Be Ready for Any Market with Liquid ETFs

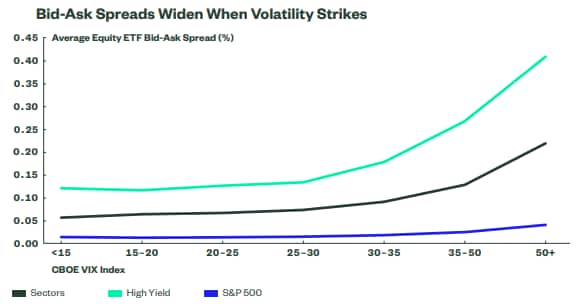

In volatile markets, liquidity is vital. You want to be able to buy and sell securities fast, easily, and at an attractive cost.

That’s why investors turn to SPDR® ETFs — especially when the VIX trends above its long-term average.

Explore Past Periods of Volatility

Learn about the most historic bouts of turbulence over the past 16 years. And see how SPDR® ETF trading volumes jump as the VIX spikes.1

- SPDR ETF Secondary Trading Volume ($ Billions) 10-Day Average

- VIX Index 10-Day Average Level

Source: Bloomberg L.P., as of March 31, 2023. Past performance is not a reliable indicator of future performance. Volatile periods noted are evidenced by the spike in VIX as well as memorable moments of macro events.

Is Your Portfolio Liquid Enough?

Discover how to review your portfolio’s liquidity profile — and how ETF creation and redemption enhances liquidity.

Get The Liquidity Playbook: Trading ETFs in Volatile Markets

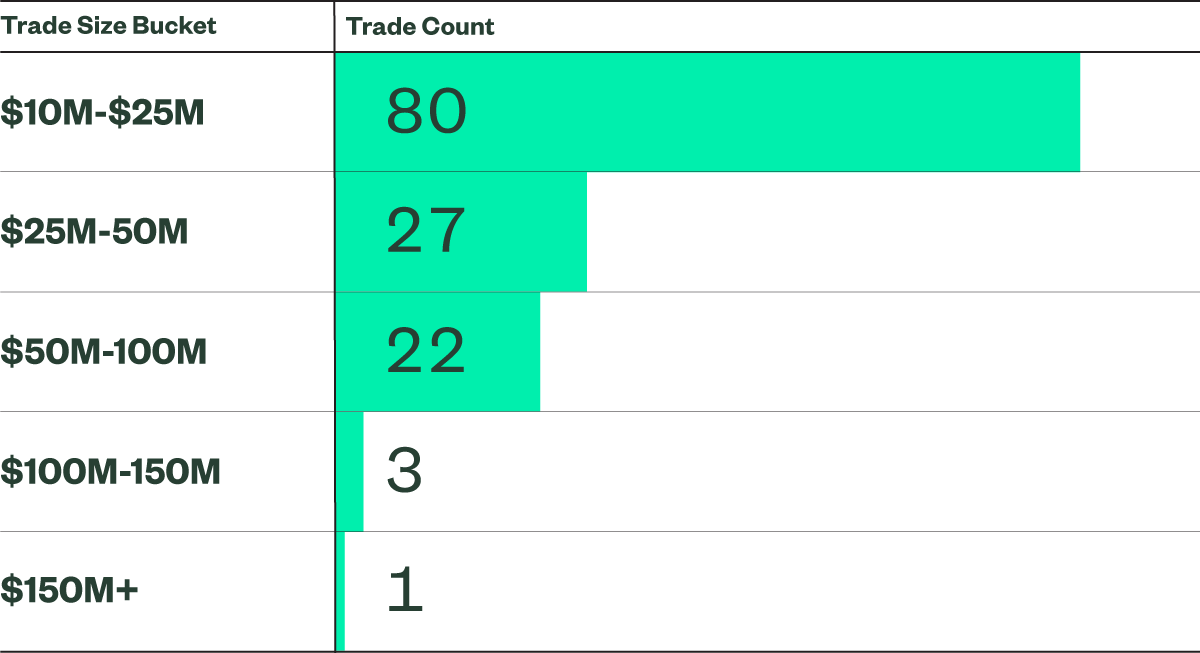

When deciding how to execute a trade, there can be a lot to consider: trade urgency and size, bid-ask spreads, the market environment, and more. That’s where our robust Liquidity Playbook can help. Receive your copy of this free eBook, created by the SPDR SEI team, and gain insight into key considerations for trading ETFs.

Learn Why Investors Choose ETFs

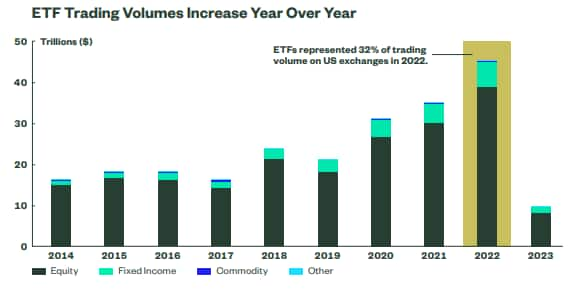

ETFs accounted for 32% of trading volume on US exchanges in 2022.

Discover Best Practices for ETF Execution

Because bid-ask spreads double on average when the VIX crosses 30, liquidity is critical.

Get ETF Pre-Trade Checklists

Identify priorities and potential constraints. Align investment objectives with execution outcomes.

Access Trade Analyses from SPDR

Gain more confidence in your fund and execution strategy choices.

Invest with the Liquidity Leader

SPDR ETFs represented 34.5% of the ETF industry’s annual trading volume ($46.6 trillion) in 2022. That’s $1.2 trillion more than Vanguard and BlackRock combined — making State Street SPDR ETFs the secondary market leader.2

4 Things Investors Can Do in Volatile Markets

When investors may be tempted to make impulsive investment decisions, here are four things they can do instead.

Questions?

We Are Here to Help

Follow Us @StateStreetETFs

Stay Connected with Us