Central Bank Ambiguity Holds Firm

Macroeconomic Outlook

April may only be a few months ago, but on the Reserve Bank of Australia’s (RBA) calendar it was a whole regime away. Four months ago the central bank was preaching ‘wait and watch’, but by July it had hiked by 50bps. To the surprise of many, the RBA hiked in May and June as inflation did not fall in line with its expectations. Of note was June’s hike which came despite softer inflation and weaker jobs growth reported in May. The RBA looked through this and pushed through another hike to hedge against inflation persistence.1

The aggressive rate hikes by RBA over the last quarter have softened the economic outlook for Australia. There was a severe hit in household consumption as shown by retail sales which were flat in April and only marginally better in May. The housing market remains at risk as the ability to continuously service household debt at high interest rates is challenged. Moreover, there is the risk to exports from a global slowdown. Commodity prices have been on a downward trend and global growth has been subdued. The anticipated strong recovery from China has not quite materialised.

There is a counterweight to these elevated risks. The recent recovery in housing prices is encouraging. The primary reason for this is strong net inward migration – which may just sustain the turnaround and have other positive economic impacts. Higher prices can also provide relief to debt stretched consumers. Inflation is also on a downward trajectory. The annual May inflation rate was 5.6% down from its 8.4% peak in December. With the RBA in ‘follow-the-data’ mode, the pause at its latest meeting in July aligned with the signs of a slowdown in inflation and growth. We think that the central bank is in the last phase of tightening given the weakening macroeconomic backdrop.

Our mid-year global outlook also indicates softening growth prospects. The slowing but sticky inflation has sustained the monetary tightening momentum, affecting both supply and demand side forces. The higher rates have stalled economic activity and eaten into consumers’ excess savings cushion.

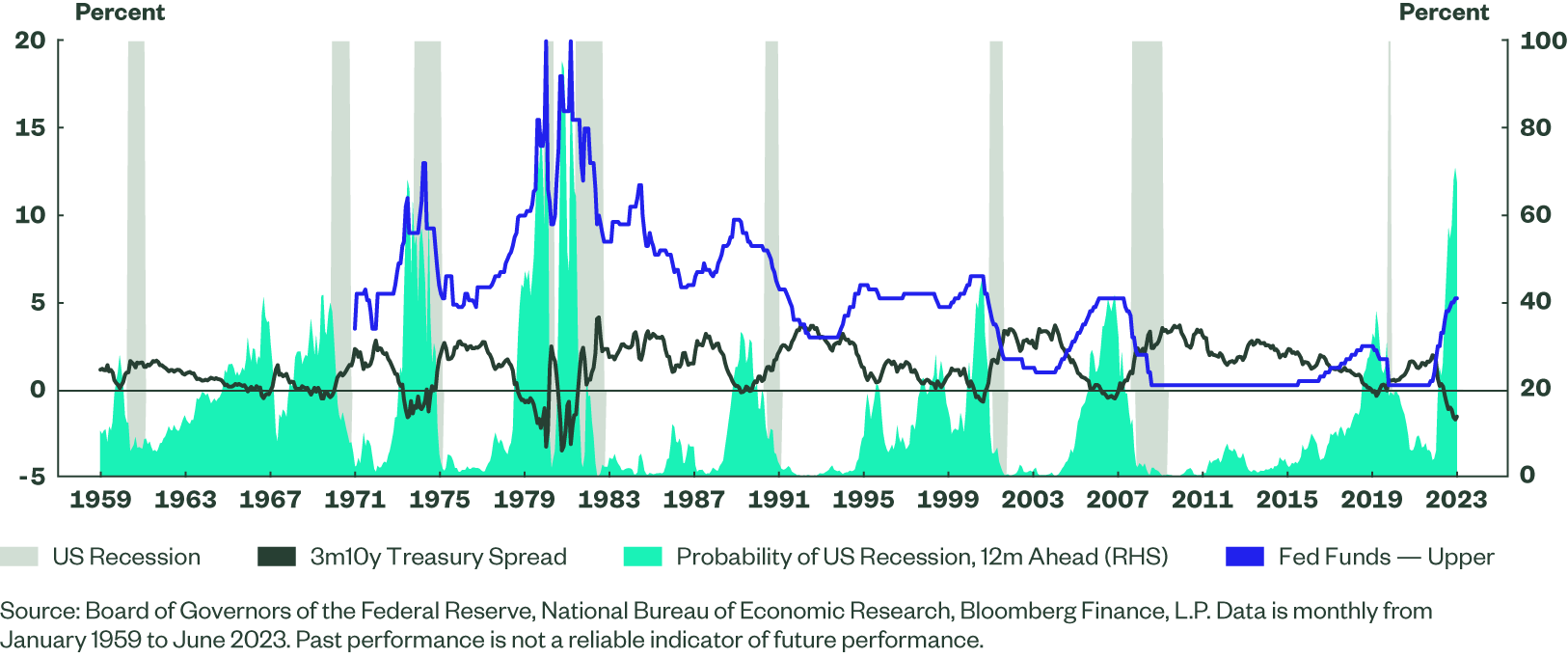

Figure 1 – US Treasury Spread and US Recessions

Figure 1 plots the history of the US Treasury Spread against periods of US recessions. The current spread indicates a potential recession in the next 12-months. A recession means it will be hard for investors to find opportunities in risky assets. Locally, the Australian treasury spread (10-2Yr) has also turned negative for the first time since 2008. Although, it is worth noting that there was no recession that followed the 2008 inversion.

Even though our economic outlook is for sluggish growth we believe there are material investment opportunities such as fixed income.

For long term investors, the decadal high yields are the main proposition to the current fixed income opportunity. The chart below plots yield for the Australia Aggregate Bond Index against the subsequent 3-year return. There is a positive correlation between these two metrics. A high Yield-to-Worst has supported a subsequent high total return for the asset. The present Yield-to-Worst is at a decadal high.

Furthermore, the tight monetary regime and lending standards are expected to slow down inflation and allow central banks to pause the rate hiking cycle. We expect lower rates, steeper curves, and wider spreads in the next 12-18 months. This reiterates the case for booking current high fixed income coupons.

However, the investment journey for fixed income investors is likely to be associated with above average levels of volatility as central bank uncertainty is a feature of markets in the near term. To ensure defensive portfolios retain greater capital stability we advocate using a barbell strategy i.e. a combination of short and long durations positions. This strategy will help hedge against policy and economic uncertainty. Second, we recommend investment grade over high yield given the possibility of a hard landing remains. In a slowdown, default risk is material for lower-rated companies and high quality fixed income is more resilient in an economic downturn.

The current yield in Australian investment grade fixed income is 5.25% (AusBond Credit Index) and is higher than the current dividend yield of 4.5% (ASX 200)2– this is the first time this has happened since 2014. The value proposition to overweight equities at these levels is poor. A possible strategic allocation as we await better opportunities in equities could be investing in Floating Rate Notes (FRNs). These instruments have negligible duration due to coupons that adjust in line with interest rates. Additionally, they offer higher yields than cash deposits. Finally, the FRN index in Australia has a higher rating profile than the fixed investment grade index, which can help manage the credit risk in the portfolio. We take a deeper dive on the role FRNs can play in the current environment in our recently published paper “Is Cash King in Uncertain Times?”.