2025 Target Retirement Annual Review

Each year, State Street Investment Management conducts a comprehensive review of its Target Retirement strategies. The annual review process is driven by the Defined Contribution Investment Group (DCIG), which blends asset allocation expertise from State Street’s Investment Solutions Group (ISG) with retirement market insights from the Defined Contribution (DC) team. The review follows a consistent and transparent framework to reassess the capital market expectations and demographic assumptions that underpin the glidepath while also evaluating the existing asset classes, as well as any new asset classes and investment themes for inclusion. The process is grounded in three key criteria: investability, desirability and suitability.1

Our 2025 review, beginning with a portfolio optimization exercise using updated capital market assumptions, did not reveal any new asset classes with significantly improved desirability or suitability for inclusion in our index-based Target Retirement series. Last year’s review focused on recalibrating the equity allocations amid persistent market shifts. This year, we shifted focus to a long-standing investor concern: the role of fixed income—particularly duration—along the glidepath.

The case for fixed income in the wealth accumulation phase is driven by two key considerations: the long-term return and income potential across the risk spectrum, and the diversification benefits of adding bonds to a multi-asset portfolio of stocks and inflation-sensitive asset classes. Over the years, we have strategically evolved our fixed income allocation in response to major yield curve shifts. Our most recent change in 2023 restored the starting allocation to Long U.S. Government Bonds after holding a mix of Intermediate and Long Government Bonds from 2021 to 2023. At that time, the outlook for bonds had improved significantly following the historically low rates of 2020. The rationale centered on stronger long-term return expectations for bonds versus equities, while recognizing the risk of further rate increases amid persistent inflation.

While findings from this previous analysis remain valid, new factors—both positive and negative—warrant further review. Equities continue to outperform bonds, driving the equity risk premium lower, while correlations, though lower than recent peaks, remain positive. Meanwhile, inflation uncertainty, fiscal supply pressures, elevated rate volatility, and global demand shifts have widened the term premium, improving long-term return prospects for longer-duration bonds versus equities and intermediate bonds. However, some of these same drivers, most notably U.S. fiscal debt levels, monetary policy uncertainty, and the risk of sticky or rising inflation, pose tangible risks to our base case outlook.

Summary of 2025 Annual Review: No Changes

While closely monitoring risks to our assumptions, we have reaffirmed our conviction in U.S. Long Government Bonds. This confidence is grounded in rigorous historical analysis, updated capital market assumptions for both equities and fixed income, stress testing and an evaluation of alternative equity diversifiers. As a result of this year’s review, our research yields several clear conclusions.

- Long Government Bonds pass the desirability test. After examining both forward-looking return expectations and diversification potential, U.S. Long Government Bonds remain our preferred diversifier. We believe long government bonds offer the potential for compelling long-term returns relative to other asset classes considered and should act as a ballast during (most) equity downturns.

- We closely monitor risks to our assumptions. This review considered scenarios such as adding diversifying asset classes and increasing equity allocations. If our base-case outlook weakens, we have a defined framework and sufficient flexibility to evaluate changes, with the objective of driving efficient growth for participants.

- The need for duration evolves over time. We are not taking a universally pro-duration stance. We are acknowledging that diversification remains a valuable tool and that long government bonds are the most efficient diversifier in equity-heavy portfolios. However, there is a point in participants' careers where the excess interest rate risk that long duration bonds provide outweighs the diversification benefits. As participants age and priorities shift, we remove this allocation entirely, resulting in a substantially lower duration portfolio than many of our peers in retirement where nominal bond allocations are the highest.

Desirability of Fixed Income: The Return Outlook

The case for fixed income in the wealth accumulation phase is driven by two key considerations – the long-term return and income potential across the risk spectrum, and the diversification benefits of adding bonds to a multi-asset portfolio of stocks and inflation-sensitive asset classes. Let’s focus on return expectations first.

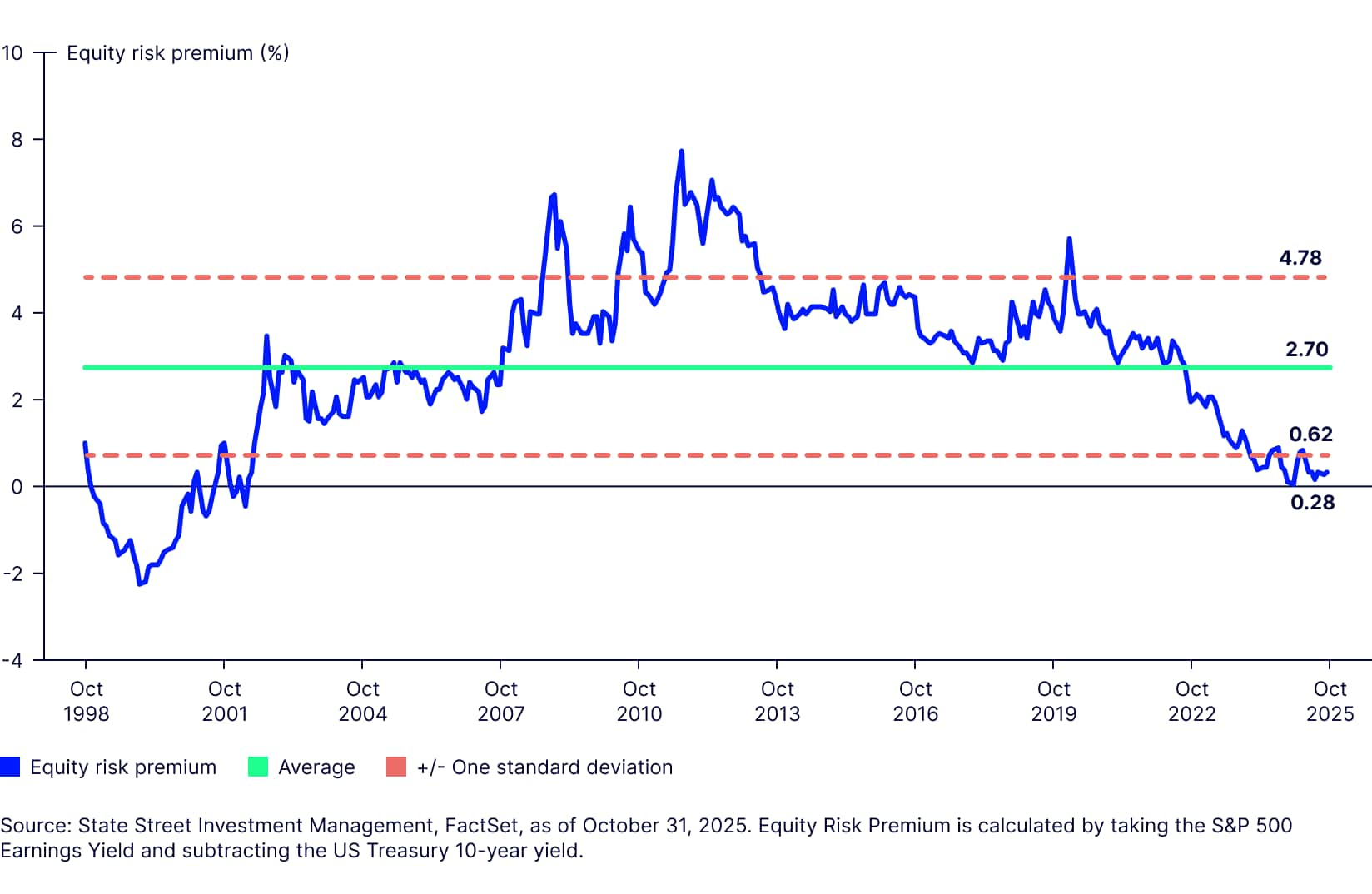

State Street’s Target Retirement strategies are built on a forward-looking approach, anchored by a long-term view. Using a widely understood metric as a starting point, the equity risk premium, which in simple terms can be defined as the expected long-term outperformance from stocks to compensate for excess risk, is near its lowest level in twenty years. While equities remain essential for wealth accumulation and offer asymmetric upside versus fixed income, this metric provides a useful gauge of relative attractiveness across asset classes.

Figure 1: Equity Risk Premium Makes a Strong Case For Bonds

Each quarter, we update our proprietary long-term capital market assumptions as a starting point to build a clear view on the evolving relationship between asset classes. In our forecasts, the expected return premium between U.S. Equities and Long Duration bonds has averaged roughly 3.5% over the last fifteen years, and reached a peak of close to 8% in 2020, prompting us to reduce our strategic allocation to long duration bonds. Today, the difference is just 64 basis points. Applied to the State Street glidepath, our forecasts project that a 90/10 starting portfolio is expected to deliver the same return as a simple portfolio of 99% global equities and 1% aggregate bonds with roughly 94% of the risk.

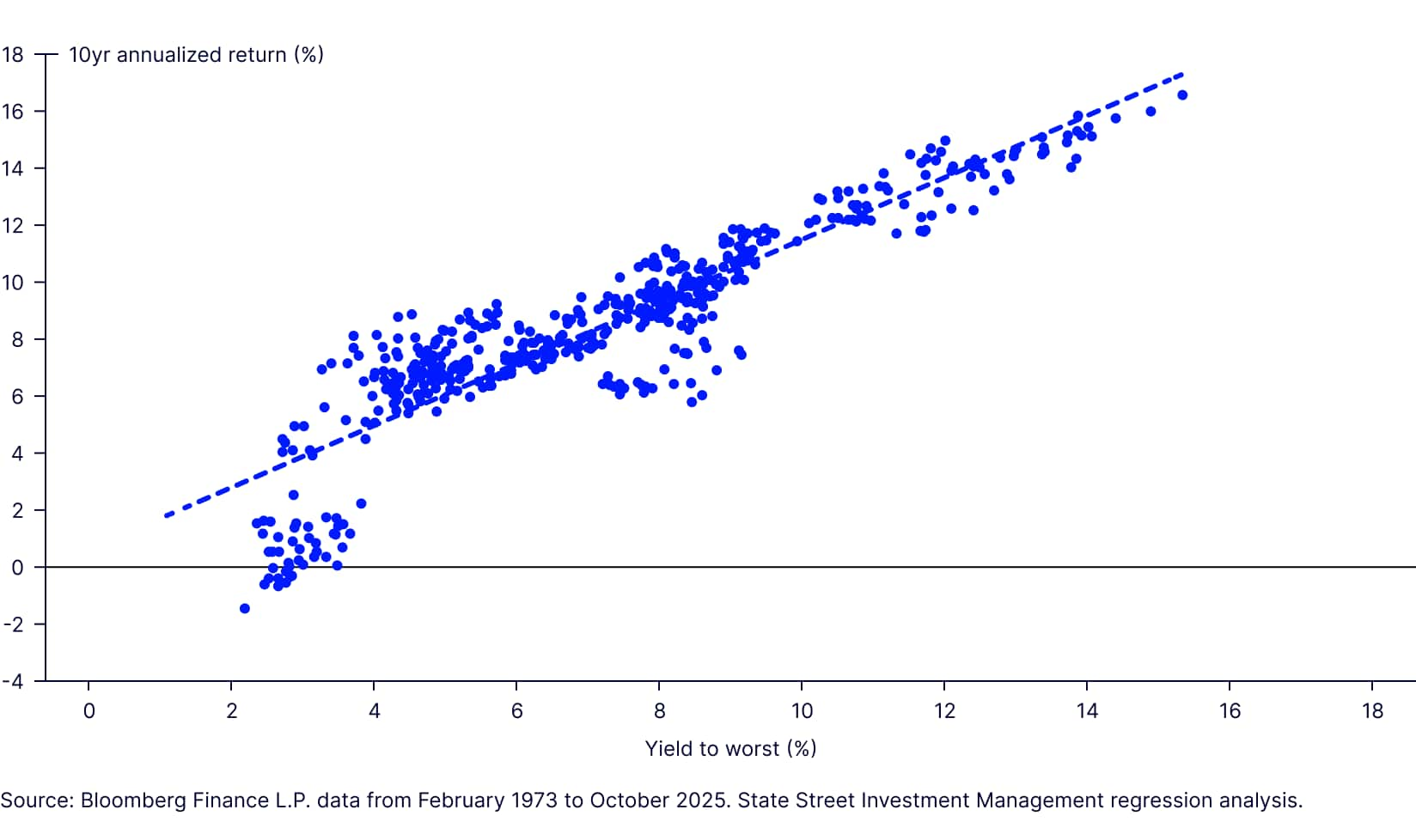

Focusing on the drivers of fixed income return, there is a strong and intuitive relationship between current yield and the subsequent return in U.S. Government debt. Today’s yield levels point to a strong likelihood of solid gains over a medium-to-long-term horizon. The scatter plot presents the historic relationship since the 1970’s - it’s clear that higher yields are predominantly associated with higher long-term returns and vice versa.

Figure 2: Current Yields support Long-Term Returns

US Long Gov't Annualized Return (10yr) vs. Yield

The return of the term premium makes another compelling point in long bonds’ favor. Today,2 the term premium—as measured by the difference between 2 and 30 year yields—sits above 110 bps, closer to long-term historical averages and a far cry from what was observed during much of the most recent hiking cycle. Our return forecast for long duration government bonds exceeds that of intermediate government bonds by 180 bps at a time when credit spreads are also at their lowest point in two decades.3 The other notable point is the change in duration of the benchmark. The general upward move in yields has allowed index duration to fall back meaningfully in the last few years - from a record high of almost 18 years in 2020 to just over 14.5 years as of November 2025.4 Shorter duration and higher yields translate into a much-improved breakeven setup for the asset class on a standalone basis.

Focusing on Diversification

While the return outlook is compelling, we don’t hold long duration bonds in isolation. For investors with a long-term horizon, the trade-off between growth and risk mitigation warrants careful consideration. Unlike tactical decisions driven by near-term rate expectations, a strategic allocation reflects a belief in enduring benefits of diversification and risk control across market cycles.

Strong equity returns—driven by a narrow group of stocks—have masked the need for diversification over much of the past five years, yet risks remain. As U.S. Large Cap equities have dramatically outperformed other asset classes, this has led to an increasingly concentrated equity market with 40% of the S&P 500 represented by just ten companies. The U.S. makes up a near-record 64% of global market cap, and Large Cap stocks make up 87% of the US Equity market compared to a longer-term historical average of closer to 80%. This period of dominance has shown signs of thawing over the last year as International Equities have outperformed U.S. and fixed income has provided solidly positive returns, reminding investors of the value of diversification over longer time horizons.

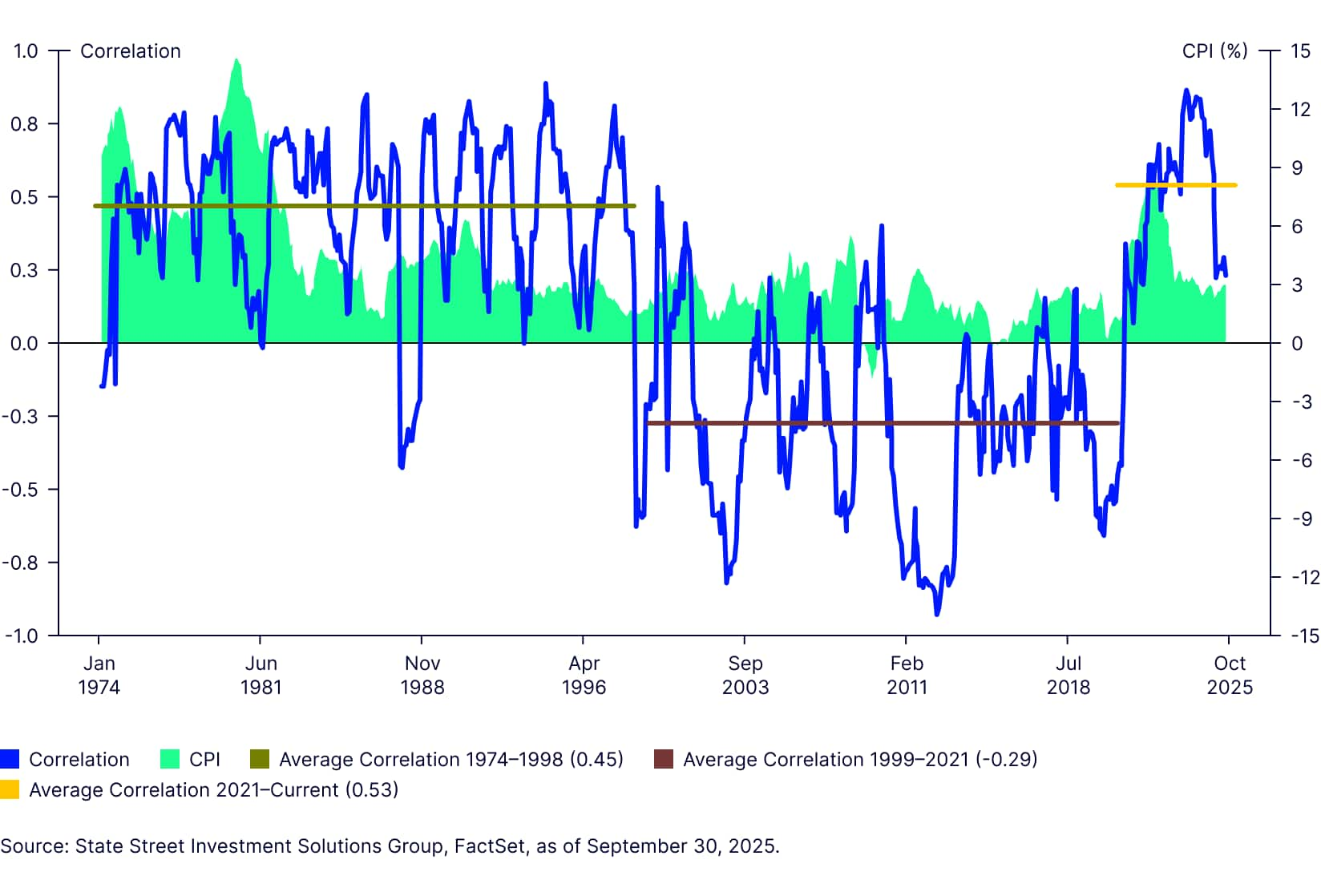

Over this period the intersection of higher rates, stickier inflation and an uncertain monetary and fiscal policy backdrop has contributed to a rise in the correlation between long duration treasuries and U.S. Equities. While the persistently negative correlations for much of the last 20+ years may be unlikely to return any time soon, a longer view of history shows that the correlation between stocks and bonds has been positive more often than not. What is important is that even in these periods where the baseline correlation was positive, long duration has still been a reliable source of diversification in major selloffs. As shown in the charts below, when market shocks occur – even when these shocks are marked by positive equity-bond correlations – the correlation reverts and long bonds act as a backstop against equity downturns.

Figure 3: Correlations Have Come Down with Inflation

Rolling 12-Month Correlation Between US Equities and Long Gov Bonds

Beyond the correlation benefits, a key differentiator for long government bonds is the expected magnitude of downside protection. Compared to U.S. Aggregate bonds and alternative diversifiers like Commodities, long duration government bonds have provided substantially greater downside protection in periods of equity market stress. Because the allocation to fixed income is modest in the early years of the glidepath (e.g. 10% in the Target Retirement series, and 5% in the Growth Target Retirement series), maximizing the downside protection from the allocation is a key consideration.

Figure 4: Relative Performance in Periods of US Equity Market Distress

Quarterly Equity Loss 10% or More

Notable in the above chart is that Q2 2022 is a clear outlier relative to historical equity market selloffs, as inflation peaked and all diversifying asset classes showed negative returns (coming off of a very strong run from Commodities as inflation rose). In environments like the last five years, marked by elevated inflation and rising rates, stock/bond correlations have been persistently higher than historical averages. This atypical market environment is not reflected in our base case assumptions going forward, but several market factors have introduced heightened risks to our assumptions that have not always been the case historically. We evaluated several of these tail risks, including:

- Monetary Policy: Monetary policy prioritizing growth and employment over inflation could lead to elevated yields.

- Fiscal debt levels: Unsustainably large deficits remain a risk for U.S. Treasuries, especially at longer maturities; investors could demand significantly higher compensation at longer maturities if fiscal matters remain unaddressed.

- Inflation resurgence: Long-Term inflation forecasts remain anchored around the Fed’s 2% target, however the potential for stubborn or resurgent inflation presents a risk to the relative desirability of nominal bonds broadly, and longer duration bonds especially.

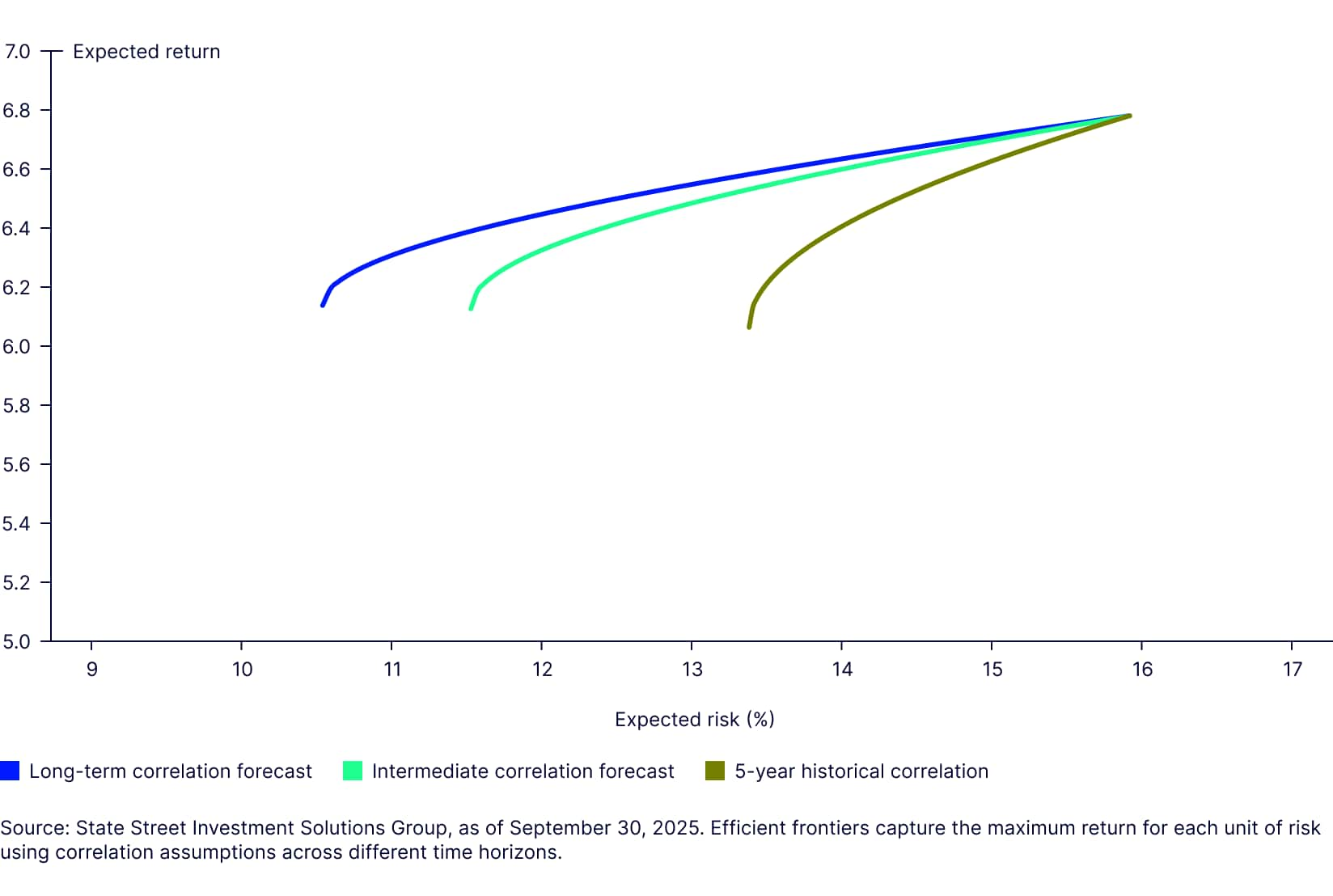

To gain a better view of some of these risks, we stress-tested our portfolio optimization using a range of correlation assumptions: Our long-term assumption, for which expected correlations remain near zero, intermediate term correlation assumptions which are modestly positive, and a less advantageous “outlier” scenario where correlations are strongly positive (i.e. the last five years of rising inflation, rising rates, and rising fiscal debt levels). The allocation to long government bonds was strongly supported in all but the outlier scenario, where, as illustrated in Figure 5, elevated correlations meaningfully detract from portfolio efficiency. In other words, after incorporating forecasts across multiple time horizons, moving away from long bonds (even to a higher equity allocation) is unlikely to be desirable purely from a capital markets and portfolio optimization perspective.

Figure 5: Efficient Frontiers Across Correlation Assumptions

Equity/Long Gov Efficient Frontier Comparison

In the outlier scenario, which represents some of the tail risks to the long end discussed throughout this paper, the case for bonds significantly erodes. We do not believe the next 10+ years will be like the last five, in large part because starting yields are over 300 bps higher today than they were at the beginning of the period. Despite this, we examined potential options to combat this stress scenario. First, we evaluated shorter duration alternatives such as intermediate term treasuries. While interest rate sensitivity is reduced, an allocation to intermediate treasuries led to lower long-term return expectations and similar correlation assumptions with lower expected downside protection. We also explored “diversifying our diversifiers” via alternative asset classes like gold and commodities. While these asset classes hold up better in some scenarios, Commodities have not been as strong of a diversifier in selloffs, and the healthy return expectations for bonds make this tradeoff less compelling during the phase of participants careers where inflation is less of a concern. Gold, similarly, has a strong case a diversifier but the lack of fundamentally driven long-term return expectations make it less of a fit for the wealth accumulation phase. Lastly, we examined reducing the allocation to long bonds and replacing with equities – less efficient using our long or intermediate forecasts, and only compelling in the outlier scenario where bonds do not provide expected diversification benefits, impacting the efficient frontier as highlighted in Figure 5.

While we intend to closely monitor the economic scenarios that could impact the efficacy of Long Government bonds as a diversifier, we believe an allocation amidst even a moderated stock-bond correlation (like what we see today) can meaningfully improve portfolio efficiency. The result of this analysis is a reinforcement of our existing approach, with a keen eye on the risks to our assumptions.

Figure 6 : Allocation to Fixed Income Supported by Long and Intermediate Term Forecasts

| Long-Term Correlation (-0.07) | Intermediate Term Correlation (0.16) | 5-Year Correlation (0.53) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mix | Return | Risk | Efficiency | Return | Risk | Efficiency | Return | Risk | Efficiency | |

| 90% Equity/10% Long Gov | 6.70 | 14.36 | 0.47 | 6.70 | 14.63 | 0.46 | 6.70 | 15.20 | 0.44 | |

| 99% Equity/1% Long Gov | 6.79 | 15.76 | 0.43 | 6.79 | 15.79 | 0.43 | 6.79 | 15.84 | 0.43 | |

| Return/Risk 90/10 vs 99/1 | 98.7% | 91.1% | 98.7% | 92.7% | 98.7% | 99.9% | ||||

*Source: State Street Investment Management Investment Solutions Group as of September 30, 2025. The above table reflects a simple portfolio of global equities and long duration government bonds. Difference in return expectation from State Street’s starting portfolio (e.g. 2070 fund) are driven by sub-asset class over-weights employed in the Target Retirement strategies.

Key Takeaways

While there are no changes to the strategic allocation of the glidepath as a result of this year’s review, there are clear conclusions we can draw from our research that will impact our process going forward. To conclude, we summarize our key takeaways and provide more detail behind each.

- Long Government Bonds pass the desirability test. After examining both forward-looking return expectations and diversification potential, U.S. Long Government Bonds remain our preferred diversifier. We believe long government bonds offer the potential for compelling long-term returns relative to other asset classes considered and should act as a ballast during (most) equity downturns.

- We closely monitor risks to our assumptions. If the relative attractiveness of the allocation, implied by the equity risk & term premiums as well as our outlook for correlations, were to erode, it is likely that the replacement for long government bonds would be a higher allocation to a diversified blend of growth assets versus traditional fixed income. While a strategic lens and transparent change communications remain a critical part of our process, should our base-case outlook substantially weaken, we have a defined framework and sufficient flexibility to evaluate potential changes.

- The need for duration evolves over time. We are not taking a universally pro-duration stance. We are acknowledging that diversification remains a valuable tool and that long government bonds are the most efficient diversifier in equity-heavy portfolios. However, there is a point in participants' careers where the excess interest rate risk that long duration bonds provide outweighs the diversification benefits. As participants age and priorities shift, we remove this allocation entirely, resulting in a substantially lower duration portfolio than many of our peers in retirement where nominal bond allocations are the highest.

Result: No change to the glidepath

Focusing on longer duration U.S. Treasury bonds, often considered a ballast in periods of equity market stress, much of the market volatility in the post-covid market environment has been driven by the bonds themselves. Some of these challenges were foreseeable. As many of State Street’s clients may recall, we made the decision to reduce our allocation to long duration bonds when the return aspect of the equation was most challenged with interest rates near all time lows in 2020, only making the decision to return to a full allocation after rates had risen considerably. Today, our base case assumptions around inflation, correlations and long-term returns suggest that a reduced allocation to long duration government bonds is not appropriate, absent a shift in objective (e.g. increased emphasis on longevity risk) that may support a tradeoff of efficiency for return.

Nonetheless, structural fiscal concerns and evolving cross-asset correlations warrant careful scenario analysis. We reinforce our conviction in the role that fixed income plays for participants seeking efficient wealth accumulation, and continue to value longer-dated Treasuries as part of a resilient portfolio framework, while remaining vigilant and flexible in monitoring these risks should the investment case evolve.