Taking the Long View on Bonds Examining the Role of US Government Bonds in DC

Despite potential for interest rate increases, we continue to believe that a strategic allocation to US government bonds plays a valuable role in the target retirement glidepath — offering essential diversification and capital efficiency.

Whether it’s an around-the-corner errand or a cross-country trek, the first action on any responsible road trip is to put on a seat belt. At State Street Global Advisors, we apply this philosophy to our target retirement strategies, seeking to provide a secure retirement journey for DC plan participants.

Across the target retirement universe, managers follow many different roads to wealth accumulation. Focusing on younger participants, approaches exist that start as high as a 99% allocation to growth assets, foregoing the proverbial seat belt in an effort to maximize return. At State Street, we favor efficiency and diversification for these younger investors by holding a 10% allocation to US government bonds. Long-duration US government bonds, which make up the majority of this allocation, have historically provided significant downside protection during equity market sell-offs due to their negative correlation with equity markets. This has improved efficiency and performance in our portfolio relative to peers.

The bond market had a rocky start to 2022 as pandemic-driven inflation and expectation for higher interest rates continued to put pressure on yields. More broadly, compressed capital market expectations across all major asset classes have prompted investors to review the role of fixed income in strategic asset allocation and raised the question: Is the seat belt still working?

At State Street, we believe the answer is yes, despite the recent undulations. While forward-looking returns for fixed income are challenged by low yields, benefits including diversification, downside protection, and risk reduction are meaningful to DC participants across the savings life cycle.

For younger participants, efficiently balancing risk and return at the onset of their career allows for a more measured approach to reducing risk later in life. For later-stage savers, the structural downside protection from our fixed income allocation allows for higher equity allocations through the later career years without taking on excess risk, thus seeking to address longevity risk and ultimately improving expected outcomes.

Herein we will explore the benefits that bonds deliver: diversification and capital efficiency.

A Unique Source of Diversification

US government bonds have provided meaningful diversification benefits to portfolios in recent decades due to their negative correlation with equity returns. When equity prices have fallen, bond prices have typically risen, partially offsetting the decline in portfolio values. The list of asset classes that have provided this negative correlation is quite short, and the benefit of consistent diversification has been particularly marked for long-duration government bonds. While US investment-grade bonds (i.e., US aggregate and credit indices) have provided a low positive correlation, long government bonds have reliably provided a clear negative correlation.

Figure 1: Asset Class Index Correlations

| Correlation June 2002–March 2022 | S&P500 | US SMID | ACWI ex US IMI |

| US Long Government Bonds | -0.28 | -0.25 | -0.29 |

| US Intermediate Government Bonds | -0.32 | -0.32 | -0.24 |

| US Aggregate Bonds | -0.02 | -0.02 | 0.07 |

| US TIPS | 0.10 | 0.12 | 0.21 |

| US Long Corporate Bonds | 0.28 | 0.30 | 0.37 |

Source: FactSet, State Street Global Advisors. Period June 2002–March 2022. Indices used in calculations: Bloomberg US Aggregate, Bloomberg Long/Intermediate Government Bond Indices, Bloomberg US TIPS Index, Bloomberg US Long Credit Index, MSCI AC World ex USA IMI Index, S&P 500 Index, Russell Small Cap Completeness Index.

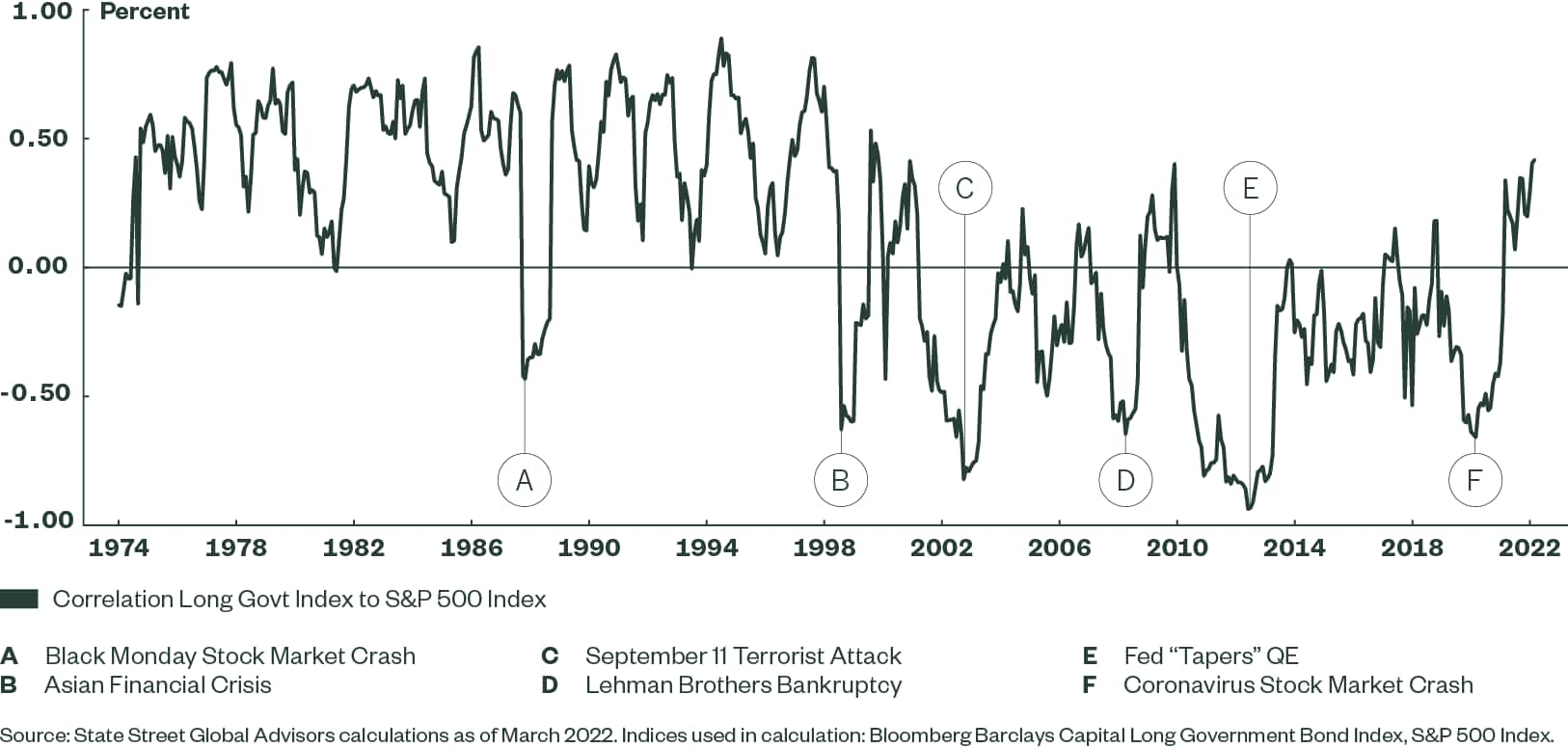

The correlation between stocks and government bonds has not always been negative. Through much of history, correlations were largely positive, most notably during periods of persistently higher inflation. In light of current inflation and interest rate environments, it is possible that the recent strongly negative correlations will be reduced or even reversed. While spikes in inflation can lead to higher correlations, long-term inflation estimates remain contained relative to these historical periods – State Street’s Long-Term Inflation Forecast was 2.3% as of March 31, 2022 – and this does not necessarily suggest a lack of downside protection in periods of heightened volatility. As Figure 2 illustrates, during the most significant equity market sell-offs, correlations have typically turned sharply negative. Despite the common refrain that all correlations approach one during equity market sell-offs, US government bonds have served as a reliable exception.

Figure 2: Historical Correlation Between Equities and Long Government Bonds through Different Market Environments

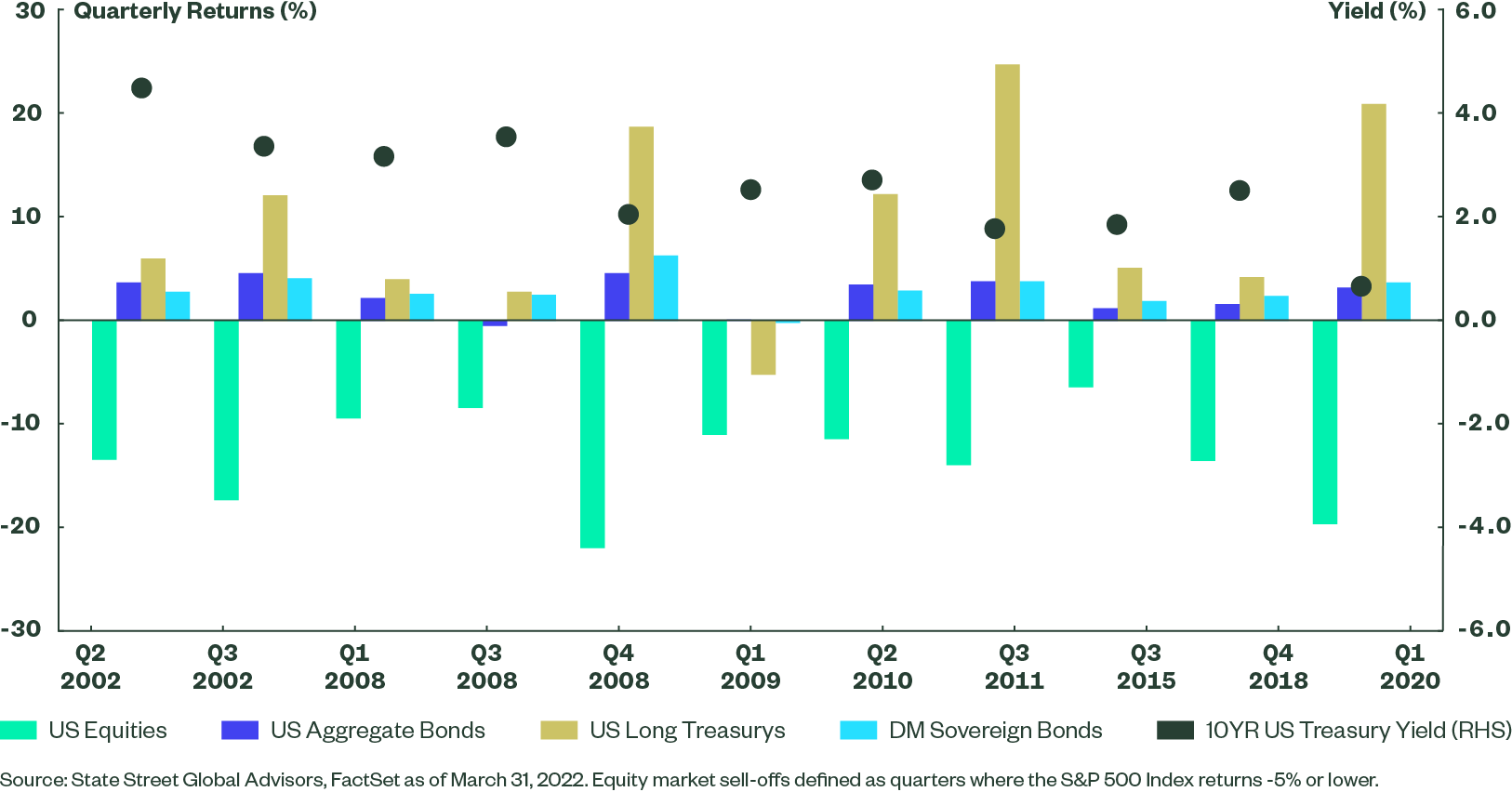

Correlation doesn’t tell the whole story; as even a negative correlation can understate the benefits from a dedicated government bond allocation. Using recent equity market sell-offs as a guide, the magnitude of downside protection from long government bonds has been significantly greater than that of core bonds, developed market sovereigns, and long credit (not pictured in Figure 2). Not long ago, the ongoing diversification benefits from a US government bond allocation were called into question due to historically low starting yields. However, downside protection during equity market selloffs held up as yields trended downwards, most notably in Q1 2020, where long government bonds returned over 20% despite yields approaching all-time lows.

Today, with interest rates well above historical lows and the Fed initiating the tightening process – potentially restoring flexibility to adapt to future market downturns – there is reason to believe that this benefit should persist. Meanwhile, the level of yield that the index provides has improved dramatically, despite potential for further interest rate normalization.

Figure 3: Long Government Bond Diversification Benefits at Different Yield Levels

Focus on Capital Efficiency

An improved yield backdrop for US government bonds highlights the next key benefit from the asset class – the opportunity to build capital-efficient portfolios. Meaningful downside protection at a modest portfolio weight allows us to seek higher returns within the growth portion of the portfolio via sub-asset class overweights. To illustrate, consider how the State Street Target Retirement 2065 Fund holds a strategic overweight to small/mid-cap stocks relative to market cap weighting, which offer higher long-term return expectations than US large-cap equities due to the risk premia associated with small/mid-cap companies. By pairing efficient downside protection with a potentially higher returning growth asset, our longer-dated portfolios offer 96% of the expected return of a portfolio of US equities, with 91% of expected risk — even at today’s low yieldsi.

It is fair to note that the historical diversification benefits from long government bonds have been realized during what has largely been a structural downward trend in interest rates. Bonds have predictably underperformed over the past year as interest rates have begun to rise, prompting investors to question the long-term case for the asset class. If the upward trajectory in rates continues, this will indeed have a short-term negative impact on long bond investors, but it is important to consider this in the context of the broader portfolio as well as participant time horizons.

First, where is the risk of rising interest rates most likely to adversely impact participant outcomes? We suggest that for those participants with long time horizons and high allocations to equities, rising interest rates are not all bad news. Total returns from long government bonds consist of two components: 1. price return (impacted negatively by rising interest rates) and 2. income return (impacted positively). As yields rise, the price impact is increasingly offset by the higher income return. Further, a target date investor making biweekly contributions benefits from higher yields more quickly than a typical investor as each subsequent contribution is made at a higher yield. Over time, interest rate normalization is healthy for markets, and those with long time horizons and meaningful exposure to equities are comparatively less vulnerable to the shorter-term, negative consequences of rising rates.

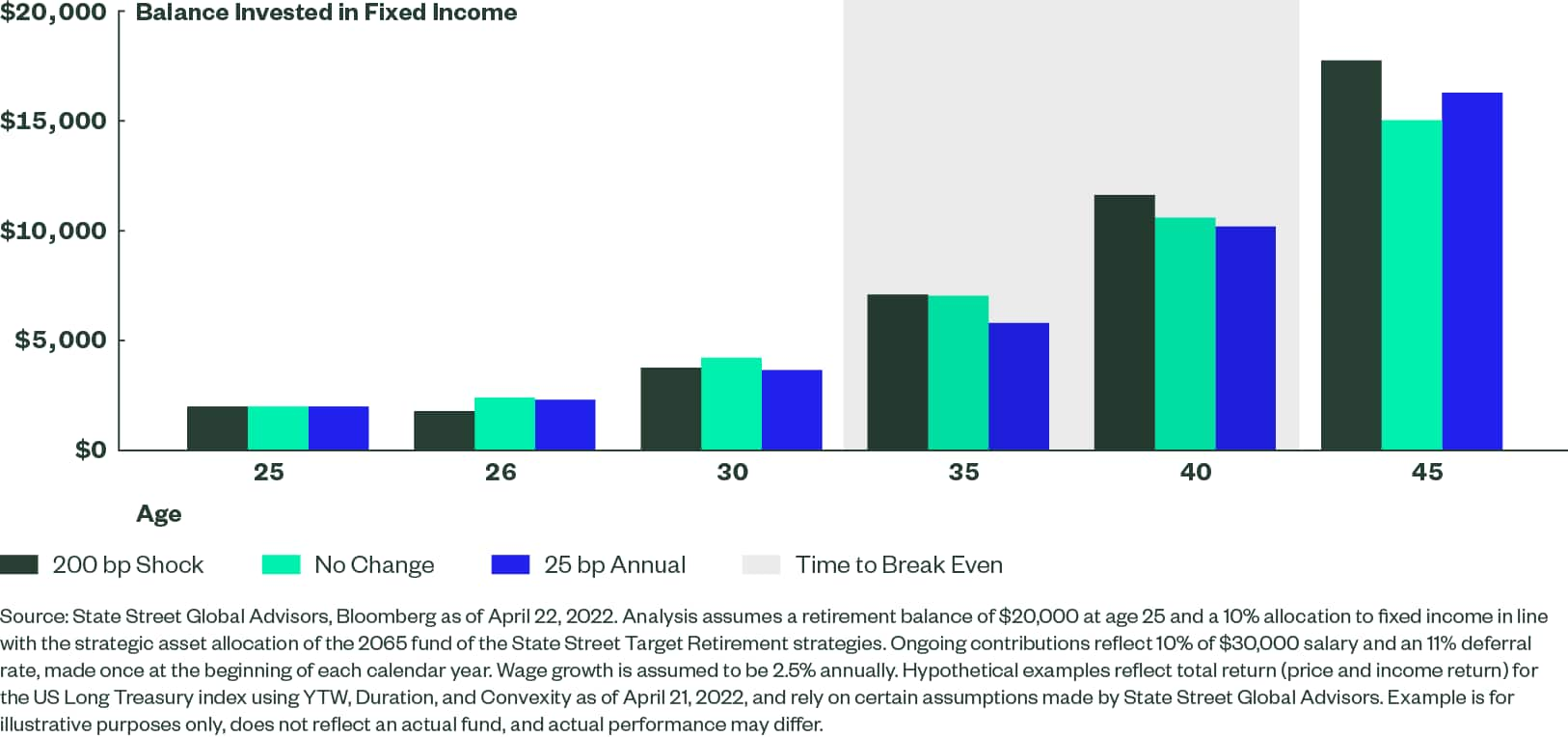

To illustrate, we highlight three scenarios for interest rates, projecting the impact on long-term wealth accumulation for a 25-year-old participant with yields at current levels. While these scenarios are intended to be illustrative, they are meant to roughly represent the magnitude of average interest rate increases during periods of tightening since interest rates peaked in the early 1980s. In the first scenario, there is an immediate 200-basis-point shock assessed across government bonds of all maturities. In the second hypothetical scenario, there is a slower grind to a higher level of yields than the previous scenario, with rates rising 25 basis points annually over a 10-year period prior to stabilizing. In the final scenario, yields remain unchanged and participants receive the income return from the fixed income allocation. Using reasonable assumptions around salary, starting balance, and wage growth, the initial shock to interest rates unsurprisingly has the greatest impact on the balance of the fixed income portfolio, with the investor’s bond portfolio down roughly 23% in that first year after accounting for income. However, reinvesting over time at higher yields quickly offsets this impact, and the higher interest rate scenario produces higher returns by year 10, with further relative benefits in the following years.

Figure 4: Initial Price Impact of Rising Rates Is Offset by Income Over Time

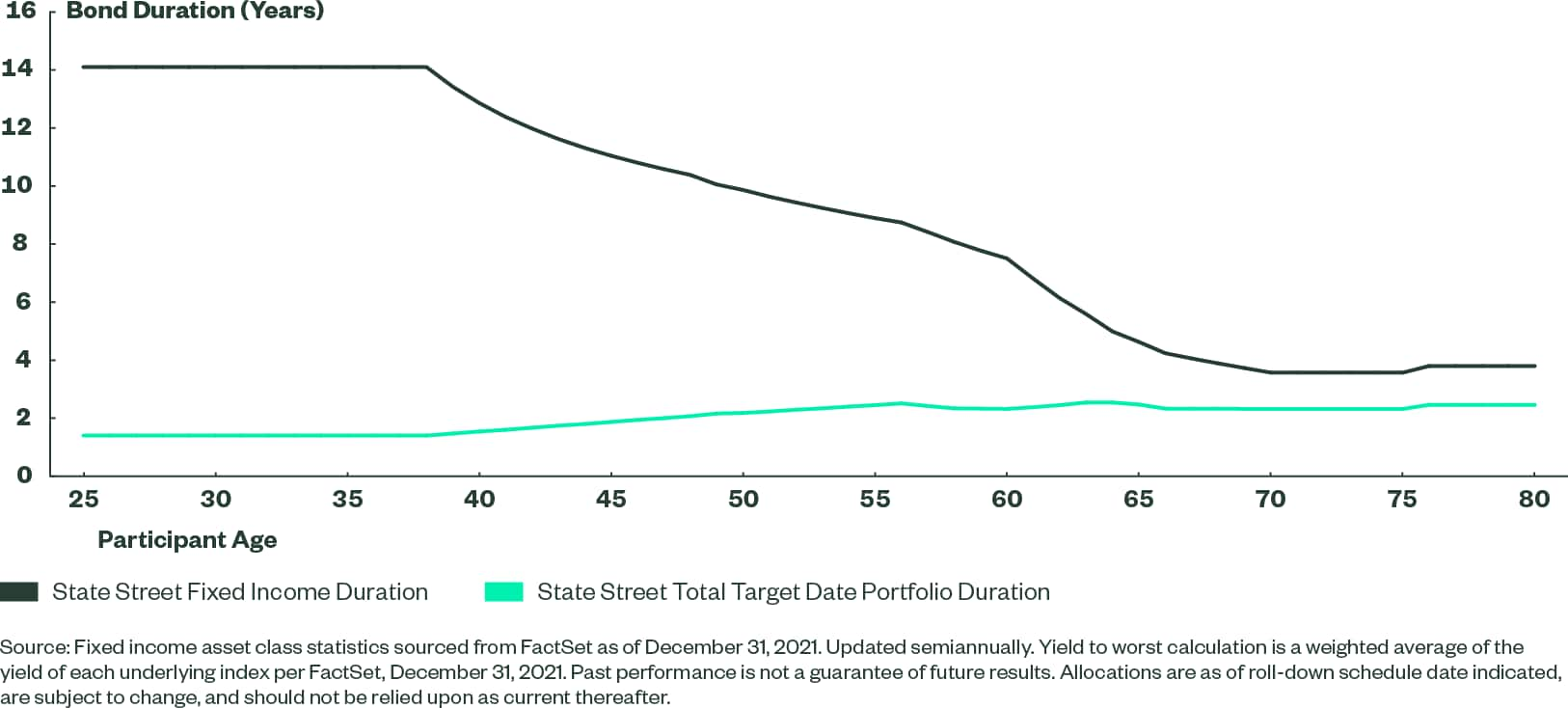

While higher rates can be advantageous for those with longer time horizons, the above illustration also highlights the elevated risk of rising interest rates for those approaching and entering retirement. These participants have much higher allocations to nominal bonds — and shorter time horizons — making them increasingly vulnerable to market and inflation risks. Elevated duration at a much higher portfolio weight is a potential recipe for larger losses in a rising rate scenario. For this reason, the State Street target retirement strategies do not allocate to long duration government bonds for participants in retirement, choosing to employ a granular approach within the fixed income allocation, significantly reducing duration as participants approach retirement (Figure 5). Holding a shorter-duration position in retirement offers the potential for an efficient trade-off of yield and duration and lower interest rate risk for participants most vulnerable to rising rates — those relying heavily on fixed income in retirement. Pairing shorter duration fixed income exposure with a dedicated allocation to real assets (commodities, REITs and intermediate TIPS) offers the added benefit of higher sensitivity to inflation.

Figure 5: Strategically Reducing Duration as Interest Rate Risk Comes into Focus

In Closing

There are many parallels between choosing the right target retirement strategy for DC participants and choosing a car. For people of all ages, despite varying priorities, safety features consistently rank as one of the most important factors in choosing a vehicle. The goal of these features — seat belts, airbags, blind-spot monitors, and backup cameras — is not to eliminate risk, but rather to mitigate the impact of the worst-case outcomes, ultimately delivering a smoother experience.

Return expectations — while improved from historical lows — are undoubtedly challenged by the current low yield environment, but fixed income exposures are not held in isolation, and an efficient starting point informs our approach to building an appropriate growth allocation for participants in the accumulation phase.

In keeping with our commitment to optimization over the long run, our Defined Contribution Investment Group introduced an allocation to intermediate government bonds to pair with long government bonds as part of our 2021 annual glidepath review. This focused enhancement improved long-term return forecasts while adjusting the duration profile of our fixed income exposure to more closely reflect historical averages. By electing to maintain a dedicated allocation to US government bonds, we continue to prioritize the critical diversification benefits associated with the asset class rather than move further out on the risk spectrum.

Our allocation decisions are based on our long-term forecasts rather than short-term tactical decisions, and this provides an important element of consistency. While more tactical approaches may seek to sidestep the potential for interest rate normalization, we recognize that interest rates do not move in linear fashion, and interest rate volatility takes on considerably different meaning for participants at different stages of their careers. Younger target date investors with longer time horizons who hold modest allocations to fixed income and typically make biweekly contributions are largely insulated from this risk compared with later-career participants. Those with longer time horizons should reap the benefits of higher interest rates, as they are essentially dollar-cost averaging their exposure. There will inevitably be periods of equity market volatility, and US government bonds will continue to provide an important element of diversification, mitigating the potential for large losses.

We believe an allocation to US government bonds, when applied appropriately, will continue to play a valuable role in the glidepath, despite the potential for rates to rise from current levels.