Private market assets in retirement plans Survey shows growing interest from plan sponsors, participants

Get our latest research on including exposure to private market assets in defined contribution (DC) plans. Explore how the Democratizing Access for 401(k) Investors Executive Order (EO) sparked new interest—and how perceptions among plan sponsors and retirement savers are evolving.

This first-of-its-kind survey since the EO reveals how sponsor and participant respondents are thinking about private markets now.

What our research says

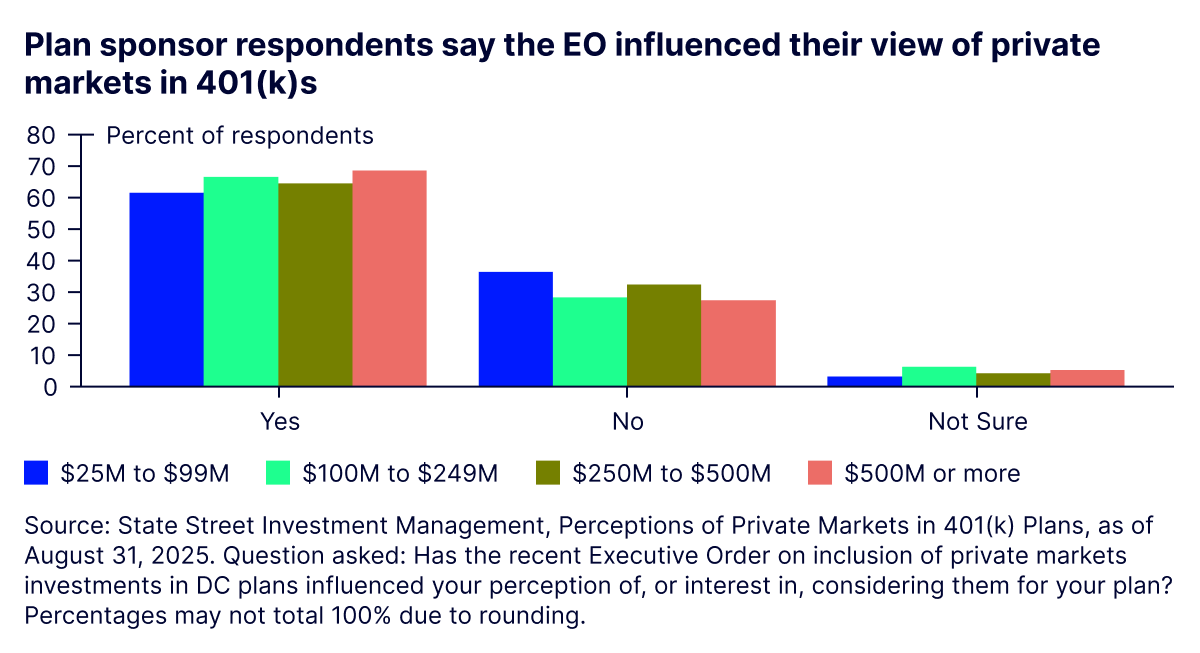

Our survey findings show the EO impacted perception of, and interest in private markets for 65% of plan sponsor respondents, spotlighting the opportunity plan sponsors have to lead now—by expanding access, boosting diversification, and potentially improving retirement outcomes.

Retirement plan participant insights

Familiarity helps shape

sentiment, potential to fuel demand

Among those knowledgeable about private markets, 62% are likely (“somewhat” or “very”) to believe an allocation to private markets will improve long-term retirement outcomes, versus just 20% of those not familiar with the asset class.

The takeaway: Building participant knowledge about the asset class may help drive interest and adoption.

Openness to allocations

About 46% of participants say they’d allocate 1% to 15% of their portfolio to private markets investments, and other survey data shows comfort grows when private markets are offered through professionally managed solutions.

The takeaway: Providing exposure in professionally managed solutions can play a role in participant confidence.

Willingness to pay more for

access varies

Participants are split on whether they'd pay more for private market access.

The takeaway: Sponsors may want to consider educating participants about return potential and diversification benefits.

Retirement plan sponsor insights

Sponsors are focused on results

Of those surveyed, 70% rank higher return potential and 60% rank broader diversification in their top three reasons for considering private markets.

The takeaway: To move forward, we believe sponsors need solutions designed to deliver on these goals—professionally managed strategies that balance innovation with oversight.

Multi-asset exposure seen as key to enhancing outcomes

Of sponsors surveyed, 48% consider multi-asset strategies to be the optimal approach to enhance participant outcomes.

The takeaway: Plan sponsors may be more likely to provide participants with access to private markets if that exposure is delivered via a multi-asset strategy.

Interest poised to surge if key concerns addressed

Sponsor respondents cite fiduciary and regulatory risks, liquidity constraints, and participant education as concerns—but overall 68% say, if addressed, their interest would increase (slightly, moderately, and very much).

The takeaway: Sponsors likely want solutions that simplify access, manage liquidity, balance fiduciary duty, and build participant confidence through education.

Many sponsors keen to

implement private markets within 1-2 years

More than 50% of sponsor respondents interested in private markets or already exploring options—regardless of plan size—plan to implement within 12 months.

The takeaway: Solutions that deliver private markets exposure in familiar frameworks, like target date funds, may be essential to meeting their desired timeline.

“Our research shows that participants want a seat at the private markets table. Sponsors who act now have an opportunity to lead, offering more diversified retirement solutions and potentially better long-term results.”

– Brendan Curran, Head of US Retirement

Moving from insight to action

Retirement plan participants want guidance. And plan sponsors are uniquely

poised to help—here’s how.

Educate participants about private markets

Watch the video for tips on how to effectively educate participants about private markets, specifically when accessing through target date funds.

Navigate the regulatory environment

Learn how the August 2025 Executive Order is designed to reduce certain legal and regulatory barriers that have limited private market access for retirement savers.

Explore the case for private markets in TDFs now

Read how a private markets allocation in TDFs may deliver broader diversification and higher return potential over time.

State Street Target Retirement IndexPlus Strategies

Looking for a transparent and scalable target date fund solution that helps deliver broader diversification and higher return potential? These funds combine index-based public market investing with access to diversified private markets exposures.

Getting there starts here with State Street Investment Management

Whether you’re exploring the idea of private markets for the first time or evaluating solutions, it helps to have a partner by your side who understands the opportunity and what it takes to get there.

Assets under management 1

Global DC plan assets 2

Participants 3

Target retirement AUM 4