The power to transform retirement outcomes

At State Street Investment Management, we’re committed to partnering with advisors to achieve better retirement outcomes. From building a diversified core menu to navigating the regulatory environment, getting there starts here.

Read more on how we’re shaping the future of retirement.

Featured insights

Private Markets in Target Date Funds – Why Now?

The State Street Apollo Target Retirement Strategies create accessibility to the fast-growing private markets asset class within the construct of a target date fund.

Our Growth Target Date Philosophy

Emphasizing longevity risk for plans that necessitate a higher risk profile through an off the shelf target date fund.

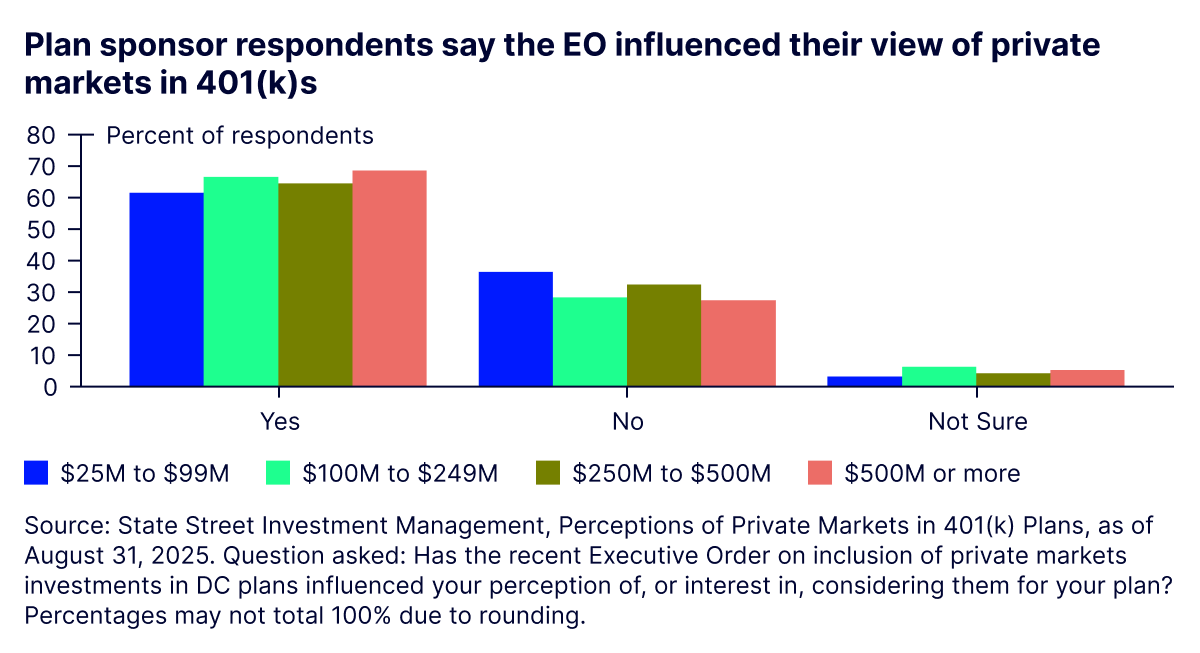

Survey: Private market assets in retirement plans

Our latest research on private market assets in DC plans explores how the Executive Order sparked new interest—and how perceptions among plan sponsors and retirement savers are evolving.

Serving up retirement security

A guide for plan sponsors to easily identify and classify retirement income solutions, providing a framework for making decisions confidently.

Helping you solve for what lies ahead

More than numbers, these stats are proof that starting here means starting strong.

Target Retirement AUM 3

In Global DC AUM 1

Participants 2

More resources

The Morning Chat

State Street brings you The Morning Chat, where experts provide insights on the topics important to you.

Defining Collective Investment Trusts (CITs)

CITs are pooled investment vehicles offered to certain qualified retirement plans and managed collectively in accordance with a common investment strategy.

ETF Education

What is an ETF? How are ETFs created and traded? How can you use ETFs in a portfolio? Learn more in our ETF Education Hub, covering everything you need to know.

Product guides

DC investment options

Leveraging a full range of institutional capabilities to enhance retirement outcomes.

DC leadership team

Learn more about Defined Contribution at State Street Investment Management.