Diversification Isn’t Broken

Equity markets have continued to climb the proverbial wall of worry in 2023 against a backdrop of high inflation, rising interest rates and growth concerns. In the fixed income arena, the aggressive pace of rate normalization has led to negative returns, which in turn has driven significant dispersion between equity and bond market returns.

While Target Retirement glidepaths are designed to focus on the marathon, navigating participants through investment risks over several decades, the upward move in rates has been more akin to a world record-breaking sprint. This comes after a multi-decade bull market for bonds, punctuated by a stretch of significant outperformance during the COVID-driven flight to quality in 2020 that left yields near record lows. Since then, underperformance, paired with the potential for a “higher for longer” environment, has led to increased scrutiny over the role of fixed income in Target Retirement funds. At the time of this writing, the Bloomberg US Long Duration Government Bond Index – a reliable source of equity risk diversification historically -- is in the midst of its steepest drawdown in its 50 year history. Does the current market environment necessitate a change in philosophy, or underscore the importance of consistency?

While diversification hasn’t worked in the short term, it is by no means broken, and bonds will continue to play a valuable role in efficient portfolio construction. That said, bonds are not a single monolithic asset class. The current environment reinforces the importance of applying a clear and consistent view on the appropriate blend of fixed income characteristics at each stage of the participant journey. Market, interest rate and inflation risks impact participants differently at different career stages, and glidepath decisions should reflect these evolving priorities.

Finally, a bit of good news -- with higher rates comes a silver lining in terms of future outlook for retirement savers. The long-term outlook for fixed income is better today than it has been in over a decade. While the aggressive climb in rates brings discomfort to fixed income investors, the view improves with each leg higher.

The Role of Bonds in Target Retirement Glidepaths

Bonds provide multiple potential benefits – namely diversification, income and potential capital preservation – but each fixed income sub-asset class exposure plays a different role at different points in this equation.

Early in the State Street Target Retirement glidepath, our approach to fixed income is focused on diversification. Younger investors hold higher allocations to equities in seeking to accumulate wealth. Equities historically deliver strong long-term returns in exchange for what is often significant volatility. A modest allocation to bonds may reduce volatility without compromising long-term growth objectives. While diversification has not worked in the short term period marked by elevated inflation, long duration government bonds, specifically, have a long history of performing best during recessionary periods when equities underperform.

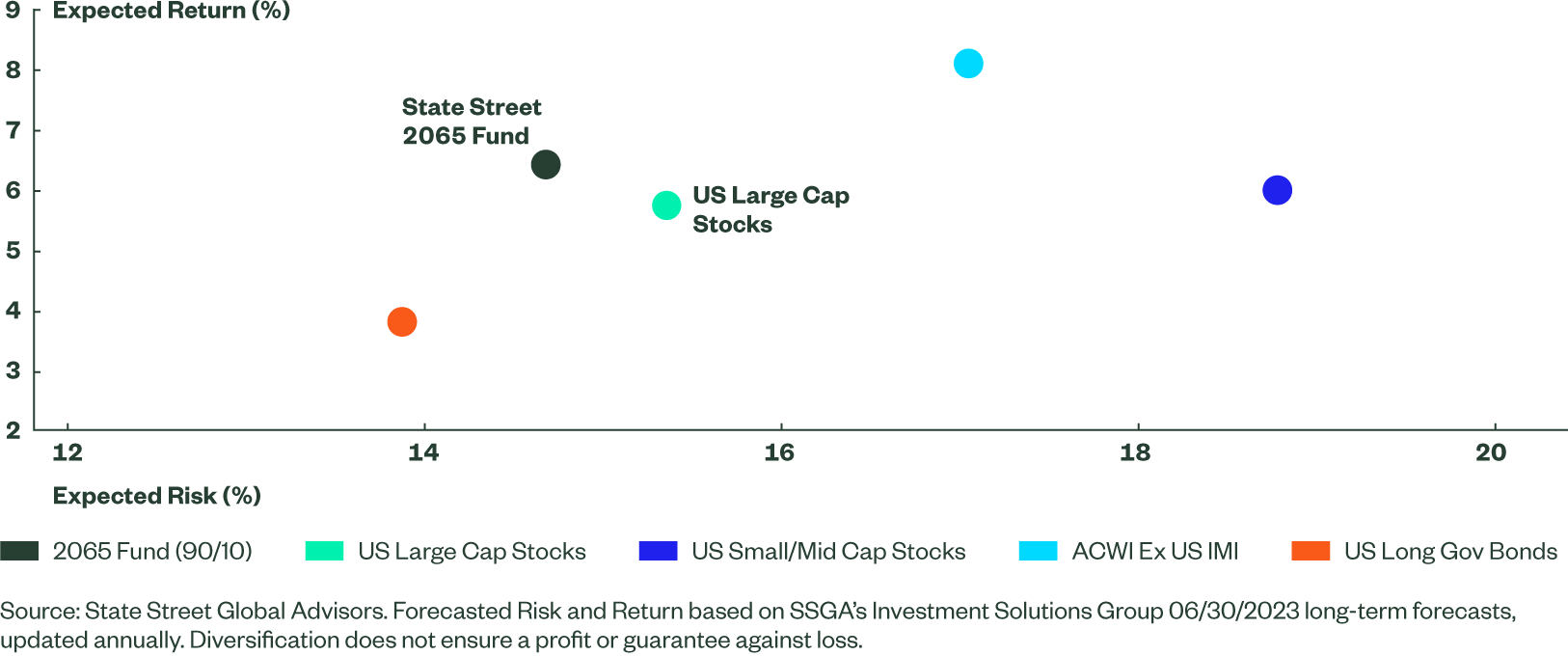

Pairing a 90% equity allocation with a 10% allocation to long duration government bonds is expected to provide a more efficient starting point than an all-equity portfolio. Factoring in additional decisions at the sub-asset class level and changing capital market expectations over time, this has provided roughly 98% of the expected return of equities with 93% of expected risk.1 Today, with capital market expectations rapidly improving for fixed income, along with a compressed Equity Risk Premium, this diversified starting point looks more desirable than it has historically.

Figure 1: Pair stocks with diversifying asset classes for a smoother journey

Diversification Improves Expected Returns

The tradeoff? Long government bonds expose younger investors to a higher degree of interest rate risk. As detailed in a more comprehensive paper written in 2022, we believe this tradeoff is appropriate for three reasons.

- Young participants hold 90% in equities and just 10% in fixed income. Longer duration exposure improves diversification benefits while total portfolio duration remains low.

- Long time horizons provide ample opportunity to reinvest at higher yields in the event of rising rates.

- Diversification from fixed income has historically been most challenged in periods of elevated inflation. However, for younger investors, equities reliably outpace inflation over longer time horizons. Rising rates and elevated inflation are greater risks for participants closer to retirement.

A cost of diversification is the expectation to lag more aggressive strategies in periods of strong equity market returns. Recent market returns have been driven by stocks – most notably US Large Cap stocks, and a small number of them at that. So while absolute returns are solidly positive, fixed income has been a notable detractor. However, the purpose of this government bond allocation is not to sacrifice growth, but rather to provide a smoother journey throughout participants careers, and drive positive outcomes through higher growth allocations at later points in the glidepath.

Focusing on Participant Outcomes – What is Appropriate for Some May Not be Appropriate for All

Expected downside protection from long government bonds allows for higher growth allocations in the middle to late career years, which have a materially greater impact on outcomes compared to longer-dated vintages. This is driven by the observation that participants hold higher balances later in their careers. Conversely, balance growth early in participants’ careers is almost entirely driven by savings, making the potential for modest incremental return in exchange for higher risk less desirable.

The key decision is not whether to hold long government bonds at all -- it is to identify where their characteristics are additive, and where the risks begin to outweigh the benefits. As participants approach retirement and time horizons shorten, longer duration bonds become less appropriate. We remove this allocation for participants in retirement, focusing more on income and capital preservation as both inflation and interest rate risks take on outsized importance.

Those nearing retirement have higher balances and shorter time horizons, and are naturally more vulnerable to the erosion of purchasing power from inflation. Compounding this problem, nominal bonds – and most notably longer duration bonds –historically experience significant underperformance and weakened diversification benefits in periods of elevated inflation. Look no further than the recent market environment.

To address these concerns, we believe that a strategic allocation to shorter-duration fixed income, paired with a diversified set of inflation-sensitive asset classes, is better suited to provide income in retirement while managing key risks. Long duration bonds are a common exposure across Target Retirement strategies, and we find that often these allocations are held through the assumed retirement years. Higher rates and higher inflation have drawn attention to the relative lack of focus that many strategies have placed on these key risks in retirement – potentially producing adverse outcomes for those participants most susceptible.

Let’s take a moment to analyze why this matters. Using the last three years as an example of a negative environment for fixed income, the median Target Retirement 2060 fund delivered solidly positive returns (+6.07% annually). State Street’s longer dated vintages lagged the peer group by 160 bps (4.47% annual return), as long duration bonds have been particularly challenged relative to equities.2

Meanwhile, the median Target Retirement Income fund (held by retirees) return over this period has been negative (-0.14%). Negative returns, compounded by elevated inflation, are far more detrimental for those in retirement than a drag on otherwise positive returns for those with longer time horizons. State Street’s Retirement Income fund has outperformed the median Income Fund by 168 bps over this period.

The result of this thoughtful focus on key investment risks has been a positive contribution to outcomes, even in an environment particularly challenged for fixed income. On a dollar-weighted basis, outperformance from State Street’s Target Retirement vintages near retirement have substantially outweighed the negative impact of longer duration bonds for younger participants.

Figure 3: 3 Year Wealth (Account Balances) as of September 30, 2023

| Fund | Starting Balance | Balance 3 years later | ||

| SSGA | Median Manager | Difference | ||

| 2050 | $10,000 | $11,668 | $12,034 | ($366) |

| 2040 | $40,000 | $45,524 | $46,893 | ($1,369) |

| 2030 | $70,000 | $77,356 | $76,989 | $368 |

| 2020 | $150,000 | $162,636 | $157,920 | $4,716 |

Source: Morningstar. State Street Global Advisors Defined Contribution, as of September 30, 2023. The performance figures contained herein are provided on a net of fees basis. The performance includes the reinvestment of dividends and other corporate earnings and is calculated in US dollars. Past performance is not a reliable indicator of future performance. SSGA Collective Investment Trust (net 12 bps) and the Median Manager returns in Morningstar Direct were used to calculate projected balance. Initial Starting Balance by fund sourced from EBRI (2023): “Workplace Retirement Plans: By the Numbers.”

Staying the Course

A common response by Target Date managers in the face of recent bond market turbulence has been to increase exposure to equities. Higher equity allocations are a logical way to maintain an expected level of income replacement despite low returns from fixed income, but also result in a material change to the risk profile– exposing participants to a wider range of outcomes. This risk-seeking behavior has been rewarded by strong equity returns, but may leave glidepaths with a less efficient and higher risk approach today than what has historically been expected.

Fixed Income yields are at their highest point since TDFs initially took hold as the default investment option of choice in 2006. Meanwhile, equity market return expectations have continued to compress. We suggest that not only is the outlook for a diversified portfolio back in place, the case for fixed income relative to equities is as strong as it has been since Target Retirement strategies were first launched.

There are many ways to illustrate this, but a useful measure of the relative attractiveness of stocks and bonds is the equity risk premium. Here, we define the equity risk premium as the relative spread in returns that an investor can expect to receive over the long-term in exchange for the higher risk associated with equities. With yields near record lows in 2020, equity risk premiums were at their highest point since the inception of the State Street Target Retirement strategies. As yields have risen and valuations have continued to stretch, however, the equity risk premium has now reached its lowest point in 20 years. This speaks to not only the magnitude of the recent move in interest rates, but also the importance of consistency and staying the course in strategic asset allocation.

Index-based Target Retirement strategies typically do not employ tactical asset allocation, as the transparent, straightforward and low-cost nature of the approach is valued by plan sponsors. Managers that elected to strategically increase equity exposure due to an appealing equity risk premium in recent years may now be faced with the decision of whether to return to a higher allocation to bonds as this relationship has reversed, potentially subjecting participants to multiple changes in risk profile over a short time horizon. We continue to take the long view, which has driven strong long-term results through multiple market environments.

Conclusion

While we are undoubtedly in a painful period for fixed income, and specifically longer duration fixed income, a thoughtful and consistent approach to risk management is a key driver in delivering long term outcomes to our clients. As testament to our approach, in dollar-weighted terms, State Street has continued to deliver strong outcomes for participants due to our focus on inflation and interest rate risks in retirement. Longer term, our focus on diversification and thoughtful risk management has allowed the average State Street Target Retirement vintage to outperform 87% of peers since inception of our Collective Investment Trust strategy in 2005, with risk lower than 79% of those same peers. Today, as we near the end of a rate-hiking cycle, historical precedent suggests that the outlook for diversifying asset classes is restored, and long duration government bonds should continue to add value as an efficient source of downside protection in periods of equity market stress. Diversification is by no means broken, and will continue to be a staple of our approach going forward.