Emerging Markets Beyond China

EM growth should, on average, outpace developed market growth. However, to be successful in EM investing, one must look beyond China. EM economies are diverse, and this offers several opportunities for investors looking to diversify.

Any decision to allocate to emerging market (EM) equities is typically predicated on growth. The size of China’s economy and its rate of growth, which have a significant impact on EM returns, also weigh on such decisions. Figure 1 illustrates the equity market correlation of various EM economies to China against those economies’ export exposure to China. In general, this means, the more export exposure an EM economy has to China, the more correlated is its equity market to the country. For instance, countries such as Taiwan, Korea, Thailand, South Africa, Chile and Peru, which have higher export exposures to China, have higher sensitivity to movements in China’s equity market. However, this also means that India, Indonesia, Russia, Poland, Brazil and Mexico, which have relatively lower export exposures to China, have lower sensitivity to China’s equity market. In other words, this correlation perspective demonstrates that EM economies are not all the same and significant opportunities exist beyond China’s orbit.

We expect EM growth to, on average, outpace developed market growth. However, at the country level, growth is bound to be mixed. There are many EM countries that are falling below their growth potential. To that extent, if the prospects of these countries were to improve, the growth profile of the EM benchmark should broaden. Although, based on political cycles, there are ebbs and flows in the momentum of structural reforms in EM, in many instances, as in the case of Brazil, the direction of such reforms tends to remain positive. Credit metrics of many EM countries have improved along with an improvement in policy transparency and credibility. Such fundamental improvements, in combination with positive demographic trends, such as a rising middle class and higher potential growth, should result in increased investment opportunities in EM economies.

Homi Kharas of the Brookings Institution, in a paper titled “The Unprecedented Expansion of the Global Middle Class”, estimates middle-class growth in emerging economies to be at 6% or more per year, compared with just 0.5%-1.0% for advanced economies. Figure 2, adapted from the paper, shows middle-class consumption in the top-10 countries for 2015 along with consumption estimates for 2020 and 2030 based on purchasing power parity (PPP). In 2015, just four EM countries made the list – China, India, Russia and Brazil. By 2030, as per the estimate, Indonesia and Mexico should make the list, displacing France and Italy, bringing the total number of EM economies in the top-10 list to six. The paper also projects that by 2030, each of Pakistan, Turkey and Egypt would have middle-class markets larger than US$1 trillion in size and that the Philippines’ middle class would spend more than that of Italy’s.

As the EM middle class continues to grow further, the consumption mix will not only change but also expand beyond just spending on staples. Consumer demand should increase for housing, healthcare, financial and insurance products, smartphones, luxury items as well as for services such as e-commerce, food delivery and taxi.

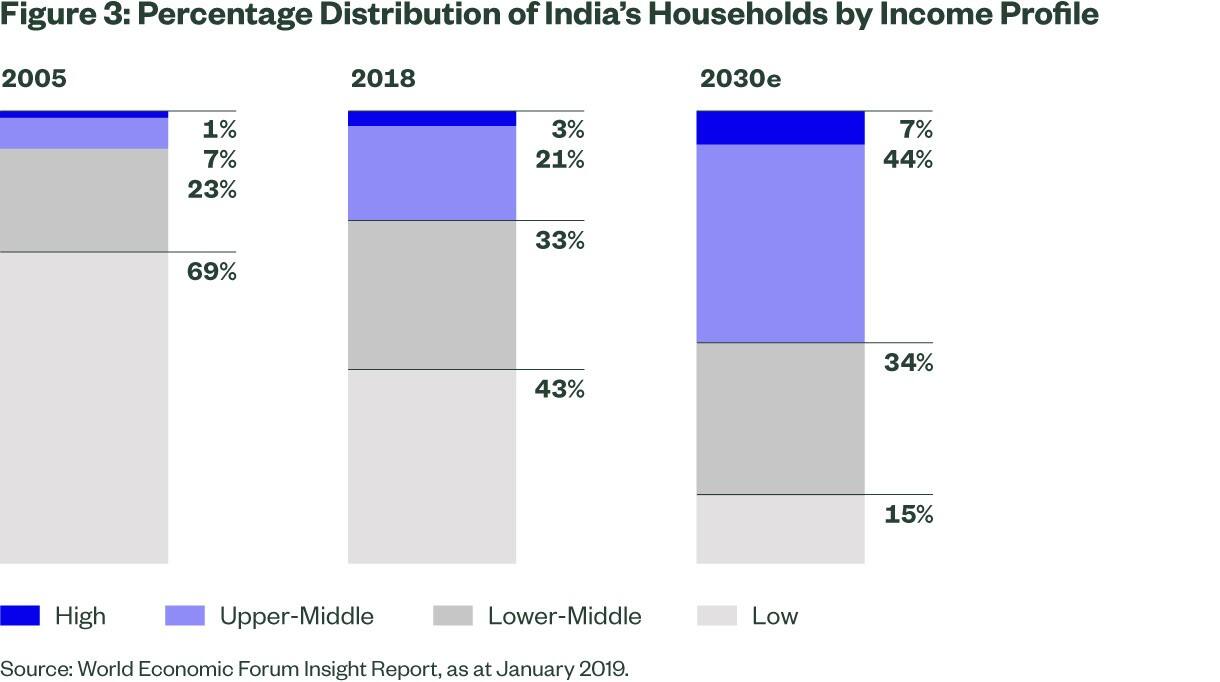

In India, for instance, middle-class consumption is expected to more than double between 2020 and 2030. Figure 3 illustrates the percentage distribution of India’s households by their income profile. By 2030, the country is expected to add about 140 million middle-income and 21 million high-income households. According to a World Economic Forum paper titled “Future of Consumption in Fast-Growth Consumer Markets – India,” upper-middle-income households in India are expected to drive about 47% (valued at US$2.8 trillion) of total consumption by 2030, compared with 30% now. High-income households will only add 14%, or US$0.8 trillion, compared with 7% currently.

In searching for opportunities in EM economies beyond China, one important trend to focus on is the rising size of the middle class and the impact that trend may have on individual and household consumption. Given their large populations, increasing consumption stands out in countries such as India and Indonesia, but other EM countries such as Russia, Brazil and Mexico should also benefit from the rising income trends in their respective economies.

In this context, it is worth mentioning that structural reforms in India, Indonesia, Russia and Brazil are continuing to progress following key elections in those countries over the past couple of years. In Brazil, social security reforms are progressing, with its Senate approving an overhaul of the country’s pension system on 22 October. Social security and tax reforms along with planned privatizations should improve Brazil’s credit profile and enhance efficiencies in both its public and private sectors. Similarly, lower sanctions risk in Russia, combined with the country’s credible macro policy, continued reforms and economic recovery, should pave way for increased exposure to a market that has quality companies with attractive valuations. This exposure offers additional diversification relative to other EM economies and China.

EM economies are facing various near-term challenges including US-China trade tensions and a strong US dollar. However, the long-term growth case for EM remains intact. At a stock-specific level, opportunities will continue to present themselves across the entire EM spectrum. Good stock selection could uncover these opportunities and broaden the sources of robust returns.