2022 Target Retirement Annual Review: An Index-Aware Approach to Fixed Income

- INVESTABILITY Can we implement this investment theme efficiently?

- DESIRABILITY Would enacting this change to the glidepath be expected to improve participant outcomes?

- SUITABILITY Is the investment decision under consideration suitable for all DC investors?

Update published March 14, 2023:

This past December, as part of our Annual Glidepath Review, we announced our intent to evaluate the split between US Intermediate and US Long Duration Government bonds in the State Street Target Retirement glidepath. We are providing you with an update on expected changes.

After completing our review, we intend to restore our US Government Bond allocation to 100% US Long Duration Government bonds, which the glidepath held prior to 2021 (and since the inception of the Target Date series in 2005). To summarize, the following changes will be made as of the close of business March 31, 2023.

- Remove allocation to US Intermediate Government bonds in the wealth accumulation phase of the glidepath, replaced by US Long Government bonds. The current strategic allocation to US Intermediate Government bonds starts at a maximum of 3% in the 2065 fund and phases out entering retirement. This change will also occur in the State Street Target Retirement Mutual Fund series: the current US Intermediate Treasury allocation will be reallocated back to US Long Treasuries.

- As previously communicated, we will change the benchmark for our US High Yield allocation from the Bloomberg US High Yield Very Liquid Index to the BofA ICE US High Yield Constrained Index in the Collective Trust Series. As discussed below, this change will not occur in the State Street Target Retirement Mutual Fund series.

Rationale for Returning to 100% Long Government Bonds

In December of 2020, with bond yields approaching all-time lows, we elected to reduce the allocation to US Long Duration Government bonds in the State Street Target Retirement glidepath. This decision, implemented in March of 2021, was prompted by challenged long-term return expectations and the potential for reduced diversification benefits as yields approached zero. In fact, our long-term return forecast had turned materially negative, driven by low starting yields and the expectation for interest rates to normalize over time.

We have maintained our position that while the significant dislocation and the subsequent impact on our long-term outlook in 2020 necessitated a change, long government bonds remain our preferred fixed income allocation during the wealth accumulation phase due to their diversification benefits and better alignment with participant time horizons. Today, the outlook for long government bonds – and fixed income more broadly – has dramatically improved. The increase in starting yields has raised long-term return expectations from what was once negative to firmly positive – roughly 4% as of 2/28/23, while the diversification qualities of the asset class continue to be appealing. Importantly, there is no tactical component to our process, so asset allocation decisions are purely driven by the long-term outlook for the asset class. Considerations for evaluating long versus intermediate government bonds include participant objectives, long-term risk and return expectations as well as expected downside protection during equity market sell-offs.

Article originally published December 13, 2022

Each year, State Street Global Advisors conducts a comprehensive review of its Target Retirement strategies. The annual review process is driven by the Defined Contribution Investment Group (DCIG), which blends asset allocation expertise from State Street’s Investment Solutions Group (ISG) with retirement market insights from the Global Defined Contribution (DC) team. The review follows a consistent and transparent framework to reassess the capital market expectations and demographic assumptions that underpin the glidepath while also evaluating the existing asset classes, as well as any new asset classes and investment themes for inclusion in the investor portfolios. The process is grounded in three key criteria: investability, desirability and suitability.1

A key differentiator for our strategy has been the consistency of our team, philosophy, and process going back over 15 years. Our annual review framework has driven a history of enhancements to improve efficiency and expand the investment opportunity set while maintaining stability of the risk profile of the glidepath. There is no tactical component to our process; the Target Retirement funds are managed strategically, and built using State Street ISG’s long-term (10+ year) capital market assumptions. We look for persistence and materiality of investment themes prior to making changes rather than altering our philosophy based on single point-in-time inputs. The volatility that has defined 2022 to date has reinforced the importance of a measured, long-term view.

The outlook for fixed income looks much different today than it did at the beginning of 2022, when long-term return expectations for Government bonds were under 1% in the US and negative throughout much of the developed world. Central banks have tightened monetary policy by raising rates in the face of persistently higher inflation, driving the performance of both equities and bonds deeply negative - but also materially improving the outlook going forward. As of September 30, the long-term return outlook for US Government bonds has improved over 300 bps to 4%, while the expectation for global equities has improved more modestly by 100 bps to 6.6%. Current expectations suggest that the gap in equity risk premium has narrowed and that fixed income continues to be an important part of multi-asset portfolios -- providing an element of diversification and significantly improved source of income. While the challenged outlook for bonds to begin the year contributed to an increase in equity exposure across many glidepaths throughout the industry, we continue to take the long view on potential changes, rather than disrupting the participant experience by altering risk levels in response to potentially temporary dislocations.

Topics of 2022 Annual Review:

- Potential optimization of our exposure to US high yield by moving from a “liquid” to a “broad” benchmark

- Commitment to evaluating the split between intermediate- and long-duration government bonds in the wealth accumulation phase

For this year’s review, rather than seek to reduce our allocation to fixed income, we looked at improving efficiency within it. First, we evaluated broadening the existing US high yield allocation — which we have held since 2010 via the Bloomberg US High Yield Very Liquid Index — by changing to the ICE Bank of America US High Yield Constrained Index (or “Broad Index”). We have witnessed significant improvement in liquidity within the high yield universe over the last decade, and a broader index may offer the potential for higher potential returns and a better representation of the high yield market.

We also continue to evaluate the allocation to intermediate- and long-duration US government bonds in the wealth accumulation phase of the glidepath. Since April 1, 2021, the strategic mix in our longest-dated vintages has consisted of 7% long government bonds and 3% intermediate government bonds. We sought to maximize efficiency with the 70/30 split between long and intermediate while also considering tail-risk scenarios. As we communicated at that time, we intend to reevaluate the strategic mix as part of our annual review process and have a systematic framework in place to continuously evaluate this decision within the context of our long-term forecasts. To ensure that any decision made on behalf of plan participants is representative of the most current characteristics, we will continue to apply this framework into Q1 2023, and announce any potential changes to the allocations in the weeks prior to implementation at the end of Q1.

The paper that follows will focus on the investability, desirability and suitability of US high-yield bonds. Specifically, we discuss the rationale for broadening the benchmark exposure to the ICE Bank of America US High Yield Constrained Index in the collective trust series while maintaining the existing high yield fund (ETF: JNK) and benchmark exposure in the mutual fund series.

Investability

Can we implement this investment theme efficiently?

High yield plays an important role in the State Street Target Retirement glidepath, serving as a hybrid asset class that offers growth-like return expectations with low historical beta and standard deviation relative to equities. While high yield carries more credit risk than investment-grade fixed income in particular default risk which is virtually absent in the latter, modest allocation established in the years approaching retirement provides higher fixed income yields without extending duration. The case for investing in high yield has always been qualified by questions around investability, most notably as it relates to liquidity. Liquidity risk has historically had the potential to increase during periods of excess volatility, creating challenges in tracking an index. As a result, conversations around high yield have typically focused on active management.

It is important to note that indexed fixed income is anything but “passive.” Indexed fixed income portfolios, especially in asset classes like high yield, do not typically fully replicate a benchmark as you may find in an S&P 500 Index fund. Fixed income investors must consider additional factors like illiquidity, inefficiency, and scarcity. Portfolio managers running indexed fixed income portfolios seek to deliver the same risk as the index, but with intelligent, skillful implementation through stratified sampling. Thus, index selection is an important consideration — seeking to balance the ability to minimize costs and efficiently track the index without taking excessive active risk.

Applied to Target Retirement strategies, when we first added an allocation to high yield to the glidepath in 2010, the 2008 Global Financial Crisis (GFC) was still close behind in the rear-view mirror. The GFC adversely impacted the vast majority of asset classes but was first and foremost a credit and liquidity crisis, and high-yield bonds were front and center. As a result, when the allocation was first added, liquidity and quality of underlying issues were at the forefront of our decision-making process. Mindful of the need for daily liquidity to accommodate DC participant cash flows and the market environment at the time, we implemented our high yield exposure via the Bloomberg US High Yield Very Liquid Index — a rules-based benchmark focused on the larger, more liquid components of the high yield universe. Not only has the high yield allocation provided a diversified source of growth to older participants, but we have successfully tracked the Very Liquid benchmark over time and even added value through our portfolio management process, outperforming the benchmark by 19 bps on average over the one-, three-, five-, and 10-year periods through June 30, 2022.

While the implementation of the high yield very liquid exposure has been, in our minds, successful, the high yield market has evolved since we originally introduced the allocation in 2010. Specifically, the breadth and liquidity of high yield has improved markedly over the last decade.

For a high-level comparison, the market cap of the Very Liquid Index was only about $182 billion when we first added the allocation and represented a small subset of the roughly $1 trillion high yield universe, owing to the index methodology that filters eligibility to the larger and more liquid issues. Today, reflective of the overall improvement in liquidity for the asset class, the Very Liquid Index has grown to make up a much larger portion of the broader market — over $871 billion of the now $1.2 trillion high yield universe2 — and the Very Liquid and Broad indices are much more similar in composition than a decade ago.

| Bloomberg US HY VLI | ICE BofA US HY Constrained |

Total issues | 1,159 | 1,964 |

Market size | $871.3B | $1.21T |

Avg issue size | $752M | $617M |

Source: Bloomberg as of 9/30/2022

Increased visibility and acceptance of the investment case for High Yield bonds, combined with a more fluid and transparent trading market, have alleviated some liquidity-related frictions for investors. While a certain amount of relative illiquidity is an understood risk in the asset class, liquidity has improved compared to levels experienced during the financial crisis. Transaction costs, as measured by liquidity cost scores, have been cut in half during this time.

Of course, market conditions have been largely favorable until recently so a natural question might be how the Very Liquid and Broad indices have performed during this most recent period of stress. Importantly, the rise in ETF popularity has played a key role in this improving picture, even during volatile periods. The way ETFs and large portfolios trade baskets of underlying bonds has improved overall liquidity, even in individual names with limited trading activity. Below, we detail the comparison in liquidity cost scores between the Very Liquid and Broad indices in recent years, showing that they have been quite comparable with a modest difference during periods of heightened illiquidity, the most notable of which was during onset of the COVID-19 pandemic in 2020.

Beyond these metrics, it’s important to note that State Street’s fixed income portfolio management team has successfully tracked the broad benchmark in live portfolios for over a decade. Notably, their demonstrated history of adding value relative to the Broad High Yield benchmark — 10 bps of annualized excess return for the composite over the last five years — was a key driver of the decision to expand benchmark exposure within the target retirement series

Desirability

Would enacting this change to the glidepath be expected to improve participant outcomes?

The allocation to US high yield in the later stages of the glidepath has added significant value, outperforming US investment-grade bonds by 345 basis points annually on a total return basis since its addition in 2010. High yield has provided diversification relative to both equities and fixed income — delivering lower volatility and shallower average drawdowns than equities during market selloffs. While more volatile than investment-grade bonds, a distinct allocation to high yield allows us to thoughtfully manage credit risk in light of the broader equity and fixed income allocations at the later stages of the glidepath.

While we continue to strongly support the desirability of high yield in the glidepath, given the significant improvement in size and liquidity of the sector, we believe it makes sense to reevaluate the existing Very Liquid Index exposure and whether efficient alternatives exist to improve diversification or returns. The ICE Bank of America US High Yield Constrained Index offers a more diverse representation of the high yield market without materially changing the risk profile or role of high yield in the glidepath. As the high yield market has matured the Broad and Very Liquid indices have become more aligned from a characteristic standpoint. Yield, duration, and average credit quality are all in line.

| Bloomberg US HY VLI | ICE BofA US HY Constrained |

Yield to maturity | 9.51% | 9.54% |

Duration | 4.15y | 4.20y |

Spread (OAS vs, US Treasury) | 522bps | 539bps |

Avg quality rating | BA3/B1 | BA3/B1 |

Source: Bloomberg as of September 30, 2022

That said, spreads are marginally higher for the Broad benchmark. The additional spread and yield of the broader index adds up over longer time horizons, resulting in an improved return profile over the Very Liquid Index, which intuitively offers a modestly lower spread in exchange for increased liquidity.

| Total Return (annualized) | |||

Index (as of 9/30/22) | Trailing 1-year | Trailing 3-year | Trailing 5-year | Trailing 10-year |

ICE BofA US HY Constrained Index | -14.06 | -0.70 | 1.39 | 3.86 |

Bloomberg VLI High Yield Index | -14.95 | -1.35 | 1.01 | 3.39 |

| Standard Deviation | ||||

Index (as of 9/30/22) | Trailing 1-year | Trailing 3-year | Trailing 5-year | Trailing 10-year |

ICE BofA US HY Constrained Index | 11.15 | 11.13 | 9.11 | 7.43 |

Bloomberg VLI High Yield Index | 12.15 | 11.09 | 9.18 | 7.62 |

Source: Bloomberg as of 9/30/2022. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

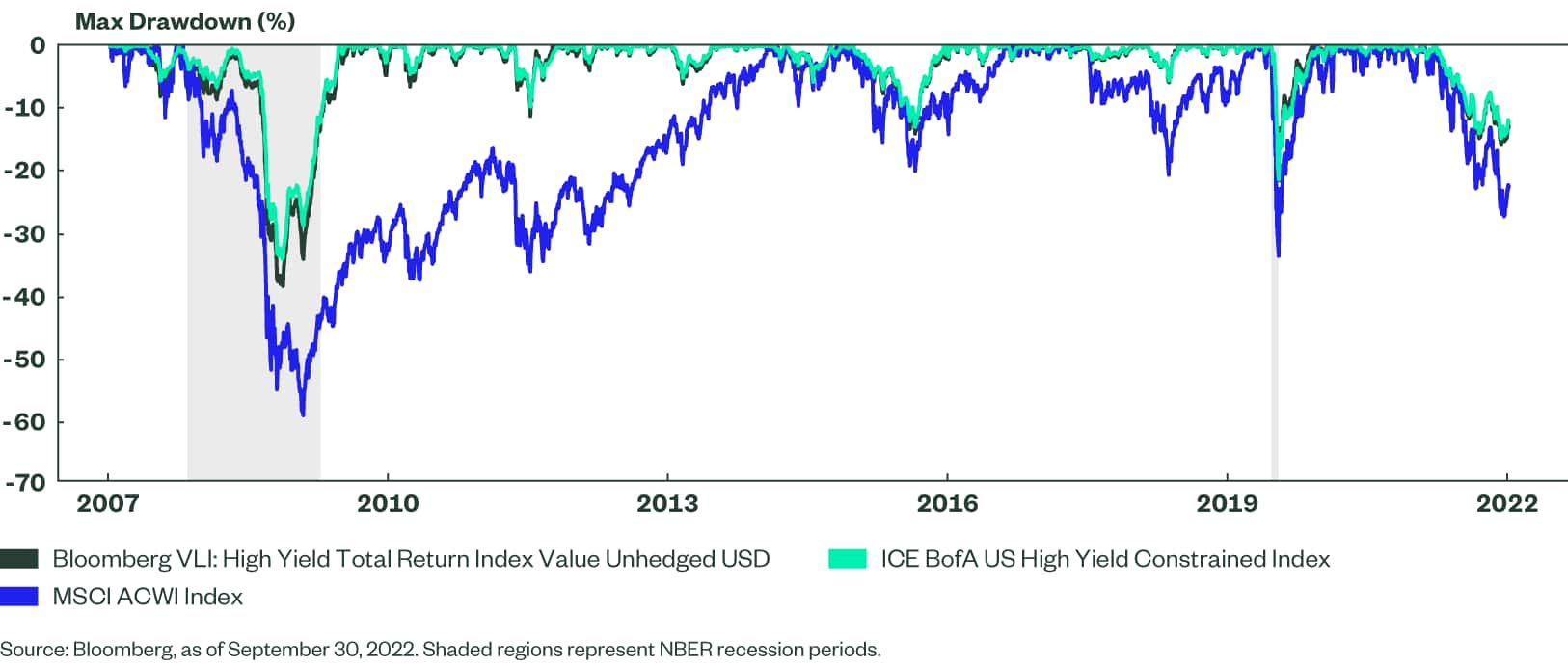

Given the alleviated concerns around tracking and liquidity, the potential for excess returns with similar historical realized risk levels between the two indices further supports the case for expanding benchmark exposure. Expanding beyond typical market conditions and looking at more of a stress test scenario, the difference in drawdowns between liquid and very broad indices has been minimal. For both exposures, high yield has experienced more shallow drawdowns than global equities during periods of heightened volatility, reinforcing the case for a strategic allocation to the asset class.

Suitability

Is the investment decision under consideration suitable for all DC investors?

While suitability of the asset class or investment theme under consideration is an important prerequisite for any potential glidepath change, in this case no new asset classes are being introduced. Suitability for DC participants ultimately comes down to the trade-offs between the desirability of higher expected returns from the broader high yield benchmark and liquidity considerations. Broadly, with the shift away from the Very Liquid Index version, which uses inclusion rules to screen out some of the less liquid issues, to the broader representation, which still uses certain inclusion rules, investors have the potential for greater long-term performance with a minimal increase in volatility and little compromise in overall liquidity. High yield also makes up a relatively modest percentage of overall assets in the series, entering the glidepath 17 years prior to retirement and reaching a maximum 7% allocation, and we are comfortable with the day-to-day cash flow expectations.

Importantly, this evaluation is impacted by not only the index characteristics but the investment vehicle. For our Target Retirement Collective Investment Trust (CIT) series, we invest in each underlying asset class in the glidepath through underlying asset class CITs. For the Target Retirement Mutual Fund series, we invest in underlying asset class mutual funds for some exposures and ETFs for others, and the high yield allocation is achieved through ETF Ticker: JNK. There are additional considerations for changing the existing JNK ETF exposure in the Target Retirement Mutual Fund series beyond the aforementioned benefits of the “Broad” index. We have summarized some of these considerations and additional trade-offs below:

- Securities Lending: Relative to the CIT series, whereby securities lending occurs only at the security-level within the underlying asset class funds (i.e. the individual high yield bonds), the Target Date Mutual Fund series also has the ability to lend out the ETF holdings directly. JNK benefits from an active securities lending market, and this has the potential to significantly impact fund returns experienced by plan participants – averaging roughly 50 basis points in return for the ETF annually over the last five years.

- ETF Liquidity: While our discussion on liquidity in this paper has focused on the improved trading and efficiency within the broader high yield market, the Target Date portfolio managers must also consider the market liquidity of the ETFs held within the glidepath. This impacts the ability to trade the daily participant cash flows and new client fundings as well as rebalance the funds. Relative to mutual funds, whereby transactions occur at the Fund’s net asset value (NAV), ETF trading can occur at a premium or discount to the NAV, potentially leading to tracking error within the Target Date Funds. The ability to buy and sell the underlying ETFs quickly and at a reasonable cost is fundamental to our goal of efficient implementation. JNK has a three-month average bid-ask spread of $0.01 and consolidated average daily volume of over 10 million shares (three-month average), as of October 31, 2022, reflective of the significant scale and liquidity within the vehicle. (Source: SSGA SPDR Trading Report, October 2022).

As a result of these considerations, we will continue to monitor the case for making a change within the State Street Target Retirement Mutual Fund series, but will not be making a change as part of this enhancement cycle. All else equal, we remain convinced of the case for broadening high yield exposure and will continue to evaluate applying this potential change as part of our review process going forward.

In Closing

The State Street Target Retirement series follows a rigorous, transparent annual review process where investment decisions are constantly re-evaluated to ensure that they reflect our long-term investment beliefs. Following this framework, and avoiding changes based on short-term tactical views, allows the strategy to deliver an intuitive, transparent solution that seeks to maximize value for fee and deliver successful retirement outcomes to participants. Taking this long-term view has led us to focus on efficiency within fixed income rather than wholesale changes to the risk profile of the strategy.

Effective Q1, 2023, we will change the high yield benchmark within the State Street Target Retirement Collective Investment Trust series from the Bloomberg US High Yield Very Liquid Index to the ICE BofA U.S. HY Constrained Index. We will continue to monitor the case for making a change within the State Street Target Retirement Mutual Fund series, but will not be making a change as part of this enhancement cycle.

Concurrently, we continue to evaluate the split between US long government bonds and US intermediate government bonds during the wealth accumulation phase of the glidepath. As discussed at the outset of this paper, we will evaluate long-term risk and return, correlation benefits, and magnitude of expected downside protection of the two asset classes and announce any potential changes in the weeks prior to implementation to ensure that any decision made on behalf of plan participants will be representative of the most current characteristics.