Ask the Actuary: Enhancing diversification in LDI portfolios

In a new feature of our newsletter, we’re inviting corporate DB plan sponsors to send their investing or plan management questions to State Street Investment Management’s head of US Defined Benefit Investment Strategy, Francois Pellerin, CFA, CERA, FSA. For this issue, he answers a question about additional steps sponsors can take to refine their liability hedging portfolios.

Q: Our company’s plan is frozen and fully funded. We have implemented a hedging strategy to immunize against interest rate fluctuations, which we see as an uncompensated risk. Our program is customized to our own liabilities, with an overall hedge ratio of 100% and duration matching along five “key rates.” Finally, we dynamically rebalance that portfolio to reflect market fluctuations and demographic changes. Are there other steps we could take with our hedging portfolio to reduce funded ratio risk?

A: Those best practices you’ve implemented have helped many sponsors substantially reduce pension risk. However, an unintended consequence has emerged from most LDI implementations: investment style concentration.

Due to their ability to closely match cash flows discounted using AA yields, high-quality corporate bonds are the main component of most custom hedging portfolios. The drawback is that virtually all corporate bond assets under management are with managers that use the same investing strategy: fundamental active management. As a result, while there are nuances, most corporate bond fund portfolios tend to look quite alike, holding similar issuers and sector exposures.

The similarity among these portfolios means that their gains are highly correlated in positive markets, but so are their drawdowns during challenging times. Management style concentration, therefore, can be a hidden risk in LDI hedging portfolios.

One way to mitigate this risk is to invest in funds that don’t follow the same security and sector selection path. The State Street family of systematic active fixed income (SAFI) strategies is specifically built to address this issue. SAFI takes a systematic approach to active fixed income investing, using quantitative signals in the form of factor scores to identify mispriced securities. This data-driven, rules-based process can deliver excess return and lower tracking error against a plan’s liabilities, with lower overall management costs.

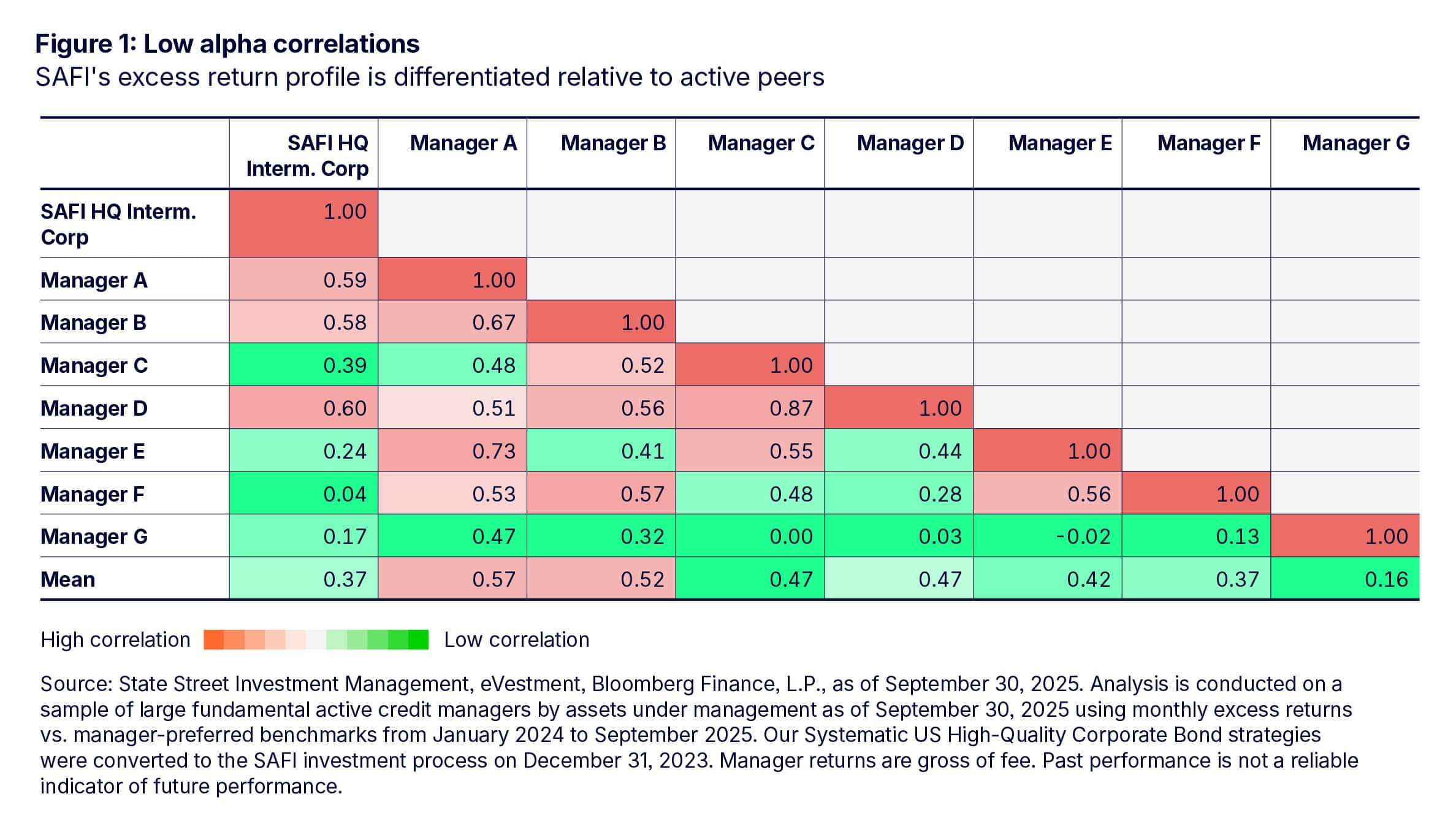

More importantly for diversification purposes, the SAFI strategy portfolio construction process results in lower correlations to fundamental active management strategies, as shown in Figure 1. For example, the Systematic US High-Quality Intermediate Corporate Strategy would have had a 0.37 correlation on average to seven major fundamental active strategies between January 2024 and September 2025.

With their risk/reward profile and lower correlations, SAFI strategies complement the fundamental active corporate bond funds that make up most LDI hedging portfolios. Sponsors may consider substituting up to 25% of their current allocation to traditionally managed credit for less correlated strategies like SAFI. This change would allow sponsors to maintain exposure to the high-quality corporate bonds that are the best hedge for plan liabilities, but with additional diversification within that asset class. The result could be a smoother (and potentially higher) “alpha ride” for increased funded ratio stabilities, overall plan cost reduction from lower net fees, and higher downside protection by taking advantage of increased diversification—the only free lunch in investing

Contact us to learn more about incorporating systematic active fixed income strategies into a plan’s portfolios.

Have a question about managing your corporate plan? Ask the actuary by filling out the question form below.