Three reasons to implement a sector strategy

Sector strategies can help investors optimize the core of a portfolio by pursuing strong-performing sectors to capture outperformance while reducing company-specific risk to diversify portfolios. They also can help reposition a portfolio in response to shifting business cycles, secular trends, or technological changes.

Sector investing can be a cost-efficient and powerful portfolio construction tool for optimizing outcomes. Since economic variables and business cycles impact segments of the economy differently, sector-based investment strategies can help investors to:

- Pursue alpha with tactical allocations to potential sector outperformers

- Diversify to reduce concentration or company-specific risk

- Reposition for business cycle changes and secular trends

1. Pursue alpha with tactical allocations to potential sector outperformers

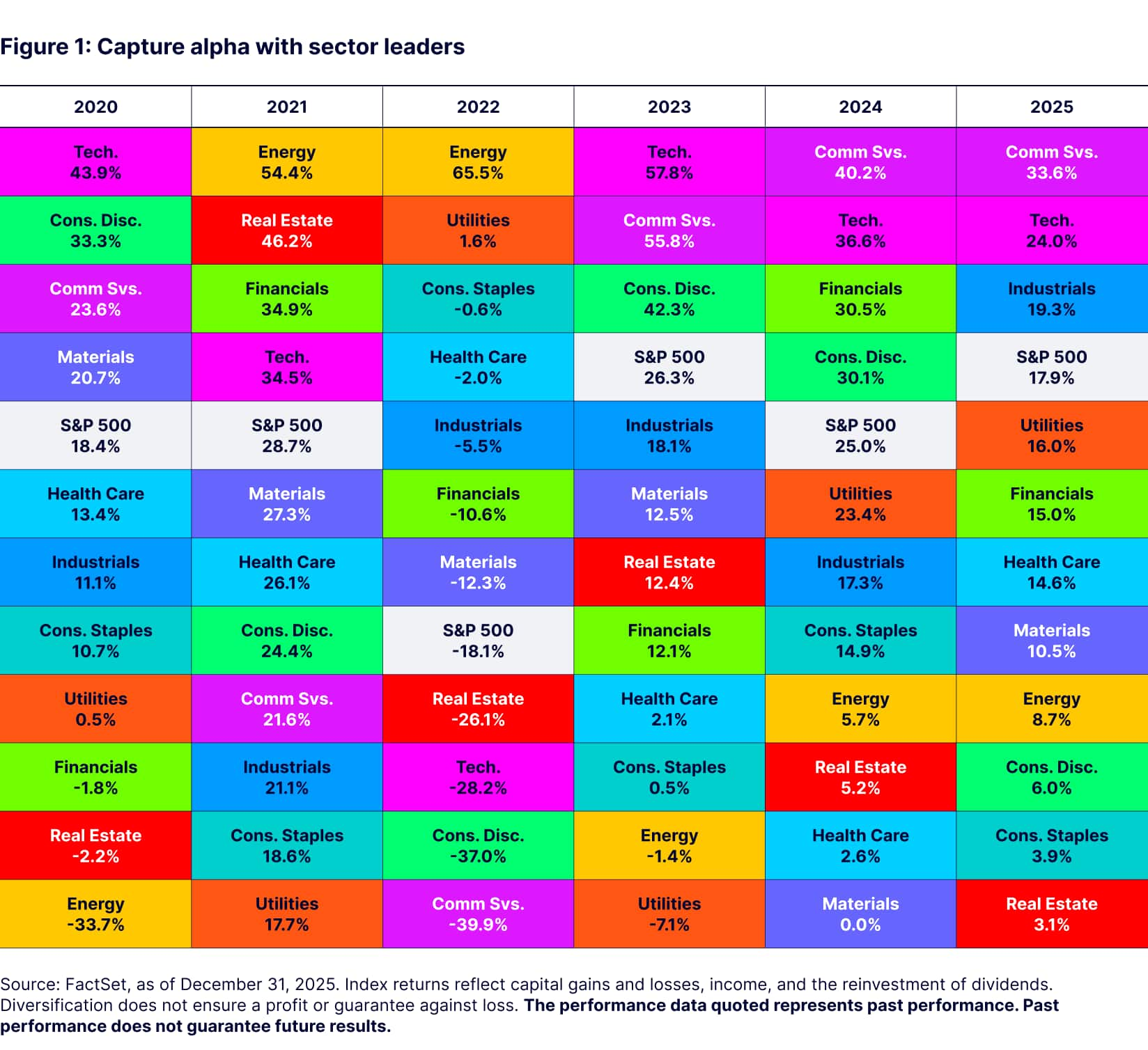

As business cycles and secular trends shift, sector investors have a distinct opportunity to enhance returns by capturing alpha opportunities across leading sectors that are outperforming the benchmark. Notably, for the past decade, the dispersion of returns across sectors—broad segments of the economy such as Technology, Health Care, or Energy—has been more than twice as wide as traditional investment styles like Growth, Value, or Size.1

While wider dispersion means the range of return outcomes is greater, it also creates compelling opportunities to pursue alpha (Figure 1). By overweighting sectors with higher expected returns and underweighting those with lower expected returns, investors can turn this variability into a potential source of excess return.

2. Diversify to reduce concentration or company-specific risk

Stock picking is challenging given the vast universe of securities and their volatility driven by unpredictable idiosyncratic risks. But sector investing can help achieve the desired exposure without shouldering too much stock-specific risk or analyzing individual securities.

For example, rather than selecting one or two utilities companies focused on powering AI data centers, seek broad exposure to the Utilities sector to capture the secular increase in AI power demand—from electricity and gas providers to independent power producers that engage in generation and distribution of renewable energy. This approach seeks to provide targeted exposure to a specific area of growth while mitigating stock-specific risk.

Selecting stocks that outperform their sector benchmark requires the ability to distinguish between companies riding the coattails of a strong-performing sector from those that deliver outperformance through solid fundamentals and skilled management. But separating skill from luck is no easy task. Over the past 20 years, more stocks (34%) have underperformed their respective sector average by more than 10% than have outperformed (29%) by more than 10% (Figure 2).

3. Reposition for business cyclical changes or secular trends

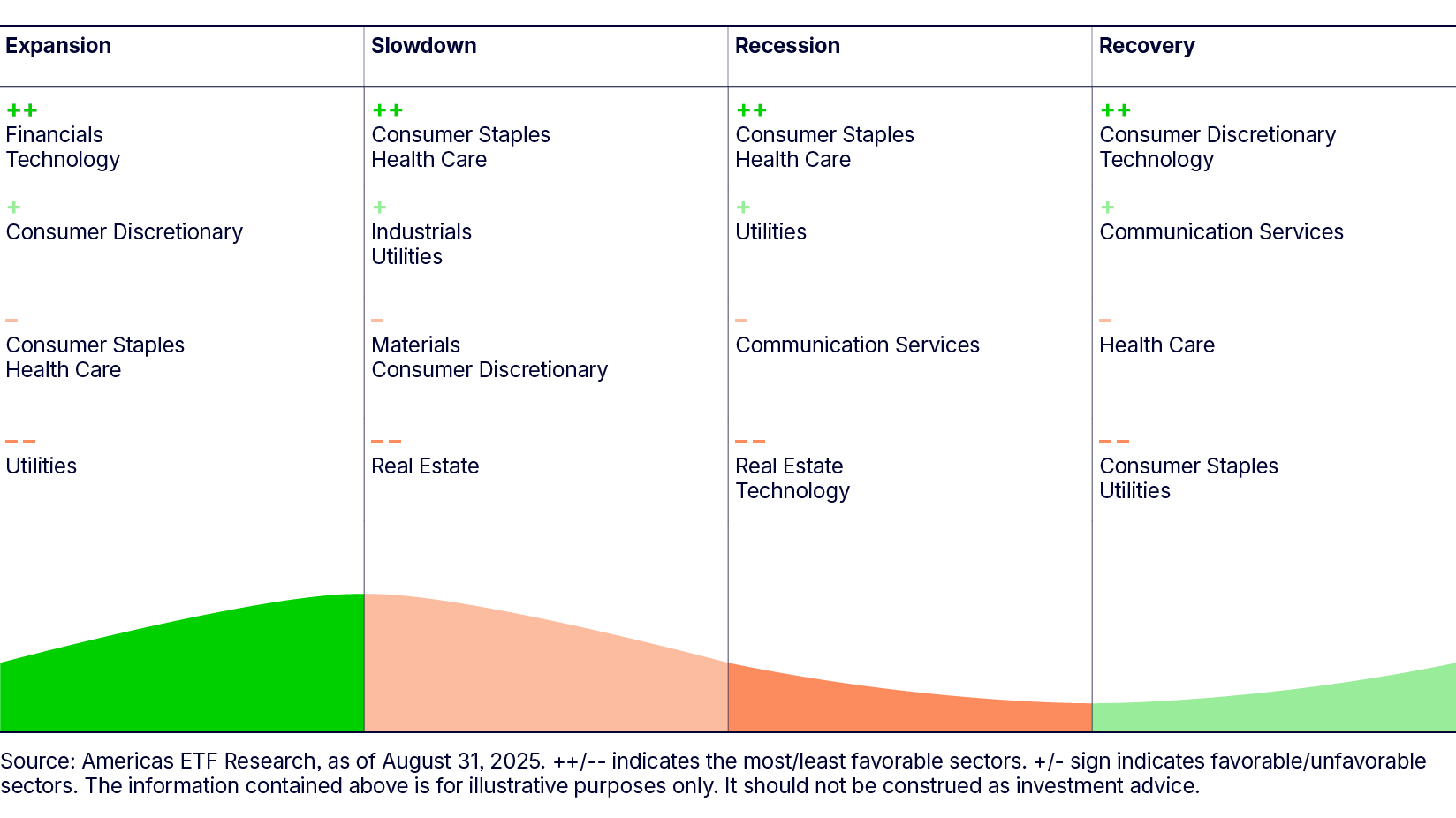

The economy moves in cycles. Each phase typically exhibits distinct economic characteristics and changes to economic variables such as interest rates, inflation, consumer spending, and business investment. These changes can impact sectors and the underlying companies differently, meaning specific sectors may outperform or underperform during different phases.

With sector-based strategies, investors can align portfolios with business cycles by increasing allocations to sectors that are favored by the current economic conditions and reducing allocations to sectors facing headwinds.

Figure 3: Capture sector opportunities with business cycle shifts

For example, in an economic recovery phase, improvement in the labor market and consumer confidence leads to increases in discretionary spending for restaurants, travel, and durable goods, benefiting Consumer Discretionary sectors. On the other hand, Consumer Staples, whose business is less sensitive to economic fluctuations due to inelastic demand for their products, is out of favor as investors embrace more cyclical sectors to capture upturns in the economy and stock market.

Sector-based strategies also can be used to capture long-term growth opportunities created by secular shifts or technological trends. Since the launch of ChatGPT in November 2022, Generative AI technology has had a significant impact on how users access information and consume and interact with digital content. Leading AI innovation and adoption, large Communication Services companies, such as Alphabet, Meta, and Netflix have benefited from AI-driven operational efficiency gains—from automated content generation and scalable personalization to advertising campaign optimization. As a result, the sector’s earnings growth ranked in the top two for three consecutive years between 2023 and 2025,2 and it was the best performing sector over the same time period, outperforming the broad market by 20% on an annualized basis3 (Figure 4).

Consider ETFs for cost-effective, precise exposure to sectors

Sector ETFs provide a cost-effective, diversified solution for enhancing the core of a portfolio by providing broad exposure to potential alpha generating opportunities while reducing the cost and risks associated with individual stock selection. They enable investors to implement both simple and sophisticated sector rotation strategies—whether technical, fundamental, or macro-driven—with precision.

State Street launched the first sector suite in 1998. Today, the State Street® Select Sector SPDR® ETF suite covers all 11 GICS® sectors and is the largest suite by AUM with assets of $338 billion as of December 31, 2025.4 The suite also boasts the lowest expense ratios, tightest spreads, and highest options volume for those seeking liquidity and option income generating strategies.5