NOK shows promise, CAD faces pressure

Model signals diverge: NOK is supported by strong fundamentals and undervaluation despite volatility, while CAD contends with tariff risks and softening demand. NOK’s upside contrasts CAD’s cautious stance amid global shifts.

The US dollar and global equities trended higher in July, but momentum stalled after a disappointing revision to US employment data on August 01. The update served as a reminder that tariffs are likely to have a growing negative impact heading into the fourth quarter.

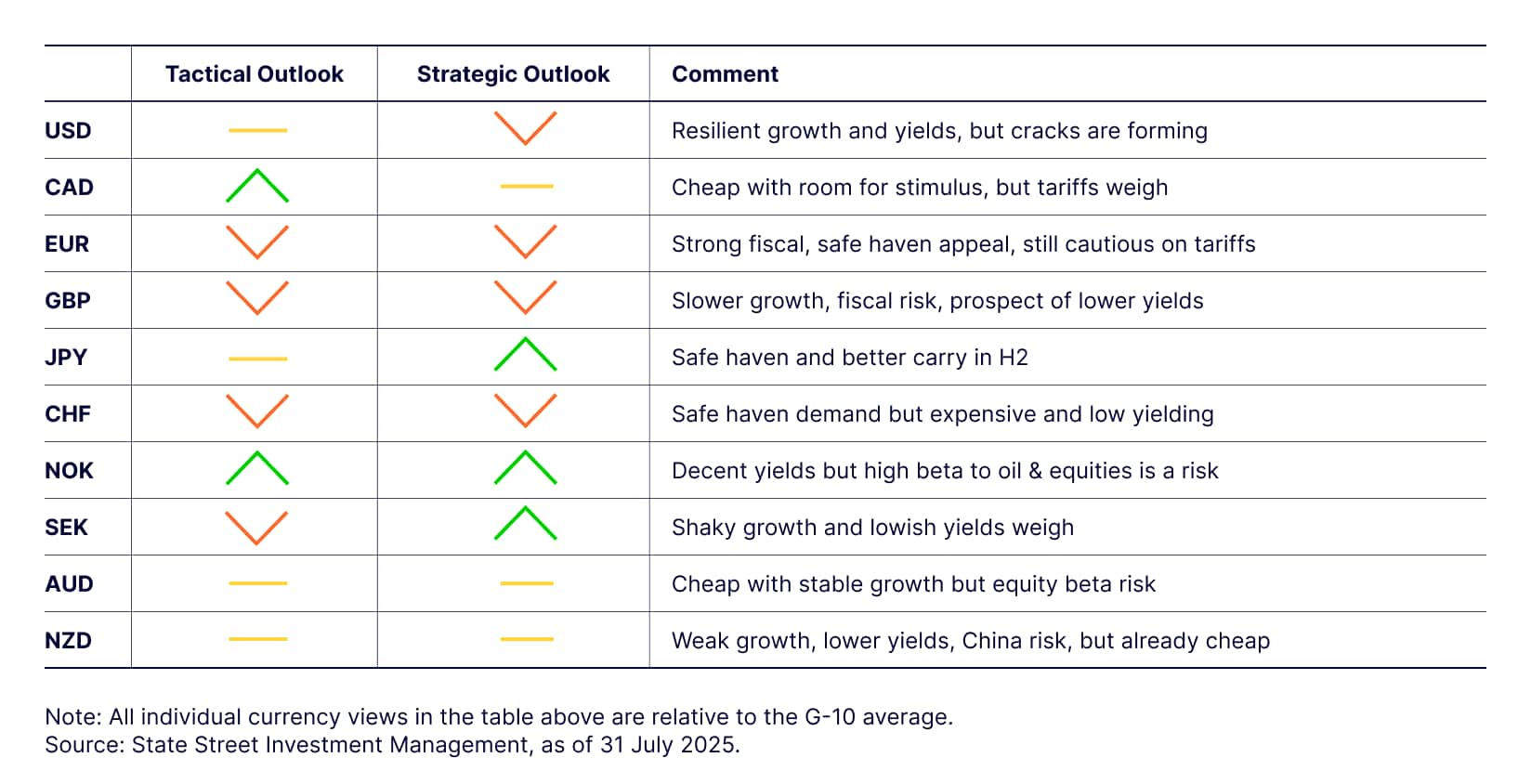

For investors with a short-term horizon, we recommend a neutral to short US dollar bias, an overweight position in safe-haven currencies, and an underweight stance in risk-sensitive currencies over the next one to three months.

Global growth appears to be slowing due to weaker US performance and a more pronounced tariff drag abroad. This is expected to weigh on equity markets, which are currently just below all-time highs. Rising equity volatility may lead to increased currency volatility and downside pressure on risk-sensitive currencies such as the Australian dollar, Norwegian krone and British pound.

While the pound has the lowest equity beta among the three, it remains more vulnerable due to weak labor markets, a stalling economy and fiscal constraints.

Over the next four to six weeks, we see value in a more cautious approach, favoring traditional safe-haven currencies such as the Japanese yen, euro and Swiss franc, which typically perform well amid rising equity volatility. Of the three, we prefer the yen due to its relative affordability and potential upside from falling global yields. While the franc has historically been a strong safe haven, we are least bullish on it given its high valuation and ongoing deflationary pressures.

Figure 2: July 2025 directional outlook

In the long term, US exceptionalism is expected to weaken due to unsustainably high debt levels, rising interest expenses and the fading impact of globalization and offshoring. The broad US dollar is likely to decline by at least 15% during this period.

Currencies with strong net international investment positions, fiscal and monetary flexibility, and historical undervaluation may outperform the dollar. Based on these factors, the Japanese yen, Swedish krona and Norwegian krone stand out. The Australian dollar, euro, Canadian dollar and British pound may also see gains, in that order. The Swiss franc, despite its safe-haven status, faces downside risk, especially on a total return basis, due to its negative interest rate carry.

US Dollar (USD)

The US dollar outlook remains neutral to negative in the near term. Growth outside the United States is subdued, and the initial effects of tariffs over the next six to nine months are expected to be more damaging abroad. The shadow cast by the August 01 jobs report may also limit the potential for rallies in equities and broader risk assets.

Cyclically sensitive G10 currencies may struggle to appreciate meaningfully. This is especially evident in the British pound, as the United Kingdom faces stagnating growth and weak labor market conditions.

In contrast, there is room for US dollar depreciation against the Japanese yen. The yen declined sharply in July as interest rates and growth expectations favored the United States. With that trend reversing after the employment report, the yen may outperform in August and September. The euro has also shown resilience during periods of heightened equity market volatility this year. While the European Central Bank may consider further rate cuts, most of its easing cycle appears complete. Slower US growth, meanwhile, points to a more dovish stance from the Federal Reserve.

The US dollar is expected to enter a multi-year bear market, with a projected decline of at least 15% over the next two to four years. While innovative companies and dynamic labor and capital markets continue to support the United States as a destination for investment, the degree of economic outperformance is likely to diminish.

Over the next 10 to 15 years, the reliability of the US dollar as a safe haven may weaken due to unsustainably high debt levels, gradually rising interest expenses and the fading tailwind from globalization and offshoring.

According to the BEA’s net international investment position report, non-US investors hold more than USD 33 trillion in US portfolio investments and over USD 62 trillion in total US investments, excluding financial derivatives. A modest 10% increase in the average dollar hedge ratio would imply more than USD 3 trillion in US dollar sales. This volume of selling could be sufficient to drive a prolonged US dollar bear market, even if the United States continues to rank among the top-performing global economies.

Canadian Dollar (CAD)

Despite a strong model signal, risks to the Canadian dollar may emerge over the next four to six weeks. At the macro level, the Canadian dollar tends to track the US dollar against the broader G10, and the dollar is expected to remain flat to modestly weaker, particularly against safe-haven currencies such as the Japanese yen, euro and Swiss franc.

Support from stronger commodity prices, as identified by model indicators, may be short-lived as global economic conditions soften and dampen demand. The Canadian economy also faces challenges in rebounding, with uncertainty around tariff policy—potentially unresolved until United States-Mexico-Canada Agreement negotiations progress.

While the Canadian dollar ranks highly on model scorecards, its performance may be middling. It is likely to remain well supported against the US dollar, other commodity-sensitive currencies and the British pound, but may struggle to keep pace with the euro and yen in the coming weeks.

Euro (EUR)

Our model signals were negative on the euro at month’s end, but support has strengthened following the August 01 US employment report. The weaker US data may weigh on relative equity performance, boosting euro sentiment. Increased equity volatility could also drive safe-haven demand for the euro.

However, the European Union (EU) economy is expected to slow in the second half of the year, partly due to weaker US demand stemming from higher tariffs and slower growth. Spillover effects from US weakness are likely to impact pro-cyclical and current account deficit currencies, including the US dollar, more than the euro.

Over the medium term, several factors support the euro: strong household balance sheets, low unemployment, positive real wage growth, increased defense spending, and the proposed €500 billion German infrastructure fund. Additionally, EU investors may reassess their concentrated exposure to US assets or raise average currency hedge ratios, as the US becomes a less reliable trade and security partner. These dynamics could support euro strength against the US dollar over the long term, with potential for EUR/USD to reach 1.35 over the next three to five years.

The outlook for the euro against other G10 currencies is less favorable. It remains expensive relative to the Japanese yen, Norwegian krone, Swedish krona and Australian dollar, and may underperform those currencies once tariff-related growth risks and equity market volatility subside.

British Pound (GBP)

The British pound has appreciated strongly this year, outpacing the United Kingdom’s relative interest rate and growth outlook. Weaker growth and employment data, combined with limited capacity for near-term monetary and fiscal stimulus, present downside risks. Policymakers may struggle to offset the effects of a global slowdown driven by US tariffs. The Bank of England is lowering rates, but with inflation remaining well above target, further cuts are likely to be gradual. This outlook suggests the potential for slower growth and faster rate reductions in 2025 and 2026, which could weigh on the pound’s medium-term performance against G10 currencies excluding the US dollar.

While the pound may face challenges relative to most G10 currencies, it appears more stable against the US dollar, with potential to remain in the low to mid 1.30s this year and approach 1.45 to 1.50 over the next three to five years. On a total return basis, the pound may also outperform the Swiss franc, which remains expensive and low yielding.

Japanese Yen (JPY)

Our model signals turned increasingly positive on the Japanese yen in July, and the August 01 US employment report may further support its performance in August. Japanese inflation remains above target, while retail sales and PMI data point to resilient domestic growth. The 15% tariff appears manageable, and the prospect of increased fiscal spending following the Liberal Democratic Party’s loss of its majority could provide additional support.

In this context, the case for a Bank of Japan rate hike in late 2025 or early 2026 is gaining strength. In the short term, the weak US jobs report and lackluster growth across the G10 suggest that interest rate differentials may shift in favor of Japan. Heightened volatility in risk assets is also likely to attract safe-haven flows, creating a favorable backdrop for the yen—particularly after its recent selloff, which cleared out many bullish positions.

Swiss Franc (CHF)

The Swiss franc is expected to materially underperform other G10 currencies going forward. It remains the most expensive G10 currency based on long-term fair value estimates and has the lowest yields and inflation among its peers. Tariffs may add further deflationary pressure, even if reduced through negotiation.

In response, the Swiss National Bank may become more open to direct currency market intervention in the second half of the year and could be forced to adopt negative policy rates. On a total return basis, the increasingly negative interest rate carry on long franc positions makes outperformance difficult. Even against the US dollar, the franc would need to appreciate by 10% to 15% over the next three to five years just to offset the negative carry.

Additionally, portfolio rebalancing away from the US dollar may be less supportive for the franc than for other currencies. Swiss investors already hedge a large portion of their foreign exchange exposure, leaving limited room for increases in US dollar hedge ratios. In simpler terms, there is less scope for US dollar selling and franc buying.

Norwegian Krone (NOK)

Our model signals were positive on the Norwegian krone at month’s end, but risks remain. Norway’s national balance sheet is strong, a notable advantage amid global fiscal concerns and rising term premiums. Yields are expected to stay among the highest in the G10, even if Norges Bank cuts rates two to three times by year-end.

However, two key issues raise concern. First, pressure on oil markets from increased OPEC+ production may coincide with sluggish demand growth if tariffs slow the global economy. Second, elevated policy and economic uncertainty could trigger further equity market volatility, which may lead to substantial swings in the krone despite a generally favorable outlook.

Over the long term, the krone remains historically undervalued relative to fair value estimates and is supported by steady potential growth and a strong national balance sheet. Norway’s fiscal and monetary flexibility positions it well to absorb the impact of current tariff shocks. The krone may be poised for gains once tariffs peak, risky assets and oil markets reprice, and attention shifts toward easing measures and stimulus.

Swedish Krona (SEK)

The outlook for the Swedish krona has shifted from neutral to slightly negative in the near term due to weaker growth data. While an upside surprise in inflation may limit the scope for rate cuts by the Riksbank, it complicates the policy response amid slowing economic activity. At a minimum, this is likely to prompt the central bank to maintain a dovish bias, even if rates remain unchanged in the short term.

The risk of a global slowdown, as markets adjust to the new tariff regime, adds further pressure. As a small, open economy with a less liquid currency, Sweden may experience greater downside volatility in the krona due to the drag on regional growth.

Over the medium term, the krona could benefit from a shift in foreign asset allocations away from the US. Even modest increases in US dollar hedge ratios may support the currency. However, given the krona’s structural sensitivity to global shocks, near-term volatility is likely to persist—especially if tariff tensions intensify during the summer.

Australian Dollar (AUD)

Our tactical models remain neutral on the Australian dollar, though we see elevated risk of further drawdowns amid ongoing uncertainty. A durable US-China trade deal remains elusive, and the Reserve Bank of Australia is expected to ease policy more aggressively than most G10 central banks over the next year. Export prices have been sluggish, and Australia faces structural challenges including weak business investment, high household debt service burdens and a long-term downshift in productivity growth. These factors limit our conviction on the currency in the near term.

Over the medium to long term, however, we are more constructive. The Australian dollar is significantly undervalued relative to our fair value estimates. While growth has been lackluster, it remains resilient, as evidenced by stronger household consumption and solid services PMI data. Australia also has ample room for fiscal and monetary stimulus to mitigate long-term damage from elevated tariffs. Additionally, Australian investors appear to hold substantial unhedged US dollar asset exposure, which we expect to be subject to higher hedge ratios or a rotation into more diversified global portfolios. Once markets adjust to the new tariff regime, the Australian dollar has room for a meaningful longterm rally.

New Zealand Dollar (NZD)

Our tactical model is neutral to slightly positive on the New Zealand dollar versus the G10 average. Growth indicators suggest a continued gradual recovery, and we expect the RBNZ to slow its pace of easing following last year’s aggressive rate cuts. New Zealand is largely insulated from direct US tariffs, though it will likely face some drag from broader growth headwinds across Asia as tariffs take effect. While our near-term outlook is slightly constructive, we caution that the New Zealand dollar may remain volatile due to its historically high sensitivity to global risk sentiment, which is likely to be unstable amid ongoing economic and policy uncertainty.

Over the longer term, our outlook is mixed. The New Zealand dollar is undervalued relative to the US dollar and Swiss franc based on our long-run fair value estimates, suggesting room for appreciation. However, it remains expensive compared to the Japanese yen and Scandinavian currencies, which may limit its relative performance over the coming years.