The Gold Standard: Key Trends in the World of Gold Investing

Which generations lean more toward gold investments? And what do investors consider as gold’s key benefits and factors when purchasing? As part of our Gold ETF Impact Study 2023, we uncover significant trends associated with this asset class.

Millennials Lead the Charge in Gold Investments, Especially Gold ETFs

Perhaps most surprisingly, among approximately 1,000 investors surveyed, we found that millennials averaged a 17% allocation to gold, while Baby Boomers and Gen X investors lagged behind with a 10% allocation.

Figure 1: Sentiment and Behaviors Toward Investing in Gold

A Generational Comparison

| Millennials | Gen X | Boomers* | |

|---|---|---|---|

| Average percent of my portfolio invested in gold | 17% | 10% | 10% |

| I agree that it’s easy for investors to buy/sell gold | 82% | 56% | 75% |

| I agree that the overall benefits of gold outweigh lack of yield | 84% | 76% | 65% |

| I agree that gold ETFs are the best way to invest in gold | 69% | 35% | 55% |

| I agree that it’s safer to buy gold ETFs than gold bullion | 64% | 35% | 40% |

| I am likely to increase my investment in gold over the next 6-12 months | 67% | 44% | 60% |

Source: State Street Global Advisors, as of April 19, 2023. *Note that the base size is under 30 for Baby Boomers (n=20).

Millennials also reported a greater appreciation for the convenience of investing in gold through exchange traded funds (ETFs). More Millennial investors (69%) agreed that gold ETFs are the best way to invest in gold compared to Baby Boomer (55%) and Gen X (35%) investors.

And survey participants who hold gold ETFs are more likely to be Millennials.

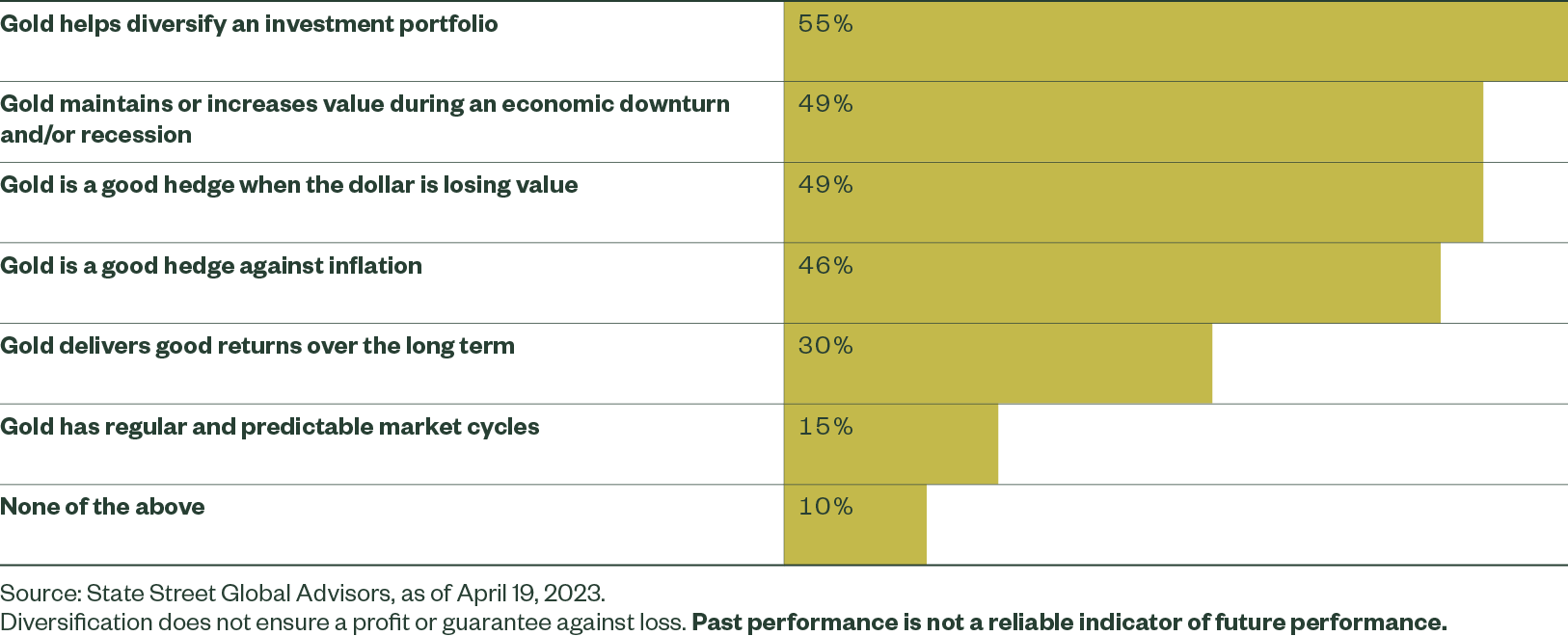

Study Participants Perceive Diversification as Gold’s Key Benefit

When we asked all surveyed investors a series of questions about the benefits of gold, more than half (55%) said diversification is a benefit to having gold in an investment portfolio, and nearly a third (30%) perceive good returns over the long term as a benefit.

Figure 3: The Benefits of Gold, Ranked

Surveying All Investors Who Participated in This Study

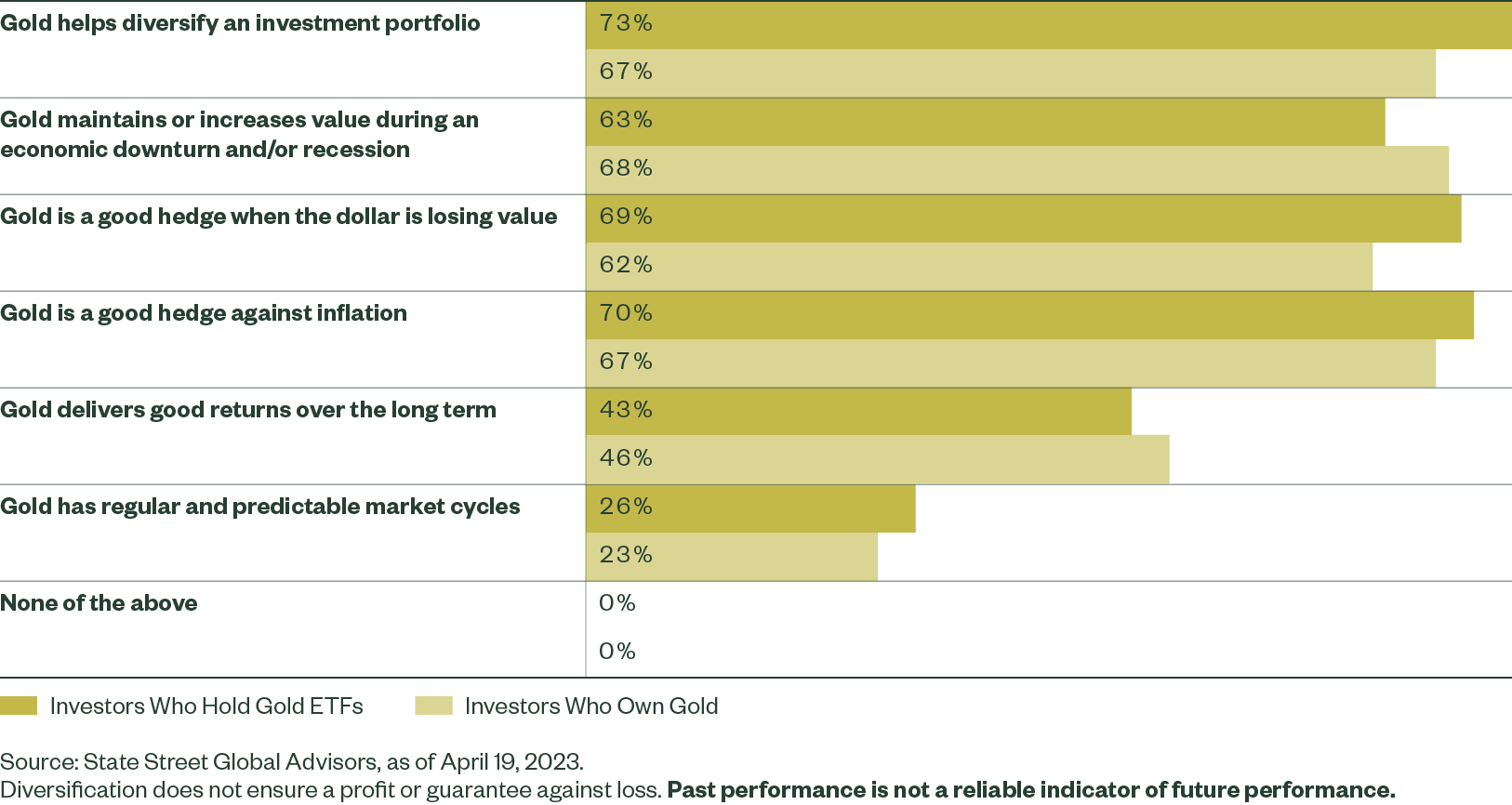

That said, those who invest in gold and/or gold ETFs perceive more benefits to having gold in an investment portfolio than those who do not. More than two-thirds of gold investors said diversification is a benefit to having gold in an investment portfolio, and nearly half perceived good returns over the long term as a benefit.

Figure 4: The Benefits of Gold, Ranked

Surveying Investors Who Hold Gold or Gold ETFs

More robust education efforts on the benefits of gold investments may help investors feel better about the long-term impacts these products can have on their portfolios.

What’s Most Important When Selecting a Gold ETF?

Nearly two-thirds (65%) of surveyed investors rank the cost/expense ratio as the most important factor when selecting a gold ETF. Following the cost/expense ratio, the purchasing considerations viewed as most important are:

- Whether it’s a physically-backed gold ETF (2)

- The company’s reputation (3)

- The five-year returns (4)

Before these factors can be weighed, though, we found that education is essential in the adoption of gold investments. So how can proper education make a difference?

Invest in SPDR Gold ETFs

Work With a Global Leader

When we launched SPDR® Gold Shares (GLD®) in 2004, it was the first US gold-backed ETF. GLD’s arrival made it convenient and cost effective for investors to have gold exposure in their portfolios. Since then, we’ve launched the low-cost SPDR Gold MiniShares® (GLDM®) and built a dedicated gold strategy team to help investors understand how gold can help their portfolio.

About the Study

State Street Global Advisors, in partnership with Prodege and A2Bplanning, conducted an online study surveying a random sample of approximately 1,000 individual investors in the US. Read more about the details.