To Strengthen the Pension System, Reform PBGC Premiums

Three recommendations would help keep plans in the system and achieve the PBGC’s mission.

Corporate pension plans have seldom been financially stronger. And yet the overall pension system is faltering as companies rapidly move participants out of their plans through buyouts and annuitization.

The disconnect is partly caused by growth in the premiums that corporate pension sponsors pay to fund the Pension Benefit Guaranty Corporation’s (PBGC’s) Single-Employer Insurance Program. While the insured risk has declined in recent years, PBGC single-employer premiums have jumped, weakening the economics of keeping participants in pension plans.

State Street supports the PBGC’s mission to make sure pension benefits are there for Americans in retirement. Encouraging private-sector companies to continue and maintain defined benefit (DB) pension plans is at the core of that mission. Common-sense reforms to PBGC premiums could help achieve it by removing current disincentives for companies to maintain their pensions—helping to strengthen this key piece of the American retirement system.

For Pensions, It's the Best of Times and the Worst of Times

The PBGC was founded in 1974 amid a crisis in pension plan funding. Times have changed: The Milliman 100 index of top corporate pension plans reached a funding ratio of 105% at the end of 2024, its highest level since before the Great Financial Crisis, following years of increased corporate funding, strong equity-market growth, and, since 2022, relatively high interest rates.1

The PBGC is in surplus as well. The single-employer insurance program had a net position of $54.2 billion at the end of fiscal year 2024, up more than 21% from 2023.2 That surplus is projected to keep growing over the next decade.

The good health of the system’s finances contrasts starkly with the declining state of the overall DB plan system. Defined contribution (DC) plans have largely replaced DB pensions as the cornerstone of Americans’ retirement finances: 67% of private-sector workers had access to a DC plan as of March 2023, compared to just 15% for DB plans.3

Meanwhile, companies have been exiting the pension system in record numbers. The PBGC recently reported that companies removed more than 4.1 million participants from single-employer DB plans between 2015 and 2022 through pension risk transfer, with about half accepting lump-sum offers and the rest participating in group annuity buyouts.4 The trend has picked up steam: Group annuity buyout contracts to settle DB plan obligations rose from $13.6 billion in 20155 to $41.3 billion in 2023.6

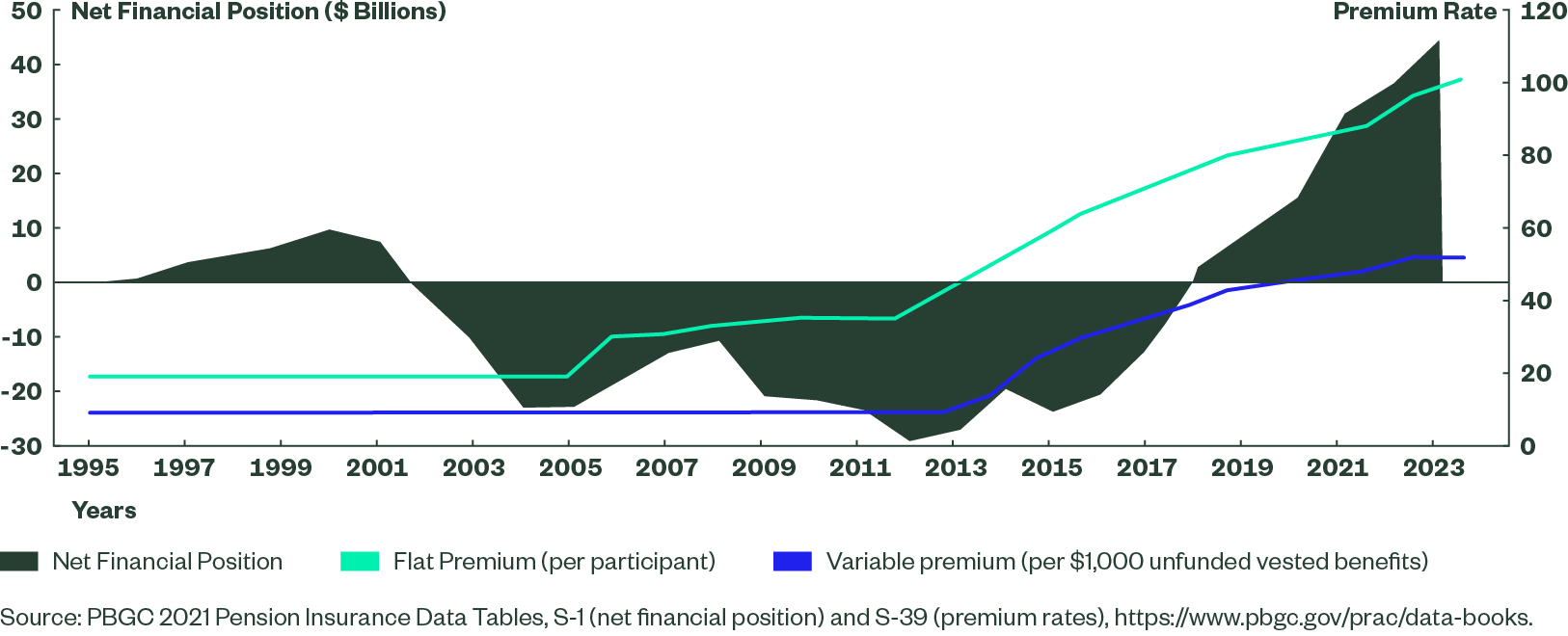

Plan sponsors cite PBGC premiums as a major motivation to exit the system. All companies with pension plans pay a flat premium per participant, while plans with underfunded benefits must also pay a variable premium. Both types of premiums roughly doubled in the last 10 years, even as the PBGC’s net financial position rose from negative to a historic surplus.

The PBGC's Premiums Have Jumped. So Has Its Surplus.

The pension system’s financial strength presents an opportunity. It creates an opening to reform PBGC premiums in ways that would make the economics of staying in the system more palatable to plan sponsors while sustaining the long-term health of the PBGC and its essential insurance programs.

The PBGC’s Advocate for Participants and Plan Sponsors in 2024 sponsored a series of roundtable discussions to explore the best ways to promote, preserve, and protect the private sector single-employer defined benefit system. Participants, included 52 individuals representing a wide range of stakeholders and experts: plan sponsors of various sizes from an array of industries, participant and plan sponsor advocacy organizations, actuarial professionals, consulting firms, academics and research institutions, economists, defined benefit plan service providers, legal professionals, human resources experts, professional investors, and other retirement thought leaders. Over six sessions, participants “overwhelmingly identified premium reform as the single change that would have the greatest impact on the preservation of the single-employer defined benefit system."

Recommendations

The PBGC Roundtable advocates for Congress to establish a new framework for determining PBGC premium rates. It suggests a framework that takes into account the financial state of the PBGC Single-Employer Insurance Program when calculating premiums and comes off budget, so it is not considered in the legislative scoring process — meaning DB system surpluses will not be used to pay for unrelated spending.

State Street supports the PBGC Roundtable’s recommendations, which include:

Ensure that premiums reasonably compensate for the insured risk. PBGC has a statutory mission to keep premiums at a minimum. The new framework should determine minimum viable premiums based on the risk being insured. Dynamic pricing would increase premium costs when risk increases, while decreasing or eliminating premiums when risk declines. For example, reaching thresholds in PBGC-funded status could trigger premium reductions or temporary premium holidays.

Incorporate reasonable anti-volatility measures. In the absence of anti-volatility controls, dynamic pricing could lead to undesirable outcomes. For example, an economic downturn and market decline could simultaneously increase pension risk, decrease plan funding, and undermine corporate balance sheets. Anti-volatility measures could ensure that companies would not face major, unexpected premium increases when they can least afford them.

Maintain a reasonable PBGC surplus to provide financial stability to the system. The PBGC plays a unique and valuable role in America’s retirement system. Any premium reforms must support its ability to meet its obligations and fulfill its mission on an ongoing basis.

“Removing the incentive to reduce head count within pension plans, which is a significant driver of pension risk transfer activities, must factor prominently into any reform of the PBGC insurance structure.”

Conclusion

Defined benefit pension plans were long the heart of retirement in the United States. Their role has become less central in recent decades, but they remain a valuable tool for both participants and plan sponsors.

Current rules governing PBGC premiums effectively tilt the playing field against DB pensions, creating an incentive for companies to leave the system. PBGC premium reform could help level the field. Basing premiums on risk could ensure that pension plans are required to pay no more than necessary to sustain the health of the PBGC insurance system. With this shift, the economics of maintaining a plan would work for more companies, helping shore up the overall pension system — ultimately benefiting participants and helping address the looming retirement crisis.