The rise of the Core-Satellite approach in fixed income portfolio construction

In this paper, we explain the Core-Satellite approach and explore why it is gaining ground among institutional investors.

Fixed income has always been viewed as a solutions asset class, and today, investors are increasingly using more targeted and customized approaches to deliver on their specific investment objectives. Scalable, efficient building block strategies are now the preferred way to construct and deliver these solutions—often in a “Core-Satellite” framework. This allows for customization across exposures from a cost, risk, and return perspective, along with the ability to blend styles including fundamental active, systematic active, and of course, indexing. The Core-Satellite approach is gaining ground for a wide range of reasons, including:

- The growing popularity of employing a building block approach to fixed income exposure management

- Ongoing de-risking by defined benefit (DB) schemes, and

- The increasing role of indexed (or passive) investing in delivering reliable and cost-effective exposures.

The Core-Satellite framework

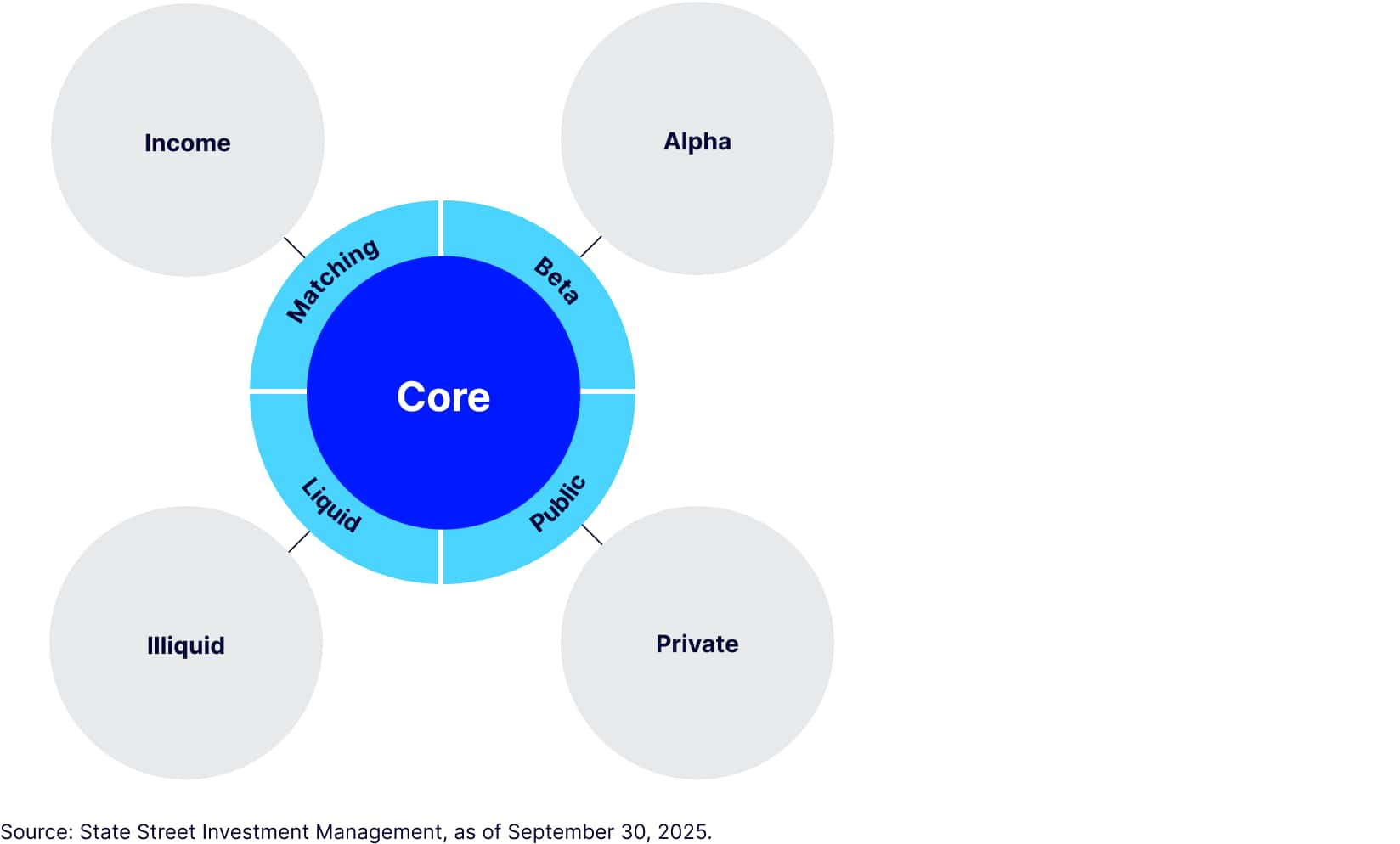

The Core-Satellite approach (Figure 1), as its name suggests, divides a fixed income portfolio into two components:

- Core: Typically a large, liquid, and low-cost foundation that usually comprises indexed building blocks such as index portfolios, funds, or ETFs.

- Satellite: A set of exposures or strategies designed to complement the core through return enhancements, managing specific risks, or exploiting market inefficiencies.

This framework enables investors to maintain broad market exposure very efficiently, while selectively pursuing alpha or yield enhancement through targeted strategies. In fixed income, where liquidity, duration, and credit quality vary widely, this framework offers a flexible, yet transparent and disciplined approach.

To optimize investor outcomes across fee, risk, liquidity, and return dimensions, fixed income exposures can be structured along several key dimensions, outlined in Figure 2.

Figure 1: Investors supplementing with nontraditional strategies allows for a bifurcated, customizable Core- Satellite framework

Figure 2: A wide range of dimensions fit Core/Satellite categories

| CORE | SATELLITE | USE-CASE | Driver |

| Beta | Alpha | Satellite strategies focus on alpha generation through active management, while the core emphasizes beta exposure via index replication. | As markets become more efficient and potential for alpha declines in the most liquid of sectors, investors look to indexing for those core exposures, saving active allocations and fee and risk budgets for sectors where inefficiencies can more easily be exploited. |

| Public | Private | Public markets offer transparency and liquidity, whereas private credit can provide yield enhancement, diversification, and performance smoothing. | The “alpha battleground” is moving from public to private markets as the fixed income landscape becomes more efficient, leading to a rise in the adoption of private credit. |

| Liquid | Illiquid | Core holdings will prioritize liquidity, while satellites offer exposure to less liquid, higher-yielding instruments | Especially amid the rise in popularity of less liquid market sectors, a liquid, indexed exposure is essential for those investors needing to make regular distributions and/or asset allocation rebalances. |

| Match | Grow | Within a liability-driven allocation, investors may use the core to match liabilities through duration and satellites to pursue growth or income | Liability driven investing and glide path management has become more sophisticated over time, with core indexed exposures used to match broader market growth and plan disbursements, while satellite exposures can provide accelerated yield or additional income. |

| Low Cost | High Cost | The core is typically low-cost and indexed, while smaller satellite allocations justify higher fees through specialized expertise and performance potential. | Most core indexed exposures have low expense ratios, delivering broad exposures at a low cost and enabling investors to balance the costs of other higher cost satellites. |

Source: State Street Investment Management, as of August 1, 2025.

Trends driving adoption

Several macroeconomic and institutional trends are accelerating the adoption of the Core-Satellite model in fixed income portfolio construction, particularly among institutional investors:

- Investors shifting to indexed investing: Indexed strategies have gained significant ground in fixed income markets. It is estimated that indexed strategies account for over 20% of global fixed income AUM, up from 10% 2010.1 This shift is driven by growing market efficiency, high transparency and reliability, as well as challenges with alpha consistency in the most liquid sectors of the asset class. As a result, investors are increasingly turning to indexed vehicles for core exposures, reserving active strategies for more specialized or less efficient market segments.

- ETF penetration and portfolio construction: Fixed income ETFs have evolved from niche tools into vital components of modern portfolio management. Globally, fixed income ETF assets have surpassed $2.7 trillion2 and are widely used for liquidity management, tactical allocation, and cost control. While broad Aggregate and Treasury ETFs serve as core holdings, a growing array of thematic, sector-specific, and maturity-targeted ETFs are being used as satellite positions to express tactical views or enhance yield. This flexibility supports the Core-Satellite model, enabling investors to blend stability with precision.

- De-risking by DB plans: The funded status of US corporate defined benefit pension plans has significantly improved, reaching 101.1% among the largest 100 plans and up to 106% for S&P 500 plans, driven by strong equity markets and elevated discount rates. Similarly, in the UK and broader EMEA region, aggregate funding levels have also surged, with UK DB schemes reaching a 123% funding level as of December 2024, and 85% of schemes now in surplus.3 This improvement has been fueled by rising gilt yields, efforts to effectively reduce scheme liabilities, and a shift toward bond-heavy portfolios. As these plans mature and close to new entrants, sponsors are prioritizing risk reduction and liability alignment, leading to increased allocations to long-duration, high-quality fixed income.

Index-based strategies have become central to this de-risking effort, offering transparency, cost efficiency, and precise liability matching. With many plans now in surplus, the focus has shifted from return generation to risk containment, further reinforcing the appeal of indexed fixed income solutions and pension risk transfer strategies like annuity purchases.

Despite the rise of indexed strategies, skilled active managers remain essential—particularly in the satellite portion of a broader portfolio. Their ability to navigate niche credit markets, identify mispricings, and manage downgrade risk adds value beyond what indexed strategies can offer. However, the active fixed income landscape is also rapidly changing. Technological changes, predominantly electronic trading as well as the increased popularity of ETFs, have greatly improved the FI market structure and pricing transparency. These changes are driving liquidity while also simplifying a once-complex marketplace, enabling greater precision and efficiency in fixed income exposure management, as well as paving the way for new approaches such as systematic active portfolio management.

The future of fixed income

The fixed income market is undergoing a structural shift. As indexed adoption increases and technology improves transparency and execution, the core of portfolios can become more granular and cost-efficient. Meanwhile, satellites will continue to evolve, offering innovation and specialization. As market dynamics shift, the Core- Satellite approach will likely become the standard for investors as it effectively optimizes costs, risks, and income within a larger fixed income allocation.

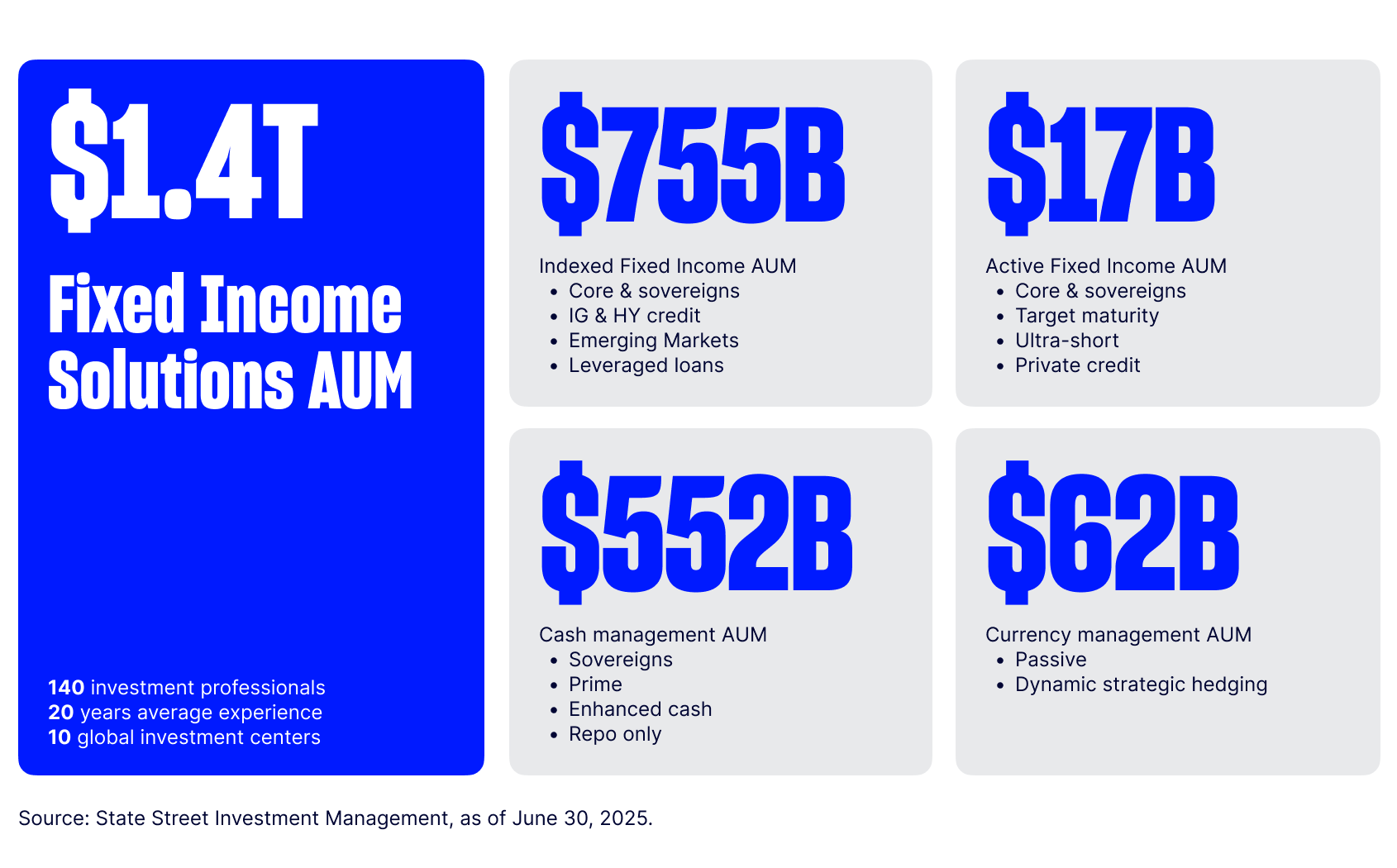

State Street Investment Management is well positioned to partner with investors to provide both core and satellite exposures through our vast array of offerings across the fixed income spectrum. Our $755 billion in indexed fixed income includes over $564 billion in “core” indexed strategies such as multisector and developed market sovereigns. In addition, we manage $190 billion in complex beta strategies such as credit, high yield, emerging markets, and leveraged loans4— strategies that offer enhanced yield and implementation alpha opportunities.

Our active fixed income team manages $17 billion5 in fundamental and systematic active strategies which span sectors and durations, in addition to the newly launched PRIV ETF, which blends both public and private credit exposures.

For more information about how State Street Investment Management can make your fixed income allocation ready for the future of the space, please reach out to your relationship manager.