ETFs on the Rise: The Investment Choice Revolutionizing Portfolios

Exchange traded funds (ETFs) have emerged as a transformative investment vehicle, gaining substantial traction in recent years. Once considered niche products, ETFs are now key building blocks within many portfolios, attracting attention from retail and institutional investors in the US and around the world.

Driving Evolution Within Financial Markets

The ETF has come a long way since its humble beginnings 31 years ago as an innovative tool for tracking market indices. In fact, today, ETFs are a cornerstone of finance within the United States and around the globe.

Innovation Across the Board

Over their short history, ETFs have garnered substantial attention and assets worldwide, because they cater to the full spectrum of investment strategies — including active management, factor-based strategies, and thematics — and cover everything from traditional asset classes to specialty markets and innovative sectors like technology and sustainability.

Behind their robust, decades-long evolution lies increasing investor demand for transparency, liquidity, and cost efficiency, coupled with the desire for more specialized investment solutions.

The proliferation of ETFs across various asset classes and the introduction of novel ETF structures — from strategies that use derivatives to structured outcomes to spot-based commodity and currency exposures — highlight the industry’s adaptability and desire to meet diverse investor needs. As a result, ETFs have become instrumental in democratizing access to investments, enabling retail and institutional investors alike to tailor their portfolios with once-unimaginable precision and flexibility.

In an exclusive interview, Anna Paglia, State Street Global Advisors Chief Business Officer and Executive Vice President, explains that this is the real power of ETFs at work:

“ETFs are bringing the power of diversification in a single trade. You can go as broad or precise as you want without relying on single stocks to get there.

That diversification, or optionality, is a powerful thing. And I know it’s going to continue to transform investment portfolios in tremendous ways as we move forward into the future.”

The Rise of ETFs Among Investors

ETFs have seen remarkable growth in popularity over the past decade. And the US market, in particular, leads the pack.

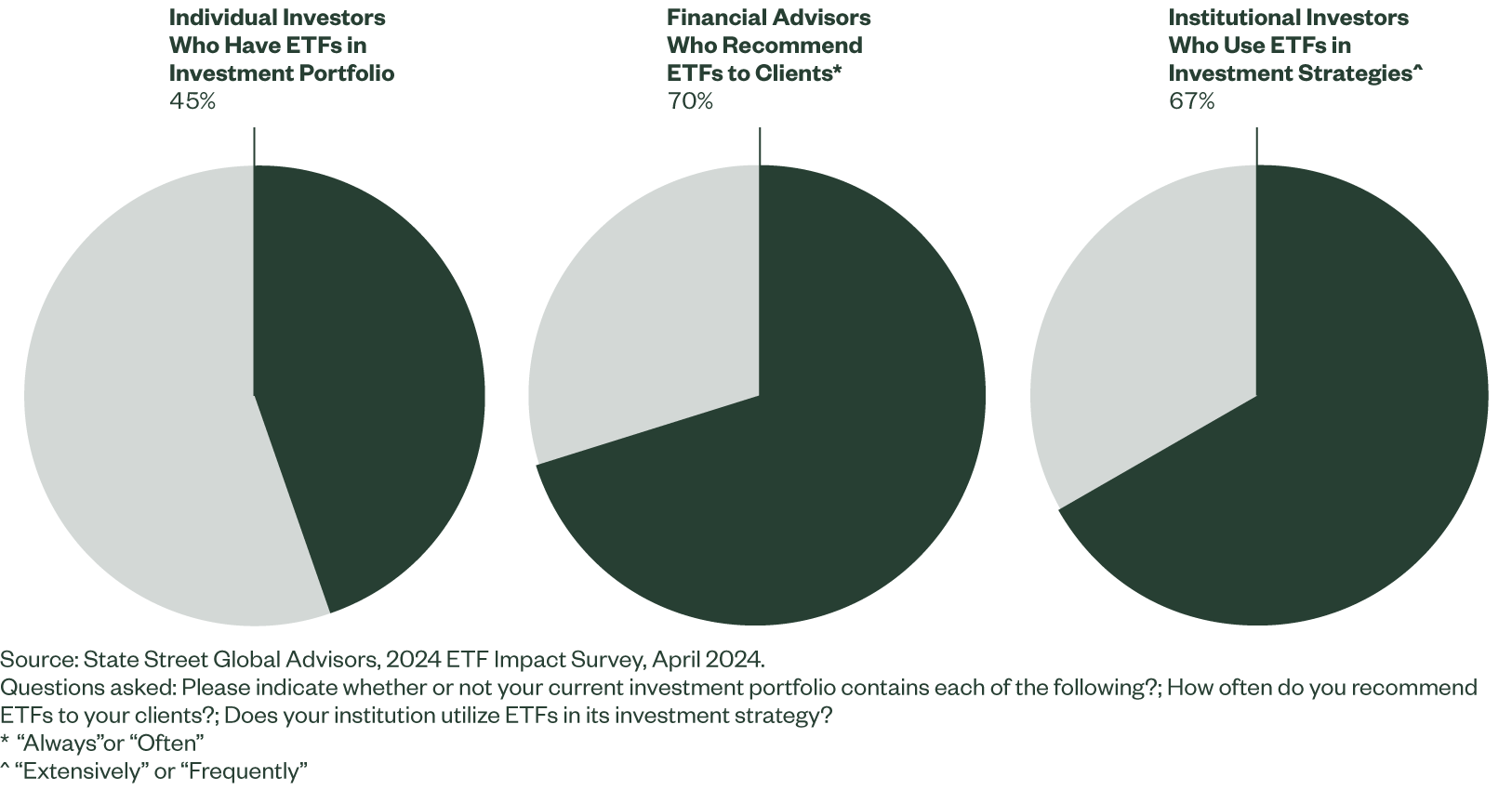

According to our 2024 ETF Impact Survey, a survey designed to understand a wide range of investor attitudes and perceptions about ETFs, the market, and the economy, nearly 70% of US advisors recommend ETFs to their clients “always” or “often.” In a similar vein, 67% of institutional investors use ETFs in their investment strategies “extensively” or “frequently.”

And among US individual investors, 45% have ETFs in their portfolios — up five percentage points from the survey we conducted in November and December of 2022 (Figure 1).1 This trend underscores the broad acceptance of and confidence in ETFs among investors of all stripes.

Figure 1: ETFs Are Particularly Popular Among Advisors and Institutions in the US

Why Are ETFs a Preferred Choice Among Investors?

Several compelling factors are driving broader adoption of ETFs, making them a favored investment vehicle for institutional and retail investors alike. According to our 2024 ETF Impact Survey, US respondents ranked the following reasons for ETF usage at the top of their lists:

ETFs offer inherent diversification by pooling various assets into a single fund, which can track a specific index, sector, commodity, or even a country’s economy. This feature allows investors to spread their risk across multiple assets without needing to buy each one individually. For example, an ETF that tracks the S&P 500® gives exposure to 500 different companies, providing instant diversification.

Within our survey, individual investors report diversification as the top reason for using ETFs (49%).

Compared to mutual funds, ETFs typically have lower expense ratios due to their passive management style. This means investors can enjoy broader market exposure without the high fees associated with actively managed funds. The cost savings on management fees and reduced transaction costs make ETFs an attractive choice for cost-conscious investors.

Both institutional investors and financial advisors rank cost efficiency as the primary driver for using and recommending ETFs (57% and 44%, respectively).

ETFs are traded on major stock exchanges, just like individual stocks. This trading flexibility allows investors to buy and sell ETF shares throughout the trading day at market prices — offering investors more control over investment decisions and enabling strategies such as tactical asset allocation and liquidity management.

ETFs are known for their high liquidity, or their ability to be easily bought and sold in large quantities without significantly affecting their market price. This liquidity is particularly appealing to institutional investors who need to manage large volumes of assets efficiently. The ability to get in and out of markets quickly ensures that ETFs remain a flexible and responsive tool in portfolio management.

According to our 2024 ETF Impact Survey, 91% of institutional investors who identified as heavy ETF users2 report that liquidity is important to their institution’s investment strategy.

And, we found that investors who use ETFs are more confident than those who don’t (Figure 2); this confidence, in turn, may help them feel better prepared to achieve their financial goals, like building a comfortable retirement.

Signs of Continued ETF Growth Ahead

The exponential growth of ETFs reflects their versatility and robust appeal across different types of investors. Financial advisors and institutions have been quick to recognize and embrace the benefits of ETFs, leading the charge in their adoption.

As more individual investors receive education on ETFs and their many advantages — ranging from diversification and cost savings to flexibility and liquidity — ETFs’ popularity and AUM should continue to grow. And it’s likely that millennials will serve as a major growth catalyst, as their current allocations to ETFs outweigh those of Gen X and boomer investors (Figure 3).

Figure 3: Percentage of Surveyed Investors With ETFs in Their Current Portfolio

Plenty of Room for ETF Growth and Adoption

Even given their explosive growth over the past three decades, ETFs still have a long runway for adoption — passive and active ETFs account for approximately 18% of investable assets globally.3

Now with US$13.8 trillion in AUM globally4 ETFs provide a highly liquid, cost-effective, and transparent way to invest in all corners of the market. And with more than 9,100 ETFs available globally,5 more investors can gain exposure to an increasingly wide variety of market segments to achieve their financial goals.