Is It Time for a Temporary USD Correction?

Much higher US yields and rising geopolitical risk led to a broad sell-off in risky assets and strength in the more defensive currencies, such as the USD, CHF and EUR, in October. Three months of equity market losses and USD appreciation have opened the door to a short-lived relief rally in risky assets and a decline in the USD. The major beneficiaries of such a decline might be the cyclically sensitive AUD and NZD, and the Scandinavian currencies.

We may see growing potential for a relief rally in risky assets and a US dollar decline. But our view into 2024 is largely unchanged. The US dollar remains both a defensive and high-yield currency, while the US economy is outperforming—a very attractive trio of factors for the dollar. We see solid ongoing medium-term support for the US dollar even if it corrects lower by year-end.

Alongside the US dollar, we see growing potential in the Japanese yen. Our models suggest that we are in the very late stages of the yen bear market and see risks skewed clearly to the upside over the 6–12-month horizon. The deeply undervalued yen also stands out as a positive risk hedge, giving it an advantage against most non-USD currencies during this period of high uncertainty.

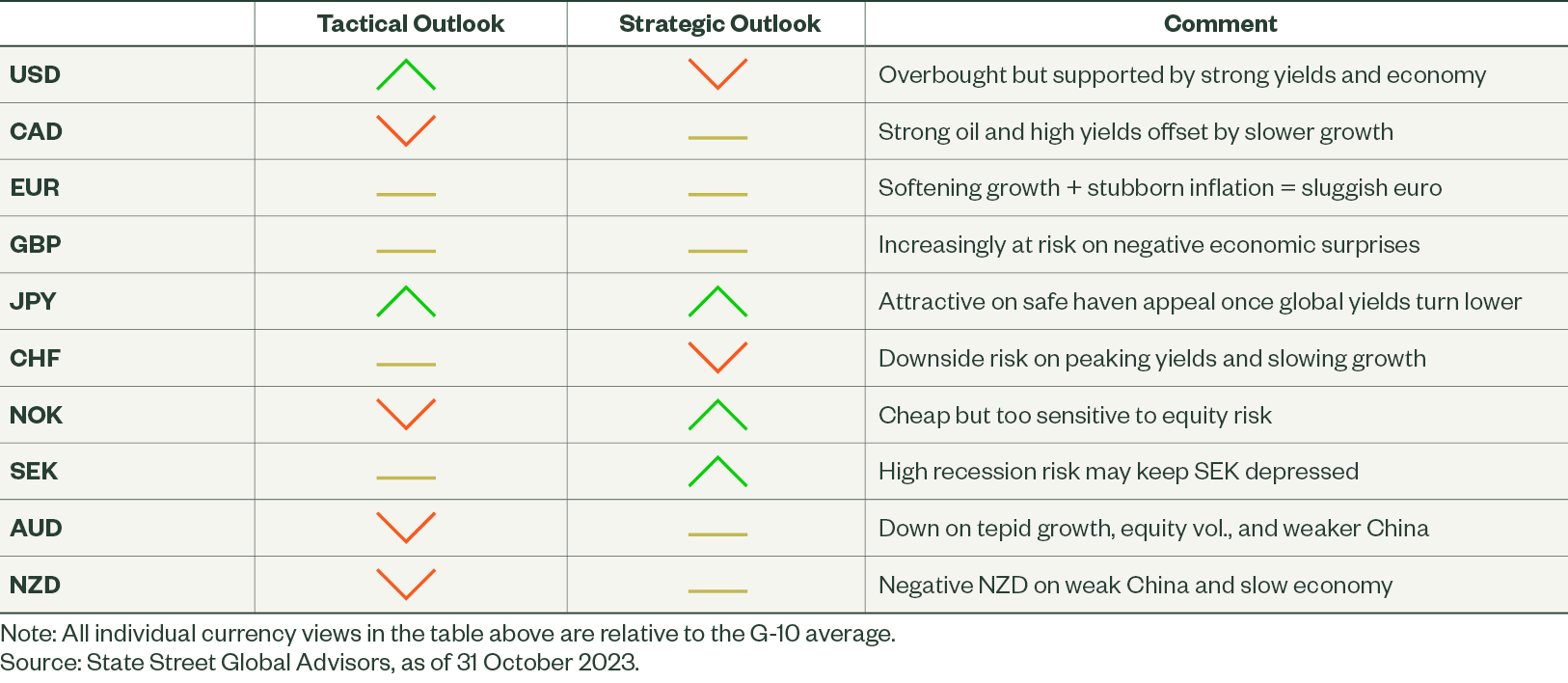

Figure 2: October 2023 Directional Outlook

That said, the yen is still likely to struggle vs. the US dollar until yields finally peak and US Federal Reserve (Fed) cuts rates. On the negative side, we expect weaker global growth, volatile risky asset performance and geopolitical uncertainty to keep medium-term pressure on the cyclically sensitive Australian, New Zealand and Canadian dollars, as well as the Norwegian krone.

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10%–15% over the coming years but is currently in a noisy transition period from a bull to a bear market, a protracted range-trading environment. Following three months of equity market losses and US dollar appreciation, the moves appear to be tiring. This opens the door to a short-lived relief rally in risky assets and a US dollar decline.

However, the next big US dollar sell-off does not appear imminent. The world is in a fragile place, while the US economy continues to grows well above trend and offers high yields. Additionally, the US dollar tends to provide a good hedge for risky assets if we slide into recession. These factors provide a strong basis of support for the US dollar.

Canadian Dollar (CAD)

We have shifted to a negative outlook on the Canadian dollar due to falling oil prices, softer economic data, and reduced interest rate expectations. The rising potential for a downside move in the US dollar, after 3.5 months of gains, may temporarily benefit the Canadian dollar outperform the US dollar in November and/or December.

However, we expect this outperformance to be limited as US growth and yields remain strong relative to Canada. Moreover, even if we see a broad, temporary correction in the US dollar, we expect the Canadian dollar to underperform most other G10 currencies.

In the longer term, we believe that Canadian growth will remain competitive and that the Canadian dollar looks cheap in our estimates of fair value relative to the euro, the Swiss franc and the US dollar. This creates room for substantial upside potential.

Euro (EUR)

We maintain a neutral to slightly negative view on the euro in response to the steady stream of weaker economic data and the dovish shift in the European Central Bank outlook. Heightened global uncertainty and equity volatility over the next few months may provide support for the euro against higher-beta currencies.

However, it is unlikely that we will see continued broad strength in the euro in the near future. Against the US dollar and other less cyclically sensitive currencies, we expect the euro to struggle over the medium term. Having said that, the recent extreme US dollar bullishness of increases the odds of a temporary correction lower in the US dollar and a potential rally in the euro over the next 1–2 months.

British Pound (GBP)

Our factor models remain neutral, but with a slightly improved short-term outlook for the British pound. This improvement is driven by negative, yet modestly improved, economic growth signals and recent UK equity market outperformance. In contrast to that slight improvement in the average signal, we see risks to the pound skewed lower, as the economy teeters on the brink of recession, inflation and wages remain uncomfortably high, and the central bank turns away from further rate increases.

Our long-run valuation model has a more positive pound outlook. It is particularly undervalued against the US dollar and the Swiss franc. However, it is important to temper upside expectations, as low productivity growth and high inflation are pushing fair value lower. Fair value to the US dollar has fallen from 1.55 to 1.42 since May 2022. Breakeven inflation expectations and recent trends in productivity differentials suggest that fair value will likely trend down to at least the mid-1.30s over the next few years. Although, even from the current levels in the low 1.20s, the pound remains significantly undervalued, even if fair value trends down into the 1.30s.

Japanese Yen (JPY)

The yen is likely to continue to struggle in the near term given its negative short-term interest rates. However, we see that the weakness of the yen will be more concentrated against the US dollar.

As most G10 central banks reach the end of the tightening cycle and G10 growth, excluding the US, stagnates, the deeply undervalued yen looks increasingly attractive. This is particularly true relative to the British pound, the euro and the Swiss franc. Over 2024, we expect US growth to slow significantly and global yields to start declining . This will support broader strength in the yen, even against the US dollar, driven by improved yield differentials and safe-haven demand. It makes sense to have a long yen bias, at least against non-US dollar currencies, although it may take some time before it begins to materially strengthen.

Swiss Franc (CHF)

We are negative on the franc over both the tactical and strategic horizons. It is the most expensive G10 currency per our estimates of long-run fair value; growth data continues to soften; inflation is rolling over; and, aside from the yen, the franc has the lowest yields in the G10.

We expect the Swiss National Bank (SNB) to hold rates for at least a couple of quarters before shifting to an easing bias. Additionally, we expect the SNB to curtail its currency intervention efforts aimed at supporting the franc strength over the next 1–2 quarters. However, despite the weaker local economic situation and potential dovish SNB pivot, our pessimistic view on the franc may require some patience. This is because the rising risk of European Union (EU) recession and the fragile global macro environment may provide some near-term support to the franc, at least vs. the euro and the British pound.

Norwegian Krone (NOK)

Our short- and medium-term models flipped from positive to negative on the krone in October. This change was driven by falling oil prices, weaker equity markets, and a less hawkish monetary policy outlook. However, it is worth noting that equity markets have experienced three consecutive months of decline. Global (and particularly US) interest rates appear to have moved too high too fast, and we expect oil prices to rebound on constrained supply. There is a possibility that the factors driving the models negative may reverse, and, as a result, we remain cautious about expressing strong short-term views on the krone. On a long-term basis, the story is more positive. The krone is historically cheap relative to our estimates of fair value, and is supported by steady potential growth.

Swedish Krona (SEK)

Our outlook for the Swedish krona remains neutral to modestly negative due to the weaker economic outlook and underperformance of the local equity market. However, given the upside inflation surprise and the ongoing Riksbank reserves-hedging program, we see a limited downside. Eventually, although it may not be in the next several months, we anticipate that both Swedish and global inflation will be under control and the economy will experience a more durable recovery. Once that happens the historically cheap krona has substantial room to enjoy a broad-based appreciation, back toward its long-run fair value on a sustained basis.

Australian Dollar (AUD)

We continue to see medium-term risks tilted to the downside on weak commodity prices and the ongoing, though gradual, slowing of the economy. However, we see potential for a near-term bounce in the Australian dollar as commodities and equity markets appear a bit oversold and due for a recovery. Should that happen, we expect gains to be limited by a fragile global growth outlook and high geopolitical risk. These factors create an unfavorable environment for the Australian dollar, especially when its economy is under pressure and Australian interest rates remain middling compared to the rest of the G10.

In the longer term, the Australian dollar outlook is mixed. It is cheap vs. the US dollar, British pound, the euro, and the Swiss franc and has room to appreciate, but is relatively expensive compared to the yen and the Scandinavian currencies.

New Zealand Dollar (NZD)

We remain pessimistic on the New Zealand dollar over the near term. Recession risk and the weak external balance — the current account is –8.1% of gross domestic product — more than offset any benefit of high yields, particularly now that the Reserve Bank of New Zealand (RBNZ) has likely ended its tightening cycle. Any further relief from the pessimistic Chinese growth theme is likely to prove temporary, as we expect sluggish Chinese growth outlook over the next few years.

In the longer term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap vs. the US dollar and the Swiss franc and has room to appreciate, but is expensive against the yen and the Scandinavian currencies.

Click Download for a more detailed report.