Could We See Further USD Gains?

In November–December, the USD fell as yields dropped, while equities surged. The January macro narrative remained unchanged, but mid-month saw reversals, later bringing economic optimism, lifting US bonds and equities to new highs. Tactically, we have now turned neutral on the CHF.

G10 currencies were directionless during the second half of the month, but that period was perhaps more informative than the volatile first half of the month with regard to prospective currency behavior over coming months.

US growth was once again convincingly above expectations and long-run potential. The US Federal Reserve (Fed) Chair Jerome Powell explicitly pushed back on the market pricing of a March rate cut. The key change was that, unlike last year, better growth did not raise risks of further rate hikes, or even threaten the easing cycle. Powell also indicated clearly that the Fed is willing to ease policy even if the economy and labor market remain hot, as long as inflation continues to trend reliably down to the 2% target.

The net result is prospects for a stronger US dollar going forward on later rate cuts and developed markets leading growth, but not the super-charged USD rallies that we saw in 2022 and 2023.

Fed’s willingness to cut rates with strong growth limits the equity downside risk and the magnitude of the US dollar upside. Let us call it a well-supported range for the dollar. The more fragile environment outside the US—stagnating growth and elevated near-term recession risk—keeps a lid on commodity demand expectations and G10 currencies other than the US dollar. This weakness extends to the British pound, despite indications that high inflation may keep the Bank of England on hold for longer than most, any rally owing to tighter expected policy will likely be short lived. High rates with a shaky external balance and stagnating economy are not a recipe for currency appreciation.

The yen continues to be one of our favorites as we approach an almost synchronized global rate-cutting cycle, but it is not exempt from the short-term US dollar positive narrative. With Fed delaying the policy easing, we might have to wait longer to see strength in the yen.

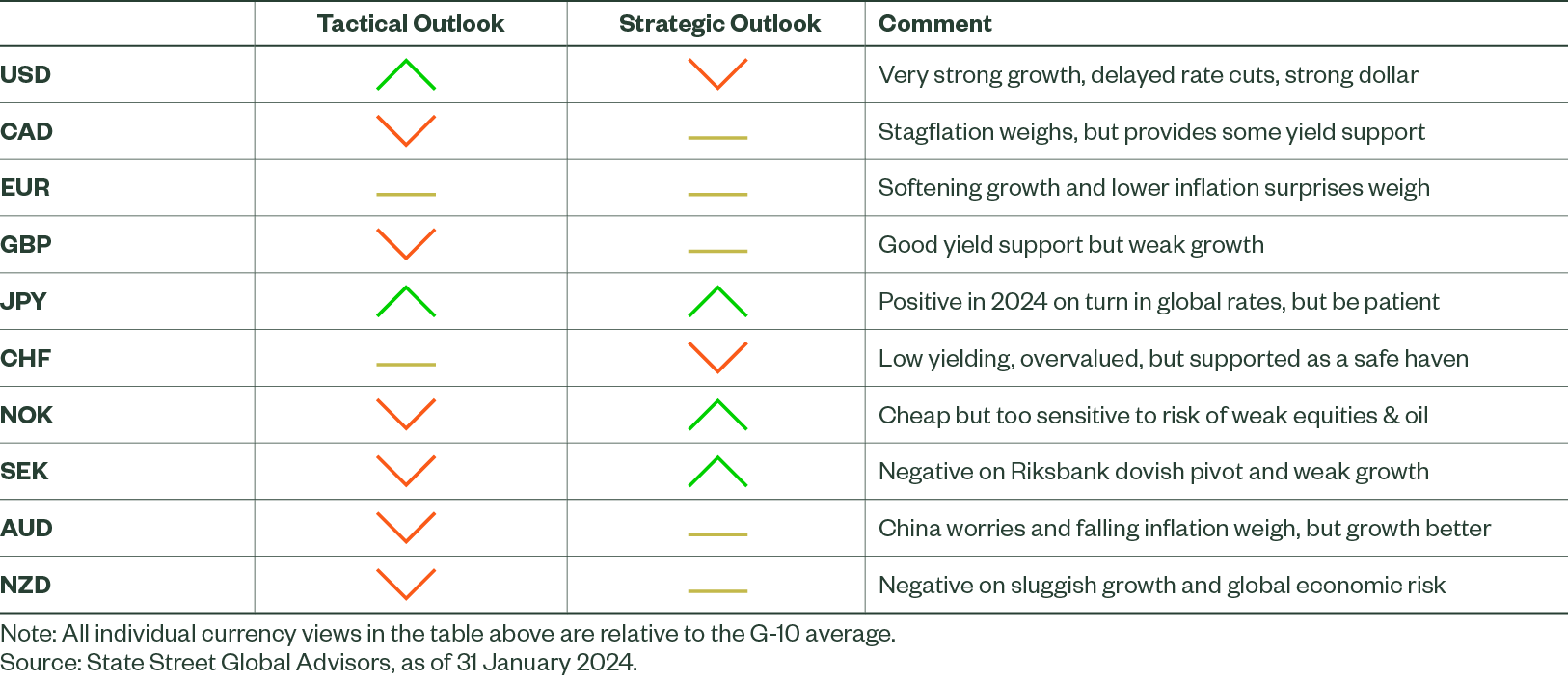

Figure 2: January 2024 Directional Outlook

Our longer-term view has not changed much. We see US dollar downside with the US losing much of its interest rate and growth advantage over the next 1–3 years, leading to a sustained dollar bear market. The unsustainably high combined US fiscal and current account deficits should weigh heavily on US potential growth and add to the dollar downside pressure. We recommend medium–long-horizon investors to position for a weaker US dollar now.

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10–15% over the coming years, but is currently in a noisy transition period from a bull to a bear market in a protracted range-trading environment. We strongly recommend investors with horizon of two years or more- to position for a lower US dollar.

However, a sustained US dollar bear market does not appear imminent. The world is in a fragile place, while the US grows well above potential, offers high yields, and the US dollar tends to provide a good hedge for risky assets should the current run of amazing data fall off a cliff.

We expect US dollar to track higher over the near-term, alongside elevated yields and resilient equity markets. We do not expect the powerful rallies we saw in 2022 and 2023, which required the combination of rising yields and a dollar safe-haven bid from panic in the equity markets — that is so long as inflation remains on a steady downward trajectory, however gradual.

Canadian Dollar (CAD)

The Canadian dollar remains one of the lowest-ranked currencies by our short- and medium-term models. Rapid deceleration in growth, alongside weak and choppy commodity prices, suggests further dollar weakness. Resilient inflation and labor markets support the currency via tight monetary policy, but we believe that inflation will give way to the weaker economic conditions over coming quarters, which will likely result in a more rapid monetary easing cycle in Canada relative to the US and other countries. This risk appears to be underappreciated in current market pricing and suggests scope for near-term Canadian dollar weakness.

In long term, looking through the weaker cyclical picture, the Canadian dollar looks more attractive as it is cheap to our estimates of fair value relative to the euro, the Swiss franc, and the US dollar. Additionally, its long-term potential growth is poised to improve on an aggressive increase in immigration and substantial plans to invest in sectors such as green energy technology.

Euro (EUR)

We maintain a neutral view on the euro against the G10 average and a negative view on US dollar and the yen. This is not a good environment for the euro as the combination of the ongoing European Union recession risk and expectations of European Central Bank easing is likely to weigh on the currency. The slowing pace of disinflation and robust labor market may keep the ECB on the sidelines until summer but the case for a material easing cycle over the next 12–18 months is strong.

That said, we see similar risks across many G10 economies and much negativity is already priced into the currency. EU economic data is weak, but has been coming in above expectations, on average, suggesting excessive pessimism, a factor our model views favorably helping support a neutral stance versus. the G10 average.

British Pound (GBP)

Our factor models remain neutral to slightly negative on the pound versus. the G10 average, but quite negative on the yen and the US dollar. As the economy stagnates, disinflation persists and the constraining effects of the high fiscal and current account deficits loom, we perceive downward risks for the pound.

However, in the very short term, those downside risks are partly offset by a few factors. We see similar risks across most G10 economies and currencies. In addition, the UK’s economic stagnation is proving to be surprisingly stable, meaning the risk of falling off a cliff into recession has proven limited. We also see the Bank of England facing greater constraints on easing policy as inflation rose higher than in most G10 economies and the disinflation process is not as far along, which may provide the pound some temporary yield support.

Our long-run valuation model has a more positive pound outlook, as the currency screens as cheap to fair value. But we expect sticky inflation and chronically weak potential growth post-Brexit are likely to weigh on fair value, somewhat limiting that potential pound upside over the next several years.

Japanese Yen (JPY)

Our models maintain a positive view on the yen relative to the G10 but retain a negative view versus the US dollar, given high US interest rates and strong relative growth. Much better-than-expected performance of the US economy and the resultant delay of the first rate cut are likely to keep the yen on the weak side longer than previously expected. But we see risks skewed toward a broad yen recovery in 2024 as yields peak and turn lower, while below trend global growth (maybe only returning to trend in the US) later this year should increase the chance for periods of volatility in risky assets.

The increased likelihood that the BoJ exits negative interest rate policy by mid-year is also supportive, though the magnitude of potential BoJ rate increases is tiny compared to the scope for rate cuts across the rest of the G10.

Swiss Franc (CHF)

We are negative on the franc over the strategic horizon, but have a rare neutral signal over the tactical horizon against the G10 average — still tactically negative vs. the US dollar and the yen.

It is the most-expensive G10 currency per our estimates of long-run fair value; growth data remains soft; inflation stable well within target ranges; and aside from the yen, the franc has the lowest yields in the G10. The monetary policy outlook is also likely to continue to shift toward easing in first quarter as indicated by Swiss National Bank Chair Thomas Jordan’s comments regarding the disinflationary impact of the strong franc.

Such a shift is likely to provide a catalyst for the highly overvalued franc to begin a reversion toward our estimate of its longer-term fair value. However, we also likely need to see stabilization and early signs of recovery in the world economy outside of the US to fully unlock franc weakness; hence the neutral signal.

Norwegian Krone (NOK)

Our short- and medium-term models remain negative on the krone due to weak and choppy oil price trends, disappointing growth data, and signals from our short-term value model suggesting recent krone strength is ahead of its fundamentals.

Even the relative tightening of the Norges Bank monetary policy outlook has had limited impact beyond the near term. The Norges Bank may hold off on rate cuts longer than other central banks but tepid growth data and a steady disinflation suggest a steady policy easing later this year and into 2025.

Going forward, we also think it prudent to be cautious on the global risk sentiment and its impact on the krone, as it is highly sensitive to equity and commodity market downside should the Goldilocks narrative sour. In long term, the outlook is positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady potential growth.

Swedish Krona (SEK)

Our short-term value model is strongly negative on the currency, as it estimates that the recent strength in the krona is not justified by economic data. The modest 0.5% loss in January was not enough to cure that undervaluation given the ongoing weakness in growth data and the dovish Riksbank.

The Riksbank met on 1 February, as we wrote this note and took a clear dovish tilt, suggesting earlier and perhaps greater rate cuts over coming quarters. The ongoing Riksbank reserves hedging program likely provided support to the krona over the past few months, but that program is nearing its end.

Eventually, though maybe not in the next several months, Swedish and global inflation will be under control and the economy will begin a more durable recovery. Once that happens, the historically cheap krona has substantial room to enjoy a broad-based appreciation back toward its long-run fair value on a sustained basis. Until then, we maintain a negative bias.

Australian Dollar (AUD)

Our models continue to see medium-term risks tilted to the downside for the Australian dollar on tepid commodity prices, underperformance of Australian equity markets, and the recent downside inflation surprise.

However, the signal has improved for a number of reasons and is only slightly negative. Our growth sub-signal has turned positive on a relative basis and we do not expect the Reserve Bank of Australia to ease monetary policy as rapidly as in the EU or North America in 2024.

In addition, the cheap Australian dollar suggests many of these negative factors are priced into the currency. Furthermore, we expect stabilization in Chinese growth this year, which does not appear to be priced into markets. In the long term, we are decidedly more positive versus the US dollar given the extreme undervaluation and Australia’s higher-than-average long-run potential growth.

New Zealand Dollar (NZD)

We are negative on the New Zealand dollar over the near term. Slow growth, choppy commodity prices, and the weak external balance — the current account is –7.5% of GDP — more than offset any benefit of high yields even after the upside inflation surprise in January. However, the current market focus on the initiation and extent of monetary easing cycles may offer some near-term support.

Markets expect New Zealand to begin its easing 1–3 months later than most G10 central banks and cut less; this seems a reasonable expectation. As a result, the New Zealand dollar is likely to remain the highest-yielding G10 currency through 2024. Longer-term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap versus the US dollar and the Swiss franc and has ample room to appreciate, but it is expensive against the yen and the Scandinavian currencies.