The Case For a Strategic Allocation Amidst An Inflation Rollercoaster

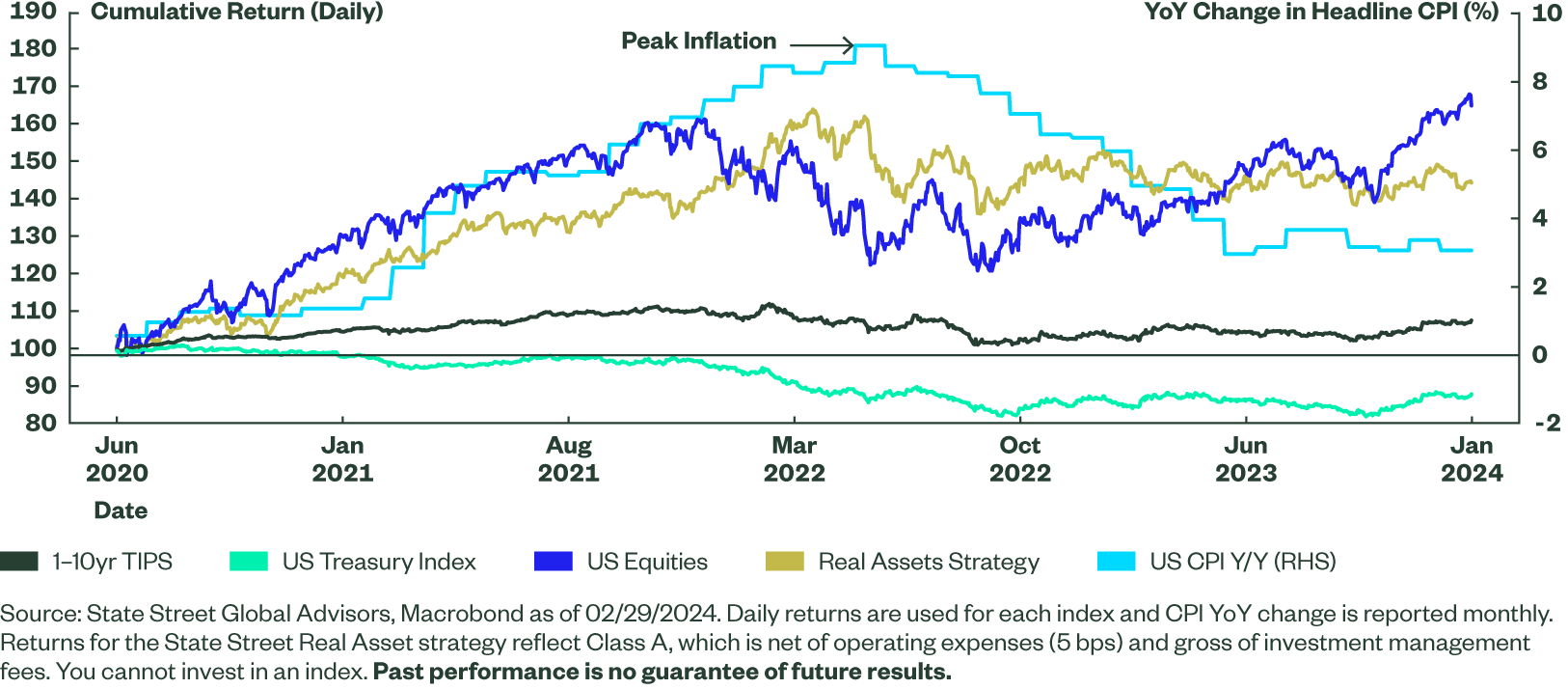

The recent surge in inflation that continues to impact market sentiment actually peaked in June of 2022, when the headline Consumer Price Index reached 9.1% Year-over-Year, its highest level in decades. While higher prices are still very much part of daily conversation, the period since has been marked by disinflation in the wake of an aggressive hiking cycle from the federal reserve. As of year-end 2023, inflation had moderated to a 3.1% year over year increase.1 Still, market history suggests that inflation has a tendency to come in waves, and disinflationary trends are rarely linear.

Rising geopolitical tensions, increased stress on supply chains, the possibility the Fed implements rate cuts too early and the potential for shelter costs to re-accelerate are risks that could alter the disinflationary trend. Recent trends in core CPI have highlighted sticky inflation as a concern, not only for asset managers but for investors as well. According to State Street’s recent Global Retirement Reality Report (GR3), 74% of respondents listed inflation as their top barrier to retirement.2

Defined Contribution investment menus should be built with participant needs in mind – and participants, especially those nearing retirement, have clearly stated a need to address inflation. That said, while their presence has increased, inflation hedging options have historically been underrepresented in DC plans, in part because inflation had remained low for the better part of 30 years. That backdrop changed starting in 2020, and changed quickly. The current inflation cycle provides an opportunity to evaluate inflation hedging options for Defined Contribution participants – both in terms of how they fared during the inflationary spike, and how they are positioned for an uncertain future. The potential for resilient – or at the very least volatile – inflation in the near term highlights the importance of an effective approach to inflation hedging.

Evaluating the Current Landscape

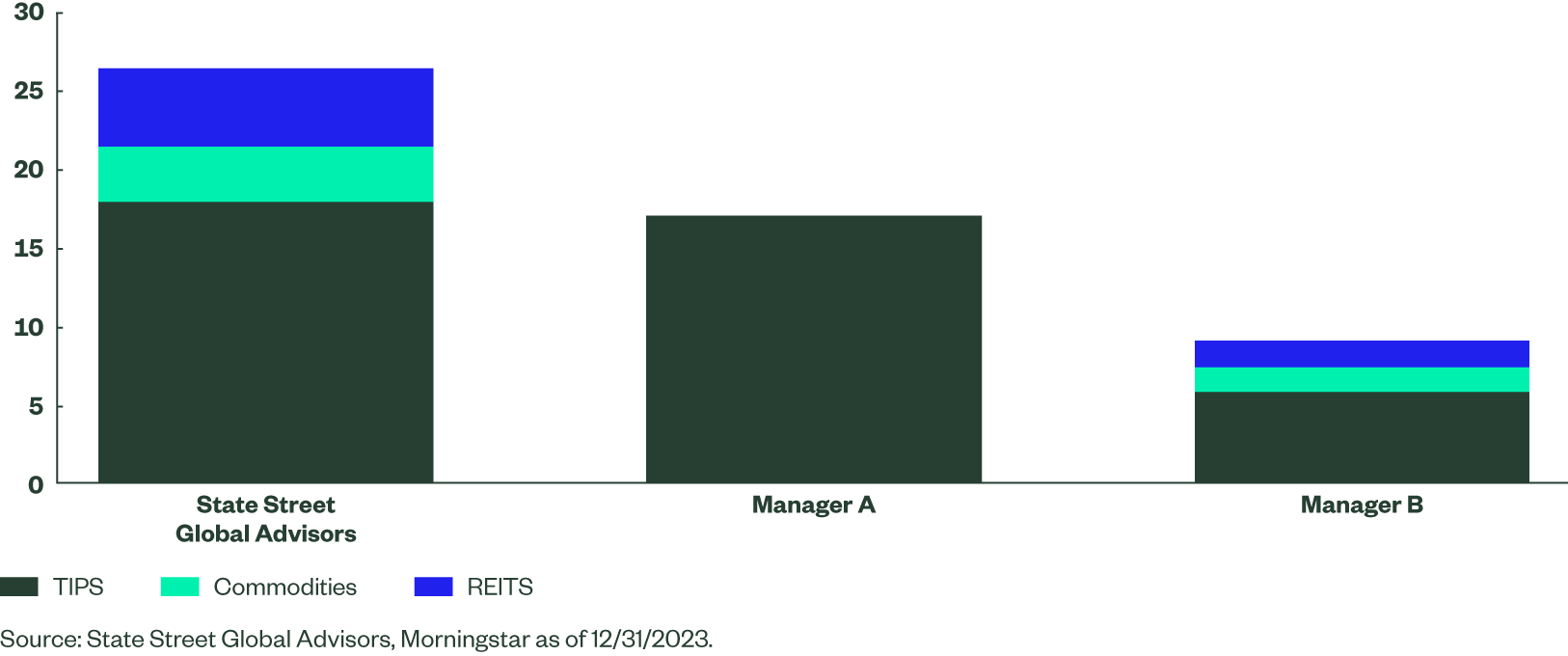

The footprint of inflation sensitive options in DC plans is noticeably light. Simply put, there aren’t many. 35% of plans offered inflation-protected bonds (i.e. TIPS) in 20233, while standalone options like Commodities, REITs and Diversified Real Assets are far less prevalent. Even when offered, inflation sensitive options consistently garner less than 2% of plan assets (similar to other seemingly niche options like emerging market equity or high yield fixed income).4 Plan defaults are more likely to offer some level of inflation hedging, but even that is mixed. While the vast majority of Target Date strategies offer TIPS exposure, the overall allocation and diversification within inflation protection is quite mixed.

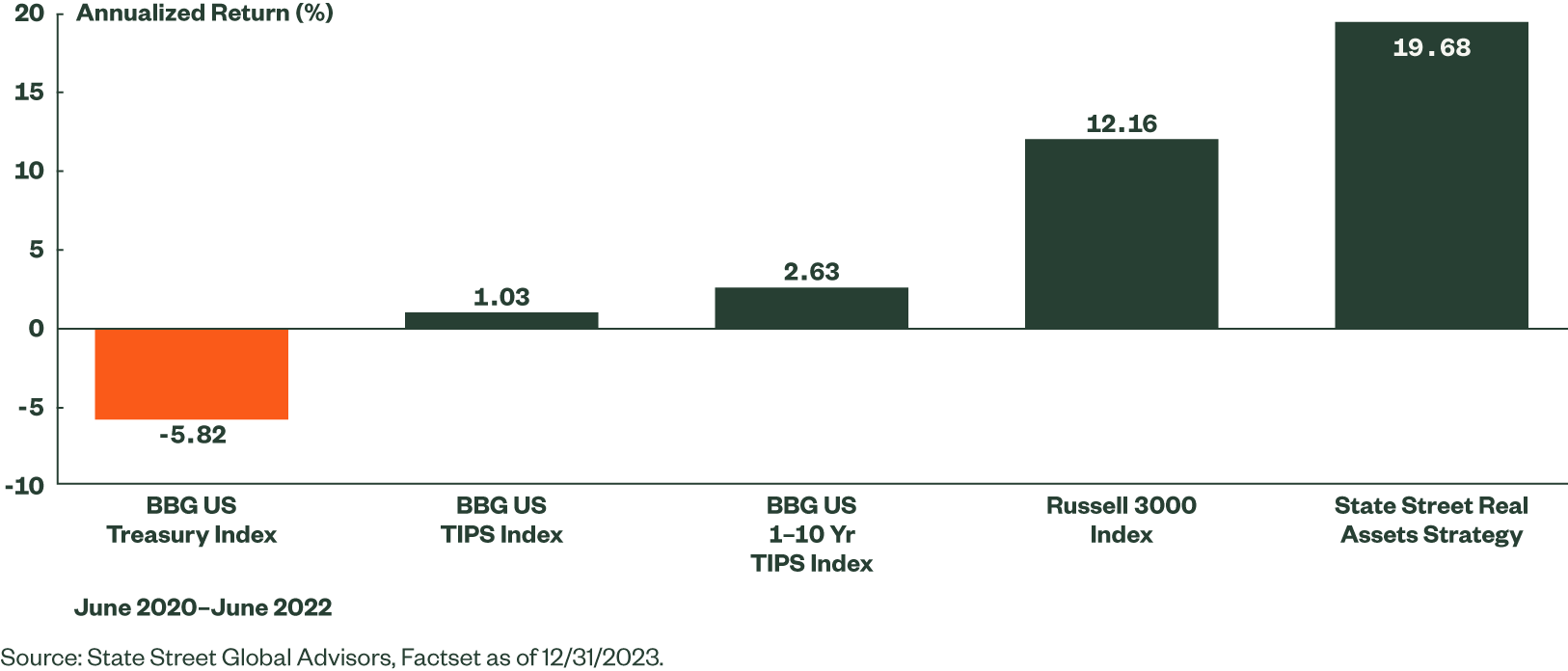

TIPS are most widely on plan menus because they offer mechanical tracking of inflation with limited volatility. In a rising inflationary environment, TIPS will provide inflation protection and perform better than their nominal bond equivalents, but they will likely generate returns that are less than desired as an inflation hedge. Because TIPS are indexed to inflation, their principal adjustments are backward-looking by nature, and as such they tend not to perfectly hedge unexpected inflation. While TIPS outperformed nominal bonds of similar maturities in the recent period of rising inflation, they did not provide meaningful inflation protection due to the sensitivity to real interest rates. While managing duration within TIPS exposure can help – State Street utilizes a 1-10 Year TIPS index over broad TIPS – rising interest rates have adversely impacted performance.

Further, while US Equities have remained remarkably resilient through this period on the back of strong growth – bucking the historical trend where equities have underperformed in periods of rising inflation – this has not come without volatility. The peak in inflation in 2022 corresponded with a significant equity market selloff.

Figure 1: Real Assets Shined As Inflation Peaked

Figure 2: Performance in a Period of Rising Inflation June 2020 (Bottom) - June 2022 (Peak Inflation)

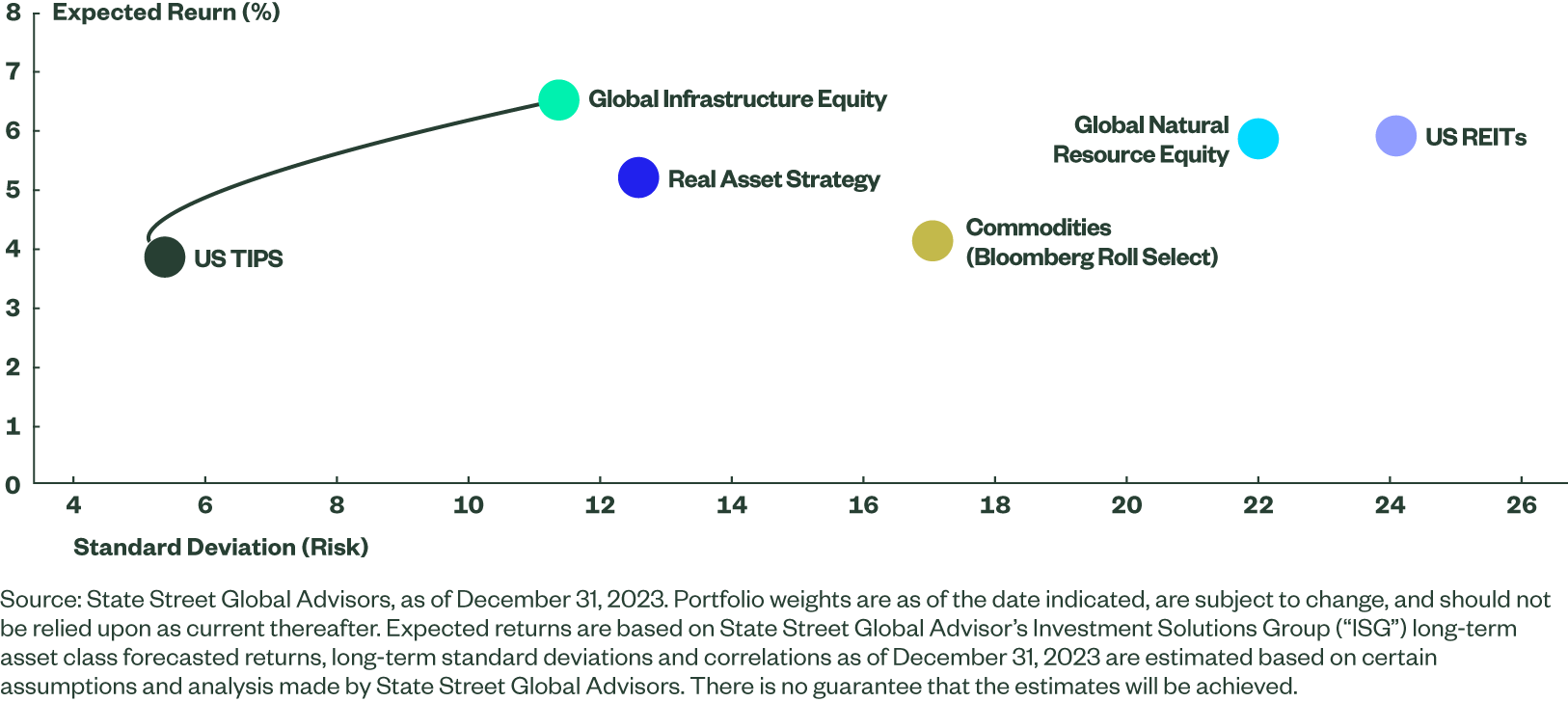

State Street offers core menu investors a seasoned, diversified multi-asset strategy composed of a blend of commodities, TIPS, REITs, infrastructure, and natural resource equities. This multi-asset approach, featuring the diversification benefits of five distinct asset classes, allows the strategy to seek a positive real-return in excess of CPI over a full market cycle, similar to the long-term return expectations of a moderate balanced portfolio with a volatility profile in line with a longer-dated TIPS index The Real Asset Strategy is expected to perform best during periods of accelerating and/or unexpected inflation. The strategy is meant to be a complement to traditional equity and bond assets, providing further diversification, attractive returns, and a source of income.

The Real Assets strategy remained more resilient through peak inflation, providing a buffer for investors as equity markets recovered. A diversified approach makes sense as different asset classes respond to different types of inflation (e.g., expected/unexpected) at different times in the market cycle. Combining asset classes that are volatile on a standalone basis -- and often considered unsuitable for core investment menus -- such as Commodities, REITs and Global Natural Resource stocks, provides a more stable allocation for participants through all phases of the market cycle by blending growth and defensive characteristics. For example, Commodities have performed best during periods of rising inflation or unexpected inflation due to their ability to reprice quickly based on economic conditions and shifts in supply-and-demand dynamics. REITs have demonstrated the ability to perform well across different inflationary regimes, particularly during periods of stable and rising inflation, due to pass-through effects where REITs can adjust rents and pass along price increases to tenants.

State Street Real Assets Strategy

A diversified, risk-managed approach to inflation hedging

| Asset | Benchmark | (%) of Strategy |

|---|---|---|

| Commodities | Bloomberg Roll Select Commodity Index | 25 |

| Global Natural Resources | S&P Global LargeMidCap Commodity and Resources Index | 25 |

| Global Infrastructure | S&P Global Infrastructure Index | 20 |

| US REITs | Dow Jones US Select REIT Index | 10 |

| US TIPS | Bloomberg US Govt Inflation-Linked 1-10 Year Index | 20 |

Figure 3: Multi-Strategy Real Asset Efficient Frontier

Focus on Participants

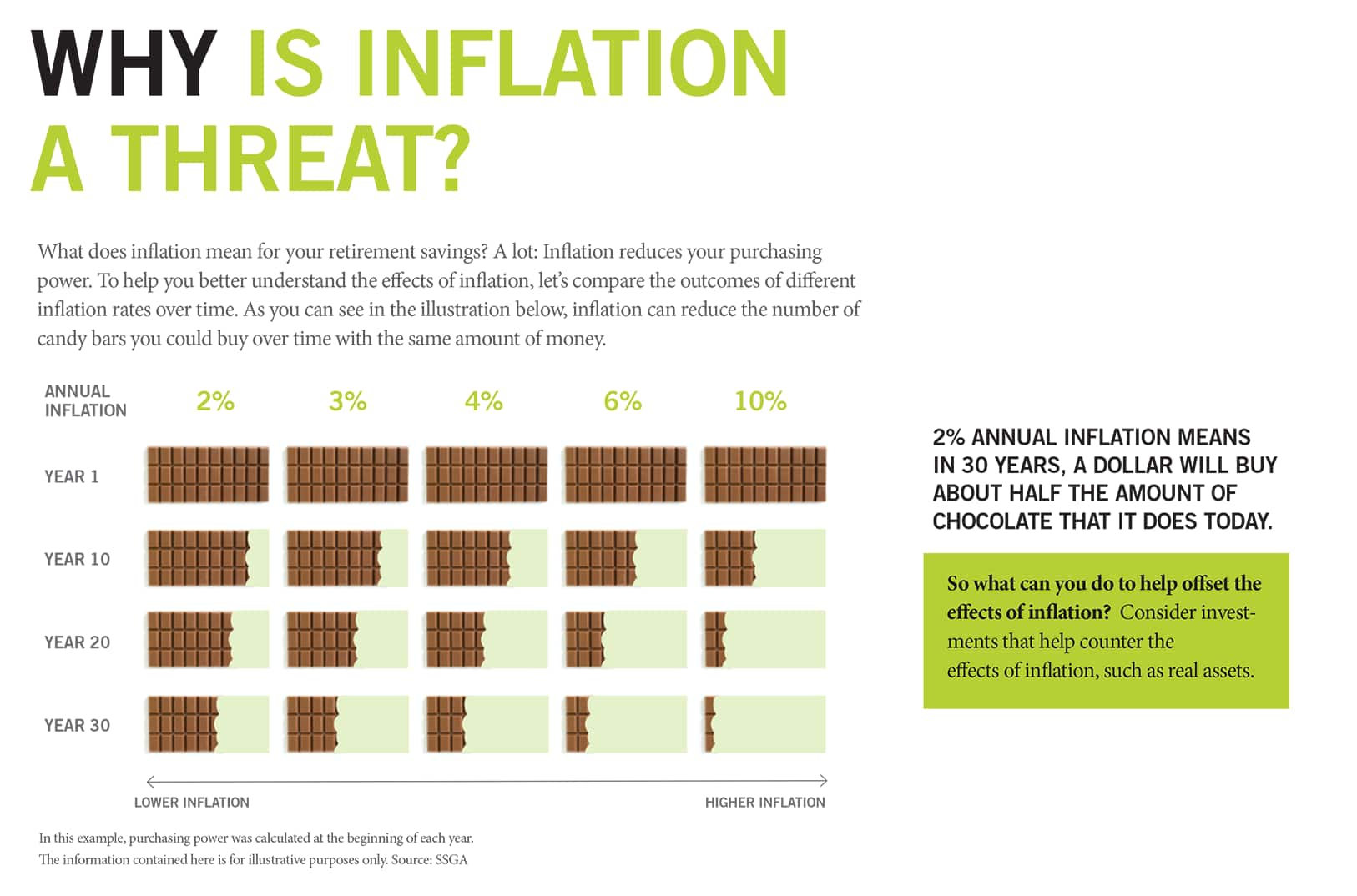

The Real Assets strategy is designed as a potential strategic allocation for plan participants, blending growth and defensive characteristics with the goal of outpacing inflation while managing risk. However, these benefits are not meaningful if participants are not actually using the strategy; outreach highlighting your Real Assets offering and palatable education explaining the potential benefits is important here. Financial sophistication aside, all participants may relate to messaging that puts the effects of inflation into real life context.

Consider our candy bar example:

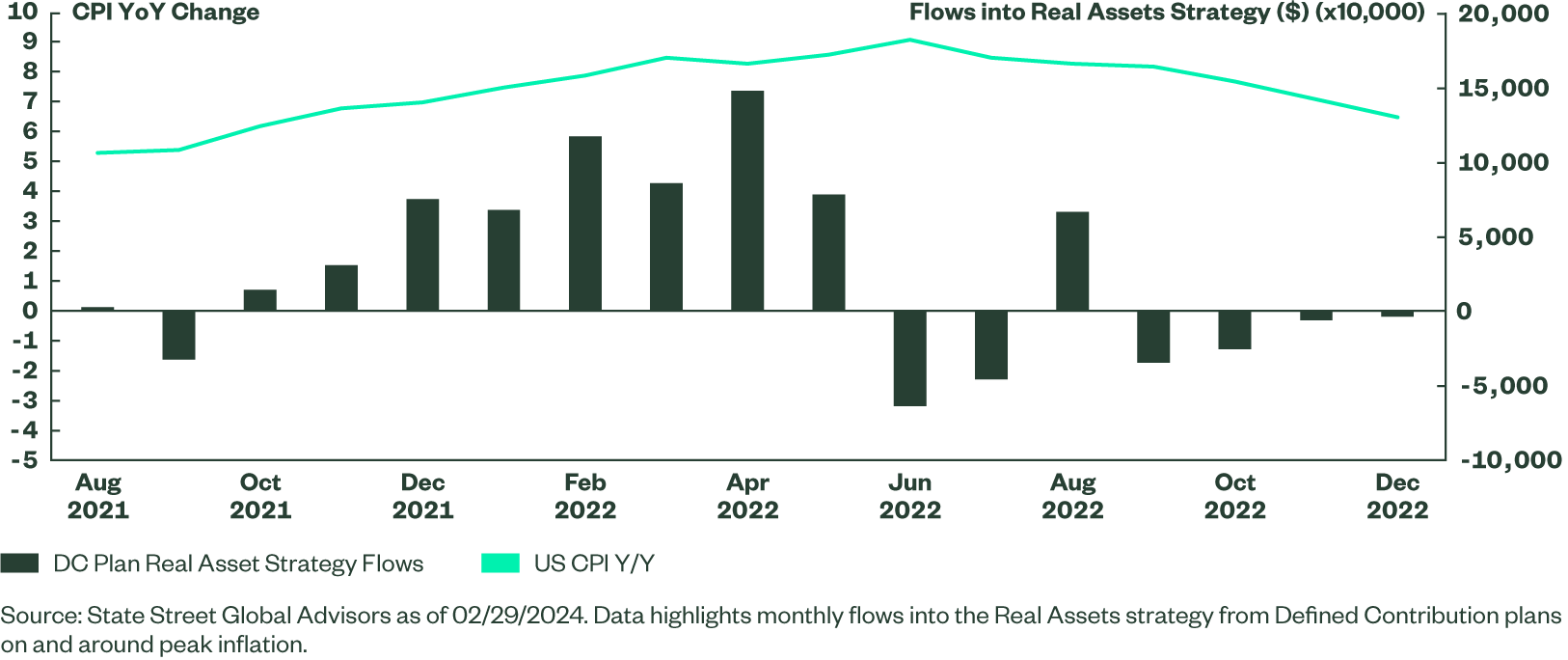

A straightforward approach, supported by simple and effective messaging can make a significant impact on participant behavior. Encouragingly, looking at flow data for the strategy, we observed a significant increase in adoption by plan participants as inflation was rising.

Figure 4: Real Asset Flows Increased as Inflation Rose

Don’t Forget the Default

We believe that plan sponsors would benefit from a diversified approach to real assets that provides growth potential beyond TIPS and manages the standalone volatility associated with the individual components. A strategic, low-cost approach promotes ease of understanding for plan participants in terms of the objective of the strategy, an State Street is able to provide robust participant engagement support to highlight the value of inflation protection.

However, the reality is that the majority of participant flows going forward will be allocated to the plan default. In a similar story to DC core menus, inflation protection has largely been underrepresented in Target Retirement glidepaths – both in terms of absolute allocation and the building blocks that are utilized.

State Street’s Target Retirement strategies place a high priority on inflation for participants approaching retirement, providing a diversified approach to real assets (commodities, REITs and TIPS) to meaningfully address the potential erosion of purchasing power during the spending phase. The result is a portfolio better designed to address inflation risks in the context of other key investment risks that participants face – namely market volatility and longevity. The last three years may serve as a prescient example of the impact that erosion of purchasing power (and loss of principal from rising interest rates) can have on retirees who lack sufficient exposure to inflation sensitive assets. Over this time, State Street’s Target Retirement Income Fund which is typically used by retirees has outperformed 94% of peers.

Figure 5: Inflation Sensitive Asset Classes in TDF Income Funds