Is Cash King In Uncertain Times?

Macroeconomic Outlook

Softening growth prospects and the macroeconomic and market events of the last few months have heightened liquidity risks. The move from quantitative easing to quantitative tightening by global central banks has seen the abundant liquidity being drained at an unprecedented speed causing bouts of extreme volatility. Looking ahead, central bank policy rate uncertainty will likely continue to be a key driver of the market outlook.

The main variable that central banks are watching is inflation. While inflation has been trending lower, it remains sticky and the speed of the downtrend is not impressing central banks. Recently, both the Reserve Bank of Australia (RBA) and Bank of Canada decided to err on the side of caution by surprising the consensus pause with rate hikes. Additionally, the RBA and other central banks are sharing forward guidance which suggests further rises may be on the way.

We believe global growth will remain fragile through the remainder of this year and in 2024. Against this backdrop, our high-level takeaways for investors include the following:

- Watch fixed income as it may present better return potential than equities

- Exercise caution and emphasise quality when considering risk assets

- Look at short-term bonds for income opportunities

- Consider a downside protection strategy

While fixed income may present better opportunities than risk assets, this challenging macro environment is still of concern to fixed income investors for a couple of reasons. The impending slowdown possesses risk to the credit beta while the policy uncertainty is a risk to the duration beta. A way to manage the credit and duration uncertainty is to allocate to cash or other cash-like instruments. We propose an alternative to the strategic cash allocation in Floating Rate Notes (FRNs). These instruments offer investors a material hedge against the current high levels of uncertainty in fixed income markets. In addition, FRNs yield higher than cash at a reasonable risk increment on cash. This article explores the characteristics, historical performance and portfolio suitability of FRNs in different situations.

Figure 1 highlights the MOVE Index and the Spread difference between 10Y and 2Y bonds for the US and Australia. The MOVE Index measures the implied volatility in the US Treasury market. Both indicators suggest ominous period for the markets. In 2022 MOVE index clocked in its highest reading since 2009. Despite some optimism earlier this year that inflation, and central bank hiking, had peaked, the MOVE Index has returned to elevated levels. This has been driven by sticky inflation and the enduring policy rate uncertainty. Additionally, the recent bank failures, a result of rapid policy rate hikes, also pushed up volatility. The other data points are the spread difference between 10Y and 2Y bonds in the US and Australia. The spread has reduced, and is in fact negative for US. The lower spread suggests an economic slowdown as it reflects bond investors’ expectations of lower rates in the future which are associated with a recession. A growth slowdown or recession can be negative for credit beta.

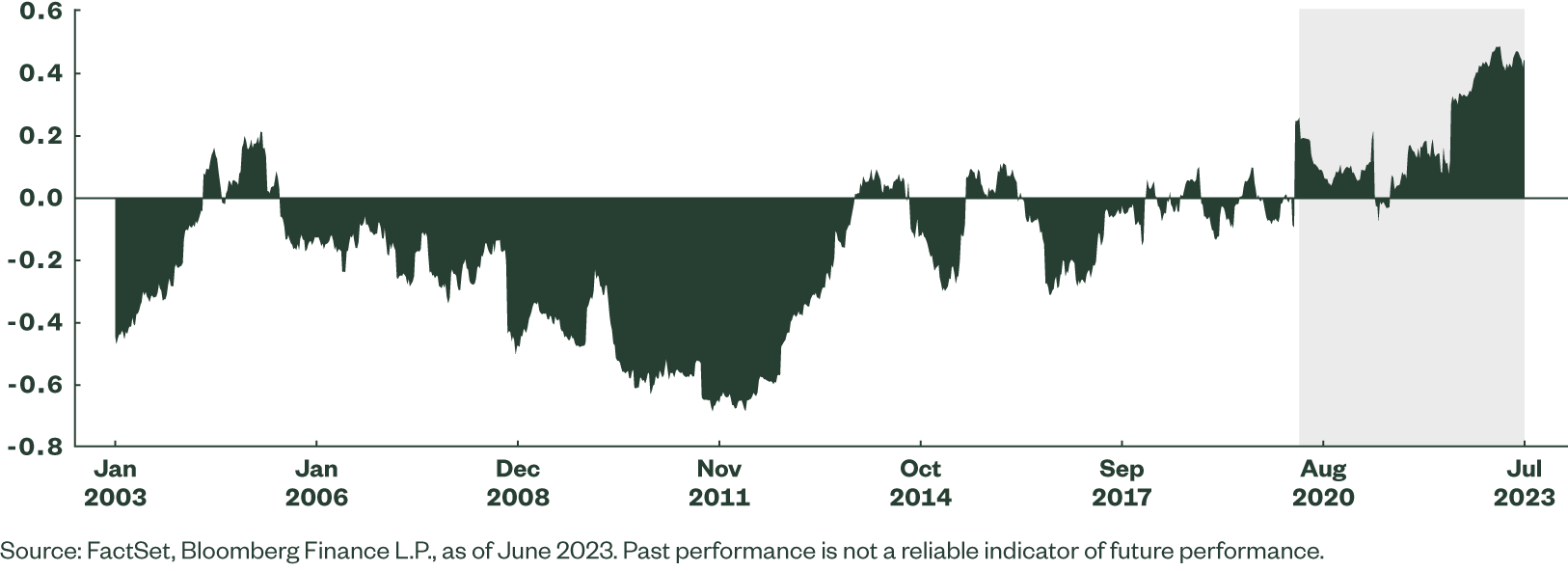

Figure 2: Weekly Australian Equity-Bond Return Correlations

Figure 2 highlights the historical stock-bond correlations in Australia. The correlation has turned positive after two decades of being mostly negatively correlated (and providing diversification). The correlation shown here is largely a function of inflation. High or increasing inflation corresponds with positive or increasing correlation, and vice versa. Our outlook for inflation has disinflation broadening as the demand-supply imbalance shifts from not enough to too much supply. However, inflation is remaining sticky, especially in the services sector, and progress to lower inflation levels that will satisfy central banks will be slow. As a result of this sticky inflation we expect the positive stock-bond correlation to remain in place for the rest of this year at least.

The lower level of diversification in stock-bond portfolios and a potential economic downturn suggest that investors should be prudent with their asset allocation. An allocation to cash is sound but we believe that a more efficient alternative is FRNs.

Why FRNs Now?

FRNs are fixed income instruments that have a coupon rate linked to the policy or reference rate (in Australia this is the 3m BBSW) plus a spread. This coupon is reset every quarter so the coupon and policy rate reconcile every three months, leading to lower interest rate duration risk than other fixed income sectors.

A snapshot analysis shows a duration on a FRN index1 as 0.13 years compared to a similarly credit rated Corporate Index which has a duration of 3.11 years. An increase of 1% can negatively impact the corporate index2 by approximately 3.11%, but will have negligible impact on FRNs (i.e. -0.13%).

Figure 3 highlights fixed income metrics for various fixed income market segments. The left scale captures the Yield, Duration, and 36-Months Standard Deviation for all bond markets, whereas the right scale captures the Yield-Per-Unit of Volatility for the markets. Broadly, the yields have climbed across all markets, but so has the volatility. FRNs dominate the other segments in extracting higher yield per unit of volatility. The high ratio is due to substantial lower volatility of FRNs. While not particularly sensitive to interest rate risk, FRNs are impacted by credit risk.

FRNs, particularly in Australia, tend to be based on high-quality investment grade credit. The credit rating that FRNs carry are similar to investment grade Corporate Bonds, although FRN indices do tend to have a higher rating profile than fixed investment grade indices. The average rating of the FRN index is AA- which is a full notch above the average rating of the investment credit index which is A+. The main reason for the higher credit rating profile for the FRN index is that this index includes a higher proportion of senior secured debt of highly rated companies, mostly well-capitalised banks. Historically, senior secured debt has had higher recovery rate in the case of default. This has contributed to spreads for this kind of debt being less volatile, increasing the reliability of the credit spread income. Therefore, in line with our outlook for emphasising quality and seeking income opportunities in short term bonds, we favour FRNs over fixed investment grade credit.

We believe that Floating rate notes can suit many different market environments. Whilst Floating rate notes have been used to complement strategic cash exposures and help to manage interest rate duration, they also offer other benefits to portfolio as the economic cycle slows. Floating rate notes can be used to help provide liquidity, enhance credit quality, and help to preserve capital.

FRNs as a Complement to Private Credit

In recent years the demand for private credit has increased as investors have sought to generate higher income and returns while protecting against inflation. Private credit takes advantage of a relative lack of liquidity to achieve price stability and impressive income/returns outcomes. However, there are logistical challenges that come with investing in such an illiquid asset class.

Private debt has had a turbulent record with liquidity in volatile markets. During the Global Financial Crisis, as investor confidence waned and they looked to withdraw capital, redemption requests were met with challenges. The low liquidity of the underlying loans meant that the assets could not be sold at a reasonable price over a short time-line. Consequently, many private debt fund managers restricted or suspended redemptions to protect their funds from selling the assets at distressed levels. Investors in private debt have to be prepared to weather that kind of lock-in period in times of stress.

Even in normal market conditions, an unknown for allocators is forecasting when committed capital will be called and how to optimise that planned investment in the meantime. Recognising investors often allocate to multiple managers/strategies with different timelines, a more liquid exposure could add value while waiting for committed capital to be called. The main challenges that investors have to deal with in managing these allocations are related to liquidity, in particular reducing cash drag and meeting capital calls. FRNs can be a useful component in investor portfolios to manage that liquidity challenge.

Firstly, FRNs can reduce the cash drag of unfunded private debt allocations as they provide current income consistent with the preservation of capital while providing a higher income than cash. In addition, FRNs are very liquid instruments with deep secondary market liquidity. This allows FRNs to be used as a core holding that can be relied upon to provide the liquidity required to fund a capital call when it occurs. FRNs can play an important role within a total portfolio as a source of diversification, potential risk-return enhancement, and liquidity.

FRNs for Strategic Cash Allocation

FRNs earn a higher income than bank or term deposits because coupons on FRNs carry a spread over the reference rate. FRNs have similar interest risk and liquidity to cash positions with a marginally higher credit risk. This credit risk of FRNs can be actively managed and we believe a defensive strategy is prudent if FRNs are to be deployed as a strategic cash allocation. A recommended defensive strategy would be to invest in bank-issued senior secured FRNs.

Our fundamental outlook for banks is strong and the increase in interest rates has helped banks post record profits. Additionally, the funding ratios and asset quality of the Australian banking sector are strong.

Figure 4 highlights the historical yield spreads of FRNs and Australian government bonds over cash. The average spread over the time period for FRNs has been 100 bps and currently sits at 96 bps. While for Australian government bonds the average has been 69 bps and the current level is 12 bps. FRNs do deliver a superior spread relative to government bonds and throughout the period have maintained a positive spread unlike government bonds. The relative reliability of the yield spread showcases the strong fundamentals of FRNs – low interest rate volatility and reasonable credit risk.

Figure 5 highlights the calendar year returns of Fixed Income instruments in Australia from 2000 to 2022. The chart validates the risk competency of FRNs. Government bonds have outperformed FRNs (4.98% vs. 4.42%) over the period but at a much higher volatility (5.63% vs 2.08%). FRNs have historically never delivered a negative calendar year return, while government bonds have delivered three negative years since 2000 with the worst return being -10.43% in 2022. Additionally, FRNs historically have delivered a better return than cash (4.42% vs 3.77%) with marginally lower volatility (2.08% vs 2.14%).

Conclusion

The macroeconomic outlook is marked by uncertainty in the short term. Inflation has remained sticky and so central banks globally have undertaken another round of rate hikes with the RBA leading the way in this regard. The policy ambiguity has started to affect growth prospects. The recommended investment strategy to deal with this uncertainty is to exercise prudence and seek high quality.

We believe that the decadal high yields offer opportunities in fixed income. However, the key challenges in this asset class remain. The impending growth slowdown possess risk to the credit beta while the policy uncertainty is a risk to the duration beta. We believe deploying FRNs is a pragmatic way to weather the short-term volatility, while generating income and maintaining high levels of liquidity.

The demand for private credit has increased and many investors now face the twin liquidity challenges of cash drag and meeting capital calls. FRNs can be utilised as a complement to private credit allocations as they can reduce the cash drag of unfunded allocations and are very liquid instruments so meeting capital calls is easier to manage.

Overall, FRNs offer an attractive alternative to other segments of fixed income like government bonds, fixed credit and cash. We believe FRNs can play an important role within a total portfolio as a source of diversification, income, potential risk-return enhancement, and liquidity.