ETF Education

Unlock the potential in your portfolio with securities lending

Securities lending is an essential component of capital markets activity, facilitating settlement, injecting liquidity, and fostering confidence for risk taking. A well-managed securities lending program can benefit institutional investors by providing a pathway to earn additional income in a risk-controlled manner.

What is securities lending?

Securities lending is a process whereby a financial institution or fund temporarily lends out its securities to another party (a borrower) in exchange for a fee and collateral. The borrower can then use the borrowed securities for various purposes such as going short a particular risk, hedging, covering pending settlements, creating arbitrage opportunities, or for balance sheet and/or collateral management. The borrower is obligated to return the securities to the lender, usually within a predetermined timeframe.

How does securities lending work?

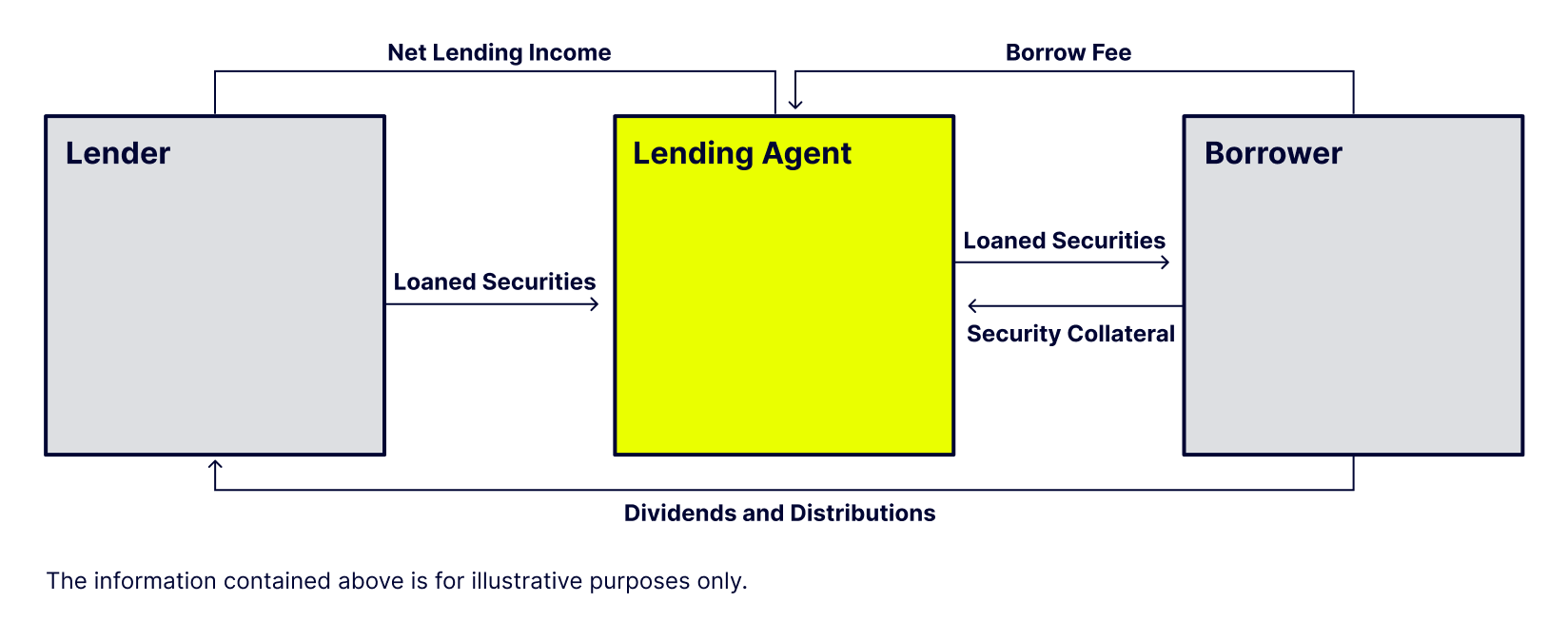

A securities lending transaction involves the temporary transfer of securities from one party (the lender) to another party (the borrower). This process is illustrated in Figure 1.

Borrowers and lenders participate in securities lending programs through their custodian by signing a loan agreement. Frequently, a securities lending agent is employed by the lender to manage the lending program and facilitate transactions. Agency or custodial lending is when the lender’s custodian acts as agent lending their securities, whereas third-party agency lending occurs when the lender has their custodian engage another custodian to act as the agent lending their securities. Lending transactions typically occur under two different loan agreements: open loans, which get repriced nightly and roll forward, and term loans, which are priced for a set duration.

For most transactions, the borrower pays a fee to the lender for borrowing the securities in exchange for collateral, which can come in the form of cash or securities. If cash is transferred as collateral, the borrower may expect interest to be paid on the cash (a rebate). In this case, instead of a borrow fee, the lender will earn the interest differential between what is earned by investing the cash in money markets and the rebate due to the borrower.

The collateral amount is marked to market daily. If collateral levels are insufficient for a particular loan, the borrower is required to provide additional collateral. If the loan is over-collateralized, the lending agent may return some of the collateral to the borrower. Collateralization levels are frequently negotiated between 102–110%. This is often above the contractual minimum and is based on the liquidity, price volatility, and currency of individual instruments. The lending agent will typically retain a portion of the borrow fees (or interest differential) as a fee for their services.

Almost any security can be lent today, including global equities, corporate credit, government securities, and ETFs.

Figure 1: How securities lending works

What are the benefits of securities lending?

Market participants can use securities lending revenue to offset other costs associated with running a portfolio and/or to boost portfolio yield.

Given ETFs’ broad user base and diversified nature, many participants in the lending markets utilize the ETF structure for a “long and lend” strategy. This gives market participants the opportunity to pursue enhanced portfolio yields and potentially earn incremental income while still retaining economic interest in the assets. This is especially true for institutional investors who may be long-term holders of equity and fixed income ETFs.

Long and lend is a huge benefit to institutional investors with long-term holding periods. But those with the tactical flexibility to create to lend when borrow rates increase in periods of market stress can also benefit from a securities lending program. A critical mitigant to a particular ETF product trading at unreasonable premiums/discounts is the fact that new ETF shares can be created to satisfy borrower demand. This mechanism represents a significant tactical trading opportunity to increase income for institutions who can take advantage of it.

State Street Investment Management has 16 ETFs that each have more than $500M of lendable assets available on a daily basis. These ETFs, shown in Figure 2, span a wide range of exposures from broad market equities to leveraged loans.

Figure 2: State Street® SPDR® ETFs with more than $500M of lendable assets available

| Ticker | Fund name | 2025 NAIC designation | S&P rating | VWAF (bps) | Utilization rate (%) |

| Broad equities | |||||

| SPDW | State Street® SPDR® Portfolio Developed World ex-US ETF | 12.35 | 29.62 | ||

| SPY | State Street® SPDR® S&P 500® ETF Trust | 15.91 | 23.64 | ||

| SPYM | State Street® SPDR® Portfolio S&P 500® ETF | 9.16 | 1.46 | ||

| Sectors and industries | |||||

| XBI | State Street® SPDR® S&P® Biotech ETF | 90.64 | 81.53 | ||

| XLC | State Street® Communication Services Select Sector SPDR® ETF | 25.33 | 8.59 | ||

| XLE | State Street® Energy Select Sector SPDR® ETF | 15.14 | 56.07 | ||

| XLF | State Street® Financial Select Sector SPDR® ETF | 14.68 | 9.01 | ||

| XLI | State Street® Industrial Select Sector SPDR® ETF | 10.74 | 39.96 | ||

| XLK | State Street® Technology Select Sector SPDR® ETF | 11.98 | 12.17 | ||

| XLP | State Street® Consumer Staples Select Sector SPDR® ETF | 13.07 | 22.69 | ||

| XLU | State Street® Utilities Select Sector SPDR® ETF | 14.51 | 27.54 | ||

| XLV | State Street® Health Care Select Sector SPDR® ETF | 11.38 | 41.30 | ||

| XLY | State Street® Consumer Discretionary Select Sector SPDR® ETF | 13.44 | 19.62 | ||

| Fixed income | |||||

| JNK | State Street® SPDR® Bloomberg High Yield Bond ETF | Preliminary NAIC 4.B | 'B+f/S4' | 29.93 | 23.01 |

| SPTL | State Street® SPDR® Portfolio Long Term Treasury ETF | 10.56 | 2.11 | ||

| SRLN | State Street® Blackstone Senior Loan ETF | Preliminary NAIC 4.B | 11.39 | 82.99 | |

Source: S&P Global® as of October 1, 2025. The source data is provided by group participants of S&P Global Market Intelligence Securities Finance. The data was from a source believed to be reliable, however, neither State Street Bank and Trust Company nor S&P Global guarantee the accuracy, adequacy or completeness of the information.

What is the potential yield?

When evaluating the potential yield generated from securities lending, we typically look at the volume-weighted average fee (VWAF) and the utilization rate percentage:

- The VWAF represents the average fee (in bps) charged by a lender to a borrower expressed in annualized terms.

- The utilization rate percentage is the shares on loan as a percentage of shares made available for loan

To demonstrate the potential return on shares made available, multiply the VWAF by the utilization rate to determine an estimated historical return from lending assets. Using the data in the table above, it could be possible to earn from a low of 0.13 bps to a high of 73.90 bps of incremental yield on these ETFs.

What are the risks?

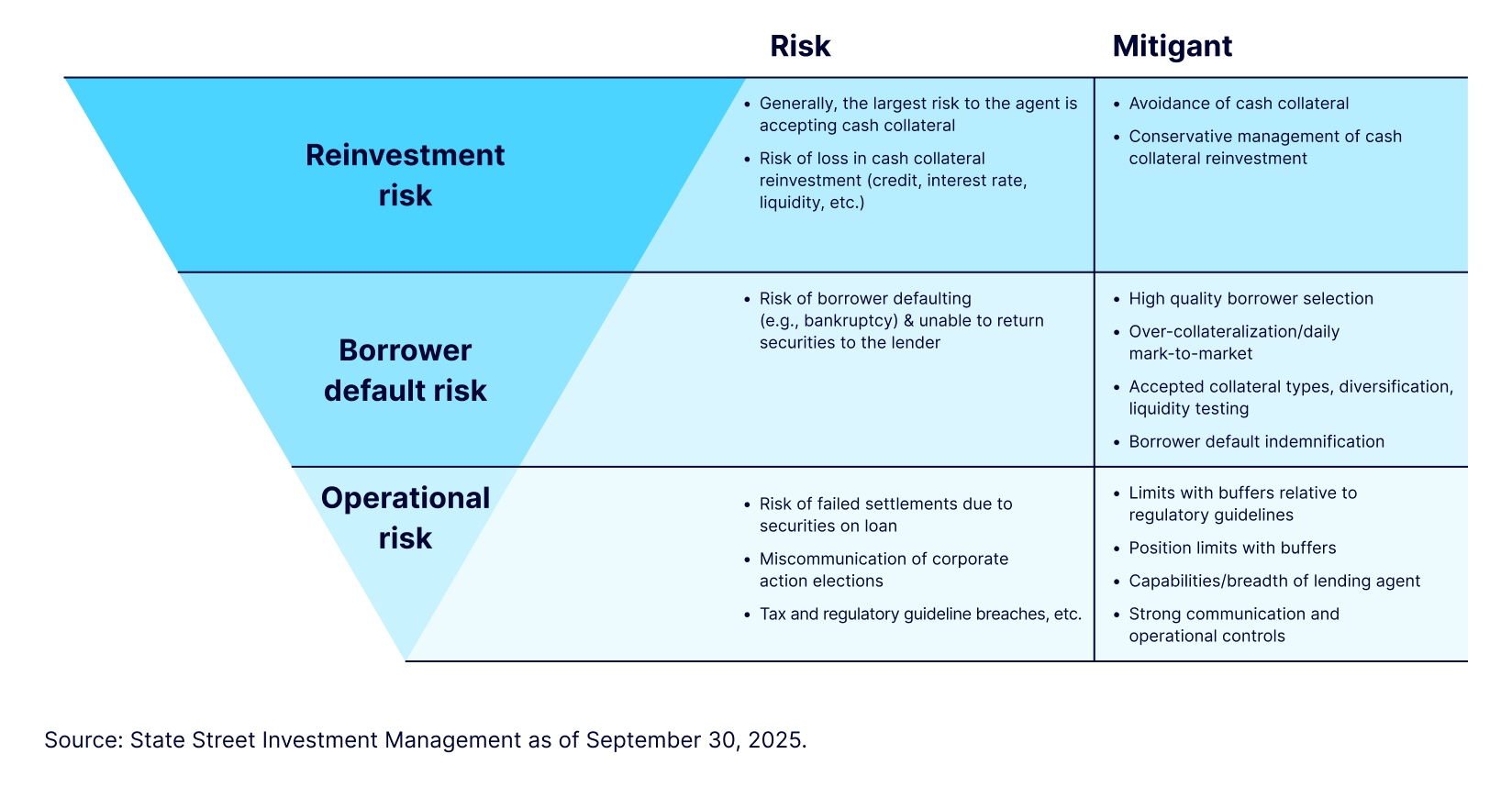

As with all investment activities, there are several risks related to participating in a securities lending program. Figure 3 details some of the key risks and their mitigants.

Figure 3: Key risks and mitigants

Governance is one of the most important risk mitigants for any securities lending program. Borrowers and lenders in any program need to be reviewed and approved. Both quantitative and fundamental approaches should be leveraged as part of the evaluation. Participants are typically subject to a continuous monitoring regime to identify any developments that may impact the creditworthiness of a borrower. At all times, it must be ensured that the collateral posted is sufficient to cover the securities borrowed.

State Street Bank and Trust Company (custodial) agency and third-party lending

State Street Bank and Trust Company (SSBT), the appointed lending agent for all US- and EMEA-domiciled SPDR® ETFs, is one of the world’s largest and most experienced lending agents, providing both custodial and third-party lending services covering more than 30 international markets for equities and fixed income. State Street Investment Management manages the cash collateral in pooled or segregated funds or self-managed. SSBT operates through entities within the State Street group of companies (which are affiliates of State Street Investment Management). SSBT has been providing securities lending services since 1974 and now operates from trading desks based in London, Boston, Hong Kong, Toronto, and Sydney.

This international presence provides local expertise and 24-hour access to the securities lending markets. SSBT offers considerable depth of inventory and market presence, thus enabling SSBT to provide insights into the level of demand for securities. Additionally, SSBT employs a number of safeguards for clients engaged in securities lending, including:

- Indemnifying clients against borrower default;

- Monitoring the daily activity of the borrowers;

- Maintaining liquid collateral with appropriate margin; and

- Ensuring collateral diversification.

This means that SSBT can provide highly customized solutions while attracting high credit quality borrowers.

Partner with State Street Investment Management today

For additional information about securities lending, please contact a member of State Street Investment Management’s Client Coverage Group:

Timothy D. Mullaney, Head of Asset Manager and Hedge Funds

Ashley Wilson, Head of US Asset Owner

Benjamin Woloshin, Head of Insurance