Sector opportunities for Q3 2025

Explore our Q3 outlook on sector trends highlighting what we believe are the best sectors to invest in now and why—along with ETFs you can use to access them.

• Insurance: State Street® SPDR® S&P® Insurance ETF (KIE)

• Utilities: State Street® Utilities Select Sector SPDR® ETF (XLU)

• Aerospace & Defense: State Street® SPDR® S&P® Aerospace & Defense ETF (XAR)

After a rocky start to the year, US equities have staged a strong comeback since the pause of reciprocal tariffs. High beta stocks have led the way with renewed AI optimism and progress in trade negotiations supporting risk-on sentiment. Meanwhile, High Quality and Low Volatility stocks are now lagging the broad market year to date after outperforming before the market bottom.

But the market isn’t completely out of the woods.

Economic data across labor and housing markets, business sentiment, and retail sales all surprised to the downside in June.1 And higher tariffs relative to pre-Liberation Day levels may create inflationary pressure and weigh on consumer spending in the near term.

As equities continue to climb the wall of worry—from stretched valuations and economic and policy uncertainty to geopolitical conflicts—investors may consider Insurance and Utilities for attractively valued high quality exposures less impacted by tariffs and Aerospace & Defense for secular tailwinds from greater defense spending.

Insurance: Strong pricing power and stable earnings outlook

Insurance companies’ strong pricing power and stable cash flows from premium collection may help investors position for a potential economic slowdown and higher inflation. The industry’s earnings outlook has stabilized after expectations were adjusted to the catastrophic losses from the Los Angeles fires in Q1. Since then, the industry’s consensus growth estimates have been stable. In fact, they are expected to rebound strongly next year, exceeding the growth of the broad market given the large downgrades in S&P 500 earnings growth due to tariff uncertainty.2

While tariffs may increase claim costs of auto insurance due to higher replacement costs, the cost pressure likely will be temporary and manageable for insurers given the limited increases in auto tariffs. In fact, thanks to their strong pricing power—auto insurance typically reprices every six months—P&C insurance companies may pass through the cost increases to customers by adjusting insurance premiums. The temporary cost pressure is likely to be more manageable because the P&C insurance industry entered 2025 with its highest underwriting profitability in 10 years.3

Strong interest in annuities and still-elevated interest rates may continue providing growth tailwinds for life insurers. As consistent growth drivers, individual and group annuities account for more than half of the life insurance industry’s written premiums.4 US annuity sales topped $100 billion for the sixth consecutive quarter in Q1,5 driven by attractive investment income and growing demand for guaranteed income amid economic uncertainty. Meanwhile, thanks to still-elevated interest rates, life insurers have been able to generate more income from the difference between investment income and the amount paid out on annuity guarantees and other liabilities.

After outperforming the broad market amid weaker economic growth outlook in March, the industry has been lagging in the recent high-beta-driven market rally. Its forward price-to-earnings ratio in the bottom quintile relative to the broad market indicates a quality growth opportunity with attractive valuations (Figure 1).

To capture the insurance industry’s high quality growth, consider the State Street® SPDR® S&P® Insurance ETF (KIE).

Utilities: Increasing AI power demand and defensive business

Strong growth prospects, more rate cuts in the second half this year, and favorable valuations position Utilities as an attractive defensive sector to manage potential downside risks to the economy.

The sector’s earnings outlook for this year and next has been stable since Q1 despite economic uncertainty. If these growth expectations are met, the sector will achieve four consecutive years of above-average growth—its longest stretch in 20 years.6

Utilities’ strong earnings growth reflects the uptrend in US electricity consumption. US electricity consumption is expected to surpass 2024’s all-time high this year and next, rising at a faster pace than in the past two decades, driven by strong data center power demand and manufacturing reshoring.7

As owners, operators, and builders of nuclear power plants, Utility companies may benefit from growing demand and policy support for nuclear power. With existing energy sources struggling to keep up with AI data center demand, big techs are increasingly signing long-term power purchase agreements with utility companies, particularly for nuclear power, to secure reliable and carbon-neutral power supply. These long-term contracts provide Utilities higher margins, stable revenue streams, and access to financing for new capital investments.

The Trump administration is also taking steps to support private sector investment in nuclear energy to power AI infrastructure. The Department of Energy seeks to quadruple US nuclear energy capacity to 400 GW by 2050 by financing reactor restarts and expediting review and approval of reactor projects.8 The Senate version of the One, Big, Beautiful Bill also keeps the production tax credit and transferability for energy production using advanced nuclear technology.

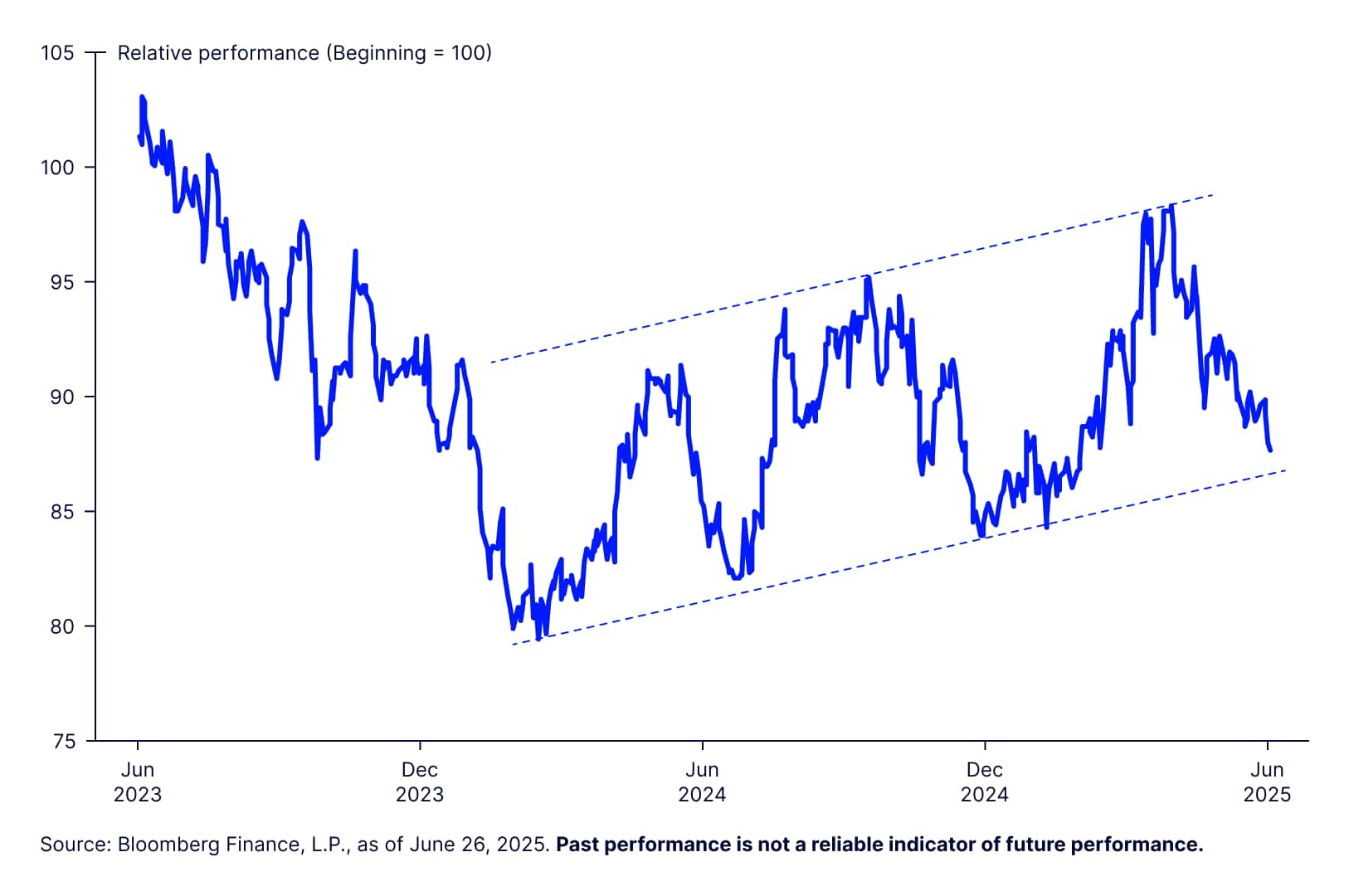

Lower interest rates and economic uncertainty may provide further tailwinds for the sector in the second half of 2025. Despite rate-driven volatility, Utilities’ relative performance to the broad market has trended higher with higher highs and higher lows since early 2024 (Figure 2), as the path to a soft landing narrowed.

Figure 2: Utilities’ relative performance: Higher highs and higher lows since 2023

Utilities’ strong growth prospects driven by AI power demand remain underappreciated by the market given its next-12-month P/E multiples now trade at a 17% discount to the broad market—the bottom decile of the past 15 years.9

To add defensive positions amid economic uncertainty while capturing the secular tailwinds of increasing AI power demand, consider the State Street® Utilities Select Sector SPDR® ETF (XLU).

Aerospace & defense: Higher global defense spending

Higher defense spending has regained traction in the US. With bipartisan support, a $150 billion increase in defense spending likely will make it to the final One, Big Beautiful Bill Act. The Trump administration’s request of a 13% increase in the defense budget from the FY 2025 level and the $175 billion proposed Golden Dome missile system underscore the administration’s ambition to invest in state-of-the-art technology to achieve “peace through strength” in national security and foreign policy.

Meanwhile, European defense spending continues to show strong momentum. NATO countries recently agreed to boost their defense spending to 5% of GDP within a decade, including 3.5% on core defense spending and 1.5% on defense-related expenditures such as infrastructure security, cybersecurity, and defense industrial base.10 Germany—the largest defense spender in Western Europe—even pledged to meet the 3.5% quota by 2029 as the country’s recent fiscal reform paved the way for higher defense funding.11

Military spending in the Middle East increased 15% in 2024 driven by the surge in Israel and Lebanon. But with the recent escalated tension between Israel and Iran, other countries in the region likely will also boost their military expenditures in the coming years.

As the US accounts for 50% of the arms imports by Europe, the Middle East, and the North Africa region,12 US aerospace and defense companies may enjoy tailwinds of accelerating global defense spending.

The US Aerospace and Defense industry has gained 47% since the market bottom on April 8, outperforming the broad market by 17% year to date. The risk of pullback is tangible, although investors may buy the dip given its reasonable relative valuations. The industry’s relative price-to-book ratio still well below both the long-term median and the median level during the last defense spending cycle indicates potential for multiple expansions.

To capture the secular increase in defense spending, consider the State Street® SPDR® S&P® Aerospace & Defense ETF (XAR).

To learn more about emerging sector investment opportunities, visit our sectors webpage.