UK Snapshot

COVID-19 has impacted almost every aspect of people’s lives globally. Whilst the short-term financial implications of the pandemic are front of mind for many individuals, we were interested to see whether these worries changed long-term savings behaviour. In this year’s Global Retirement Reality Report (GR3), we investigate the impact that COVID-19 has had on personal finances and behaviour around retirement planning. In this report, we share the results of our survey of defined contribution (DC) pension scheme members in the United Kingdom.

Key Findings

Whilst a third of UK savers in our survey said they have been negatively impacted financially by COVID-19 and have adjusted their short-term spending accordingly, this hasn’t yet affected long-term views around retirement confidence. The inertia of the UK’s auto-enrolment system continues to show strength, with only 7% of members having reduced or stopped their pension contributions (below the global average of 13%) and 80% taking no action with regard to their retirement savings.

Although not a direct result of COVID-19, we continue to see a lack of retirement confidence in the UK. One of the key reasons limiting retirement confidence was not having enough spare money to save for retirement. This, coupled with a strong desire from members for their employers to continue with contributions, highlights the importance of maintaining automatic levels of saving.

We were pleased to see a good sense of awareness from members about the risks of overreacting to market events and “selling at the bottom,” with almost 60% of the sample believing now is a good time to invest for the long term. Only 5% of members felt that they should sell stock market investments and switch into something lower risk. Members also showed an appreciation for lower volatility strategies and for companies that are managed responsibly with regard to the crisis. These findings provide useful insight into the kinds of funds members would like to see their savings invested in.

Key Finding #1: Almost a third of savers have experienced a deterioration in their financial situation since the COVID-19 outbreak

We began by taking a pulse check on the current financial situations of individuals, compared with the period before the COVID-19 outbreak. With 24% of the sample reporting to be furloughed from employment, our results were in line with data from the Office for National Statistics, which reported that 27% of the UK workforce had been furloughed and less than 1% had been made redundant between 23 March and 5 April 2020. 1

Given that a significant number of savers have seen an impact to their jobs and the income they receive, it is not surprising that almost one-third (31%) of our sample felt that they were worse off financially compared with before the outbreak. Whilst the majority (42%) of the sample said that their financial situation hadn’t changed, we may not see such a positive picture in the future as furlough schemes come to an end and redundancies increase.

Key Finding #2: Retirement confidence remains low

What impact does this change in employment circumstances have on retirement confidence? Are people thinking that far ahead? We asked our savers how optimistic they are that they will be financially prepared for retirement by the time they plan to stop working.

50% were not optimistic about their retirement.2

However, when we asked members the same question in 2018, we gathered similar results, suggesting that this lack in confidence may not be solely attributable to the COVID-19 pandemic.

Key Finding #3: COVID-19 is not the main factor affecting retirement confidence levels

Whilst 18% of the UK sample said that the COVID-19 situation was having a high impact on their retirement confidence levels, the majority (73%) said that COVID-19 was having low or no impact.

More pertinent than COVID-19 in the impact on retirement confidence was:

- No spare money to save for retirement

- Uncertainty about retirement plans

- Complexity of retirement savings system

However, some members displayed a degree of worry with regard to COVID-19:

“I am most worried about being able to save enough. I am too scared currently to put any more money into my retirement. I want a certain amount of cash around me for any emergency that COVID-19 could create for me and my family.”

Key Finding #4: Many think that the impact of COVID-19 will be short-lived

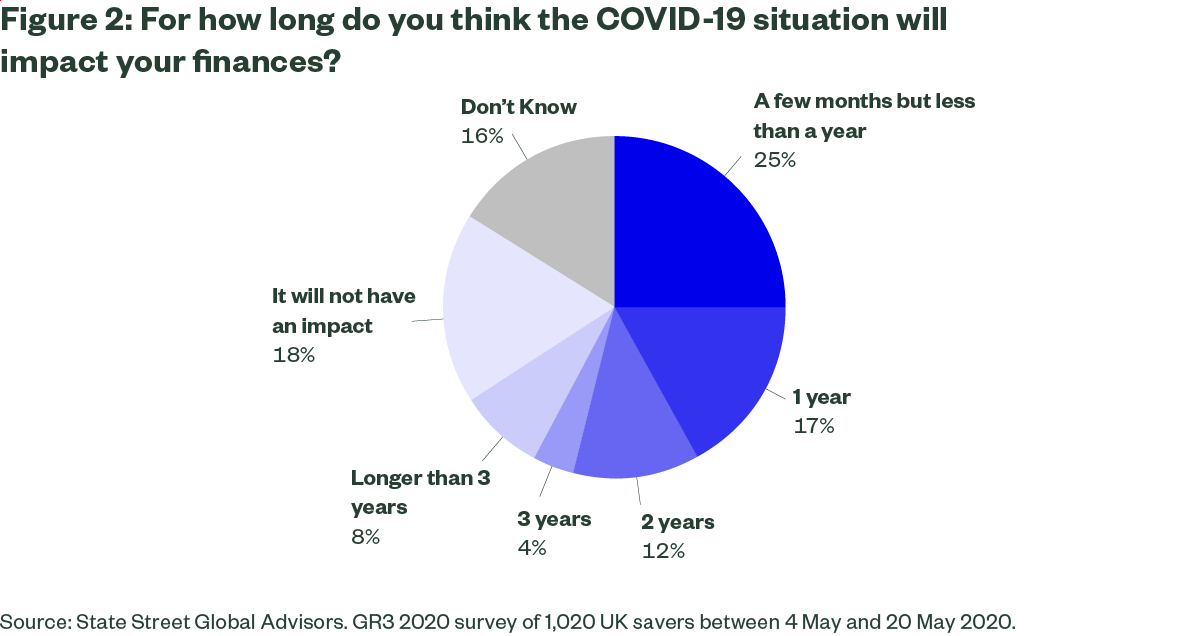

It was clear from our survey that the impact of COVID-19 had limited implications for long-term retirement confidence, suggesting that there is an expectation that negative financial impacts will be short-lived.

The majority of UK savers felt that the impact that COVID-19 would have on their finances would most likely last less than a year.

This view was shared among other markets surveyed, with the majority of members feeling that the effect COVID-19 will have on their finances will be no longer than a year and a half.

Whilst we could take comfort from members not expecting a long-term negative impact, we are still in the early stages of the crisis with a lot of uncertainty about the future state of the world.

Key Finding #5: Whilst most have adjusted their short-term saving and spending habits, few have made changes to their retirement saving behaviour

Our survey results show that there continue to be low levels of engagement from members when it comes to saving for retirement. Whilst a significant proportion of savers have recently adjusted their short-term saving and spending habits, the majority have not thought about their retirement savings plan. Only 7% of UK members claimed to have reduced or stopped their pension contributions, which is below the global average of 13%.

We asked members if they had taken any other actions with regard to their retirement savings plans such as checking balances more regularly or seeking financial advice. Whilst 13% had checked their balances more regularly, the majority had taken no action whatsoever.

80% of members had not taken any action with regard to their retirement savings plan.

Inertia has meant that the majority of members have not thought about their rate of saving, and are therefore continuing to save for their future even in a time of financial difficulty.

Key Finding #6: Savers would not be happy for their employer to pause contributions into their retirement savings plan

Given the difficulties that thousands of businesses in the UK have faced during the pandemic, we asked savers whether they would be comfortable with their employer stopping retirement contributions temporarily if the employer were struggling to survive in the current climate.

Across all of the countries surveyed, half (50%) of members said they would disagree with the idea of their employer stopping contributions; UK members felt even more strongly about the matter, perhaps because of the precedent that auto-enrolment has set.

Nearly 60% of members would not want their employer to pause pension contributions.

Key Finding #7: Equities are seen as a good long-term investment, but members prefer lower volatility

March saw 20%+ falls in stock prices and record-high levels of volatility. Whilst some investors flocked to safe assets, others took the opportunity to buy at potentially low valuations. The members in our survey indicated a sense of awareness about crystalising losses, with only 5% thinking they should sell their equity investments. Meanwhile, 59% of members thought that now may be an opportunity to invest in the stock market for the long term.

However, the majority said they would prefer an investment that had a lower expected return but with less chance of loss.

59% would prefer lower expected returns if it means less chance of loss.

Key Finding #8: Almost a third of members are in favour of responsible investments

The COVID-19 crisis has shone a light on the way that companies are managed with regard to environmental, social and corporate governance (ESG) principles. Immediate issues such as employee health, serving and protecting customers, and ensuring the overall safety of supply chains have important implications for company performance.

We explored the extent to which savers shared this view and whether they would prefer their retirement savings to be invested in companies that have taken some of these issues into account in their response to the crisis.

Close to one-third of respondents said they would want their retirement savings invested in companies that treated their workers well during the crisis.

Closing thoughts

- We continue to see a lack of retirement confidence in the UK because of long-standing issues such as having no spare money, uncertainty around retirement plans and complexity of the retirement savings system. This reinforces the need for automation to keep members enrolled and saving and clear communications to help navigate uncertainty.

- Members expect the impact of COVID-19 to be short-lived, aren’t changing their retirement saving behaviour and don’t believe their employers should either. Auto-enrolment has laid strong foundations in the UK pension system. Whilst company priorities are understandably going to be focused on staying in business in the short to medium term, it is critical that retirement savings are not put on the back burner and we don’t undo the good work of what we have achieved so far.

- A preference for investments with lower volatility came through, even if this means lower returns. Big drops in value have the potential to knock members’ confidence, and it is therefore important that defaults incorporate mechanisms to limit severe drawdowns and that these benefits are communicated to members.

- Managing the social impact of the crisis is seen to be important, with immediate issues such as employee health, serving and protecting customers, and ensuring the overall safety of supply chains having implications for company performance.

What can you do?

- Consider targeted communications to help build member confidence in times of uncertainty. Emphasise key messages such as the importance of saving for the long term, how to navigate retirement income decisions and the benefits of the default.

- Continue to support employer contributions into retirement savings plans.

- Incorporate volatility protection mechanisms into default investment strategies to reduce losses.

- Speak to your asset manager about how their stewardship activities are promoting good ESG behaviour in response to COVID-19.

Survey Methodology

As the COVID-19 pandemic was peaking in many countries this spring, and many had adjusted to the new normal enforced by nationwide lockdowns, State Street Global Advisors commissioned YouGov to conduct an online survey across five countries. YouGov surveyed 3,479 individual savers with access to defined contribution schemes:

| Region | Number Surveyed |

| Australia | 504 |

| Ireland | 403 |

| Netherlands | 510 |

| United Kingdom | 1,020 |

| United States | 1,042 |