How A Taft-Hartley Plan Revived Retirement Readiness

The situation: Inertia, age appropriate asset allocation, and diversification deficits

A Midwest union defined contribution plan, led by its 10-member Board of Trustees, is a respected member of the multi-employer employee benefits industry, due in large part to its conscientious approach to benefits management.

For the trustees, the responsibility extends beyond the defined contribution (DC) and defined benefit (DB) plan details to the lives of the individuals they serve. It’s the human element that has driven the board’s decisions for plan action, most notably over the past five years.

While the DC construct continues to find its place within the DB-dominated Taft-Hartley retirement infrastructure, the approach outlined here offers a blueprint for assessing and optimizing DC outcomes.

Today’s DC plan (the “Plan”) originated as a monthly balance-forward, money purchase plan in 1982 and was evolved into a daily valued mutual fund bundled approach in 1997. As plan assets grew significantly, that design was transitioned in 2009 to an unbundled hybrid commingled and mutual fund lineup, heavily weighted toward less expensive commingled funds. In 2016, the Plan transitioned recordkeeping services to John Hancock.

With the move to John Hancock came the appropriate cascade of participant communications, including an enrollment kit containing a QR code to enable seamless account sign-up. Despite the multimedia outreach, many participants did nothing. By 2018, an analysis conducted by John Hancock showed that 80% of participants had not established a user ID and logged in to the John Hancock portal. Furthermore, an analysis of participant investment decision-making conducted by RVK Inc., the Plan’s investment consultant, highlighted a lack of age-appropriate asset allocation selections (Figure 1). According to Josh Kevan, senior consultant at RVK and the Board of Trustees’ relationship manager, “Age-appropriate asset allocation is the single most important metric in assessing participant utilization of the DC plan investment menu, and it is critical to look beyond simple averages. Plan averages can be misleading; it’s the individual experience that counts.”

For the Plan, with $2.2 billion assets under management (AUM) at the time, only 26.8% of invested assets were in the default target date fund (TDF). Nearly an equal portion of assets lay in the S&P 500 (27%), while 14.7% were in stable value. Most concerning to the board was that the majority of participants were invested in only one fund, and given that TDFs represented only a quarter of asset allocation, that meant deficient diversification and real risk exposure to plan participants. In fact, some participants were 100% invested in a small cap fund. As reflected in Figure 1, aggressive equity exposure was concentrated among those closest to retirement, a cohort with the shortest runway for recovery and therefore with the most to lose in the face of a market disruption. Additionally, many younger participants had allocations that were much too conservative given their time horizon until retirement.

Figure 1: Participant Equity Risk Allocations as of November 30, 2018 (Before Reenrollment)

Source: Participant information as of November 30, 2018, provided by John Hancock. Allocations shown may not sum up to 100% exactly due to rounding. Aggressive/conservative allocations exhibit equity exposure that is beyond +/- 15% of the equity exposure for an age-appropriate target date fund.

In addition to almost half of the participants being outside the range of age-appropriate investments in the RVK analysis, the concentration of stable value investment (14.7%) pointed to overly conservative portfolios as well. A possible explanation for the stable value concentration was inertia. Before the Pension Protection Act of 2006 established TDFs as one of three approved default options for DC plans, stable value had been the Plan’s default investment.

A unique dimension of this plan population was that as a result of a 1996 union membership vote, about 3,000 participants had their participation in a defined benefit plan frozen and those contributions were allocated to the DC plan, while the balance of participants remained enrolled in both DC and DB plans. At the time of this change, the equity markets were strong and the seceding participants, most of whom were in their early career, assumed greater growth capture through the DC plan. Twenty-two years later, the board wanted to make sure that these mid- to late-career DC-only investors had the best opportunity for appropriate investment allocations to achieve retirement readiness.

The solution, part 1: Straightforward data, complicated consensus

The combination of investment inertia and subpar diversification signaled to the board that the issue required more than participant education. In fact, participants already had access to a third-party service provider to offer retirement readiness seminars targeting people 55 years old, with little impact on the glaring investment allocation issues. This same provider was engaged to conduct financial literacy programs for all participants regardless of age.

The time seemed right for a TDF reenrollment campaign to stimulate participant decision-making and to help deliver optimal retirement outcomes.

“A [TDF] reenrollment campaign was not only the right thing to do — we considered it a fiduciary responsibility,” said the Executive Director.

The decision to proceed with an investment reenrollment was not easy for the Board of Trustees. “They take their fiduciary responsibility seriously and wanted to make sure they fully evaluated all of the pros and cons associated with such an action,” Kevan noted. By leveraging data in partnership with RVK to highlight the potential impact of participants doing nothing, the board ultimately concluded that an opt-out TDF reenrollment was the best path forward for the Plan’s participants and beneficiaries.

The board understood that “participants who are paying attention to their retirement investments don’t need a reenrollment, and they will have an opportunity to opt out if they choose to do so.” The real concern was for the disengaged participant population that lacked either the time, interest, or knowledge to manage their retirement assets. The trustees agreed that action was unignorable, “How can we desert our brothers and sisters on this critical issue?”

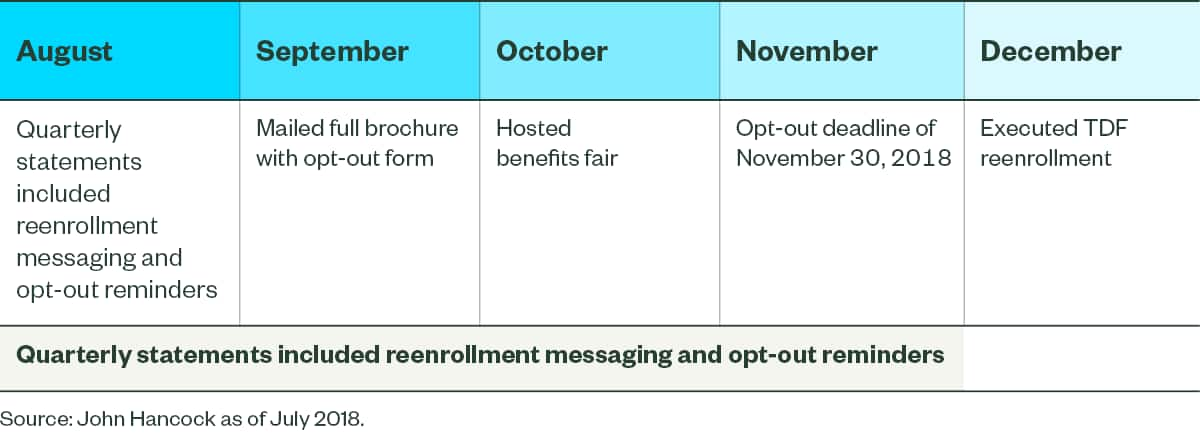

Following trustee approval, the reenrollment campaign rolled out with a monthly structure of communications, beginning in August and culminating in a November 30 opt-out deadline.

Figure 2: TDF Reenrollment Communications Calendar

As part of the communication efforts, the Plan developed a concurrent segmentation strategy targeting pre-retirees. Delivering customized communications to this audience aged 55 and older, the board leveraged the existing third-party participant education resource to help participants understand how the reenrollment could impact their investments as they neared retirement.

The Plan was both thoughtful and thorough in its communications approach, and shared that the investment was partially offset by ERISA-sanctioned revenue-sharing. This is a tactic other plans can pursue to counter campaign-costs-as-a-hurdle and cover or reduce associated expenses.

The solution, part 2: December volatility delivers reenrollment panic and proof-point

The reenrollment took place mid-December 2018. But what should have been a quiet trading month ended up being a volatile market period, with the S&P 500 plummeting by 14% on Christmas Eve, compared with the start of the month.

This market activity caused some participants to panic, believing they had lost money that they wouldn’t be able to recoup at the same pace now that they were invested in a TDF. In most cases, however, these concerns were easily alleviated by providing participants with greater insights into how they were positioned both pre- and post-reenrollment, and how the age appropriate and diversified nature of TDFs provides each individual participant with a professionally managed solution that is dialed in to their unique time horizon. Older participants who had previously been overly aggressive in their allocations to equities were spared from even worse losses than they ultimately experienced, while younger participants who had been overly conservative could benefit from their long time horizon, the ability to purchase new shares at lower prices, and the ability to recoup short-term losses and maximize long-term growth.

With less than a 4% opt-out rate from the campaign, the Plan population experienced an extraordinary uptick in age-appropriate asset allocation, from 55% to 93% of the population (Figure 3). Viewed through an investment lens, the percentage of TDF assets went from 27% to 80.5% of the Plan. For the youngest savers, this could translate into greater savings balances than would have been achievable with a stable value-heavy portfolio.

“It absolutely changed participants’ lives,” the Executive Director said of the reenrollment campaign.

Figure 3: Participant Equity Risk Allocations as of December 31, 2018 (Following Reenrollment)

Source: Participant information as of December 31, 2018, provided by John Hancock. Allocations shown may not sum up to 100% exactly due to rounding. Aggressive/conservative allocations exhibit equity exposure that is beyond +/- 15% of the equity exposure for an age-appropriate target date fund.

The TDF reenrollment wasn’t the only enhancement the Board of Trustees made to its DC plan in 2018. The team used the campaign as an opportunity to execute two additional improvements in the service of furthering participants’ retirement readiness:

- Delivering a fuller financial planning portrait to participants by including DB balances and a Social Security calculator within the John Hancock-powered client portal

- Offering the option of partial distributions from the plan for retirees, with the objectives of providing much lower cost investment options inside the Plan and a trusted drawdown option and decumulation approach

The takeaways: Passion, proof-points, persuasion, and permission

“The biggest takeaway here is the courage displayed by the Board of Trustees,” Kevan said. “They were willing to do something that wasn’t easy and had the potential for negative feedback, but they did it because it was the right thing to do.”

Kevan noted that the initial plan investment analysis his team shared with the trustees — the one that catalyzed the reenrollment effort — is a standard tool that RVK utilizes to help their DC plan clients understand how well participants are utilizing the plan’s investment menu. He also noted that “while a reenrollment campaign won’t be the right solution for every situation, it often does make a lot of sense. Yet the number of plans that have opted to do so remains relatively small.” The Board of Trustees were willing to pursue a combination of quantitative and qualitative angles to determine that a reenrollment was the right choice for their plan and to gain buy-in from participants and other key stakeholders. This approach can be distilled down to four key takeaways:

- Passion: Believing in the life-changing benefit to participants, the trustees were willing to stake their reputation on the predicated positive impact of the program.

- Proof-points: Education and data delivered in partnership with RVK, including a review of the then-recent Illinois State Board of Investment TDF reenrollment success executed with T. Rowe, offered a quantitative case for the trustees.

- Persuasion: Underscored by an evidence-based belief, the validity and clarity of the data overcame potential concerns and initial reactions.

- Permission: Accrued trust from union members, built up over years of transparent decision-making, enabled greater participant buy-in.

- For most case studies, this is usually where the story ends. But in keeping with the Board of Trustees’ comprehensive approach, there’s more.

By May 2021, total DC plan AUM was up to $3 billion and, for the first time in the Plan’s history, a participant retired with an account balance of more than $1 million. In reflecting on the plan recalibration, the Executive Director noted that the TDF allocation dipped from 80.5% to 75%; however, the board continues to be pleased with the results and posits that the change in allocation could reflect the actions of more engaged participants pursuing customized strategies. Participant empowerment in conjunction with optimized outcomes is the best result of all.

Figure 4: Participant Equity Risk Allocations Before, Following, and 30 Months After Reenrollment

Source: Participant information as of November 30, 2018, December 31, 2018, and March 31, 2021, provided by John Hancock. Allocations shown may not sum up to 100% exactly due to rounding. Aggressive/conservative allocations exhibit equity exposure that is beyond +/- 15% of the equity exposure for an age appropriate target date fund.