Building resilience with private CRE

Discover how private US commercial real estate offers diversification, inflation protection, and steady income, with insights on market trends, sector opportunities, and investment strategies.

Private US commercial real estate (CRE) stands out for its ability to move independently of the stock market, showing almost zero correlation with US equities. This characteristic makes private CRE a valuable option for balancing risk in a broader investment mix. Private CRE also offers practical inflation protection.

Rents tend to rise along with operating costs, and over time, property income growth has outpaced inflation. As a result, capital invested in private CRE is more likely to maintain its purchasing power during inflationary periods.

A key appeal of private CRE is its capacity to generate steady, predictable income. Long-term leases and reliable tenants contribute to consistent cash flow, and average yields compare favorably with other investment options. Price movements in private CRE are generally more stable, avoiding the sharp swings often seen in public markets.

The following pages take a closer look at how private CRE performs across different property types, what’s driving demand and risk in today’s market, and the practical considerations for investors exploring this space.

The paper also explores the main approaches to accessing private CRE, highlighting the trade-offs between passive fund investing and active direct property ownership. For those interested in the details—market trends, sector opportunities, and the mechanics of investing—the rest of this paper provides a deeper dive into what sets private CRE apart and why it’s attracting attention in the current environment.

Understanding commercial real estate

Zero correlation to US equities

Private US CRE offers strong diversification benefits due to its lack of correlation to the public investment market, including real estate REITs (Figure 1). Unlike stocks and bonds, CRE is a tangible asset that often behaves differently, helping investors mitigate some of the risks associated with public market volatility.

Investing in different property types—such as office, retail, industrial, and multifamily—can further diversify a portfolio. Also, investing in a mix of stabilized core assets, properties with lease-up and value-add strategies, as well as ground-up development deals, provides diversification of portfolio execution risk.

Figure 1: Asset class correlation matrix

| U.S Real Estate | Listed REITs | U.S. Equities | Fixed Income | 10-yr Treasuries | |

| U.S Real Estate | 1 | 0.22 | 0 | -0.13 | 0.12 |

| Listed REITs | 0.22 | 1 | 0.6 | 0.3 | -0.08 |

| U.S. Equities | 0 | 0.6 | 1 | -0.02 | -0.38 |

| Fixed Income | -0.13 | 0.3 | -0.02 | 1 | 0.8 |

| 10-yr Treasuries | 0.12 | -0.08 | -0.38 | 0.8 | 1 |

Source: State Street Investment Management, as of December 2024. Analysis of 2000–2024 data from NCREIF NFI-ODCE Index, FTSE NAREIT All Equity REITS Total Return Index, S&P 500 Index and Bloomberg Barclays U.S. Aggregate Bond Index.

Real assets, real hedge

Inflation erodes the purchasing power of money, making it crucial for investors to seek assets that can protect against inflation. CRE is known for its ability to hedge against inflation as tenant rents typically increase along with rising operating costs, which helps maintain the market value of properties. Apartments and hotels can be particularly good at hedging against inflation as rental rates are able to be reset to market rates more frequently due to their short-term leases.

Historically CRE has outperformed inflation, providing returns that preserve purchasing power, making CRE a reliable option for investors looking to safeguard wealth in inflationary periods. For instance, despite CRE’s underperformance over the last three years, between 2005 and 2024 inflation growth averaged 2.6% vs. CRE price appreciation of 3.4% (Figure 2). Meanwhile, between 1994 and 2023 property income growth outpaced inflation (Figure 3).

Yield you can use

One of the attractive features of CRE is its potential to generate current income or yield (Figure 4). Stabilized CRE investments typically provide steady cash flow via contractual and/or predictable rents. This income can be particularly appealing for investors seeking regular cash distributions.

Average annual income yield of institutional private real estate over the 2015–2024

The current average premium that US households pay to own versus rent

Value that holds

Compared to other investment options, private US CRE tends to have lower price volatility. Values are generally more stable as they are less influenced by daily, weekly or even monthly market movements. Long-term leases and consistent rental income also contribute to this stability. The result is a smoother return profile without the high volatility typically associated with public market investments.

Favorable risk-adjusted returns

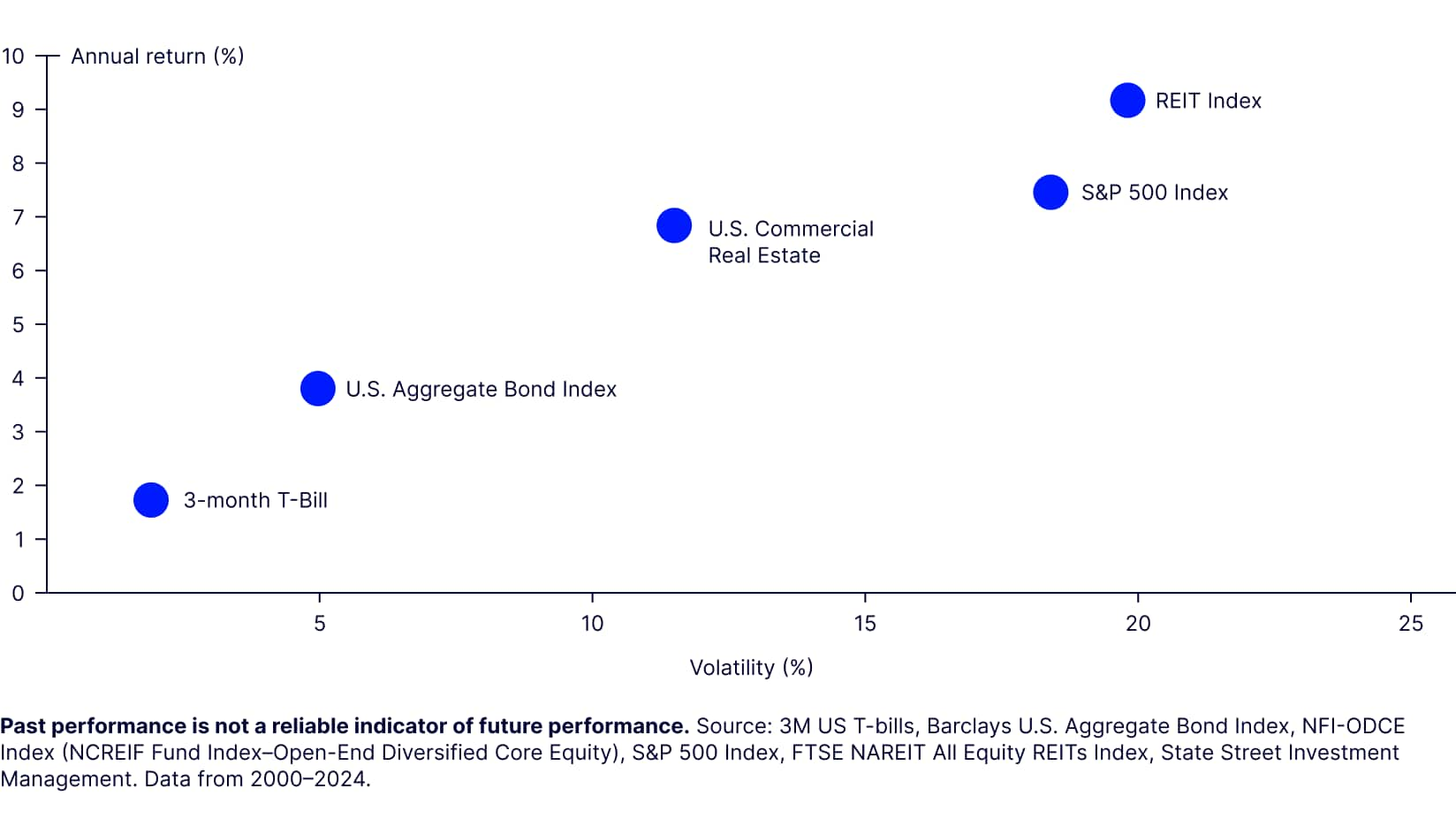

Risk-adjusted returns measure the profitability of an investment relative to the risk taken. This can be measured by comparing the overall return of an investment against the standard deviation (volatility) of that return over a period of time. The lower the standard deviation, the lower the volatility, the lower the risk. CRE offers favorable risk-adjusted returns, making it an attractive option for investors. Figure 6 illustrates that the return of private US CRE investments is similar to US equities, but with significantly less volatility.

Figure 6: US CRE offers favorable risk-adjusted returns

Opportunities in Private CRE

Multifamily investments persistently attractive

The multifamily property segment is particularly attractive due to the persistent undersupply of housing and affordability challenges. Despite recent increases in apartment supply, tenant demand remains robust, driven by the lower relative cost of renting vs. owning (Figure 7).

According to Zillow, between 2015 and 2021, the average premium a US household paid to own vs. rent was just 6.9%. The average premium US households have been paying to own since then is 43.7%.

The multifamily market’s resilience is evident in its ability to absorb new supply, with vacancy rates remaining strong despite the high level of recent new deliveries. In Q1 2025, the US multifamily market saw vacancy begin to decline for the first time in 13 quarters, with new construction starts dramatically reduced as a result of inflation and higher interest rates.

Affordability remains a critical issue, as many individuals struggle to afford the downpayment and mortgage interest required to purchase single-family homes, continuing to push them toward rental options. Wage growth outpacing rent increases has also improved apartment affordability, further fueling demand. These strong underlying leasing fundamentals, combined with the lower property values discussed above, result in an attractive investment opportunity in this sector.

E-commerce boom fuels industrial real estate

The industrial sector has experienced significant growth due to the continued rise of e-commerce. E-commerce sales have been increasing rapidly, accounting for a substantial portion of total retail sales (Figure 9). This growth drives tenant demand for industrial spaces, particularly for fulfillment centers and last-mile delivery facilities.

The pandemic accelerated e-commerce adoption, leading to higher occupancy rates and rising rents in industrial properties. The need for faster delivery times has further increased demand for last-mile locations within close proximity to consumers.

As e-commerce continues to grow, industrial real estate remains a strong investment opportunity. That said, the sector is not without some headwinds. As a result of increased tenant demand following the pandemic, additional new supply has resulted in vacancies increasing over the past three years. This trend is forecast to continue through 2026 and has led to rent growth reducing to its worst pace since 2012; however, new construction starts have declined sharply, which is projected to lead to improved market conditions in the near term.

Office investments could become attractive again

Office investments are pricing at historically high cap rates, providing the potential for high investment returns as the market recovers (Figure 10). Opportunistic investors target assets priced below replacement cost, allowing for property upgrades while maintaining appealing rents and earning substantial returns.

However, this sector does come with a higher level of risk as office tenant demand and the office financing market remain very challenged, with current vacancy levels at an all-time high.

Benefits of direct property investment

Many investors fill allocations to private US CRE in their portfolios by investing in comingled fund vehicles sponsored by external managers. This is an efficient way to invest capital with experienced managers and spread the risk across large, diverse portfolios of assets.

Some of the managers also specialize in alternative asset types, providing investors with access to attractive sectors like data centers and international industrial properties. However, there is limited liquidity with this strategy, with closed-end funds typically carrying terms of about 10 years.

Open-end funds offer the potential for greater liquidity given investors can file redemption notices after a minimum commitment period, but during times of market turmoil the managers can limit payment on redemptions to avoid being forced to sell assets at lower valuations during a market downturn.

An alternative solution is to have a direct property strategy, with investors purchasing and managing individual assets—either with an in-house team or investing via a separate account arrangement with an asset manager. This strategy offers greater liquidity as the investor has a majority equity stake in each property, which offers input into asset strategy and control over major decisions like the timing of property sales. Although asset diversification is limited compared to fund investing, investors benefit from more control and a typically lower asset management fee and incentive fee structure, reducing profit leakage and making this option appealing.

Conclusion

Investing in private commercial real estate provides numerous advantages, including diversification, inflation protection, current income, low correlation to public markets, reduced volatility, and favorable risk adjusted returns.

In addition, investors can also benefit from attractive market timing as the global pandemic and recent spikes in interest rates have resulted in lower property valuations—allowing new investments to be available at an attractive basis. These benefits make CRE a compelling addition to any investment portfolio, offering cash flow stability with growth potential.

This can be accomplished by investing in funds, direct properties, or a combination of both execution strategies to achieve an investor’s desired diversification and liquidity goals.

Investing in different property types also provides diversification, with multifamily properties benefitting today from strong demand and affordability challenges, industrial spaces thriving on e commerce growth, and while there are still headwinds for office, that sector offers the potential for high returns at elevated cap rates.

The broader market conditions, including loan maturities and institutional under allocation, create a favorable environment for investment. As the market stabilizes and interest rates begin to decline, commercial real estate presents a promising opportunity for investors seeking long term growth and returns.