SPDR Dividend Aristocrats ETFs

Implement income strategies using Dividend Aristocrats, with exposures spanning multiple regions and ESG indices.

Why Choose SPDR?

Dividend ETF Provider In Europe by AUM 1

Expertise in dividend strategies dating back to 2005

A comprehensive range of Dividend Aristocrats strategies across the globe including ESG methodology.

Related Content

Smart Beta Compass

Learn about recent flows across smart beta exposures and where the opportunities may lie in the coming quarter.

Can Machine Learning Improve Portfolio Risk-Adjusted Performance?

Our recent whitepaper demonstrates how hierarchical clustering techniques could play a role in smart beta investing.

An Overview of Dividend Aristocrats Strategies

Investors seeking dividend yield should consider strategies that aim to deliver diversified quality income.

Meet the Author

Why Choose Dividend Aristocrats?

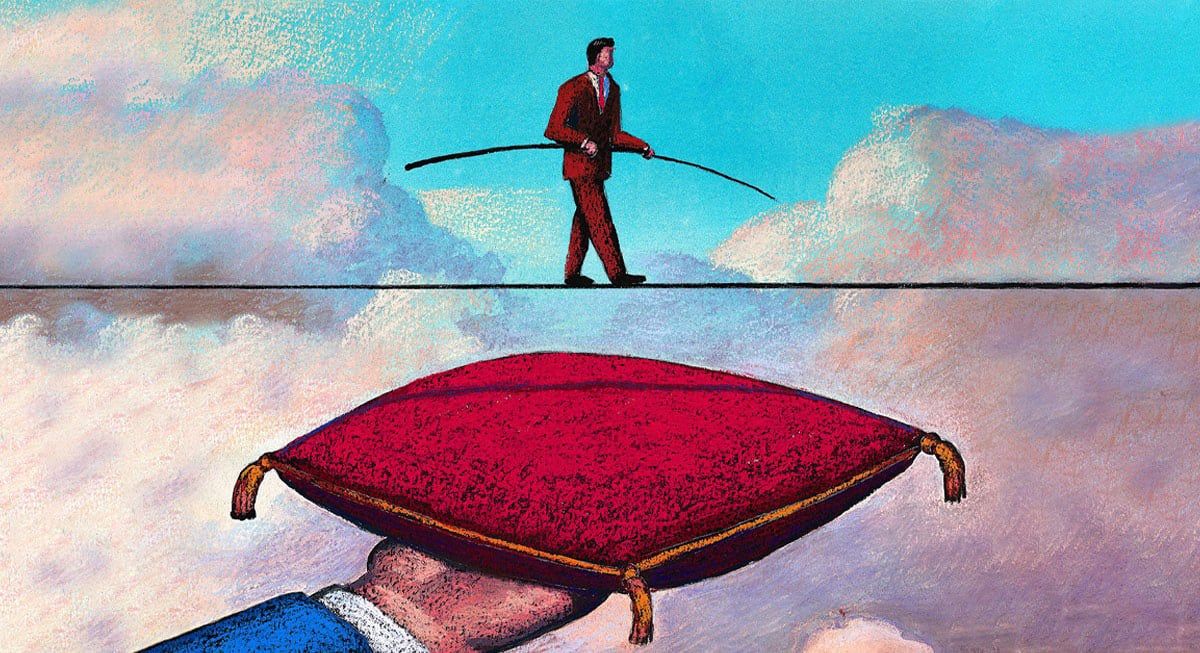

Dividend investing requires more than just yield—quality matters, too.

- At SPDR, our methodology for quality accounts for the past and looks to the future, and it’s supported by empirical, long-term research. Investors can also generate dividend yield through selecting companies with sound fundamentals.

- The SPDR Dividend Aristocrats ETFs source quality yield by focusing on companies with a long, consistent history of paying dividends. Additional filters, such as maximum payout ratio, help to further ensure that the companies in the Dividend Aristocrats indices are of the highest order.

- With the SPDR Dividend Aristocrats ESG range, investors can also add an ESG exclusion strategy to the global, European and US exposures, which introduces a layer of sustainability to these ETFs.

Funds in Focus

Sign Up for Latest Insights

Stay on top of market trends and opportunities. Get new insights and investment ideas delivered to you.

For questions or any further information please Contact us. You can also stay connected with us on LinkedIn