hard to bet against the currency at the moment. The US dollar is both a defensive and high-yielding currency, and the US economy is holding up better than most—a very attractive trio of factors for the US dollar against the backdrop of a fragile world. The recent increase in the US Federal Reserve (Fed) policy rate expectations—higher for longer—reinforces this theme.

In the near term, currency market performance is likely to resemble the one from August–September, with investors considering the relative growth and monetary policy outlooks. The British pound, the euro and the Swiss franc look increasingly vulnerable as recession risk rises and central banks reach the end of their tightening cycle.

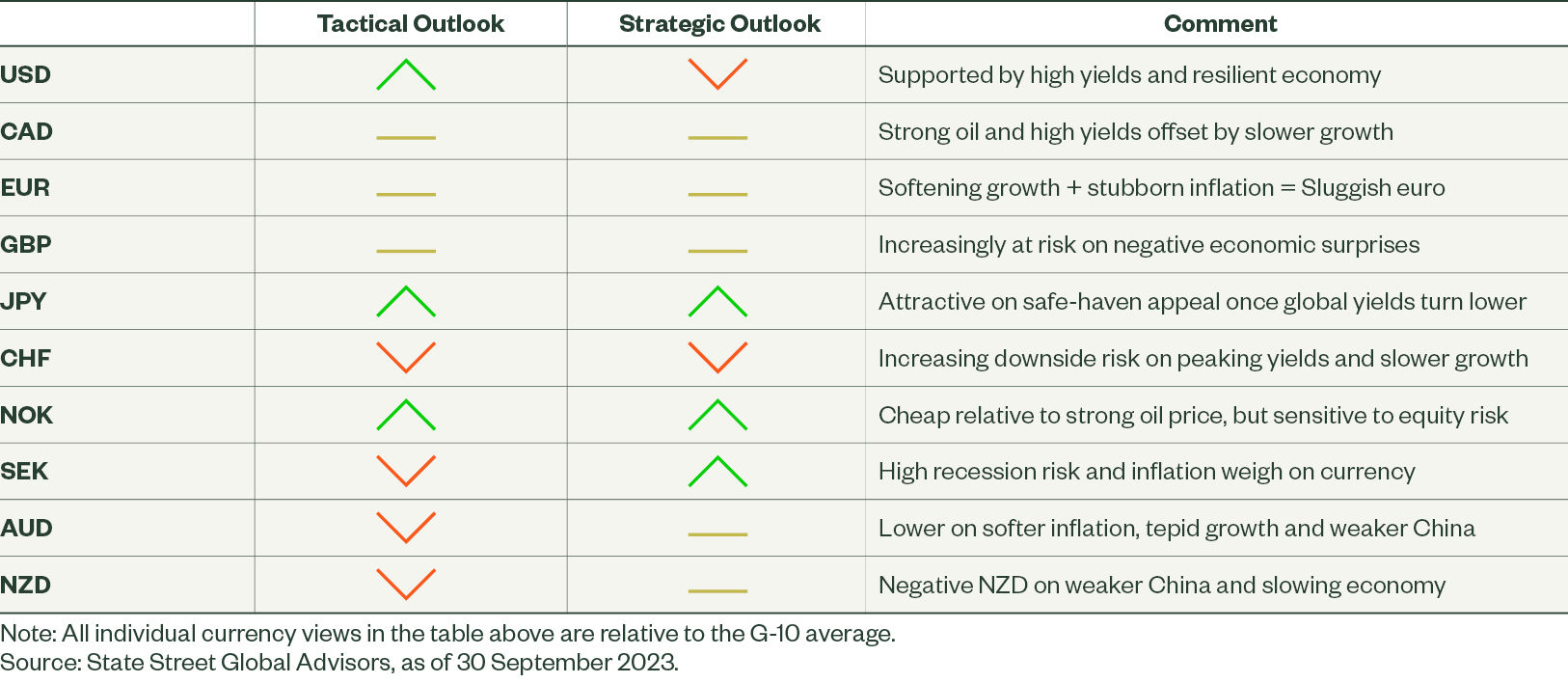

Figure 2: September 2023 Directional Outlook

The Norwegian krone may face challenges due to higher equity volatility, but looks increasingly attractive relative to strong oil prices and further central bank tightening. The Japanese yen looks increasingly cheap as global yields surge higher. We see additional downside for the yen against the US dollar, but it may have better near-term prospects compared to the European and China-sensitive currencies.

US Dollar (USD)

We confidently believe that the next big, sustained move in the dollar is lower—a broad decline of 10%–15%—but it appears early for that now. The near-term US dollar outlook is strong. It is hard to bet against a defensive currency with high yields and strong growth in a world fraught with macro fragilities.

We expect relative US growth and yields to converge lower with the rest of the world over the course of 2024, and that process may begin over the next few months. Eventually, once we get through, or are at least well into a global economic slowdown, and witness the Fed actually implementing monetary policy easing, investors are likely to look forward to a coordinated global recovery catalyzing a sustainable and large US dollar downtrend.

Canadian Dollar (CAD)

Our models are neutral on the Canadian dollar, with improved oil prices offsetting modest softening in economic data and sluggish relative Canadian equity market performance.

Like the US, the Canadian labor market is tight, and the consumer is holding up better than one might expect, given the high levels of household debt and rapid rise in interest rates over the past year, though we see early signs of softening domestic demand.

Its high correlation to the US dollar also makes it more attractive than other more cyclical currencies such as the Norwegian krone and the Australian dollar in a global hard-landing scenario, though the Canadian dollar may underperform the US dollar in that scenario.

In the longer term, we think Canadian growth will remain competitive, and the Canadian dollar looks cheap in our estimates of fair value relative to the euro, the Swiss franc and the US dollar, creating room for substantial upside.

Euro (EUR)

We maintain a neutral to slightly negative view on the euro in response to the steady stream of weaker economic data surprises and rising recession risk. Further pessimism and equity market volatility over the next few months may help support the euro vs. higher-beta currencies, but a broad euro strength appears unlikely in the near future.

We must also pay closer attention to the Italian fiscal deficit and the potential for rising peripheral spreads in light of the upwardly revised Italian fiscal deficit projection for 2024. Without the ECB’s quantitative easing program to purchase EU peripheral debt, private markets may require a higher risk premium. This, in turn, tends to put downward pressure on the euro.

British Pound (GBP)

Our view on the British pound is increasingly negative in response to the decelerating economic data, persistently high inflation, and poor UK equity market performance. While we are happy to see signs of a more rapid disinflation, this is primarily a result of weaker economic performance, leaving the Bank of England (BoE) in a precarious position.

It is cautious to add to monetary tightening, leaving the risk of reacceleration in inflation, but are also unable to ease policy to stave off a recession. This is not a good macro and policy backdrop for the British pound.

Our long-run valuation model suggests that the pound is cheap. However, low productivity growth and high inflation are pushing fair value lower, which is on pace to trend down to the lower 1.30s against the US dollar over the next few years.The pound is still cheap even at those fair value levels, but the UK’s cyclical weakness and falling long-run pound fair value make for a tough outlook for the BoE and the currency into 2024.

Japanese Yen (JPY)

In the near term, the Japanese yen is likely to continue to struggle due to its negative short-term interest rates. But we see yen weakness to be more concentrated against the US dollar.

As most G10 central banks reach the end of the tightening cycle and G10 growth outside of the US stagnates, the yen, which is deeply undervalued, becomes increasingly attractive. This is particularly true relative to the British pound, the euro and the Swiss franc.

Over 2024, we expect US growth to slow significantly and global yields to start declining. This supports a broader strengthening of the yen, even against the US dollar, driven by improved yield differentials and safe-haven demand. It makes sense to have a long yen bias, especially against non-US-dollar currencies, although the yen may take some time before it begins to materially strengthen.

Swiss Franc (CHF)

We are negative on the franc over both the tactical and strategic horizons. It is the most expensive G10 currency per our estimates of long-run fair value; growth data continues to soften; inflation is rolling over; and, aside from the yen, the franc has the lowest yields in the G10.

We expect the Swiss National Bank (SNB) to hold rates for at least a couple of quarters before shifting to an easing bias, while backing off its intervention in the currency markets to support franc strength. This dovish shift in policy should encourage a correction lower for the highly overvalued franc. However, it is important to note that the rising risk of a recession in the EU, concerns over Italy’s debt levels, and the fragile global macro environment may slow the expected sell-off of the franc.

Norwegian Krone (NOK)

Our models are increasingly positive on the krone in the near term. The krone appears oversold relative to the recent strength in oil prices and tighter monetary policy outlook.

However, it is important to note that our current positive bias is limited to the near term. We continue to see medium-term risks due to slower growth data and the krone’s high beta to equity market risk during this highly uncertain macro environment.

In the long term, the story becomes more positive. The krone is historically cheap in our estimates of fair value and is supported by steady potential growth.

Swedish Krona (SEK)

Our models retain a neutral to modestly negative bias on the krona in response to a weaker economic outlook and poor local equity market performance. However, we see increased risks that the krona may outperform model expectations as the ECB appears to be shifting to a more dovish policy stance before the Riksbank and the Riksbank will steadily buy krona as it hedges about 25% of its exchange reserves.

This does not mean we expect meaningful, broad krona strength. It just means that its performance may not be as bad as the models suggest. Eventually, though, maybe not in the next several months, Swedish and global inflation will be under control and the economy will begin a more durable recovery, opening the door for the krona to enjoy a broad-based appreciation back toward its long-run fair value.

Australian Dollar (AUD)

We see risks for the Australian dollar tilted to the downside as we see rising risks to global growth and equity market performance later this year and into 2024. China is unlikely to provide meaningful support for global growth, including Australia.

That said, there are some positive signs—such as stronger homes prices, low unemployment, strong wage growth, rising energy prices—and an increased pace of Chinese stimulus suggests that the strong Australian dollar downtrend over the past couple of months may slow for a time, and even reverse slightly.

In the longer term, the Australian dollar outlook is mixed. It is considered cheap vs. the US dollar, the British pound, the euro and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies.

New Zealand Dollar (NZD)

Despite the rally in September, our outlook for the New Zealand dollar remains pessimistic in the near term. Recession and the weak external balance—the current account is at –8.1% of the gross domestic product—outweigh any benefit of high yields, particularly now that the Reserve Bank of New Zealand has likely ended its tightening cycle.

Any further relief from the pessimistic Chinese growth theme is likely to prove temporary. We expect the tepid Chinese growth outlook and risks of slower global growth into 2024 to be additional headwinds for the currency.

In the long term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that the New Zealand dollar is cheap vs. the US dollar and the Swiss franc, and has room to appreciate. However, it is expensive vs. the yen and the Scandinavian currencies.

Click Download for a more detailed report.