Japan’s “Truss Shock": A market scare, but not a systemic crisis

The recent surge in long‑end Japanese Government Bond (JGB) yields—with the 40‑year bond breaking above 4% for the first time since its 2007 debut—has sparked comparisons to the UK’s 2022 Gilt Crisis. The drivers in Japan, however, are different. The risk of a systemic yen-carry unwind remains limited due to a variety of forces which encourage Japanese investors to maintain their US asset exposures.

As Japan moves toward a high stakes snap election, volatility is elevated, but the structural backdrop remains far more stable than crisis narratives imply.

Recent concerns over consumption tax cuts and other fiscal spending policies in Japan led to a sharp rise in long-end JGBs last week. While the rate rise has seen some reprieve following reassuring comments from policymakers, JGB market risk still looms. This piece addresses key client questions on JGB volatility, the yen carry trade, and what to monitor as election‑related fiscal uncertainty unfolds.

1. Is Japan facing the same risks that helped spawn the UK’s Gilt Crisis?

Answer: No—Japan is not experiencing a UK-style pension crisis.

There’s no forced seller risk

The UK gilt crisis was fueled by leveraged LDI structures. When yields spiked, margin calls triggered and forced asset liquidation. By contrast, Japan is 90% domestically funded, not levered, and LDIs are not the prevailing presence in Japan that they are in the UK. Therefore, there is no forced seller risk. Japan’s market architecture is entirely different, as follows:

- Life insurers sold JGBs largely on a net‑neutral basis to lock in equity gains while realizing bond losses. This mechanically amplified market volatility.

- Pension funds are unlevered long term holders of JGBs—the opposite of the UK’s vulnerability.

- Banks sit on over ¥400 trillion in surplus liquidity, positioning them as natural JGB buyers once volatility stabilizes and BOJ hikes approach terminal levels.

The structure of Japan’s investor base—stable, cash rich, and overwhelmingly domestic—contrasts sharply with the UK’s dependence on foreign capital, LDI, and rate hedging.

Japan controls its own fiscal destiny

Japan’s macro fundamentals differentiate it from the UK in critical ways. Japan has the world’s largest net international investment position (NIIP) surplus, a persistent current-account surplus, and deep domestic savings funding the sovereign (Figure 1). While gross debt/GDP is high, net debt is materially lower, and the sovereign is funded domestically. Japan’s self funded structure helps to absorb volatility, rather than amplifying it.

Figure 1: Japan’s significant net external asset base contrasts sharply with that of the UK and US

| Country | NIIP* USD (trillions) | Status |

| Japan | 3.49 | Net Creditor |

| Germany | 3.62 | Net Creditor |

| Canada | 1.34 | Net Creditor |

| Italy | 0.35 | Net Creditor |

| UK | -0.35 | Net Debtor |

| France | -0.70 | Net Debtor |

| US | -26.54 | Net Debtor |

| China | 3.30 | Net Creditor |

Source: Bloomberg. As of December 31, 2024.

*NIIP (net international investment position), from external assets minus external liabilities, is also known as net external assets.

JGB weakness reflects technicals and sentiment, rather than fundamental credit stress

The recent long-end selloff is tied primarily to positioning, liquidity gaps, and election-season caution. The JGB had a weak 20-year auction on January 20, and several other long-end auctions are set ahead of the February 8 elections. In addition, insurers stepped back after extending duration ahead of the 2025 regulatory transition, creating a temporary vacuum in the long end.

Market sentiment remains risk‑averse rather than dip‑buying (“don’t try to catch a falling knife”), with election‑related fiscal noise distorting positioning. While 2025 JGB repricing largely reflected a higher term premium from firmer inflation and a higher terminal rate, the recent selloff is better attributed to an election risk premium and sentiment overshoot—as shown by the 30‑year yield already retracing over 20bps of its initial 30bps spike.1

Japan lacks leverage-sensitive triggers

Japan’s fixed-income ecosystem does not contain the accelerants that worsened the UK Gilt Crisis. Insurers hold long JGBs outright and Japanese banks remain flush with cash. As mentioned above, pensions are unlevered and rebalance over multiyear cycles, so forced selling is not an issue. Furthermore, Japan’s household sector is asset‑rich and low‑leverage, with financial assets close to double the level of national debt. A JGB yield spike does not trigger margin-call feedback loops, and any snowball effect is brief.

2. Will the yen carry trade unwind?

Answer: No— a yen carry trade structural unwind is unlikely.

The yen carry trade, which is based on borrowing yen at low rates to invest in high-yielding foreign bonds, is heavily trafficked. The increase in JGBs has sparked concerns that this trade will unwind. However, we think a structural unwind is only a “grey swan”—not a base case. Key stabilizers include:

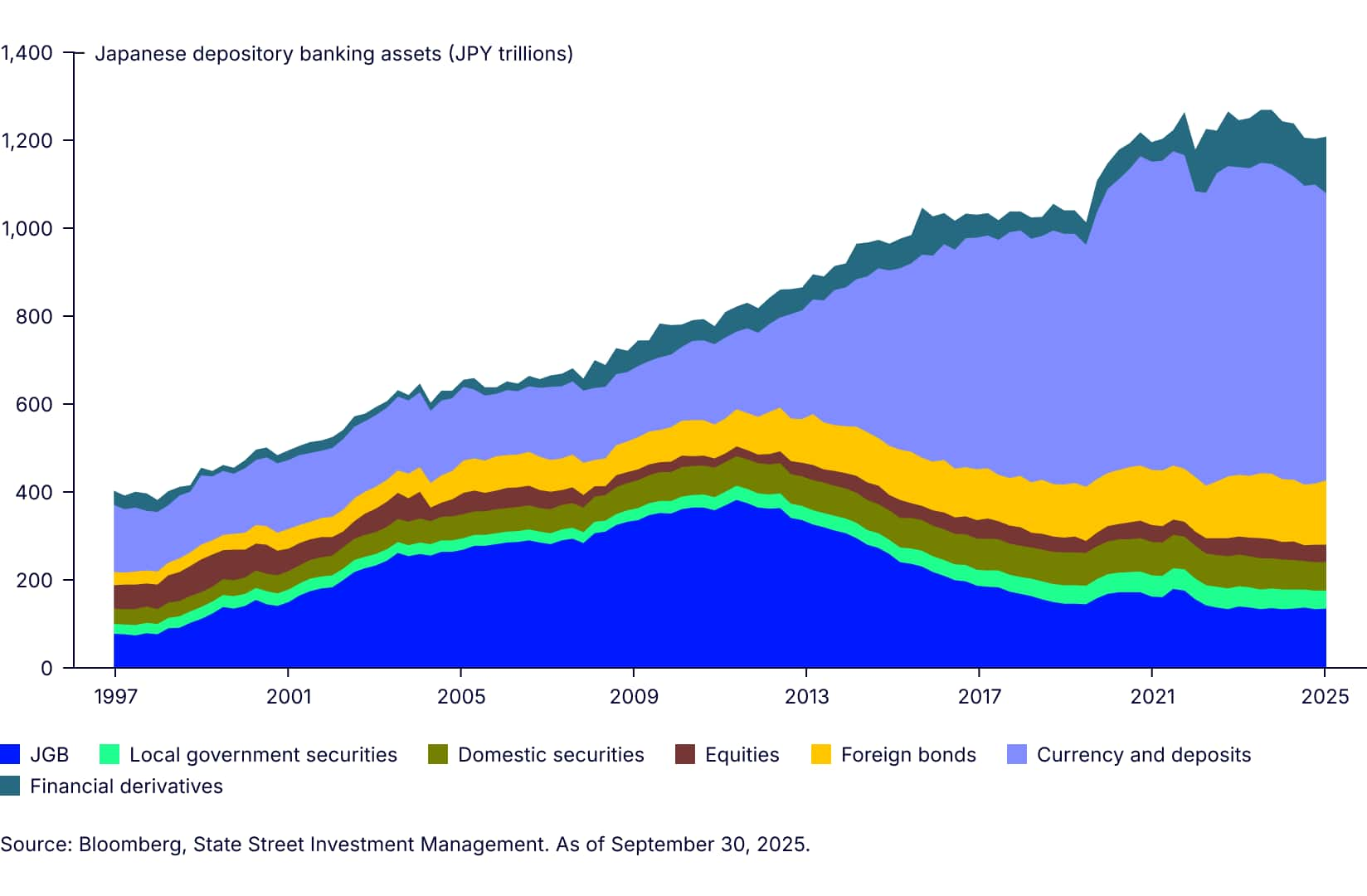

- Higher JGB yields will anchor capital at home. Japanese banks hold ¥400 trillion in idle cash, which they could redeploy before selling foreign bonds (Figure 2).

- Meanwhile, over US$1 trillion of Japanese US Treasury holdings are structural, not speculative, limiting forced-selling risk. Any joint Fed–Ministry of Finance (MOF) FX intervention would be read as a policy concession by Japan to the US Treasury (under Treasury Secretary Scott Bessent), effectively reinforcing US Treasuries as Japan’s core long‑term assets.

- Japanese allocations to foreign equities remain “sticky” unless a true risk-off event emerges or a sharp yen spike forces delveraging.

In short, some episodic volatility is possible, but a broad, systemic unwind is not our base case.

Figure 2: Japanese banks are likely to tap idle yen cash (currency & deposits) before selling foreign bonds

3. What is the outlook for JGBs?

Answer: Volatility now, stabilization ahead.

The forward picture comes into better focus when discounting political noise. Investors need to watch for:

- Steepness to persist through 1H 2026. This is driven by issuance patterns, investor sidelining, and ongoing BOJ normalization dynamics (i.e., the BOJ is still behind the curve in policy rate increases).

- Stabilization and gradual flattening post 2H26. As banks redeploy their large cash buffers and issuance adjusts to the post election environment, we could see long-end yields start to moderate. As temporary fiscal-year end and election related distortions clear, structural domestic demand is positioned to re-anchor the curve.

- Fiscal policy risk. The key risk for JGBs would be a post‑election gear up toward aggressive, unconstrained fiscal expansion—spending as if there were no limits—which is a fat-tail risk rather than our base case. Even under a more hawkish or national‑security‑focused leadership, which could be positive for select domestic equity segments, Japan’s fiscal policy remains institutionally constrained and typically incremental rather than disruptive.

- Sell the rumor, buy the fact. Markets may continue to price in worst case scenarios — only to reverse once policy details are clearer. Fundamentals remain sound as rates beyond the 10 year point exert minimal influence on the real economy, given that corporate and mortgage markets price off shorter tenors.

4. Is this a tantrum or a crisis for Japanese assets?

Answer: This is a market tantrum, not a funding crisis.

The surge in super long JGB yields is a technical overshoot linked to weak auctions, fiscal-year end balance sheet mechanics, and election period fiscal noise — not a break in Japan’s funding model. Japan remains highly liquid, and historical episodes of sharp moves (the October 2025 LDP leadership race, the April 2025 Liberation Day selloff, etc.) show that yields tend to stabilize once clarity returns.

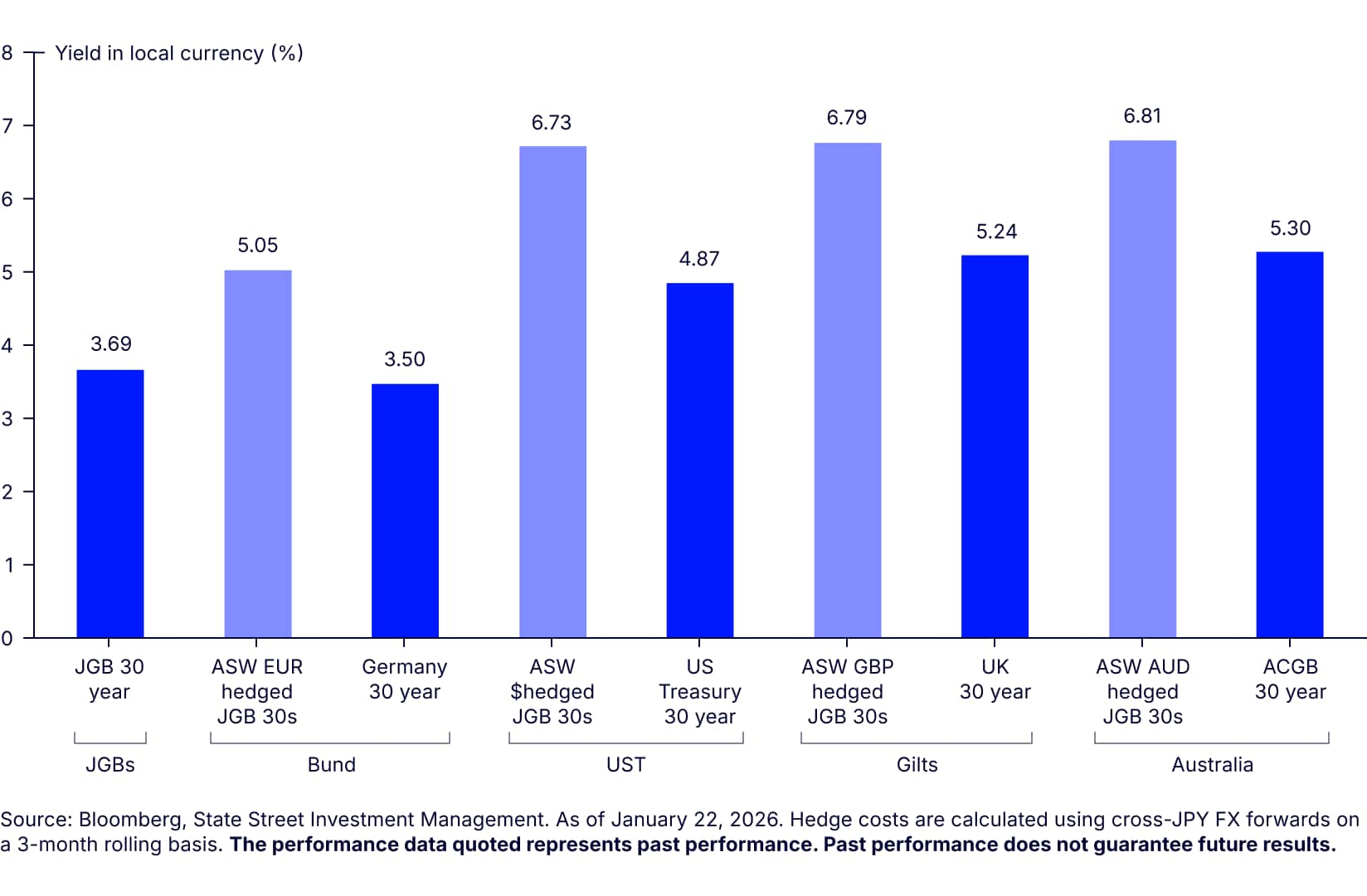

Real money investors remain cautious amid “don’t try to catch a falling knife” dynamics, but appetite to rebuild JGB exposure post 2H26 is rising as BOJ normalization nears the terminal policy rate. For foreign investors, sticky inflation, higher nominal yields (Figure 3), a structurally cheap yen, and governance-driven earnings improvements all reinforce the “Japan is Back” narrative.

Japan is Back: Japan is set to reestablish itself as a fully investable, functioning market, firmly on the radars of global investors.

Figure 3: JGBs offer structurally higher yields in both JPY and hedged terms

For more on opportunities in Japan and other fixed income markets around the globe, see our Global Market Outlook.