Evolving the 60/40 Portfolio to Meet Today’s Needs

Has the death of the 60/40 portfolio been greatly exaggerated? While 2022 was one of the worst years on record for the classic allocation mix, yields are now up. And the current higher-for-longer environment is likely to persist, even if the rate-hiking cycle is over. Far from calling for the 60/40’s demise, we still believe mixing stocks and bonds is one of the best ways to bolster risk-adjusted returns.

That said, we think the traditional 60/40 is too simple of an allocation mix and leaves many return-enhancing strategies untapped. State Street Global Advisors has evolved the basic 60/40 portfolio in creative ways aimed at improving risk-adjusted returns and meeting the needs of different types of investors.

With US equities down nearly 20% in 2022, and fixed income shedding 13%,1 some investors and market watchers have said the current environment signals the end of the traditional 60/40 portfolio. But it may be premature to dismiss this still-reliable, albeit imperfect, asset allocation strategy — even amid interest rate volatility, persistent inflation, and a degree of economic uncertainty.

Why the 60/40 Portfolio Should Evolve, Not Disappear

As a thought experiment, imagine a world where you can only invest in two assets: stocks, which allow you to take an ownership stake in economic growth and entrepreneurial ingenuity, and bonds, which render you a creditor to all enterprises.

You’re then given three options:

- Invest everything in stocks, a choice appropriate for aggressive investors;

- Invest everything in bonds, fitting for more conservative investors; or

- Invest 60% in stocks and 40% in bonds.

As investment professionals, how would we respond? Naturally, we’d ask more questions — the same ones that routinely help inform our thinking on the potential effectiveness of the 60/40 portfolio:

- What objective or goal are we targeting for our investments?

- What is our time horizon?

- How much risk are we willing to assume?

- And how exactly are those risks defined?

Others may evaluate a 60/40 portfolio’s efficacy by simply sizing up likely relative returns over various time periods using an assortment of risk metrics or other analytics. But for us, that’s just one piece of a multi-step evaluation process.

What is the 60/40 Portfolio’s Future?

Want to keep this research handy? Download the full PDF and take the report with you.

The 60/40 Portfolio: A Brief History

Since Harry Markowitz developed what would come to be known as Modern Portfolio Theory (MPT) in the early 1950s, mean variance analysis — and its visual representation by way of efficient frontiers — has helped investors to evaluate and build investment portfolios suitable for their risk tolerance. The 60/40 portfolio has been a popular medium-risk allocation mix along that frontier, because the mix offers an attractive risk/return balance for many investors: the ability to pursue strong absolute returns and manage market drawdowns.

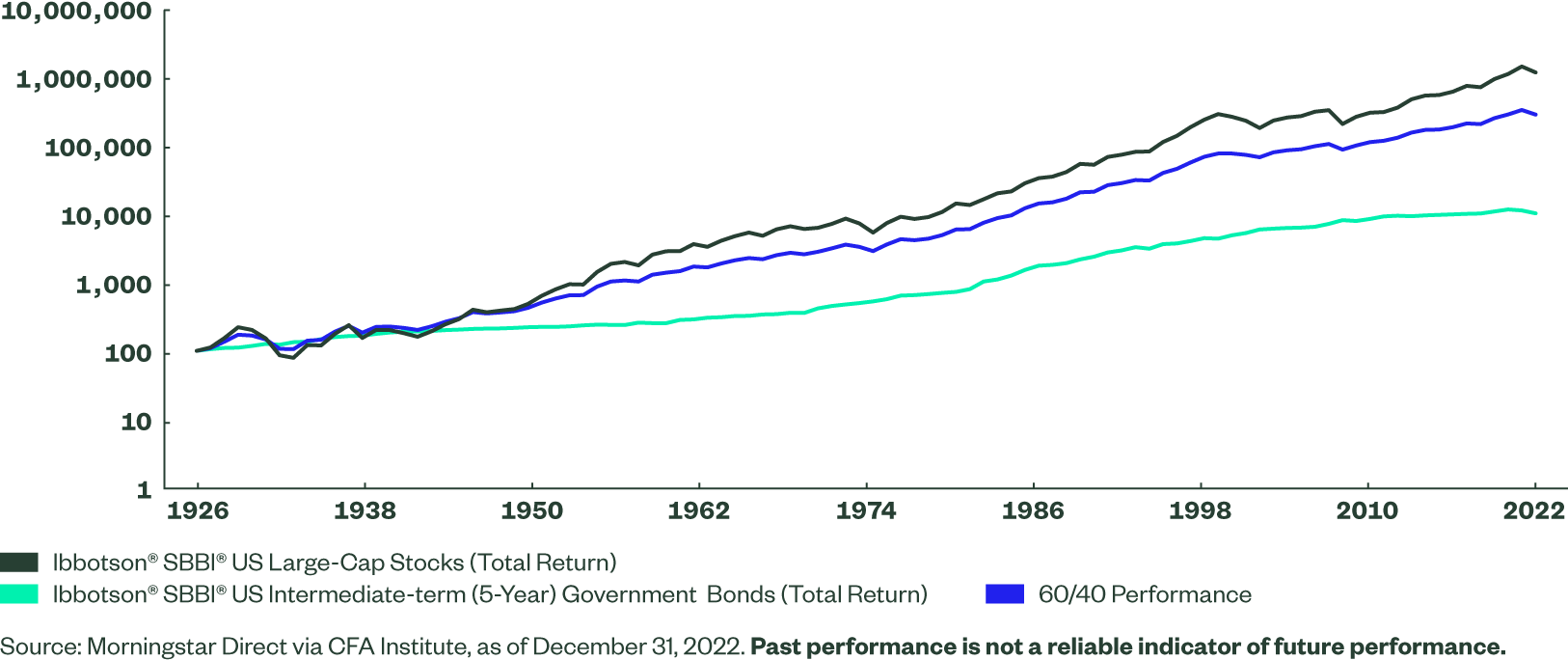

Figure 1: Historical Performance of a 60/40 Portfolio

And, historically, over a long period of time, the performance of a balanced portfolio consisting of 60% equity and 40% bonds has delivered as expected. Though performance is smoothed to some extent by the lengthy time horizon and logarithmic scale in Figure 1, the bond allocation in the 60/40 portfolio helped offset sharp losses during market downturns, while still capturing a solid portion of equity returns during equity bull markets.

But what happens when we take a closer look at the worst drawdowns of the past 50 years?

How the 60/40 Performed During the Worst Drawdowns

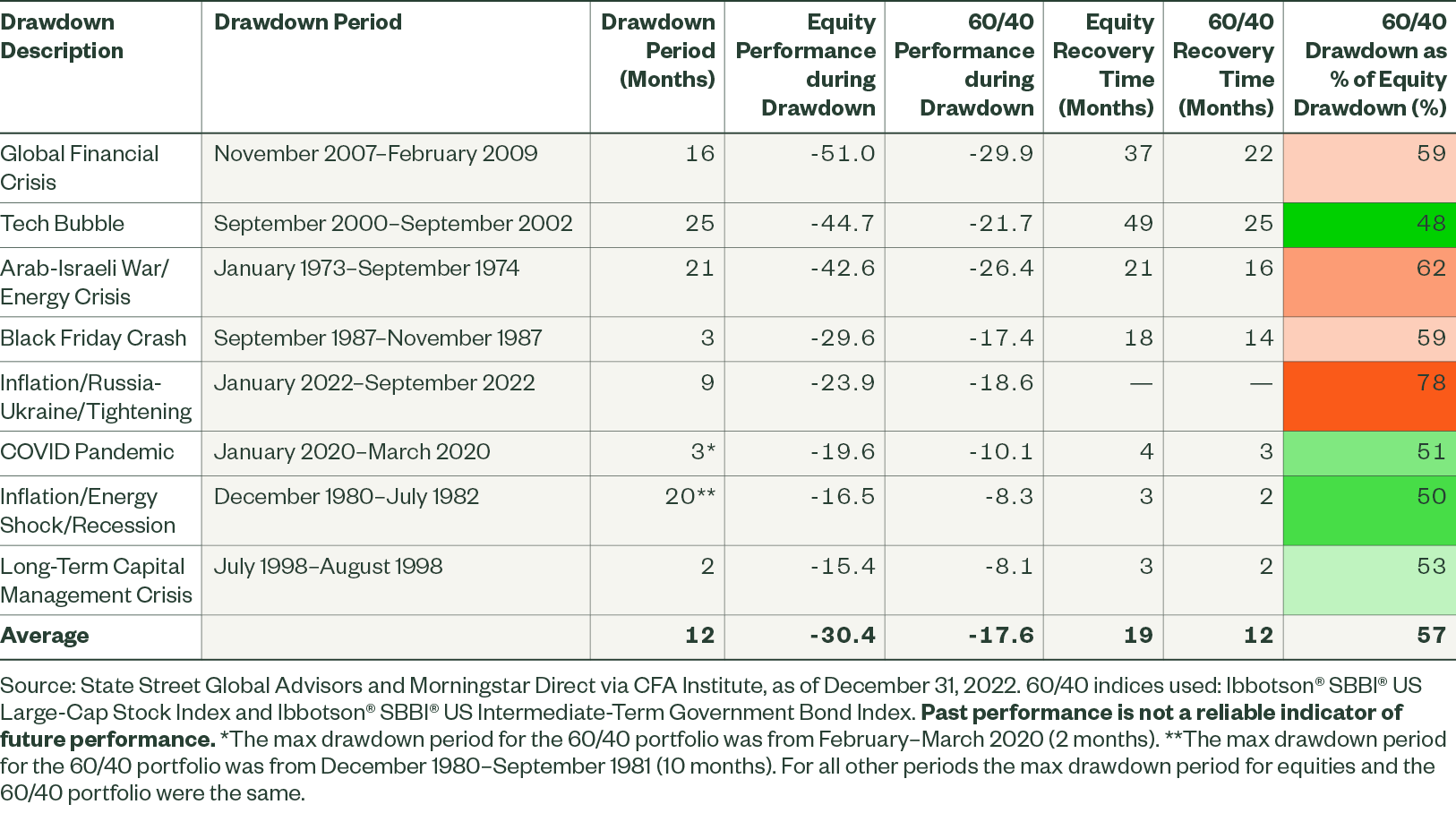

For additional analysis on the relative benefit the 60/40 portfolio has provided, we looked at the worst equity drawdowns from the last 50 years. As you can see in Figure 2, even in those worst-case scenarios, the 60/40 portfolio mix has tended to fall roughly 50% to 60% less than the corresponding equity decline. The 2022 drawdown does stand out as a notable exception, even when we compare it with earlier inflation-afflicted markets.

Figure 2: Comparative Drawdown Analysis

The devastation on both stocks and bonds in 2022 led to a lot of soul-searching when it comes to asset allocation and portfolio construction. The downturn in 60/40 performance occurred amid a vicious circle of high inflation on the one hand and Federal Reserve monetary tightening on the other. Inflation was, in part, propelled by the post-pandemic resurgence of economic activity and excesses fueled by fiscal support. Already high inflation was further exacerbated by an energy crisis and the Russia-Ukraine war.

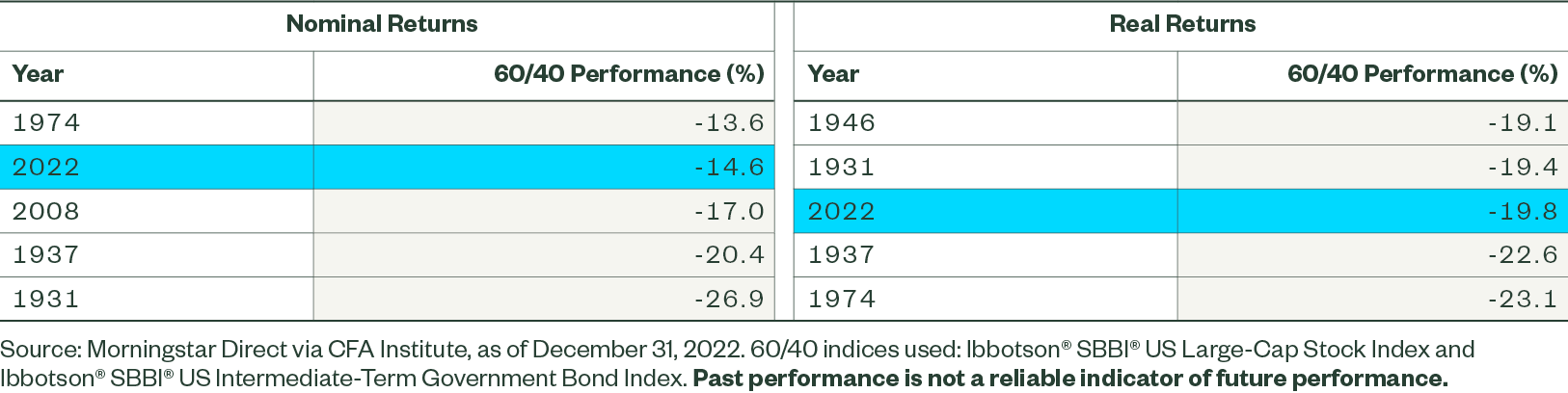

All of these factors came together to make 2022 one of the worst periods on record for the 60/40 portfolio. Only three calendar years have delivered worse results than 2022 in nominal terms, and two were in the 1930s, as shown in Figure 3. In real terms, for the 60/40 portfolio, only two years (1937 and 1974) have delivered weaker inflation-adjusted performance than 2022.

Figure 3: The Worst Calendar Years for the 60/40 Portfolio

Looking at only aggregate performance may obscure another criticism of the 60/40 portfolio: dysfunction in diversification. For example, in 2008, while the 60/40 steeply declined amid a near -40% stock plunge, its bond allocation significantly cushioned that blow. This begs the question of how often stocks and bonds have moved in unison — or perhaps more concerning for investors, how often have they moved downward in unison?

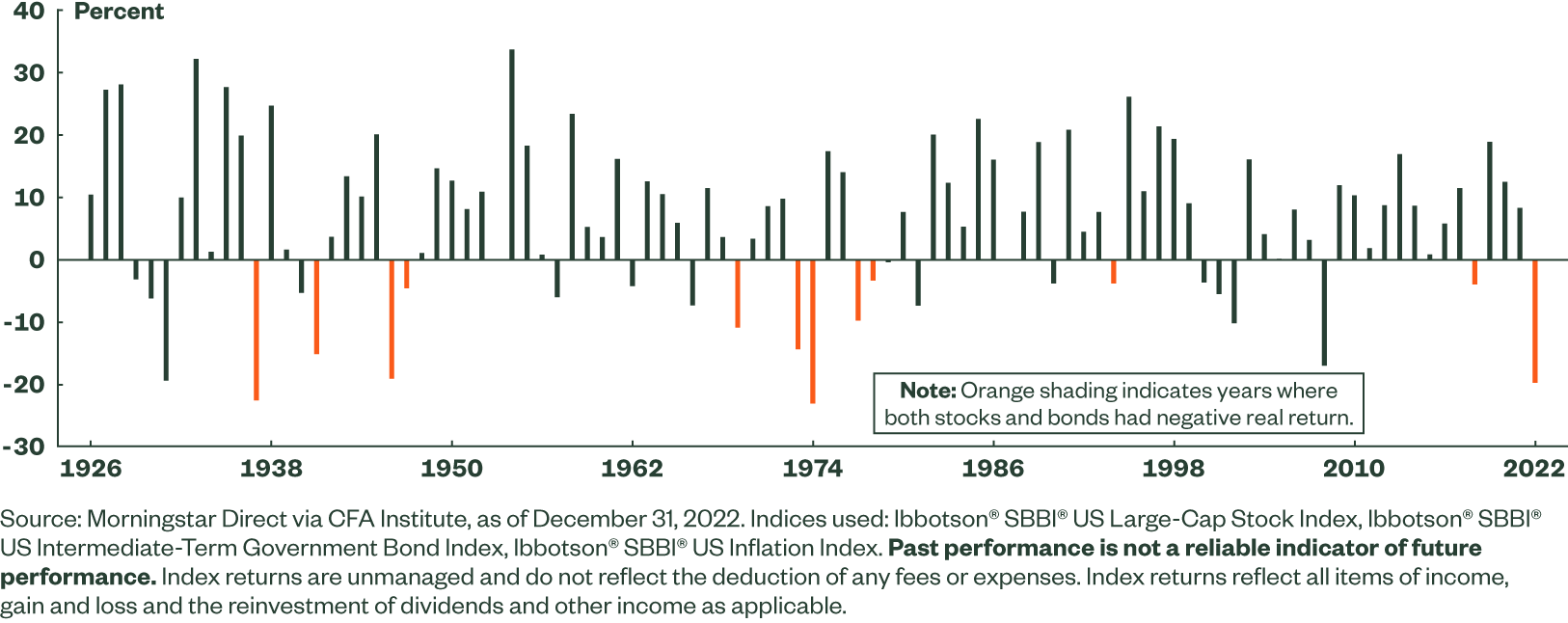

Over the past 97 years, only three years saw both US equities and bonds deliver negative total returns in the same calendar year: 1931, 1969, and 2022. And in 1969, the performance of bonds was barely below zero (-0.7%).2 The somewhat higher hurdle of real returns, which are insightful given current inflationary risks, came in negative during just 12 calendar years over the past century (Figure 4).

Inflation was front and center during those periods when negative real returns persisted. Looking at the years just after World War II, both stocks and bonds had negative real returns as inflation soared due to pent-up demand, supply-chain issues associated with the transition to peacetime, and the lifting of price controls. Key contributors to negative real returns in the 1970s, meanwhile, were lax monetary policy and a series of energy shocks.

Figure 4: Years of Negative Real Returns in Both Stocks and Bonds

Coming back to today’s environment, not only do we believe that periods like 2022 will turn out to be anomalies, but the repricing that occurred in bond markets has significantly lifted our capital market assumptions. As a result, our forward-looking expectations for a 60/40 portfolio are as compelling as they have been in years.3 Additionally, we continue to see signs that ongoing disinflation should help us avoid the same degree of debilitating 1970s-style negative real returns. Does this mean we’ve won the battle against inflation? Not yet. But it doesn’t mean we should abandon the 60/40 portfolio either.

Tailoring the Baseline 60/40 for Different Types of Investors

A simple 60/40 portfolio might allow for easy long-term data analysis over many different market cycles and risk regimes. But that simplicity doesn’t reflect the current asset allocation landscape, where straightforward 60/40 portfolios are relatively rare.

To make the 60/40 concept relevant to the complex investment needs of today’s investors, we believe it needs to evolve. As a result, we’ve tailored the 60/40 to the needs of different investors, including the following types:

- US investors using ETF model portfolios, or diversified portfolios that target specific allocation mixes in order to achieve an anticipated risk/reward balance.

- US defined contribution clients, or those with retirement plans like a 401(k).

- Institutional investors across Europe, the Middle East, and Africa (EMEA).

For each of these investor types, the 60/40 foundation remains firm. How we aim to enhance that foundation is with additional asset class opportunities, risk-based overlays, and portfolio construction innovation.

For US ETF Model Portfolio Investors

Among State Street’s ETF model portfolios, we offer a moderate-risk profile portfolio that tends to correspond with a 60/40, but with some nuanced and important differences.

Commodities We own commodities to help protect against inflation risks and for their diversification properties, which can help to improve overall risk-adjusted returns over time. While we’ve moved away from the traditional 60/40 by holding assets outside of stocks and bonds, we think of commodities as a growth-oriented asset class with great diversification potential. We believe this is especially true for portfolios otherwise dominated by equity risk, and we fund them with assets that otherwise would have been earmarked for stocks.

Active Asset Allocation An active, or tactical, allocation process has been a key differentiator for State Street’s ETF model portfolios since the 1980s. On top of our strong baseline allocation, this disciplined process aims to add value by incorporating signals from long-term, persistent market trends; quantitative models; and our own discretionary insights.

Precision in Asset Allocation Decisions We aim to implement a high degree of specificity in our allocation process. Treasury inflation-protected securities (TIPS) are one example of that. Rather than simply accept broad TIPS index exposure, we use intermediate-duration TIPS. That’s because our research shows they tend to be better correlated to inflation, while reducing some of the interest-rate risk.

Hybrid Assets We also use hybrids in our ETF model portfolios when we believe they can improve outcomes for clients. Hybrid assets include high-yield bonds, bank loans, and emerging market debt, which tend to look attractive for enhancing long-term, risk-adjusted returns.

Open Architecture Beyond these approaches, we also use non-proprietary products in our ETF model portfolios, which allows us to take advantage of the breadth of ETFs available in the marketplace.

For US Defined Contribution Investors

For defined contribution plans like 401(k)s, target retirement strategies have overwhelmingly replaced the concept of risk-based balanced funds. But the concept is still meaningful, even if it’s not the focus or default investment for most investors, as target retirement strategies can be viewed as a dynamic mix of risk-based funds.

Rich Fixed Income Toolkit One way we adjust our approach in target date funds is by expanding our fixed income toolkit well beyond core bonds. We include, for example, long-duration bonds to provide diversification for equities; short-duration bonds to mitigate interest rate sensitivity; TIPS to hedge inflation; and high yield as a source of income and as a hybrid asset. This more granular approach means we can fine-tune our exposures and provide increased diversification, while also targeting different yield and duration profiles along the glidepath.

Preemptive Inflation Hedging 2022 was brutal for portfolios not already properly positioned for inflation and interest-rate risk, but we have always taken these risks into consideration in our target date funds. As clients approach retirement, we strategically build a meaningful allocation of inflation-hedging assets that allow us to pursue an efficient, all-weather approach: intermediate-duration TIPS, global real estate investment trusts (REITs), and broad commodities. This trifecta may better help clients preserve their purchasing power without sacrificing growth potential.

Sizing Up Hybrids for Optimal Usage For these portfolios, we focus on how hybrid assets fit in with our long-term risk-return goals and critical forward-looking market assumptions, and also on how they get bucketed between stocks and bonds. For instance, high yield is categorized as fixed income but is far more highly correlated with equities. And, more broadly, fixed-income-classified hybrids typically don’t offer Treasury-like downside protection. So, to ensure a robust mix, we look to stress test the portfolio via both historical and hypothetical scenarios.

Diligent Customization We look to create approaches that fit the majority of US defined contribution investors. But if the average participant is sufficiently “different,” we don’t shy away from developing custom target-date strategies that marry the best of our current thinking with the investor’s unique needs.

For EMEA Institutional Investors

Finally, for institutional investors across Europe, the Middle East, and Africa (EMEA), we generally use the 60/40 concept as a reference point for capturing the risk-reward balance toward which medium-term investors often gravitate.

In practice, we’re seeing these investors utilize more sophisticated risk-management strategies around their targeted portfolio, whether that’s 60/40, 70/30, or some other construct.

Target Volatility Triggers One dynamic, risk-managed equity strategy that we believe sets us apart with institutional investors in EMEA is Target Volatility Triggers (TVT).4 During market volatility and stress, TVT allows investors to remain within targeted risk bands by reducing equity allocations. Without a risk-management overlay like this, some asset managers may exceed risk bands in volatile periods.

Real Asset Investments and Equity Sector Rotation We offer a deep range of diversifiers, which is relatively rare in the market. For example, it’s not typical to have a full spectrum of infrastructure exposure, but we might suggest an infrastructure building block that offers a good combination of bonds and equities.

Hybrids as Growth Assets We largely view hybrid asset classes — such as convertibles or high-yield bonds — as growth assets for this investor type. Hybrids are highly correlated to other growth assets and tend to suffer during risk-off periods. And while they are generally costlier than traditional asset classes, for this type of investor they serve as a reasonable diversifier in the growth asset space and within the portfolio as a whole.

The 60/40 Portfolio’s Future

“Everything should be made as simple as possible, but not simpler.”

— Albert Einstein

Depending on the investor and their objectives and risk tolerance, we believe the simple 60/40 portfolio may need to evolve in a number of ways, as asset behavior and correlations often can be quite unpredictable. For example, elevated cross-asset correlations can be helped with volatility management techniques. Or if you’re using a risk-based portfolio, consider incorporating some degree of alternative asset class exposure for enhanced diversification — whether those alternatives be commodities and infrastructure, or investment styles such as commodity trading advisors or hedge funds.

In general, we continue to believe that the interest-rate risk embedded in fixed income can, and will, serve to diversify against equity risk. This view and the following principles guide our efforts to manage strategies for different types of investors.

- Diversification across stocks and bonds didn’t work in 2022, but that doesn’t mean it’s a broken concept. We continue to believe that blending stocks and bonds is one of the most effective ways to bolster a portfolio’s risk-adjusted returns. Volatility management can help mitigate simultaneous declines in stocks and bonds.

- Overly simplistic two-asset-class portfolios, or similar constructs, leave important diversification benefits on the table. Investors should embrace assets that can help target risks or opportunities that may not be adequately captured by broad stock or bond exposures.

Incorporating diversified, risk-appropriate funds into a portfolio’s glidepath can assuage investor worries. Even when a risk-based portfolio fits the bill, we’d caution against taking too simplistic a view of diversification. Some degree of exposure to alternatives may still be appropriate: commodities or infrastructure, for example, or differing investment styles like those of commodity-trading advisors or hedge funds. - A 60/40 mix is a useful starting point, but it isn’t the right mix for all investors. Depending on individual risk tolerances and investment objectives, investors should consider:

• Different stock/bond risk profiles.

• An automated “glidepath” portfolio construction technique.

• A risk-based overlay that dynamically adjusts asset class weights.

Like any useful tool, theory, or practice, the original concept may need to be enhanced over time. We believe that means keeping portfolio construction and asset allocation solutions as simple as possible — but no simpler.