5 Strategic reasons institutional investors are turning to ETFs

Exchange traded funds (ETFs) have revolutionized the investment landscape from the moment State Street Investment Management launched the very first US ETF in 1993. In the 30-plus years since the ETF industry’s inception, ETF adoption has surged with global ETF assets now sitting at $13.8 trillion.1 These products have a resilient track record that demonstrates their ability to deliver value in all kinds of markets and to all types of investors—including institutions.

Here are five strategic reasons for ETFs’ growing popularity with institutions, based on our survey of institutional and professional investors.

1. ETFs are no longer niche—survey suggests institutional investors are all in

ETFs have grown in popularity since their debut in the early 1990s. Today, nearly 10,000 ETFs are available globally,2 catering to a wide range of investment strategies—including active management, factor-based strategies, and thematics—and covering everything from traditional asset classes to specialty markets and innovative sectors.

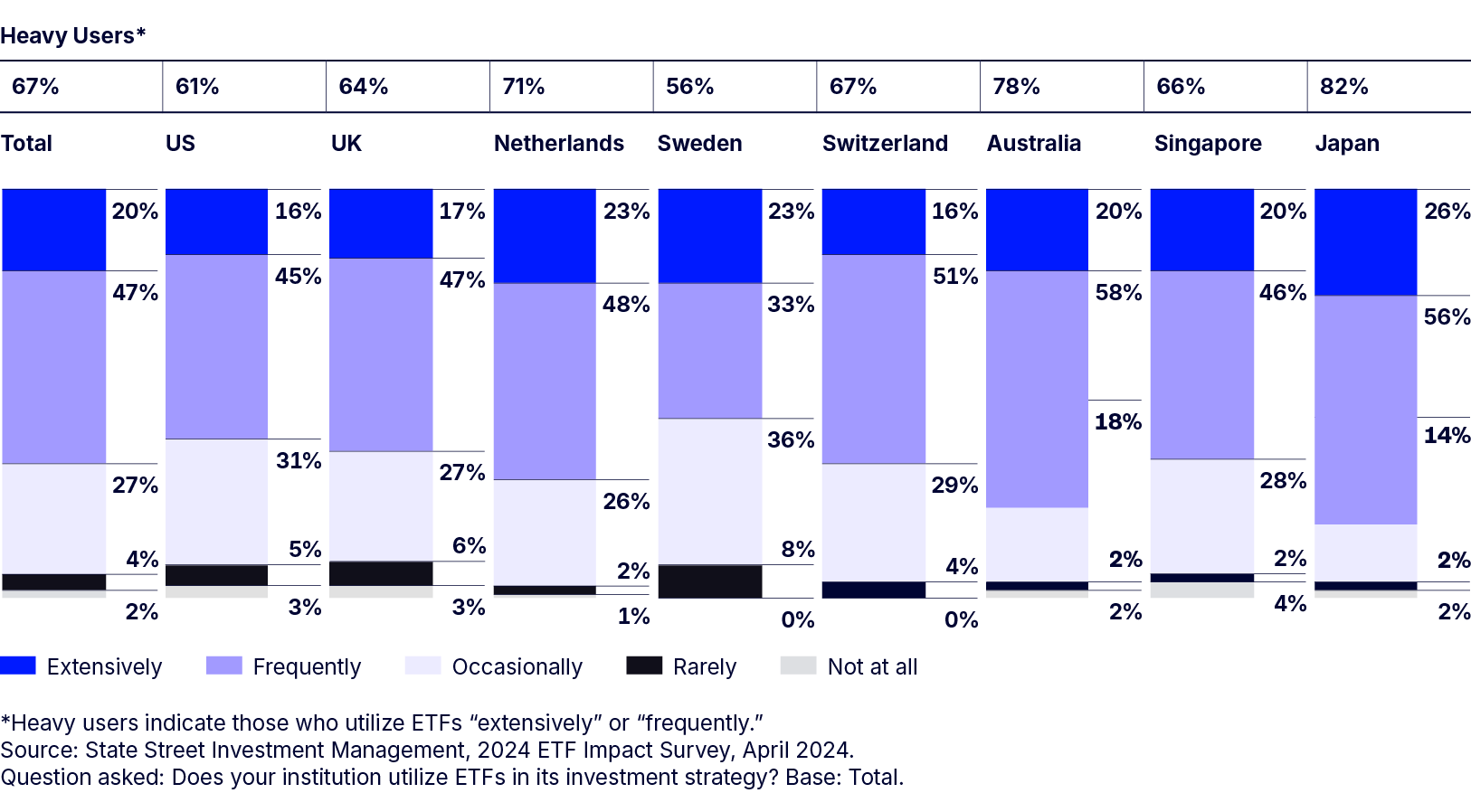

In our 2024 ETF Impact Survey, 67% of institutional investors said they use ETFs “frequently” or “extensively” as part of their institution’s investment strategy.3 Usage is even higher in Japan (82%), Australia (78%), and the Netherlands (71%)4—suggesting institutions see inherent value in ETFs.

Figure 1: A majority of institutional investors are heavy ETF users

This widespread adoption underscores a fundamental shift in how sophisticated investors construct portfolios. ETFs offer versatility, liquidity, and access to niche exposures, making them more than just a trend—they’re now a compelling strategic opportunity for institutions looking to stay competitive.

2. Institutions use ETFs to combat their biggest challenges

Risk and uncertainty are constants in institutional investing. Today investors are more focused than ever on tools that offer stability in the face of disruption. According to our survey, the top three investment management challenges institutions face are:5

- Managing risk effectively (30%)

- Dealing with market volatility (28%)

- Cybersecurity threats (28%)

These structural headwinds require adaptable, reliable solutions. And that’s reflected in the top three reasons institutional investors use ETFs:

- For liquidity management and hedging (23%)

- As core holdings for diversified exposure (19%)

- For tactical asset allocation and market timing (16%)

ETFs offer a number of potential advantages—diversification, deep pools of liquidity, and targeted exposure—that directly address those top challenges (Figure 2). Institutions aren’t just using ETFs to round out portfolios, but to actively manage uncertainty.

3. ETF liquidity is reshaping institutional portfolio construction

Liquidity consistently ranks as the most critical factor for institutional investors when choosing ETFs.

Figure 3: Top decision criteria among surveyed institutional investors

| 1 | Highest liquidity | 59% |

| 2 | Best track record/performance | 55% |

| 3 | Lowest total cost | 54% |

Source: State Street Investment Management Center for Investor Research, 2024 ETF Impact Survey, April 2024. Question asked: When making a choice between ETFs that offer the same or similar exposure, please rank the following factors in order of importance to which ETF is chosen. Base: Those who utilize ETFs

Among heavy ETF users, 91% said liquidity is important, compared to 68% of light users. This suggests that more experience with ETFs increases reliance on them as essential liquidity tools.

Did you know? State Street SPDR ETFs represented 31% of the ETF industry’s annual trading volume in 2024. That’s 4.5x larger than Vanguard and 1.2x larger than BlackRock6—underscoring State Street Investment Management’s position as a liquidity leader.

In today’s markets, liquidity is a necessity. Institutions face multiple liquidity-related challenges, from needing to maintain flexible cash buffers and navigating regulatory liquidity risk frameworks, to managing portfolios with harder-to-trade assets. Whether preparing for large redemptions, reallocating across asset classes, or simply rebalancing with precision, liquidity can often be a friction point.

ETFs provide multiple layers of liquidity—including both primary market creation/redemption mechanisms and deep secondary market trading—making them flexible and cost-efficient tools for institutional portfolios, especially when executing sizable trades.

A guide to ETFs for institutional investors

Unlock the power of ETFs and find out how institutions can capitalize on the growing $13.8 trillion global ETF industry.7 Explore use cases, case studies, and more.

4. ETFs offer high-impact exposure at low-cost entry points

Fees can significantly impact long-term returns. In our survey, 60% of heavy ETF users and 51% of light users cited cost-efficiency as a top reason for using ETFs.8

Figure 4: Why institutional investors use ETFs

| Heavy users* | Light users^ | |

|---|---|---|

| Cost efficiency | 60% | 51% |

| Diversification benefits | 56% | 50% |

| Cash/liquidity management | 50% | 38% |

| Access a specific asset class or investment exposure | 49% | 38% |

| Trading convenience | 49% | 36% |

| Tax benefits | 48% | 36% |

* Survey findings identify heavy users as those who use ETFs “extensively” or “frequently.”

^ Survey findings identify light users as those who use ETFs “sometimes” or “rarely.”

Source: State Street Investment Management Center for Investor Research, 2024 ETF Impact Survey, April 2024. Question asked: Why does your institution use ETFs?

Yet, despite their lower average costs compared to mutual funds (0.44% versus 0.92% median expense ratios), many institutional investors may overlook ETFs’ potential cost advantage.

The median expense ratio of ETFs 9

The median expense ratio of mutual funds 10

And now, ETFs span virtually every market segment and investment style—equities, fixed income, currencies, alternatives, commodities, industries, active approaches—making them ideal low-cost building blocks for institutional strategies.

5. ETFs can enhance institutions’ portfolio diversification

The traditional 60/40 portfolio may be the most universally recognized allocation in investment management. But it’s been tested by rising stock-bond correlations. By the end of March 2025, stocks and bonds had exhibited positive correlation for more than 700 days.11

This has led investors to explore alternatives for added diversification (Figure 5).

A variety of alternative ETFs have caught investors’ attention, including:

- Digital assets and transformative tech for next-gen innovation exposure

- Gold and other commodities for hedging, diversification, and appreciation

- Structured, outcome-driven ETFs to help manage equity risk while still pursuing upside potential

ETFs are increasingly providing relatively easy, liquid, and cost-efficient exposure to once harder-to-reach opportunities. For institutions looking to future-proof portfolios, ETFs potentially offer a powerful way to embrace a more modern, multi-dimensional approach to risk management.

Top ETF trends and bold predictions

What does it take to build resilient portfolios for the future? Discover the trends shaping ETF adoption worldwide and innovative strategies helping institutional investors adapt to new terrain.