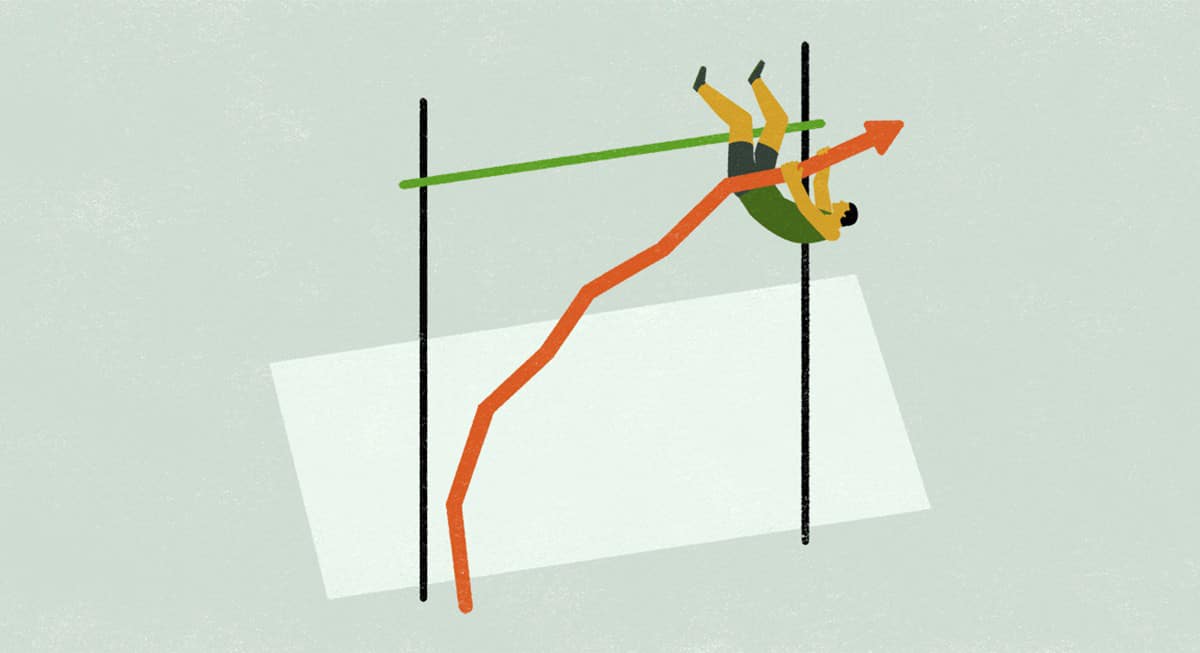

Exponential Growth in the Past Decade

32

62

77

105

2012

2016

2020

March 2025

Source: Morningstar, as of March 31, 2025. Calculations by SPDR Americas Research. Past performance is not a reliable indicator of future performance.

With active ETFs, you can seek potentially higher returns without significantly adding to your overall costs thanks to the liquidity, transparency, and trading flexibility of the ETF wrapper. Could active ETFs boost your portfolio’s performance?

Investing in actively managed ETFs

Explore how the liquidity, transparency, tax efficiency, and trading characteristics of ETFs position them to deliver compelling benefits to investors in active strategies.

Active ETFs are growing at a rapid pace, and have had 60 consecutive months of inflows.1

Exponential Growth in the Past Decade

32

62

77

105

2012

2016

2020

March 2025

Source: Morningstar, as of March 31, 2025. Calculations by SPDR Americas Research. Past performance is not a reliable indicator of future performance.

The sheer size of the fixed income market creates opportunities for active investing.

Actively managed fixed income ETFs

The extraordinary breadth and depth of the fixed income universe creates inefficiencies — and opportunities — for active managers to apply their skills and potentially generate higher returns.

Explore some of our actively managed fixed income ETFs.

SPDR Active ETFs combine State Street’s 30 years of ETF experience with skilled portfolio managers who have specialized active expertise.

Blackstone

Bridgewater Associates

Founded in 1975, Bridgewater is a premier asset management firm with deep expertise in portfolio construction and risk management. Bridgewater develops insights and designs strategies to deliver value through any economic environment.

ETF Managed:

DoubleLine Capital

DoubleLine was founded with the mandate of delivering better risk-adjusted returns. They do this by combining top-down and bottom-up investment processes with a disciplined approach to risk management.

ETFs Managed:

Galaxy Asset Management

Galaxy is one of the world’s largest digital assets and blockchain investment managers, delivering institutional-grade access to the digital assets ecosystem.

ETFs Managed:

Loomis Sayles

Loomis Sayles combines top-down credit cycle views with fundamental research to create a mix of credit-focused asset classes and sectors. They take a tactical approach to asset allocation while also focusing on risk management.

ETF Managed:

Nuveen Asset Management

Municipal bonds may enhance after-tax returns due to their preferential tax treatment. Nuveen has 125 years of experience identifying opportunities and mitigating risks in municipal bond investing.2

ETFs Managed:

State Street Investment Management

By working with experts on our institutional investment teams, we bring institutional strategies to easy-to-access ETFs.

ETFs Managed:

Active ETFs continue to attract strong inflows—and investors are finding new uses for these adaptable funds. Find out more in our latest ETF Impact Report.