US inflation returns to historical sweet spot

US inflation is expected to settle in the upper 2% range through 2026, a level historically linked to strong corporate profits and healthy equity market returns, creating a favorable economic backdrop.

The final stretch to 2% inflation has long been considered the hardest. After ending 2024 at 3%, CPI is projected to settle in the upper 2% range through 2026. Historically, this level sits at the center of the inflation distribution over the past 66 years—an area that reflects economic normalcy rather than stress. Before the 2022 inflation spike, the US was inflation-starved, with the last reading above 2.5% occurring in 2011. In reality, inflation in the upper 2% range is historically quite normal.

Weekly highlights

Source: FactSet and State Street Investment Management Forecasts, as of October 22–23, 2025

Upper 2% inflation: A forgotten sweet spot for corporate profits

As we move through 2025 and look ahead to 2026, consensus expectations suggest inflation will hover in the upper 2% range. While headlines often frame inflation as a risk factor, history tells a more nuanced story: moderate inflation has often coincided with strong corporate profitability and healthy equity market returns. Yet, this relationship is frequently overlooked in today’s discourse, which tends to focus on extremes—either the specter of runaway prices or the drag of deflation.

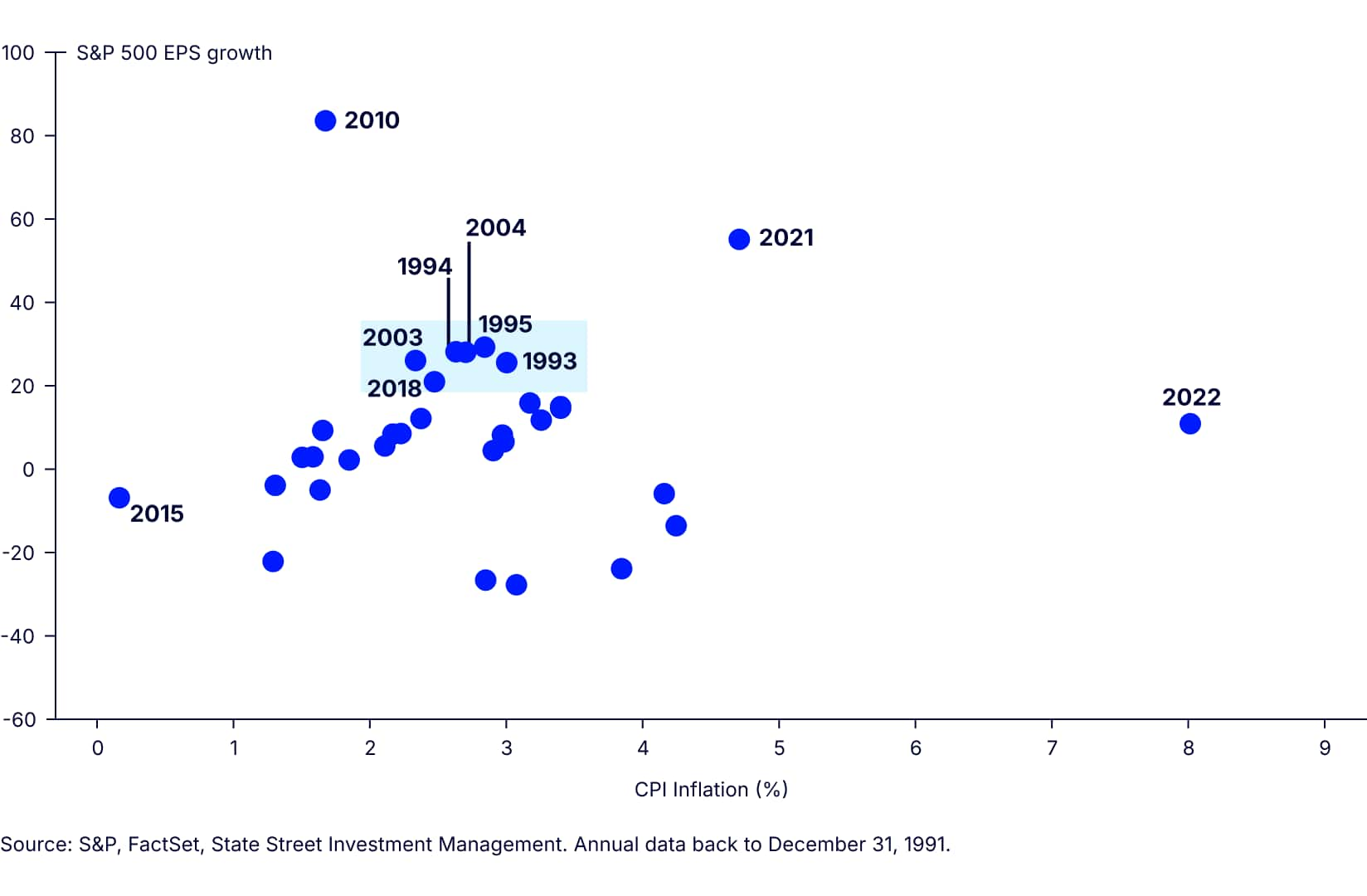

Annual S&P 500 EPS growth and inflation

Inflation in the 2–3% corridor can be a constructive backdrop for U.S. equities. The chart above is almost 35 years’ worth of annual CPI Inflation along with the corresponding S&P 500 earnings growth. The main observation is that there is a nice clustering of > 20% earnings growth years in the 2-3% inflation bucket, which isn’t really seen in the other inflation areas. In essence, modest inflation acts as an enabler for economic activity. It allows companies to pass through incremental cost increases, expand revenues in nominal terms, and maintain or even improve operating leverage—particularly if productivity gains or scale efficiencies offset rising wages and materials costs.

Why upper 2% inflation is constructive

The Federal Reserve’s long-standing target of 2% inflation reflects a level consistent with price stabilityand sustainable growth. When inflation runs slightly above that—say, in the 2.5–3% range—it often signals robust demand without tipping into overheating. For corporates, this environment offers a coupleof advantages:

- Pricing Flexibility: Firms can raise prices modestly without triggering consumer backlash, preserving margins even as input costs rise gradually.

- Nominal Earnings Growth: Revenue lines expand in nominal terms, which matters for equity valuations tied to earnings per share.

The link between inflation and earnings is not linear; it depends on the source of inflation and thecorporate sector’s ability to manage costs. Demand-pull inflation, driven by strong consumer demand,supports both volume and pricing, while cost-push inflation from supply shocks can compress margins ifpass-through lags. The post-pandemic surge in inflation illustrated this dynamic, as profit margins initiallyspiked but later normalized when input costs surged. Looking Ahead, we believe real GDP growth in 2026 will be above trend, around 2.3%. Policy measures—such as lowertaxes for both corporations and individuals, higher consumer tax refunds looking to be spent, along withsome other kickers of the OBBB like increased capex spending due to immediate expensing forcorporations—should sustain demand for goods and services. In our view, inflation is likely to remaintame and not materially spike further, creating a favorable backdrop for profitability and margins.

Go beyond the headlines...

Skimmed the summary? Dive deeper with the full PDF—your go-to for weekly market insights and analysis.