Currency Markets Still Fragile

Weaker-than-expected inflation and a dovish monetary policy shift boosted investor sentiment in July, with the NOK gaining 4% vs. the G10 average, while the USD declined 1.8%. But the markets are still in a fragile place, which will limit upside in risky assets and result in periods of support for safe-haven currencies such as the USD and the JPY. Tactically, we turn negative on the GBP and neutral on the CAD and the NOK.

There is strong momentum behind the positive move in risk assets currently supported by disinflation and the shift of major central banks toward a pause, or an outright end, to the policy tightening cycle. That risk-loving environment, if it continues, favors a weaker US dollar and yen against strength in more pro-cyclical currencies such as the Norwegian krone, the Swedish krona and the Australian dollar.

Our base-case outlook (“Favor USD, JPY as Stagnation Ahead,” 13 July 2023) is for a period of significantly-below-potential global growth through 2024. We already see stagnation across the UK and Europe, while China continues to disappoint expectations. We believe it is too soon to abandon caution and count out the defensive and high-yielding US dollar even if the US Federal Reserve (Fed) is done tightening monetary policy.

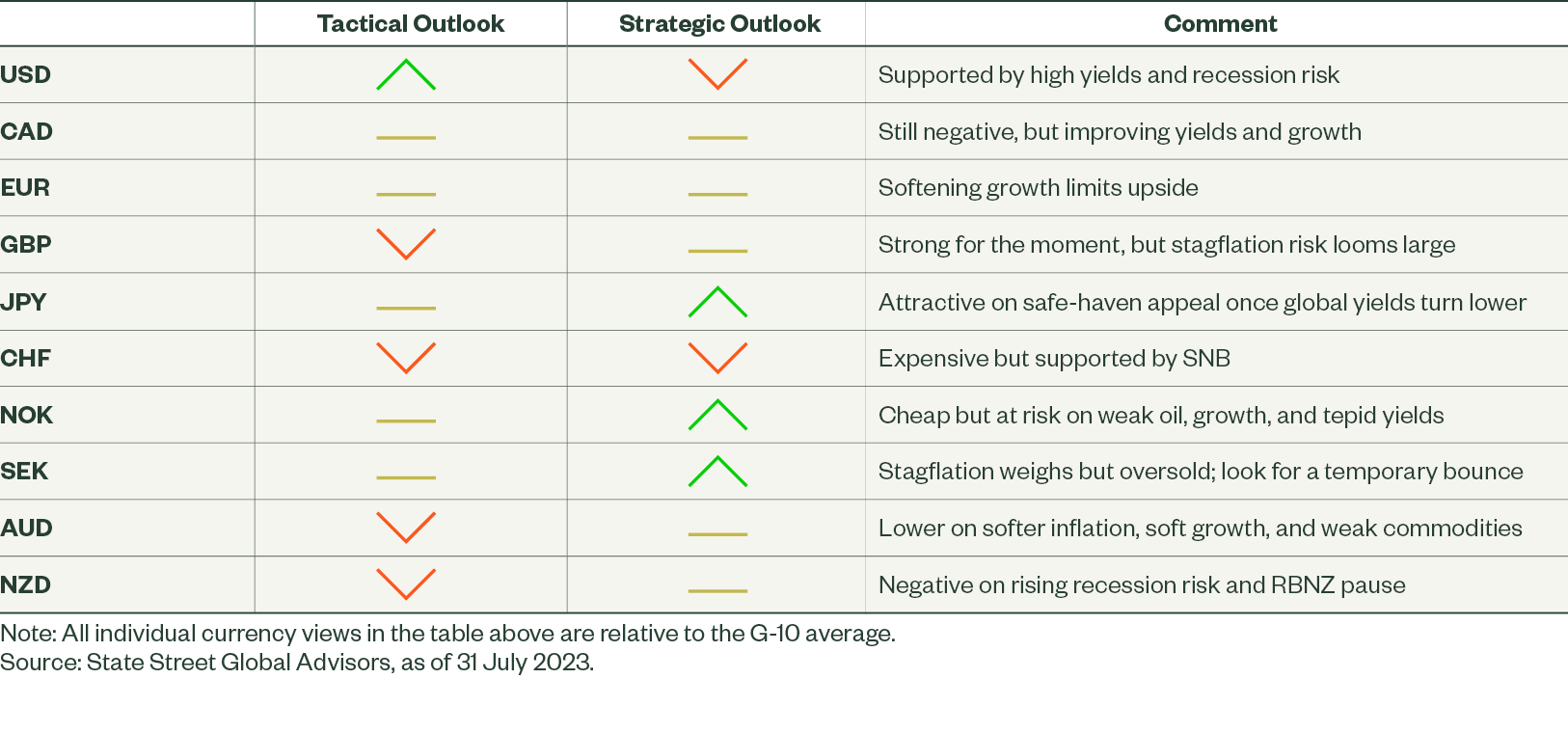

Figure 2: July 2023 Directional Outlook

US Dollar (USD)

We confidently believe that the next big, sustained move in the US dollar is lower – a broad decline of 10%–15% – but it appears a bit early for that now. US growth and yields are among the best in the G10 and the equity rally since October 2022 looks ripe for a correction at some point, leading to safe-haven demand for the US dollar (though that is very difficult to time). It is hard to bet against a defensive currency with high yields and growth. Once we get through, or are at least well into, a global slowdown and see the Fed actually begin to ease monetary policy, investors are likely to look forward to a more fundamentally sound global recovery catalyzing a sustainable US dollar downtrend.

Canadian Dollar (CAD)

We move our Canadian dollar view from negative to neutral as a result of improved commodity prices, decent yields and the ongoing positive economic data surprises, which offset relative weak local equity market signals. Its high correlation to the US dollar also makes it more attractive than other cyclical currencies, such as the Norwegian krone and the Australian dollar, if recession risk sours investor sentiment, though in that case the Canadian dollar may likely underperform the US dollar.

In the longer term, we think Canadian growth will remain competitive and the Canadian dollar looks cheap in our estimates of fair value relative to the euro, the Swiss franc, and the US dollar, creating room for further upside.

Euro (EUR)

We are neutral to slightly negative on the euro in response to the steady stream of weaker economic data surprises and a more dovish European Central Bank (ECB) policy outlook. Any return of pessimism and equity volatility over the next few months would likely support the euro vs. higher-beta currencies, but a broad euro upside appears unlikely in the near future. ECB policy rates are middling relative to the rest of the G10, providing only limited yield support, while the risk of recession is rising as the ECB tightens monetary policy, adding headwinds to an EU economy that is already flatlining.

British Pound (GBP)

We shift to a tactically negative view on the British pound in response to decelerating economic data, very high inflation and poor UK equity market performance. Inflation risks becoming entrenched. Failure to tighten monetary policy sufficiently would risk Bank of England (BoE) credibility and drive the pound lower. Aggressive tightening in an economy that is already stagnant risks serious recession, sending the pound lower. And there is a high and growing risk that a recession may happen regardless of future BoE policy decisions. The path to further pound strength is very narrow.

Japanese Yen (JPY)

The yen is likely to struggle in the near term given its negative short-term interest rates. But we see risks skewed toward a yen recovery later this year and through 2024. The yen is very cheap, and we expect global yields to turn lower along with a period of severely below-trend global growth as we head into the next year. This supports yen strength via improved yield differentials and safe-haven demand. Timing of these factors requires patience and tolerance for additional yen weakness. Nevertheless, we believe it makes sense to build a long yen bias now.

Swiss Franc (CHF)

We are negative on the franc over both the tactical and strategic horizons. It is the most expensive G10 currency per our estimates of long-run fair value; growth data continues to soften; inflation is rolling over; and, aside from the yen, the franc has the lowest yields in the G10. Despite those negative forces, our pessimistic view on the franc will require patience. As we mention above, the recent deceleration in EU growth is a near-term support and the Swiss National Bank has not yet shifted to a more dovish or even neutral posture. Once it does, there might be ample scope for the franc to move lower.

Norwegian Krone (NOK)

We shift from negative to neutral on the krone due to the strength in oil prices, better-than-expected economic data, and hopes of further monetary tightening. A jump in core inflation to 7% YoY vs. 6.6% expected increased pressure for further Norges Bank policy tightening and pushed the krone higher.

That said, we are cautious due to the krone’s high beta to equity market risk during this highly uncertain macro environment. In the long term, the story is more positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady long-run potential growth.

Swedish Krona (SEK)

We are tactically neutral on the krona. Now that the krona has bounced off oversold levels, we need to see a meaningful increase in expected policy rates and/or signs of economic recovery for a sustained recovery in the krona. We see neither. At the same time, we do not see large downside risks to the currency. The Riksbank is likely to keep pace with or tighten more than the ECB over the next several months and the cheap krona already reflects the ongoing recession risk in Sweden. Once Swedish and global inflation is under control and the economy begins a more durable recovery, the historically cheap krona has substantial room to appreciate back toward its long-run fair value.

Australian Dollar (AUD)

We continue to see risks in the Australian dollar tilted to the downside though stronger commodity prices have helped to improve our forecast. Weaker-than-expected inflation, sluggish growth, and the dovish RBA monetary policy pivot are tough for the Australian dollar to overcome in the near term. Rising risks to global growth and equity market performance in H2 and into 2024, in our view, linger as another important risk on the horizon. In the longer term, the Australian dollar outlook is mixed. It is cheap vs. the US dollar, the British pound, the euro, and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies.

New Zealand Dollar (NZD)

We are pessimistic on the New Zealand dollar in the near term. Rising recession risk and the weak external balance – the current account is –8.1% of the gross domestic product – more than offset any benefit of high yields, particularly now that the Reserve Bank of New Zealand has likely ended its tightening cycle. We expect the tepid Chinese growth outlook and risks of slower global growth into 2024 to be additional headwinds for the currency. In the longer term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap vs. the US dollar and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies.

Click Download for a more detailed report.