How a Cash Overlay Solved a Public Pension’s Liquidity Challenges

See how one public plan worked with State Street Global Advisors to overcome some of its thorniest challenges.

Liquidity is at the heart of public pension plans’ mission. Pensions need ready cash to provide regular payments to beneficiaries, meet payroll and other expenses, satisfy regulatory requirements, provide collateral for currency hedges or other instruments, and more.

Many plans seek to maintain sufficient liquidity simply by holding enough cash to meet projected expenses and liabilities, plus a buffer that provides a margin of safety against unexpected outlays. The average public pension plan held 2.1% of its assets in cash in 2022.1

A sizable cash stake can create challenges, however. One is cash drag: Although cash yields are relatively high now, with Treasury bills paying above 5%, the 3-month Treasury historically has paid an average yield of just 2.4% since 1980, based on month-end data2—far short of the 6% to 7% annual returns typically targeted by public pension plans.3 Likewise, holding a significant allocation to cash can make it difficult for a plan to maintain target exposures to its strategic asset allocation ranges, resulting in increased tracking error relative to cashless benchmarks.

Plans often try to mitigate these challenges by holding only a little more cash than needed to cover their projected cash flows. But this approach opens them to the risk that their cash holdings will fall short of unexpected liquidity needs. What’s more, the thin margin between holdings and projected outlays requires the plan’s staff to spend considerable time managing the cash position, a task that can be especially onerous for plans with limited resources. And in the event the plan needs greater liquidity than it can generate through its cash holdings, it must raise cash by selling other holdings. Those moves trigger trading costs that can eat into returns, and in some instances reduce active manager allocations intended to generate alpha.

These challenges have only grown as public pensions have increased allocations to less-liquid private investments in pursuit of income and total returns with low correlations to public markets. Public pensions’ average allocations to private equity, hedge funds and miscellaneous alternatives rose from about 15% in 2013 to more than 20% in 2022.4

Plans may be able to overcome these and related challenges by collaborating closely with institutional partners to develop tailored solutions. The partner may propose a cash overlay strategy to support liquidity while minimizing cash drag, tracking error, staff time, and expense. Overlay strategies can take many forms, and each plan is unique; as a result, the partner must listen deeply and understand the plan thoroughly, so it can craft a bespoke solution that suits the plan’s size, needs, guardrails, liabilities, and other characteristics.

The case study below illustrates how that process can play out and the benefits it can offer.

A public pension with a liquidity problem

In 2018 State Street’s Investment Solutions Group (ISG) was working with a public pension plan to hedge its currency exposures. The team noticed that the plan’s staff was spending an inordinate amount of time managing its cash position. Informal discussions revealed that the fund, like many of its peers, had increased its allocations to private investments, and those larger private allocations had heightened its challenges around liquidity. ISG and the plan’s officers arranged a meeting to discuss the situation.

During an in-depth conversation, the plan’s staff explained the difficulties they faced. The most pressing one, from their perspective, was the time required to manage the plan’s cash holdings. They were trying to thread a fine needle, holding only as much cash as the plan needed while doing their best to make sure it would not be caught short. As a result, one member of the plan’s three-person staff spent too much of their time simply dealing with the cash allocation: monitoring cash balances, chasing down letters of direction, maintaining elaborate spreadsheets projecting inflows and outflows, redeeming investments to boost cash after outflows, and more. “Managing cash was interfering with their ability to do much else,” said Michael Martel, ISG’s Managing Director and Head of ISG Portfolio Management Americas.

Before considering potential solutions, the ISG team worked to understand the plan thoroughly: its liabilities, objectives, expenses, current holdings, investment managers, sources of cash, investment restrictions and limitations, and other characteristics. “The first thing is to thoroughly understand the client,” says Martel.

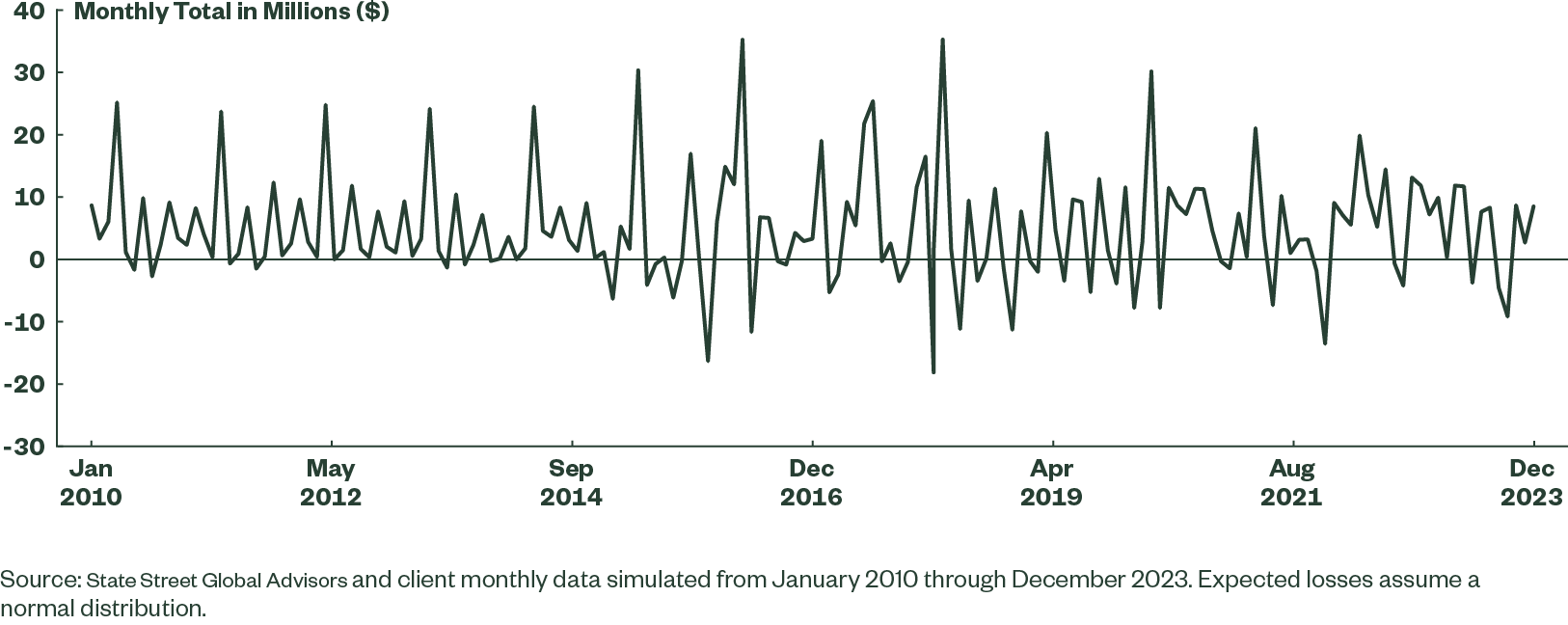

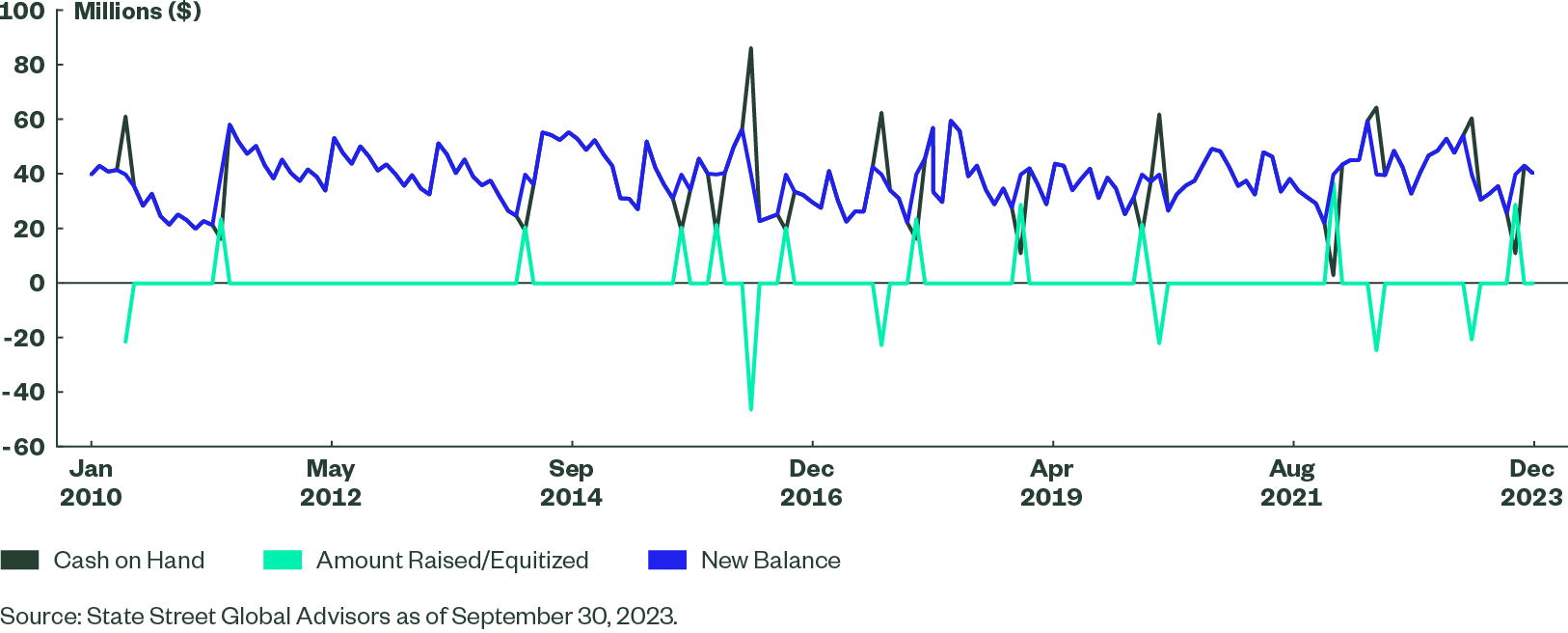

After gaining a comprehensive view of the plan, the team performed a liquidity analysis, examining projections of its cash needs and the impact they could have on its cash balance. They used five years of historical information combined with expected plan changes to estimate the plan’s cash flows over the following five years (Exhibit 1, below). Then they simulated how the plan might manage outlays and maintain its cash balance using a strategy of holding a minimal amount of cash to reduce cash drag and periodic rebalancing (Exhibit 2).

Exhibit 1: A volatile cash flow projection

Exhibit 2: Volatile cash flows demanded frequent trading

The team’s observations underscored the plan’s difficulties maintaining liquidity. The client was projected to have to manage 40 cash events per year between payroll and expenses, income receipts and currency hedging settlements. Note that those events did not include the irregular and harder to predict capital calls and distributions from their private investments. Reducing the cash balance would certainly help to mitigate cash drag, but at the cost of further draining staff resources.

The trading required to maintain cash presented multiple challenges. Every transaction boosted the plan’s costs, particularly redemptions from managers in less-liquid parts of the market and potentially exacerbated if forced to sell quickly during adverse market conditions. (For example, selling shares of emerging markets equity strategies cost the plan roughly five times as much as redemptions with domestic equity managers.) Moreover, any redemptions from long-term holdings had the potential to throw off the plan’s asset mix, complicating efforts to meet its strategic allocation targets and return objectives.

Tracking error was another problem. The plan’s benchmark consisted of approximately 40% equities, 47% fixed income, 13% alternatives – and zero cash. To maintain its cash allocation, the plan had to reduce its other allocations, heightening the likelihood that its returns would not track the benchmark’s. And unlike some other sources of tracking error, holding cash offers no potential for alpha. “The cash allocation’s tracking error presented an uncompensated risk,” says Martel. “Minimizing uncompensated risks is a basic principle of portfolio management.”

Holding a meaningful allocation to cash also weighed on returns. Cash yields in 2018 were only around 1%, while the plan targeted a 7.5% annual return. The ISG analysis estimated that the plan’s cash holdings detracted more than three basis points per year from its returns.

The State Street solution

The ISG team produced a plan to overcome these challenges. “We proposed an overlay program that would provide equity and fixed-income exposure through futures contracts,” Martel says. “The overlay could help the plan maintain its strategic target allocations without sapping its cash, helping meet its liquidity needs more easily, efficiently, and effectively.”

The overlay strategy consisted of a custom basket of futures. Since the futures did not need to be funded, the asset-class exposure they provided enabled the plan to top up and maintain its strategic allocations without affecting its cash holdings. With the overlay helping the plan meet a portion of its target allocations, the plan could hold more in cash, making it easier to manage liquidity needs and reducing the potential for overdraws. And when the cash stake needed replenishing, the plan could trade opportunistically knowing that the overlay would keep exposures in line with targets.

The plan’s officers worked with ISG to refine and implement the solution. Since then, the overlay strategy has delivered a range of benefits:

Improved efficiency. The overlay strategy enables the plan to raise cash much less frequently, while keeping cash holdings relatively steady (Exhibit 3, below). Having to raise cash less often has meant less trading of long-term positions – particularly with managers that impose high transaction costs – helping reduce plan expenses. Moreover, plan staff spends much less time managing cash than they did prior to implementing the overlay program. And the overlay has eliminated the need for the plan to choose between holding sufficient liquidity and fully funding its strategic allocations, helping to minimize tracking error.

Exhibit 3: The overlay reduces the need to trade

Enhanced returns. The asset-class exposures provided by the overlay have helped to eliminate cash drag – an especially valuable benefit between 2018 and 2021, an era of generally strong equity returns and low cash yields. In addition, the overlay streamlined the plan’s process for implementing tactical views: Expressing those views with futures is simple to manage, imposes low costs, and has minimal impact on portfolio liquidity.

The cash overlay also has helped the plan capitalize on portable alpha — increasing exposure to alpha from particular active managers without boosting exposures to their underlying asset classes. With the overlay, ISG can hedge away extra exposure to those managers’ beta, so it can hold asset allocations consistent with its Investment Policy Statement while increasing exposure to their potential excess risk-adjusted return.

The right solution: a strong partnership

The case study above is just one example.5 In this instance, the plan benefited from a simple and straightforward cash overlay strategy. Other plans may have distinct needs that call for different solutions. Institutional partners can customize these solutions using a variety of tools, potentially including:

- Risk management tools designed to mitigate equity downside, hedge currency volatility or manage liability hedge ratios

- Strategic or tactical rebalancing

- Judicious use of leverage to enhance returns efficiently while managing risks

Every pension plan is unique, with a complex set of resources, liabilities, restrictions, and goals. To craft a program that meets an individual plan’s needs, an institutional partner must bring deep listening, creativity, and expertise. For plans struggling with liquidity-related challenges, the solution is not a product or a set of strategies, but a relationship. “When we provide overlay services, we think of ourselves as an extension of a plan’s investment staff,” says Martel. “We get to know their portfolio intimately and have a robust give-and-take with them – and the result is that we can alleviate their cash challenges and make their lives easier.”

For more information on how State Street Global Advisors can assist with your investment needs, please contact your Relationship Manager.