Insights

Target Retirement Annual Review: Fine-Tuning with a Focus on Inflation Protection

Each year, our Defined Contribution Investment Group conducts a comprehensive review of our target retirement strategies, reassessing the capital market expectations and demographic assumptions that underpin the glidepath, while also evaluating new asset classes and investment themes for inclusion in investor portfolios.

The process follows a consistent and transparent three-pronged framework:

- Desirability: Would enacting this change to the glidepath be expected to improve participant outcomes?

- Suitability: Is the investment decision under consideration suitable for all DC investors?

- Investability: Can we implement this investment theme efficiently?

While in past years we have concentrated on a single asset class, this year we will focus on three areas of adjustment. For a full copy of the report, click here

The coming year poses a unique set of changes, as we will merge our 2015 Fund with the Target Retirement Income Fund and open the 2065 Fund for the next generation of retirement savers. Concurrent with these changing vintages, we plan to implement enhancements to the glidepath that balance key risks participants face by fine-tuning our inflation protection allocation and improving return expectations for younger participants.

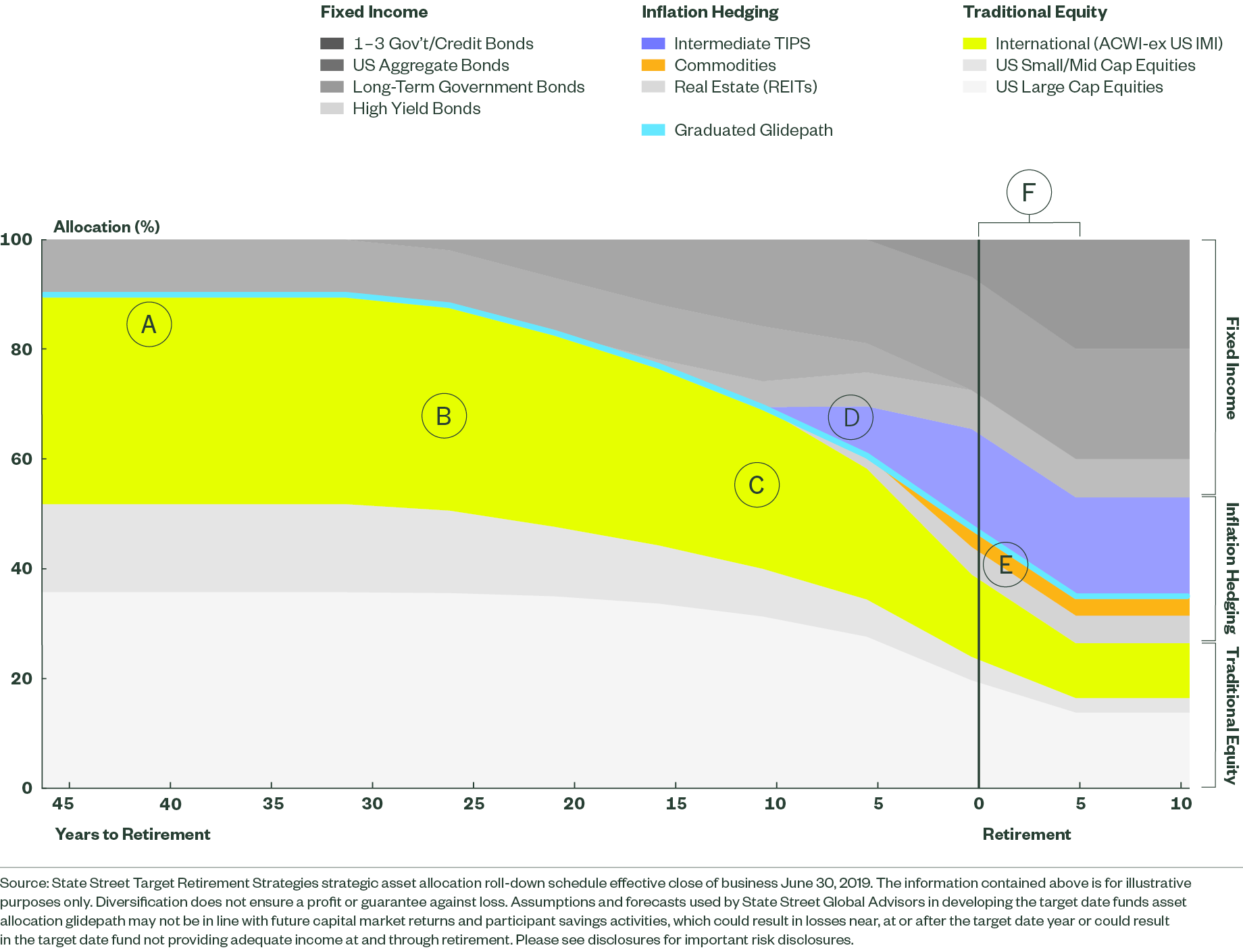

Figure 1: Evolving a Glidepath that Balances Long-Term Returns and Key Risks

A Commodities replaced by equities early in glidepath to improve expected returns

B 42.5% of total equity exposure in International equities due to higher long-term return expectations

C International equity reduced to 40% to manage volatility (unchanged from current glidepath)

D Broad TIPS removed. Intermediate TIPS established at age 55.

E Commodities established at 60 for inflation sensitivity and diversification

F 5 Years After Retirement (Income Strategy)

1. Focus on Wealth Accumulation and Protection Where and When It’s Needed Most

To do this, we will be replacing commodities exposure with additional international equity exposure (MSCI ACWI ex US IMI Index) early in the glidepath and then will re-establish the commodities exposure starting at age 60. The intended benefits of this approach are to:

- Increase global diversification for younger participants (42.5% of total equity) while providing higher expected returns in wealth accumulation years

- Provide more inflation-sensitive asset class exposure through commodities to participants at age 60 to reduce volatility via increased home bias (international equity will make up 40% of the equity allocation for participants entering retirement, unchanged from the current glidepath weight)

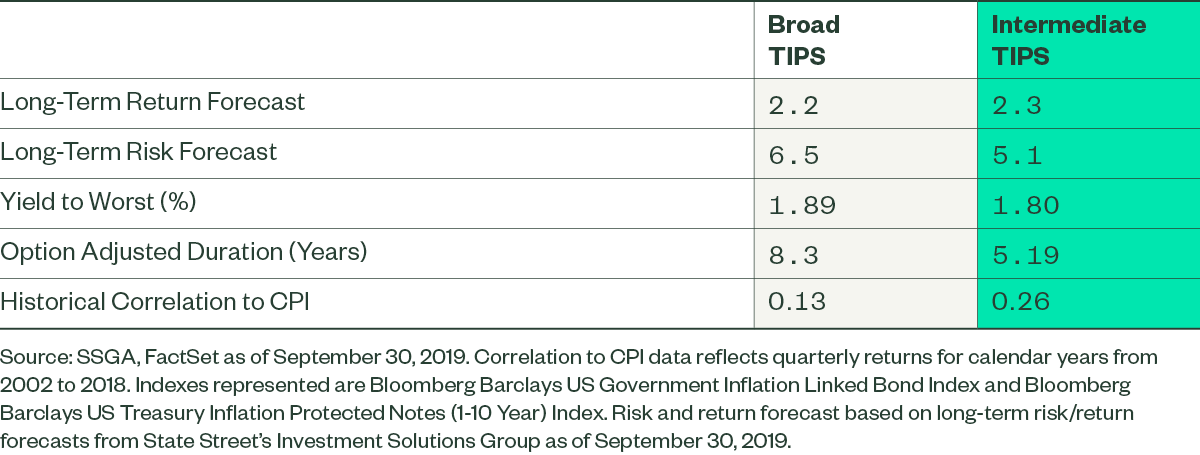

2. Review Portfolio Efficiency, Lower Expected Risk

Here, we look to remove broad-based US TIPS exposure and reallocate to intermediate TIPS, with the intended benefits being to:

- Provide a comparable long-term return expectation and lower expected risk, with the additional benefit of a higher historical correlation to the Consumer Price Index (CPI), an aggregate measure of consumer goods and services commonly used for identifying periods of inflation or deflation

- Reduce interest rate risk

Figure 2: Intermediate TIPS Offer More Efficient Means of Inflation Protection

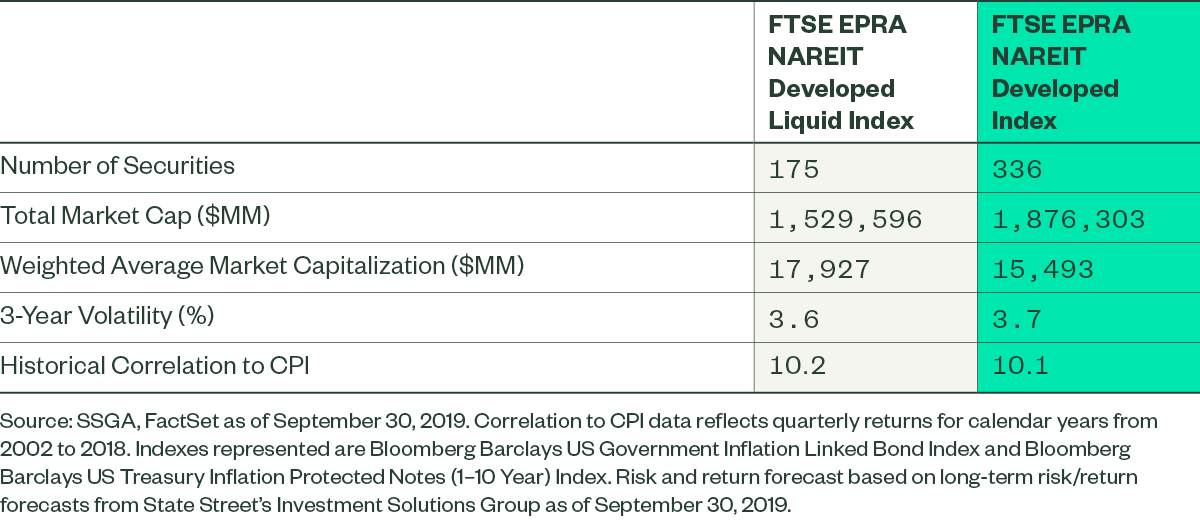

3. Increase Strategic Diversification in Pursuit of Returns

Finally, we plan to replace the FTSE EPRA NAREIT Developed Liquid Index with the FTSE EPRA NAREIT Developed Index with the intention to gain:

- Diversification through broader exposure to the REIT universe, including smaller market cap exposures

- An opportunity for increased returns

Figure 3: Characteristics of REIT Benchmarks

In Closing

In keeping with the opening (2065 Fund) and closing (2015 Fund) of our target retirement vintages, our strategy is designed to evolve in the service of helping participants achieve retirement readiness. Changes do not need to be drastic to be additive, and by virtue of the broad building blocks at our disposal we are able to tweak the asset class exposures in order to deliver more appropriate risk and return expectations for participants at each stage of the life cycle.