State of the Market

Equity markets delivered impressive returns during the first three months of the year, led once again by the US. We pause to take a look at the current market environment and think about what it may mean for equity markets over the rest of the year. At the moment, there are few signs of stress within markets although exogenous risks remain present.

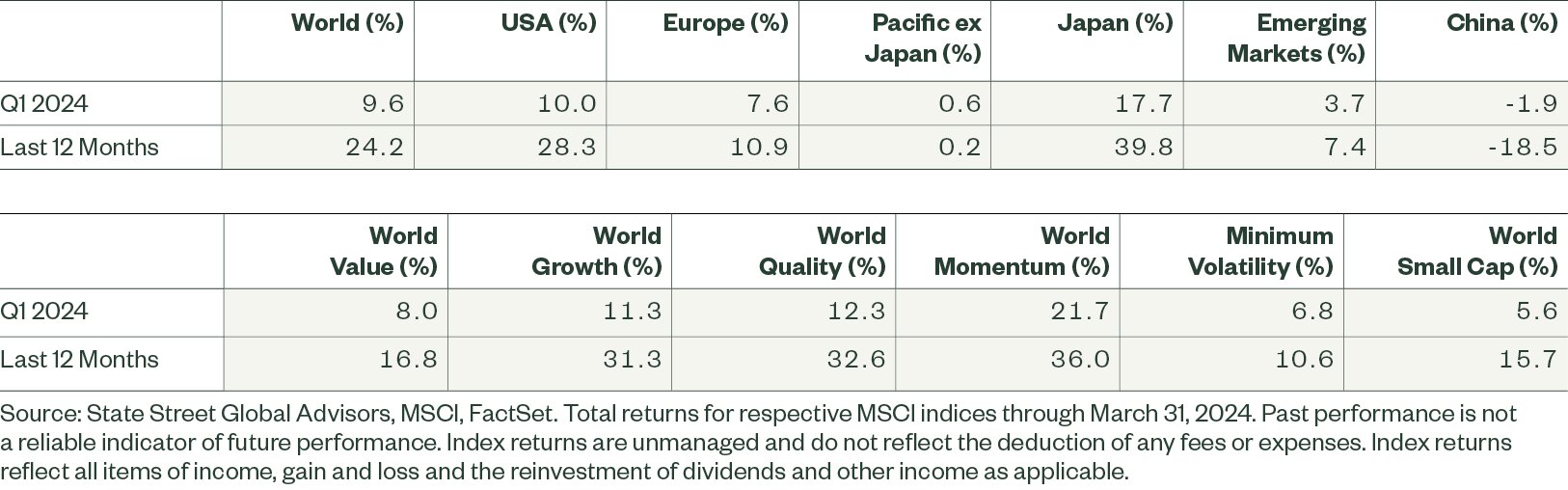

Equity Market Returns

Equity markets started 2024 with a ripping first quarter: developed markets posted a nearly 10% return, emerging markets were up around 4%, although dragged down by weakness in China. From a Style perspective Momentum dominated, as we wrote about in February, but Value, Growth and Quality were more than supporting players.

Figure 1: Global Equity Returns

Corporate Earnings and Valuations

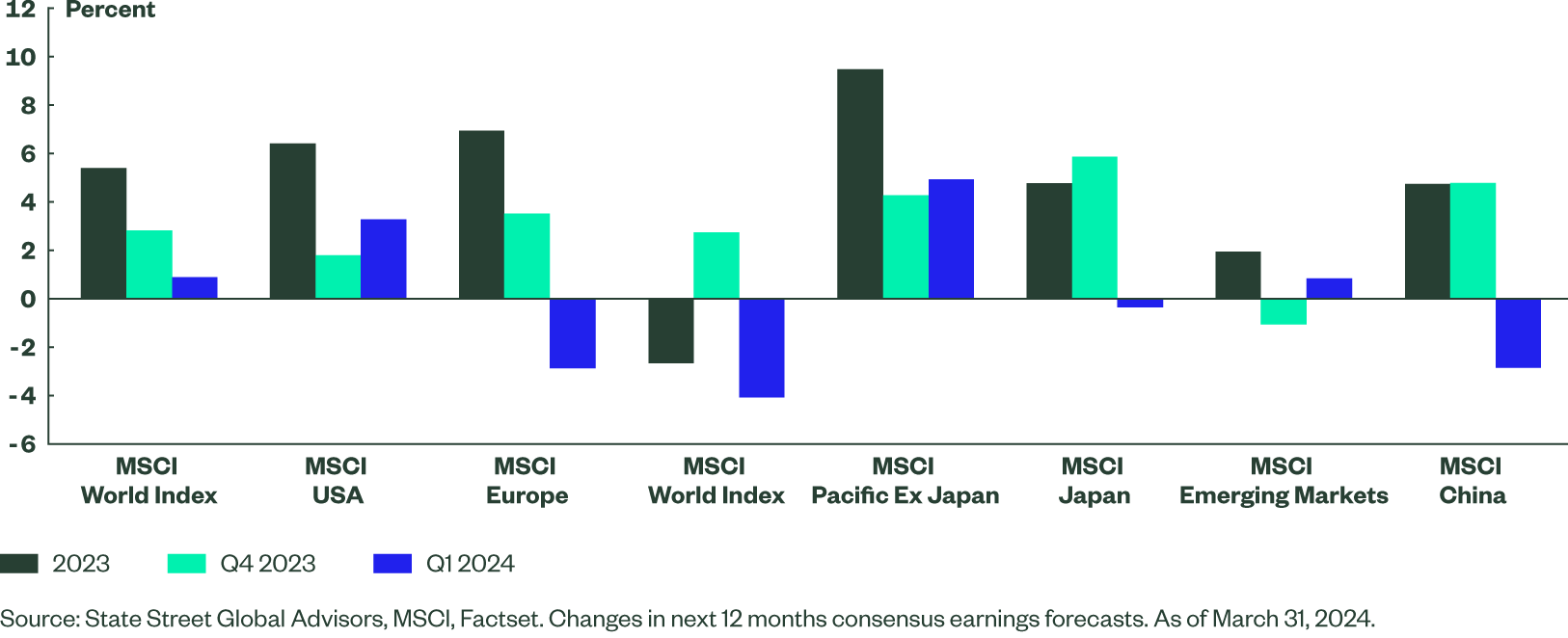

As we discussed last month, the recent strong equity market returns have been supported by growing earnings and increasing expectations for future earnings. While this earnings growth had been concentrated in US mega-cap technology-enabled companies, it has been broadening out more recently. However, we now see that the rate of revisions in analysts’ earnings forecasts over the most recent quarter has been slowing relative to the end of last year. While still positive in many markets globally, in some regions earnings are expected to decline.

We consistently believe that investors should balance returns and earnings with the price they are paying for those earnings, i.e. valuations matter. Although valuations have become a little more expensive this year, they are not extreme, but will require continued robust earnings to support them. Developed markets, in aggregate, are currently priced at around 19 times earnings expectations for the next 12 months, compared to 17 times at the end of last year. Emerging markets, and in fact most markets outside the US, sit on a valuation discount to US equities. An investor would only need to pay 12 times the next 12 months’ earnings to buy emerging markets exposure, for example, as of the end of March. For the more expensive parts of the market, the risk of slowing earnings momentum is something equity investors should watch closely.

Figure 2: Changes in the next 12 Months Earnings Expectations

As we negotiate the coming reporting season, and the rest of the year, we will gather more information on the path of earnings and gain a better understanding of the interplay between the macro and the micro. Specifically, the dynamics around the path of inflation, interest rates, inflation and to what extent higher rates will erode corporate profitability are finely balanced and hard to predict at present.

Stock Correlations and Dispersion

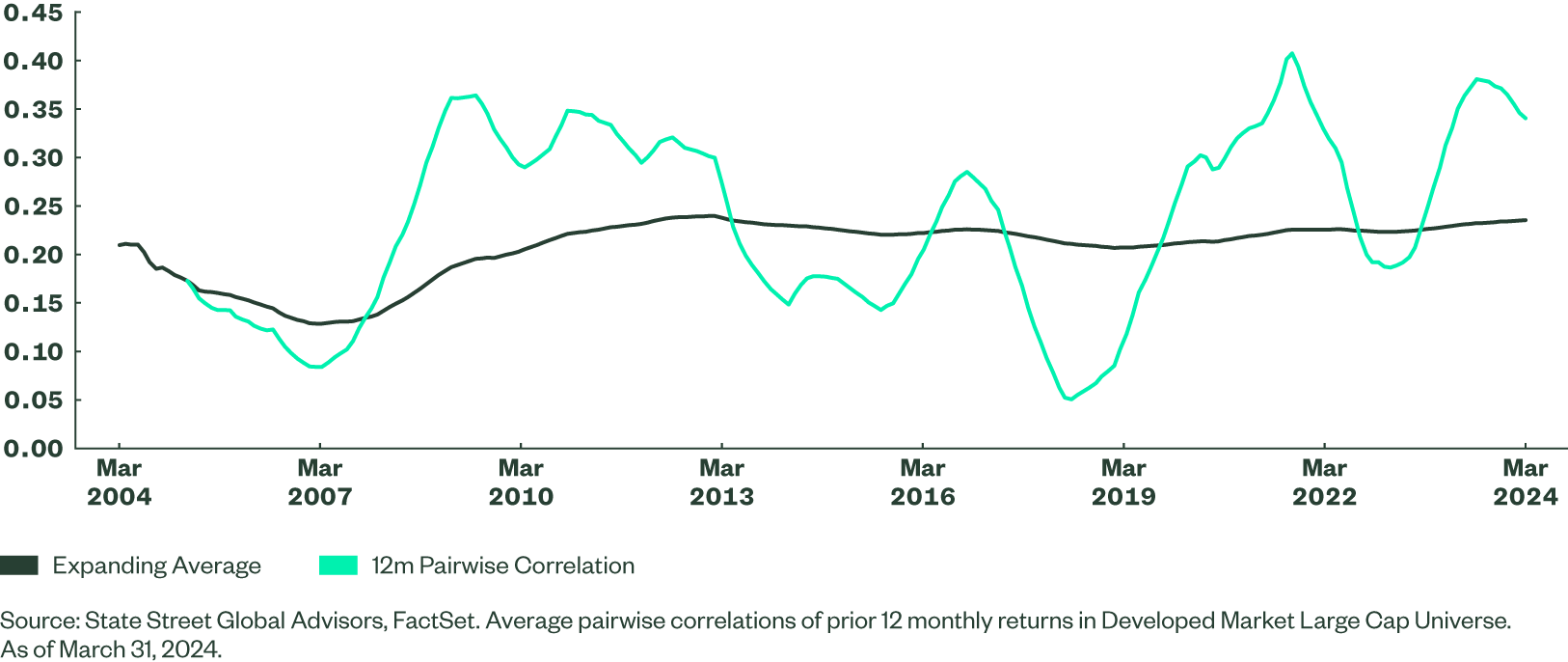

Over the past few years, equity markets have been very focused on a few narrow drivers of return including trade wars and COVID, artificial intelligence and inflation. This has led to elevated correlations between stocks. High correlations often point to markets driven by a single, or at least small number of, risk factors. This can lead to a winner-takes-all market environment and may cause headwinds for active stock pickers if all stocks are being pushed in the same direction by the same exogenous driver.

We can measure this trend through calculating an average pairwise correlations across all stocks within the market. Encouragingly, there are signs that so called pairwise correlations between stocks are starting to roll over again.

Figure 3: 12-month Rolling Pairwise Correlations

The exact driver for these changes is hard to pinpoint, but recently many investors have started to anticipate a higher-for-longer rates environment. In this regime higher debt servicing costs for companies and tightened financial conditions may well push investors back towards fundamentals and away from the higher-level macro and thematic positioning. A reversion towards the long-term mean correlation could benefit stock picking strategies, with markets interested in company fundamentals and idiosyncratic characteristics once again.

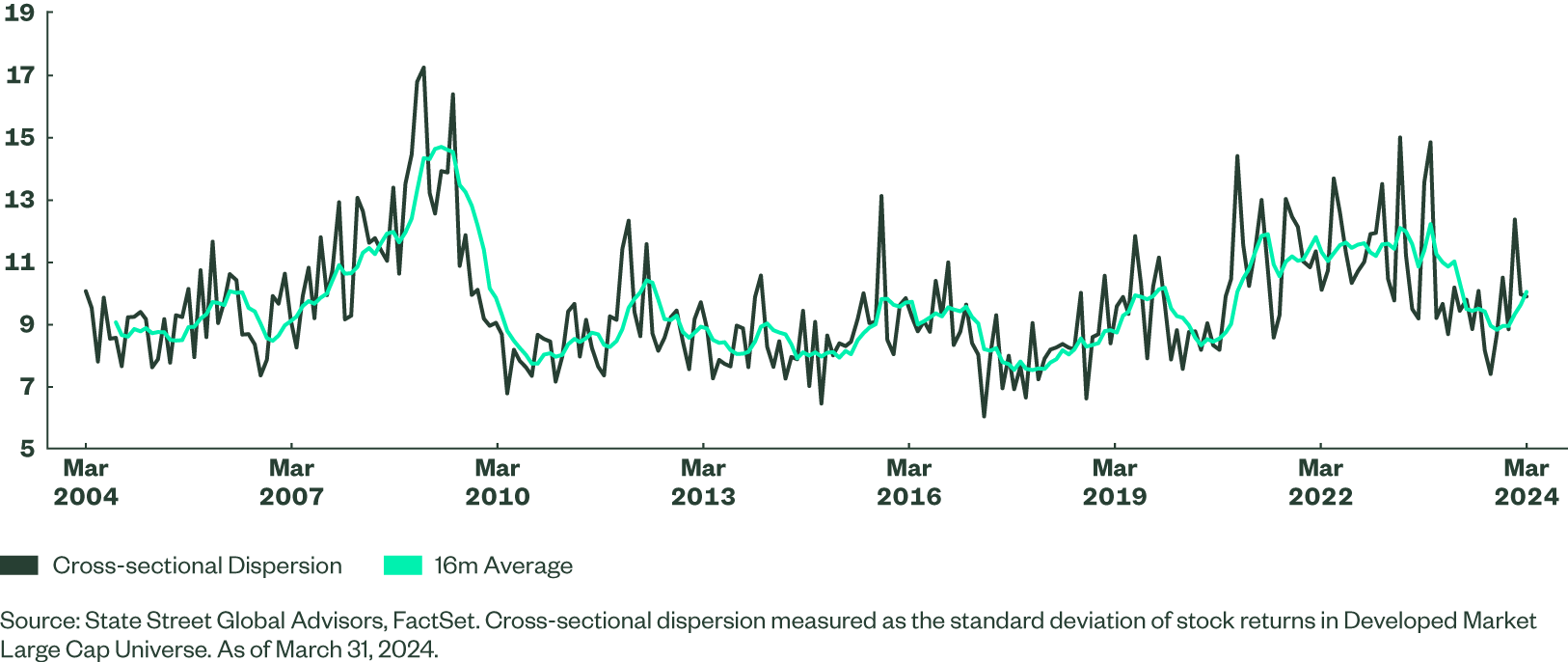

Cross-sectional dispersions, which measures the spread of returns between stocks, is another useful variable to assess the market environment. In the post-Global Financial Crisis (GFC) period dispersion was unusually low, before picking up again in 2018-2019 and into the COVID period. After a brief dip, there are signs that dispersion is picking up again back towards long-term average levels.

Figure 4: Cross-Sectional Dispersion Between Stocks

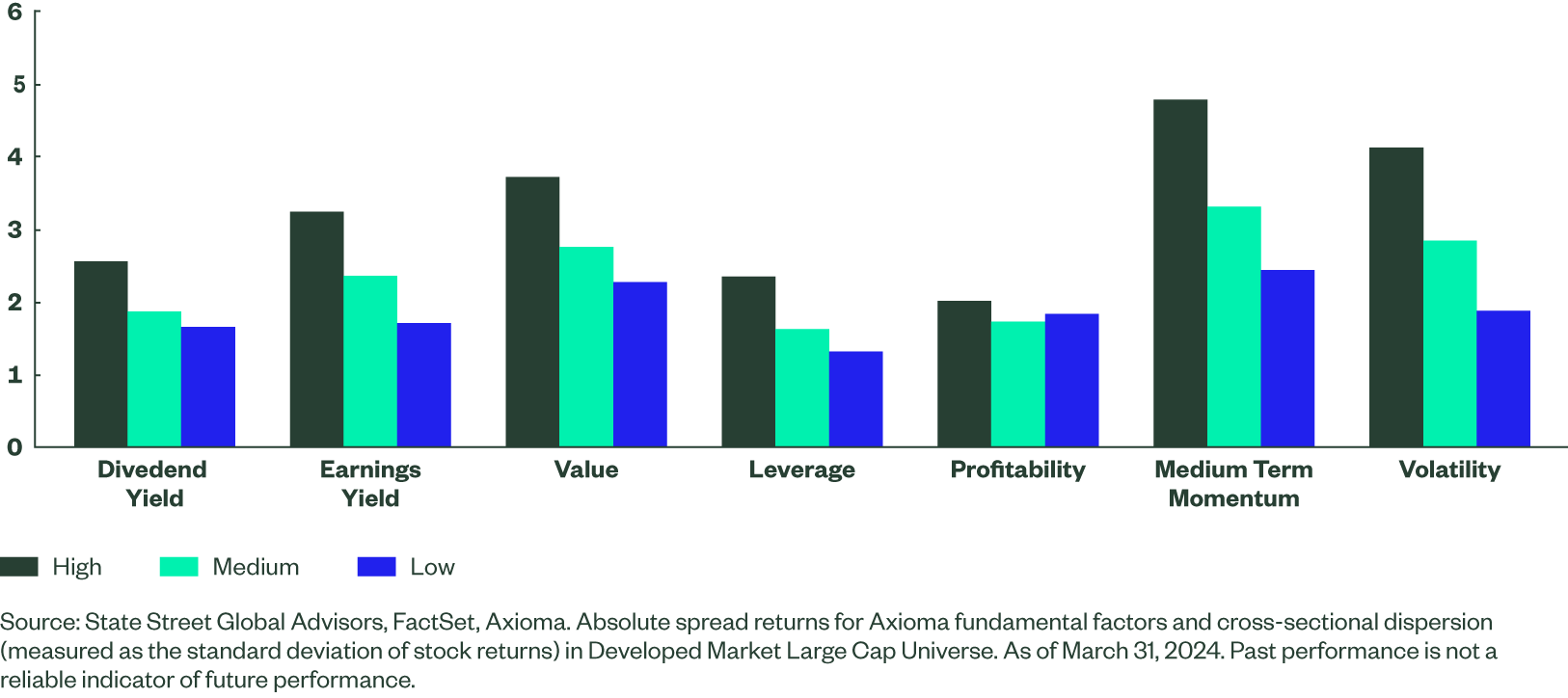

For active managers, higher dispersion can also be beneficial as it implies higher differentiation between returns for the winners and losers, and therefore higher active returns for skilled investors. Being on the on the wrong side of high dispersion can be painful, however. To illustrate, we can look at the average absolute returns of fundamental factors in regimes of high, medium, and low dispersion. As expected, returns are higher in high dispersion periods, indicating opportunities for excess returns in these regimes.

Figure 5: Fundamental Factor Absolute Spread Returns

The Bottom Line

Despite a robust start to 2024 in equity market returns, many indicators are pointing to a well-functioning market environment. Market returns are supported by expected growth in earnings, while valuations are elevated but not extreme in most parts of the market. Similarly, within markets, correlations between stocks appear to be heading back to more normal levels and dispersion is stabilizing around long-term averages.

We believe company fundamentals are even more critical in this environment, as the market evolves to be more supportive of stock picking and less driven by top-down views and stories. However, as always, we do not want to put all our eggs in one basket and do not bet on any single market outcome. We build diversified portfolios with abundant drivers of return which we believe will grow in many market environments.